Has the market sensitivity really become this poor? Although I haven't responded to all my friends' comments, I have roughly gone through them, and almost no one asked why the market rose today. This makes today's task a bit awkward. I actually spent over an hour browsing through today's news, and I really didn't see any particularly valuable positive news that led to the market's rise. I wonder if I missed something; if so, please add it.

However, there are indeed a few important pieces of information today. One is that the SEC has approved a new interest-bearing stablecoin. We discussed this topic a bit in Coinbase's earnings report. Although Coinbase will provide some yield for USDC, this is not the general utility of USDC. The YLDs that were approved this time will accumulate daily and pay interest to users monthly, and this constitutes a securities action.

In addition, the SEC has shown a strong interest in ETF staking. Although I haven't seen any media reports on the Grayscale staking event, much information points to a high probability that the staking of the #ETH spot ETF submitted by 21Shares may be approved. Moreover, last week, a staking provider focused on #SOL communicated with the SEC about the staking process and details.

Additionally, there were some remarks from Vance and Michael. Michael is also calling for the U.S. not only to consider #Bitcoin as a strategic reserve but also to actively buy BTC. I wonder if these are all catalysts. In fact, although the price trend hasn't been ideal in the past two weeks, I have been emphasizing that there are currently no negative policies. While the macro situation isn't great, it is mostly within expectations. On the contrary, there have been frequent positive policy developments, which, although not directly reflected in prices, are indeed promoting cryptocurrency.

Of course, even now, I still feel a bit "out of breath." I don't know what is missing, but if this breath cannot be inhaled and exhaled smoothly, the price may still maintain a trend of fluctuation.

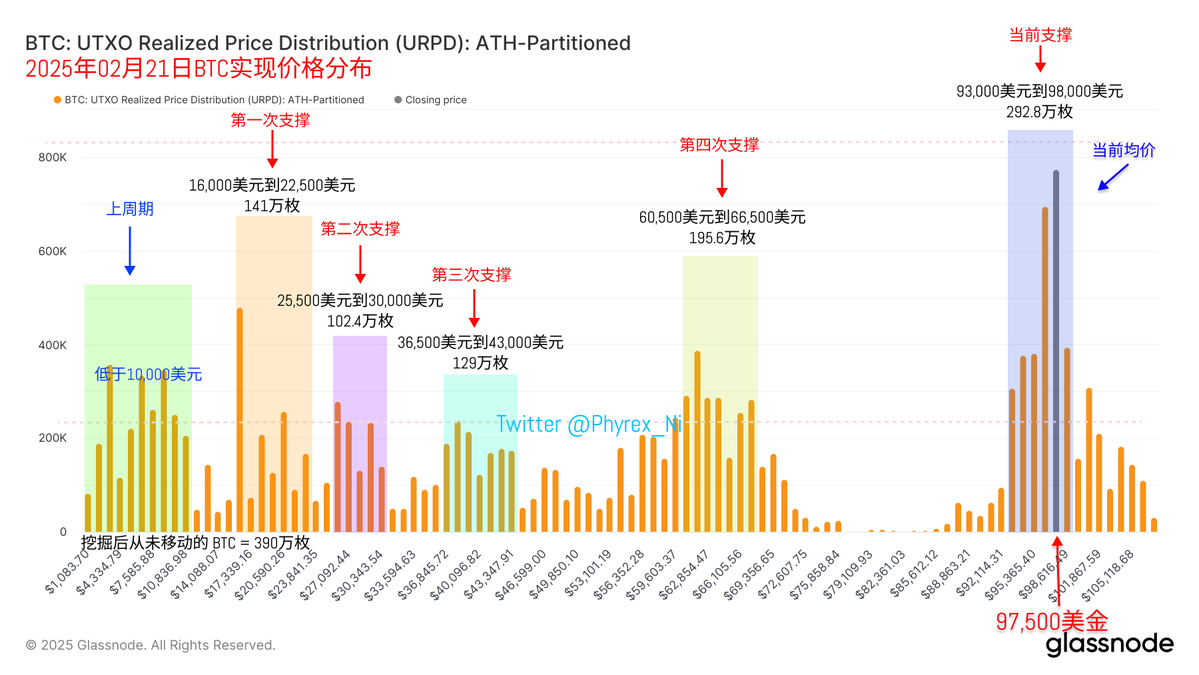

Looking back at the data for BTC itself, the continuous price rise has led to an increase in turnover rate for two consecutive days. However, even so, the overall turnover data remains very low, and most investors are still indifferent to the current price. This lackluster market has awakened some quantitative and short-term investors, especially those who bought the dip in the last two days are now exiting in large numbers, while earlier investors are still maintaining a wait-and-see attitude.

From the support data, it is still very strong. A large number of investors are concentrated between $93,000 and $98,000. This group of investors has already begun to settle down. After the last breakthrough of $100,000, although no new bottom has formed upwards, the current position is still a support level that investors are relatively satisfied with.

Tomorrow is Friday again. If the sentiment can continue to maintain this upward trend, this weekend should be a good time to rest. Tomorrow, the activities in Hong Kong will basically be over, and if all goes well, I should be in Tokyo when I write my task tomorrow. If things don't go well, it will be troublesome.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。