Author: Spirit, Golden Finance

Introduction

As the cryptocurrency market matures, Exchange-Traded Funds (ETFs) have become an important bridge connecting traditional finance with digital assets. This article compiles the latest developments in cryptocurrency ETF applications, detailing the applicants, feasibility analysis, introduction of underlying assets, token price performance over the past month, and key information regarding the SEC's review and response timelines, providing readers with comprehensive market insights and future outlook.

I. Overview of the Latest Cryptocurrency ETF Application Progress

As of February 19, 2025, the cryptocurrency ETF market continues to heat up, especially after the approval of Bitcoin and Ethereum spot ETFs, prompting more institutions to submit applications for other cryptocurrencies. Here are the main developments:

ADA (Cardano) Spot ETF

- Applicant / Institution: Grayscale Investments

- Progress: Grayscale submitted the world's first ADA spot ETF application to the U.S. SEC in the second week of February 2025. Following the announcement, the ADA price surged by 16%. The application is currently in the SEC's preliminary review stage.

- Final Response and Review Period: The SEC typically has a 45-day preliminary response period after receiving an application (approximately by March 25, 2025), which can be extended to 90 days (approximately by May 10, 2025).

XRP Spot ETF

- Applicant / Institution: Bitwise Asset Management, Grayscale, 21Shares, WisdomTree, Canary Capital

- Progress: Bitwise officially submitted the XRP spot ETF application through the Cboe BZX exchange in February 2025, and the SEC confirmed receipt on February 18. Other institutions like Grayscale and 21Shares also submitted similar applications from late 2024 to early 2025, all currently under review.

- Final Response and Review Period: For Bitwise, the SEC must provide a preliminary response within 45 days (approximately by April 4, 2025), which can be extended to 90 days (approximately by May 19, 2025).

SOL (Solana) Spot ETF

- Applicant / Institution: VanEck, Grayscale, Bitwise, 21Shares, Canary Capital

- Progress: Multiple institutions submitted SOL spot ETF applications from late 2024 to early 2025, with Grayscale and VanEck's applications currently in a 21-day public comment period.

- Final Response and Review Period: For Grayscale, after the comment period, the SEC has 45 days for a preliminary response (approximately by the end of March 2025), which can be extended to 90 days (approximately by mid-May 2025).

LTC (Litecoin) Spot ETF

- Applicant / Institution: Grayscale, Canary Capital, Nasdaq (representing undisclosed issuers)

- Progress: Nasdaq submitted the LTC spot ETF application on January 29, 2025, which the SEC has accepted and is currently in a 45-day preliminary review (approximately by March 15, 2025). Grayscale and Canary Capital's applications are also progressing simultaneously.

- Final Response and Review Period: The preliminary response is due by March 15, 2025, which can be extended to 90 days (approximately by April 29, 2025).

DOGE (Dogecoin) Spot ETF

- Applicant / Institution: NYSE Arca (representing undisclosed issuers), Grayscale Investments, Bitwise Asset Management, 21Shares, WisdomTree, Canary Capital

- Progress: The DOGE ETF application submitted in early 2025 is still in the early stages, with the SEC not publicly disclosing more details, leading to slow progress.

- Final Response and Review Period: A preliminary response period of 45 days is expected (approximately by mid-March 2025), which can be extended to 90 days (approximately by the end of April 2025).

II. Feasibility Analysis

The feasibility of cryptocurrency ETFs is influenced by regulation, market demand, legal risks, and technological maturity:

Regulatory Environment

- Positive Factors: The new leadership of the SEC (Paul Atkins) is more favorable towards cryptocurrencies, with expectations of relaxed policies in 2025. The success of Bitcoin and Ethereum ETFs sets a precedent for other cryptocurrencies.

- Challenges: SOL and XRP have been questioned by the SEC as "securities," requiring clarification of their legal status; ADA and LTC have a higher probability of approval due to their decentralized characteristics; DOGE faces greater uncertainty due to its meme nature.

- Probability of Approval (Bloomberg analyst predictions): LTC (85%), ADA (70%), SOL (60%), XRP (50%), DOGE (20%).

Market Demand

- LTC and ADA have certain demand due to technological maturity and community support; SOL benefits from the DeFi and NFT ecosystem but is negatively impacted by the downturn in the MEME market; XRP has institutional investor interest; DOGE relies more on retail sentiment, which may limit its scale.

