Macroeconomic Interpretation: In this spring, where traditional finance and the crypto world are colliding at an accelerated pace, a dramatic Bitcoin reserve competition is unfolding among the state governments in the United States. The Utah HB0230 bill allows the four major public funds to allocate up to 5% in Bitcoin, a seemingly conservative figure that translates to a potential purchasing power of $70 million, akin to dropping a deep-water bomb into the crypto market. The legislative push in twenty states across the country evokes memories of the 2017 rush to embrace blockchain technology—only this time, politicians are targeting real asset allocation rather than concept hype.

The deeper logic behind this "state-level arms race" may be found in the statement of Trump's new Secretary of Commerce, Howard Lutnick: "Bitcoin should be traded freely like gold." This declaration from the Wall Street veteran, coupled with spot gold breaking through the historical high of $2,950, has quietly sparked a value resonance between precious metals and crypto assets. Interestingly, Trump himself recently announced a personal visit to Fort Knox to inspect the gold reserves, adding a real-world footnote to the "Where is the gold?" mystery, which unexpectedly enhances Bitcoin's narrative as "digital gold"—after all, when the prices of traditional safe-haven assets are high, institutional investors need to find new places for their funds.

However, the market's script never develops in a linear fashion. Just as state legislation is in full swing, Bitcoin spot ETFs recorded net outflows for two consecutive days, with BlackRock's IBIT fund unusually experiencing a "halftime" with zero inflows. This scene of contrasting fortunes resembles the classic personality split of the crypto market: long-term narratives and short-term volatility are always pulling at each other. CryptoQuant founder Ki Young Ju's observation is quite incisive: "ETF fund flows are the thermometer for bull-bear transitions." The fact that the market is still in a net inflow state is like the oppressive air before a storm, brewing unease while hiding vitality.

When we peel back these complex surfaces, we find that the underlying logic has remained unchanged—the balance of supply and demand is undergoing a historic tilt. The potential entry of public funds from various states is equivalent to adding twenty new pivot points on the institutional buying side. Based on Utah's $70 million purchasing power, if all twenty states collectively follow suit, it could potentially leverage a demand increase of $1.4 billion. While this figure may not seem astonishing in a crypto market with daily trading volumes in the tens of billions, its symbolic significance far exceeds the numerical value itself: when government funds begin to include Bitcoin in their strategic reserves, it effectively completes the identity leap from "alternative asset" to "quasi-sovereign asset."

The chain reaction brought about by this transformation may be more profound than most people anticipate. Imagine if a state government's disaster recovery fund successfully hedges against inflation risks by holding Bitcoin; this "policy demonstration effect" would spread like a virus. Just as the petrodollar reshaped the global financial landscape in the 1970s, the current allocation experiments by various states regarding Bitcoin may be writing the prologue to a Bretton Woods system for the digital age. After all, even Musk couldn't help but suggest on the X platform that the Fort Knox gold reserves be reviewed annually; this collective skepticism towards traditional reserve systems creates an excellent historical opportunity for crypto assets.

From the perspective of market participants, what should be most concerning right now may not be the short-term volatility of ETFs, but rather the liquidity reconstruction brought about by institutional entry. When government funds, pension funds, and other "whales" begin to systematically allocate Bitcoin, traditional analytical frameworks such as "halving cycles" and "mining difficulty" may need recalibration. Just as the gold market's pricing logic has been reshaped by central bank gold purchases, Bitcoin is undergoing a qualitative change from "retail paradise" to "institutional battleground." This transformation brings not only a decrease in price volatility but also a capillary-level connection between the entire crypto market and the traditional financial system.

However, the market always likes to leave some suspense. Just as analysts were busy calculating state budget forecasts, news of gold prices soaring 12% in a single day suddenly emerged, reminding us of the vitality of traditional safe-haven assets. This competitive relationship between "new and old hedging assets" may be the most noteworthy undercurrent in the next three years. After all, when Trump is banging on gold bricks at Fort Knox, Wall Street traders may be quietly adjusting the allocation ratio between Bitcoin and gold—this is perhaps the subtlety of financial evolution: disruption often occurs imperceptibly, and by the time the market reacts, the landscape has already been turned upside down.

LTC Data Analysis:

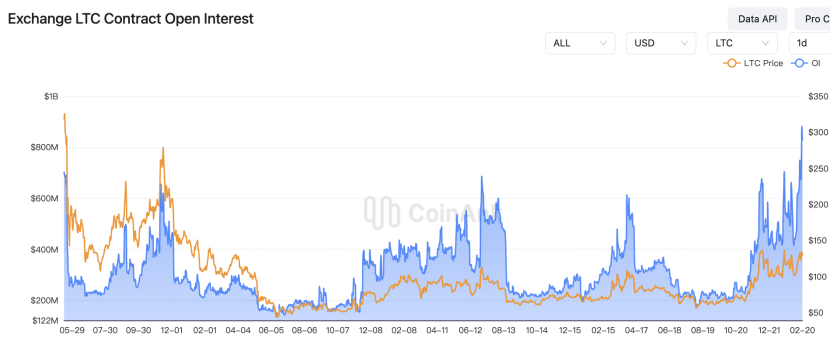

According to Coinank data, the total open interest for LTC futures contracts across the network is 6.7224 million LTC, approximately $891 million, reaching a new high in nearly four years, with a 24-hour increase of 5.8%. Among them, Binance's LTC contracts have an open interest of 2.3146 million LTC (approximately $307 million), ranking first, with a 24-hour increase of 11.41%.

We believe that the recent record high in LTC futures open interest reflects a significant increase in market participants' expectations for price volatility. The data shows that the total open interest for LTC contracts across the network has reached 6.7224 million (approximately $891 million), with a 24-hour increase of 5.8%. Binance leads with an open interest of 2.3146 million (approximately $307 million), and a daily increase of 11.41%, demonstrating its dominant position in LTC contract trading.

This phenomenon may be driven by multiple factors. Firstly, the rapid growth of open interest is usually associated with market divergence in future price direction or an increase in leverage demand. As one of the mainstream crypto assets, the increased activity in LTC derivatives may be related to the overall recovery of market risk appetite. For example, the total open interest in the cryptocurrency derivatives market has repeatedly hit new highs by the end of 2024, and the policy expectations following Trump's election victory have further stimulated speculative sentiment. Secondly, Binance's outstanding performance in LTC contracts may be related to its liquidity advantage and user base, indicating that the platform's market share in specific coins continues to concentrate.

It is worth noting that the design of LTC futures contracts and the regulatory environment may also influence market participation. For instance, the Commodity Futures Trading Commission (CFTC) has relatively conservative limits on LTC futures positions, with individual contracts accounting for a very small proportion of the circulating supply, which may restrict large-scale institutional involvement. However, current data still shows a significant increase in the activity of retail and small to medium investors. Additionally, historical data indicates that the expansion of LTC open contracts, if accompanied by price breakthroughs, is often seen as a signal of trend continuation; this data may suggest a prevailing bullish sentiment in the short-term market.

Overall, the activity in the LTC derivatives market is both a reflection of the comprehensive expansion of cryptocurrency derivatives and a manifestation of structural opportunities for specific assets within the cycle. Future attention should be paid to the potential impact of leverage risks and regulatory dynamics on market sentiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。