The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui talking about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smoke bombs!

I have disappeared for a while again, but Lao Cui has not been lazy. A wave of decline has caused many friends to start questioning the direction. It is understandable for contract users to have doubts, but I cannot resonate with the doubts of spot users. Bitcoin has reached a new low of 93, and users who have read Lao Cui's articles should be very clear that a new low is just the beginning of building positions. As a result, many users, after the market stabilized, were unable to make the correct judgment. I would like to remind everyone again that altcoins and mainstream coins have two different trends, so please do not view the overall trend from the same perspective. Today's article mainly responds to everyone's recent questions, the first being why small coins will not participate in a bull market? Will there be no coin market value that can surpass Bitcoin in the future? At least a dozen users have mentioned these two questions this year, and today Lao Cui will thoroughly analyze the underlying logic with everyone.

To clarify this logic, we need to start from the financial market. The year 2024 can be said to belong to the financial market. Gold, energy, and the US stock market have all welcomed a wave of growth, with the Nasdaq index reaching a historic high. The cryptocurrency market is no exception, with Bitcoin reaching a high of 108,000 and the market value of the cryptocurrency market also breaking through the previous 38 trillion. In terms of return on investment, small coins naturally have the highest return rate, with almost all of the top ten coins in the cryptocurrency market experiencing exponential growth, allowing some users to taste the sweetness. However, the current trend has basically caused everyone to give back some profits. The fundamental reason for the explosion in all markets comes from the US interest rate cuts, and it is guaranteed that the next few years will mainly be about interest rate cuts, which is the cornerstone. With capital, the trading volume of the market will be driven, leading to market growth, and there will definitely be bubbles during the growth. In a highly volatile market, bubbles are most severe, such as those in Nvidia, Musk's companies, and the cryptocurrency market. These three are almost all characterized by large ups and downs, as their values cannot be stabilized, leading to investor uncertainty. At the same time, all three belong to future products, and investing in them is almost always aimed at future returns, which also causes instability.

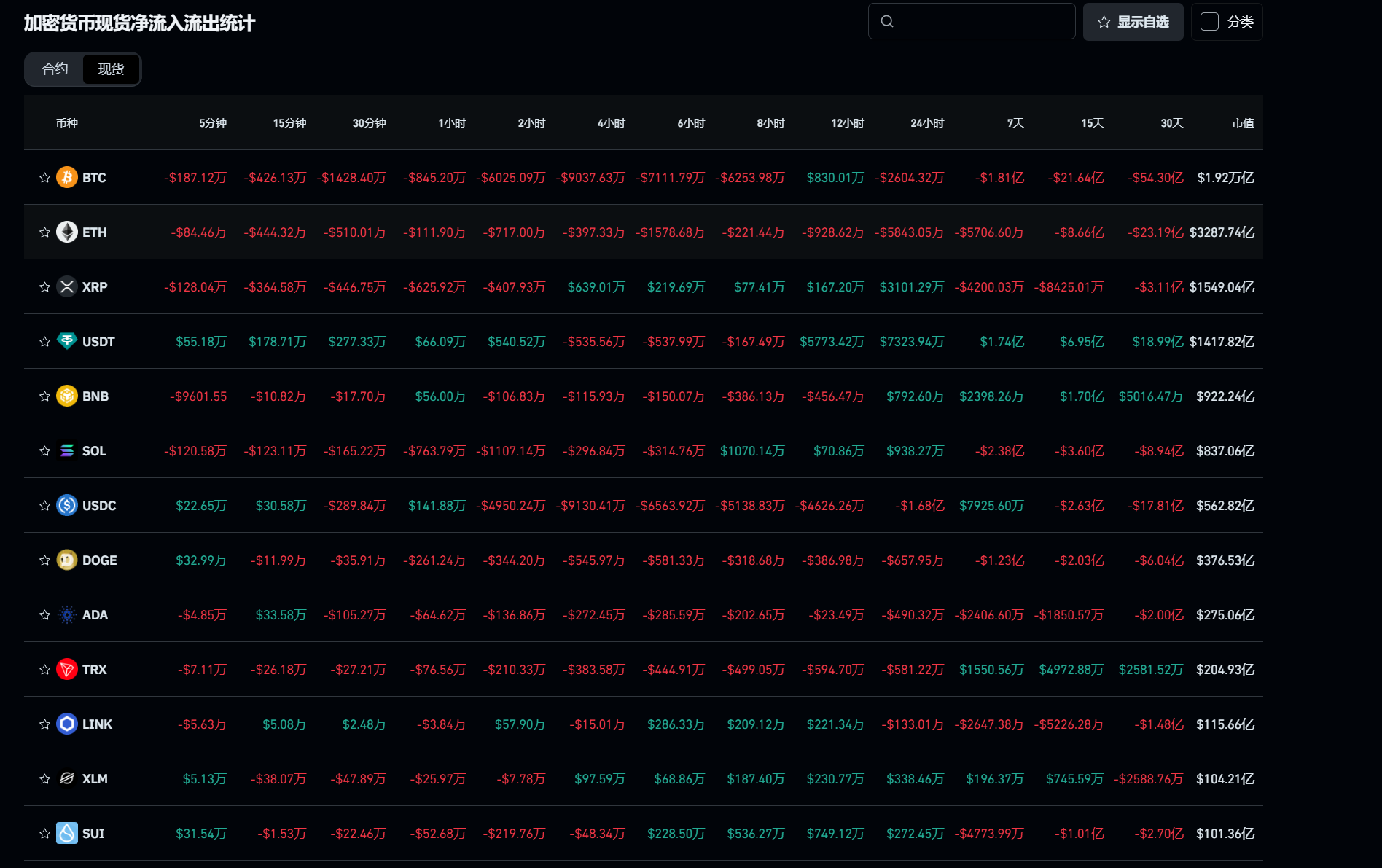

The entire cryptocurrency market also needs to be subdivided in terms of investment value. The overall value is 38 trillion, with Bitcoin occupying 20 trillion. The simplest logic is that many investment companies and individuals predict Bitcoin in this bull market, mostly around 150,000 to 200,000. Taking the lowest value of 150,000, Ethereum at a new high of 5,000, SOL at 1,000, and temporarily ignoring other coins. What does this mean? If it really reaches such a high position, the overall market value of the cryptocurrency market will reach around 80 to 100 trillion. What does this data mean? This would mean that Bitcoin's market value would be second only to gold's market value, and the cryptocurrency market would leap to become the second-largest asset globally. This is still not considering the market value of small coins. If the highs of small coins really reach new highs as everyone thinks, we are not even talking about exponential growth; the cryptocurrency market will easily stabilize at 100 trillion. So the question arises, where will the remaining 62 trillion flow into the cryptocurrency market from? Gold? US stocks? These two markets are almost in competition with the cryptocurrency market, and with this year's interest rate cut stimulus, they will also grow. Who will invest? This will be a very critical question.

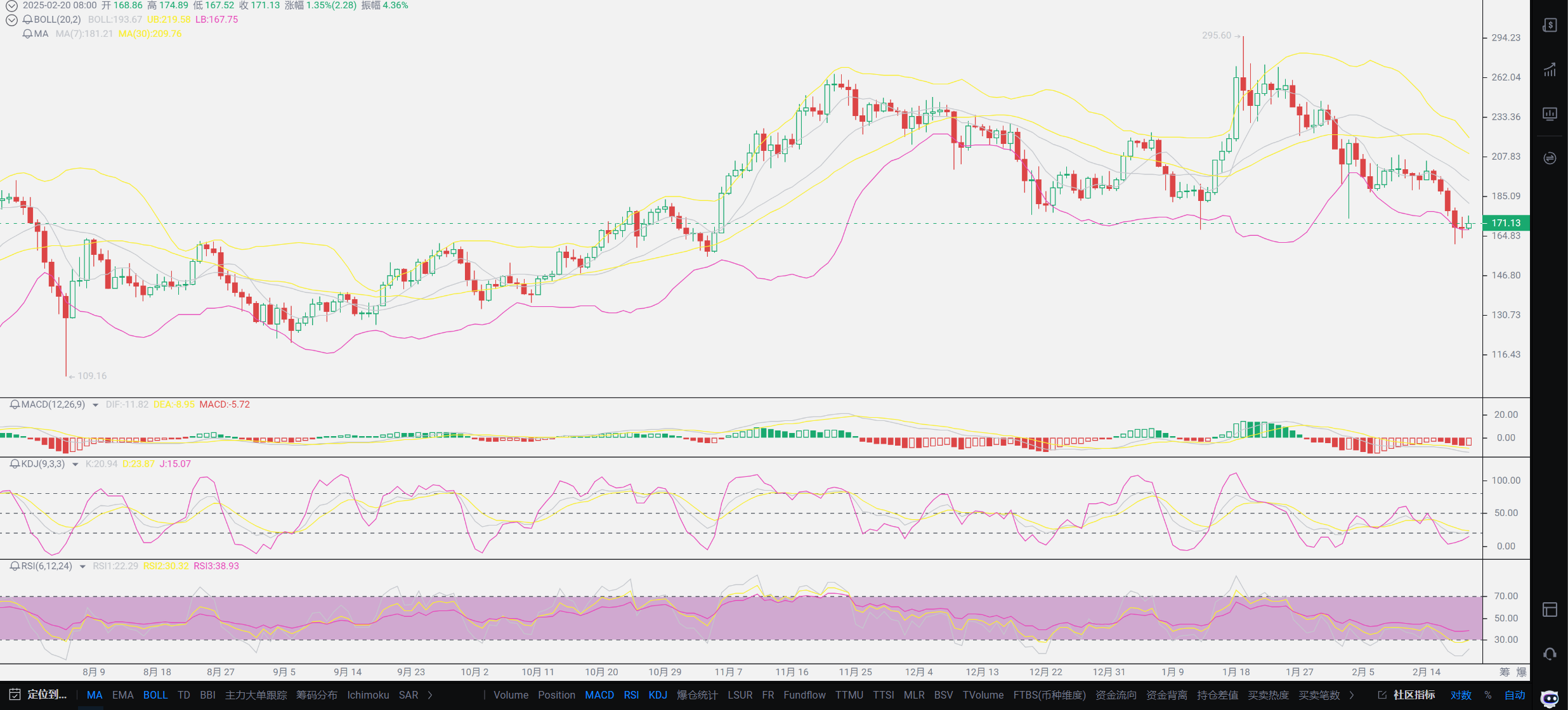

Speaking of competition, in the financial market, if one wants to maintain competition, one must maintain return rates and let investors see returns. This requires creating idols, making everyone believe in the cryptocurrency market. Among all coins, Bitcoin is the face; if the cryptocurrency market is to grow, Bitcoin is definitely the first choice. The more people discuss it, the more inflow there will be. Therefore, under the condition of limited capital investment, the first choice will definitely be Bitcoin, followed by Ethereum. The commonality between Ethereum and Bitcoin is that both have been listed, making it easier for everyone to enter the market. Being listed provides a safety net from traditional capital. Therefore, it is now visible to everyone that compared to the previous period, the decline rate of Bitcoin and Ethereum will slow down, and there has been almost no halving situation. The future trend of these two will be a steady upward trend. As for return rates, this year's biggest dark horse is whether SOL can be listed. The listing of a third coin will also drive the growth of the cryptocurrency market. Lao Cui estimates that this year SOL will be between 400-500 (data after listing). The characteristic of SOL is that it has a higher cost-performance ratio. It can be said that at this stage, if a coin wants to go on a platform, the first choice will be to stake through the SOL channel, and cost control will definitely prioritize SOL. The Trump coin has already given everyone direction; the two can be said to be symbiotic. The growth of small coins will only belong to the SOL system, and using its channel will lead to the growth of SOL. Therefore, saving costs or having a small capital volume can choose this coin as the first bucket of income. Bitcoin, Ethereum, and SOL are your top investment choices this year. SOL is basically linked to the market value of small coins, so please do not choose the wrong side. There is only one special coin, the Trump series, which will not be elaborated on. The growth of the cryptocurrency market will also grow during his term, belonging to a phenomenon-level coin. You can decide to invest after controlling the risks.

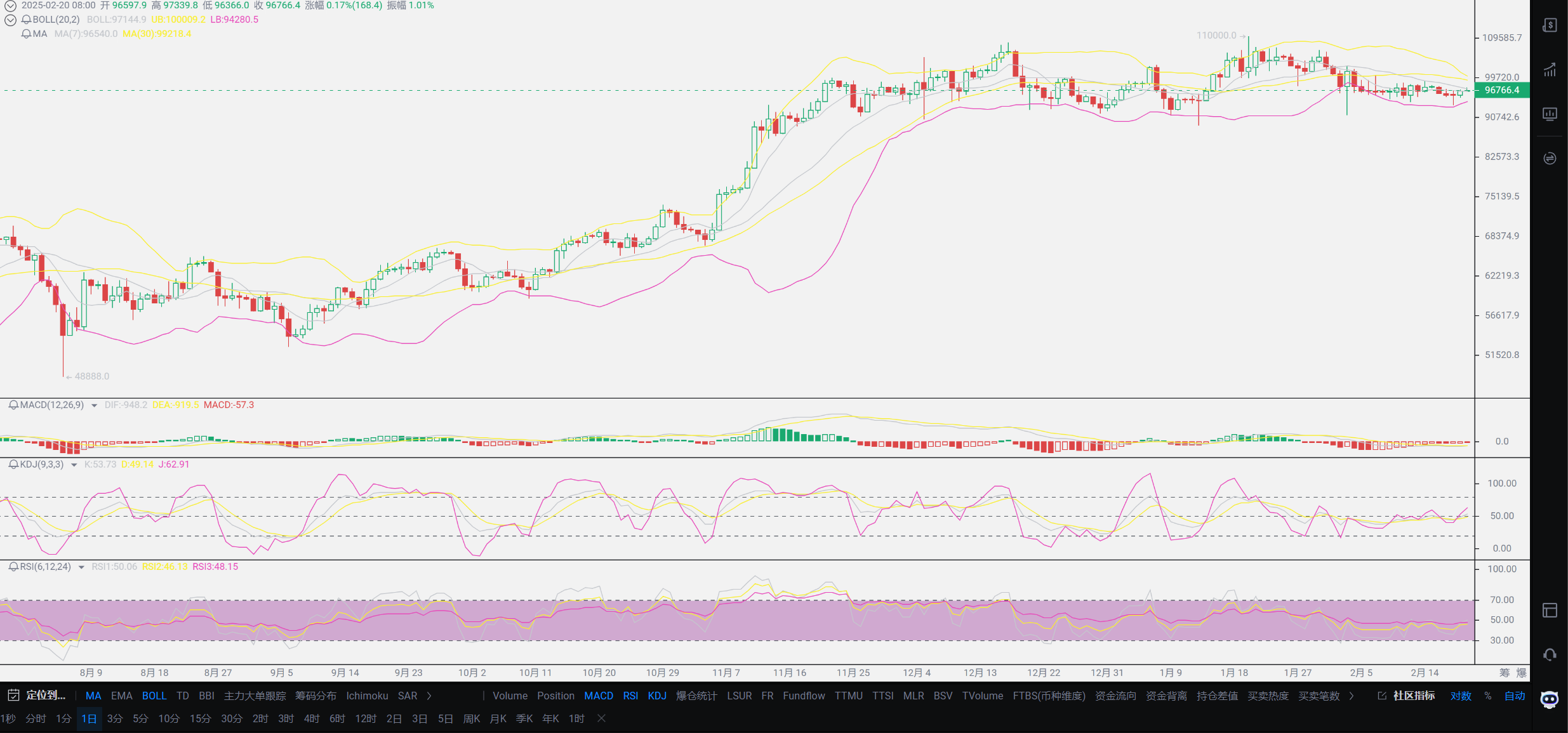

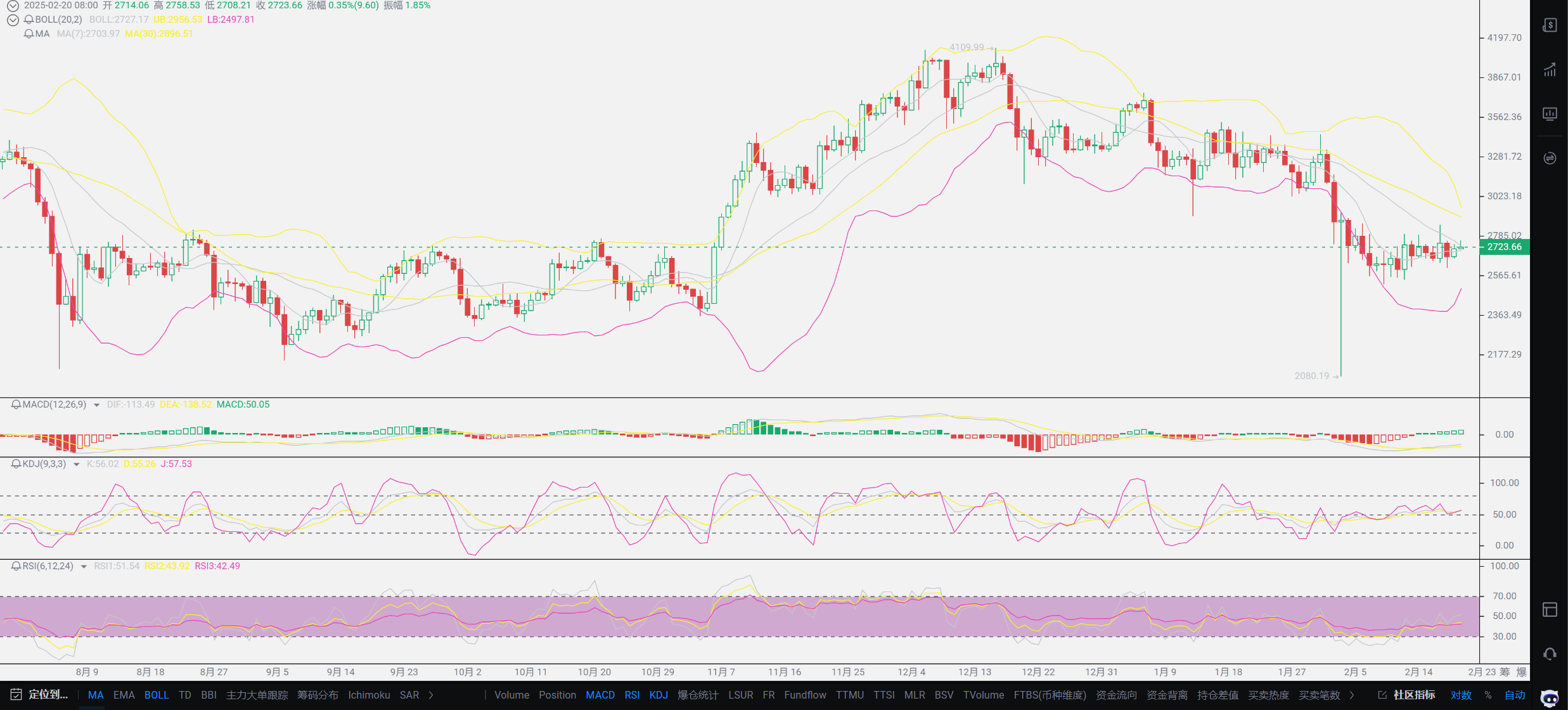

Lao Cui's summary: Every time the trend is mentioned, many of you will have doubts. Just like the so-called small coins, I can understand everyone's mentality, which is nothing more than the psychology of taking a small risk for a big reward. This psychology can indeed be infinitely amplified in the cryptocurrency market, but times have changed. All trends point to a bull market, and the volume of funds is not the previous market value. It can be said that every step forward will be very difficult. Rather than hoping for overnight wealth, it is better to be steady and steady. First, take what you can get, and then find ways to earn what is beyond your understanding. Based on current indicators, the upper limits of Bitcoin and Ethereum can at least touch 120,000 and 4,000 positions. Therefore, Lao Cui's current layout will revolve around these two for allocation, with an investment allocation of 40% in Bitcoin, 30% in Ethereum, and 30% in SOL. These three, especially SOL, have given everyone an entry point at around 180, with the previous low point also reaching around 160. Currently, Lao Cui's holdings of SOL and Ethereum are mainly at a loss, with only the average holding price of SOL around 173, while the others have not changed. The target points above have also been given to everyone for reference, but they do not constitute investment advice. Lao Cui will definitely add positions after the subsequent decline; it just depends on your own choice. The future of small coins has limited development, but it does not mean that the market for newly issued coins will no longer exist. For those users who like to engage in pump and dump schemes, thinking they can exit first, the market for newly issued coins will still see growth, but the speed of retreat must be faster in the future! The evaluation summary of small coins is just one sentence: the legal and regulatory process in the US will definitely eliminate the dross, and in the future, more than 80% of coins will be eliminated!

Lao Cui's message: Investing is like playing chess. A master can see five, seven, or even more than ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the ultimate victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning and reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。