III. Introduction of Underlying Assets and Token Price Performance Over the Past Month

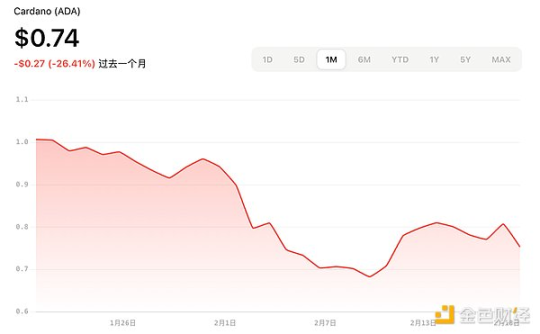

ADA (Cardano)

Introduction: Cardano is an open-source blockchain platform focused on academic research and sustainability, supporting smart contracts and DApp development.

Price Performance Over the Past Month (January 18, 2025 - February 18, 2025): The price fell from $1 to $0.74, a decrease of approximately 26.41%.

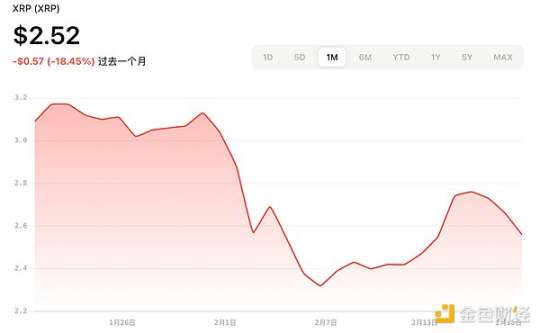

XRP (Ripple)

Introduction: XRP is supported by Ripple Labs, focusing on cross-border payments, emphasizing fast and low-cost transactions.

Price Performance Over the Past Month: The price fell from approximately $3.09 to $2.56, a decrease of approximately 18.45%.

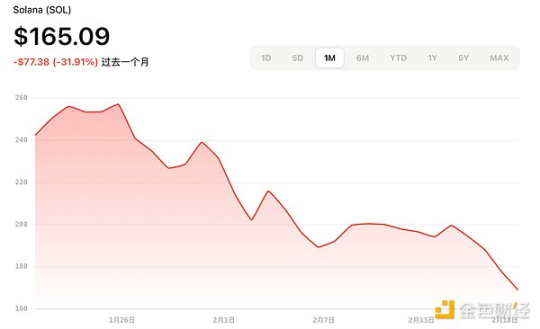

SOL (Solana)

Introduction: Solana is a high-performance public chain known for its high throughput and low latency, widely used in MEME, RWA, DeFi, and NFT.

Price Performance Over the Past Month: The price fell from approximately $242 to $169, a decrease of approximately 31.91%.

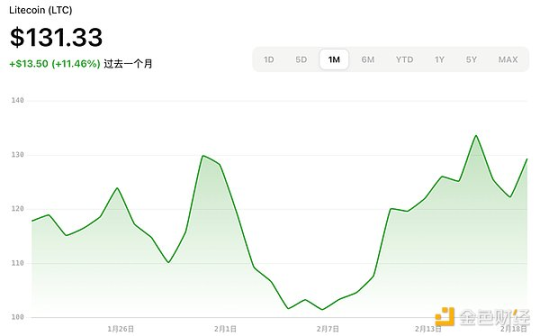

LTC (Litecoin)

Introduction: Litecoin is a Bitcoin fork, positioned as "the silver to Bitcoin," with faster transaction speeds and lower fees.

Price Performance Over the Past Month: The price rose from approximately $117 to $131.33, an increase of approximately 11.46%, boosted by ETF applications and market sentiment.

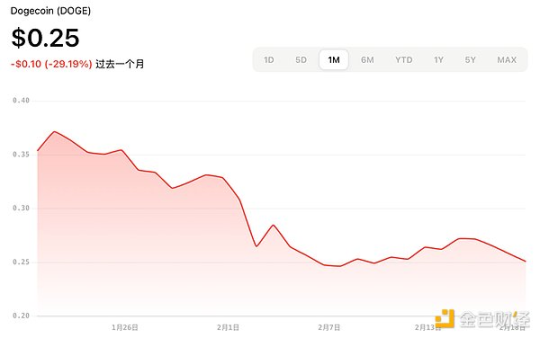

DOGE (Dogecoin)

Introduction: Dogecoin originated from meme culture and is now a leading cryptocurrency by market capitalization, driven by community and celebrity (such as Elon Musk) support.

Price Performance Over the Past Month: The price fell from approximately $0.35 to $0.25, a decrease of approximately 29.19%, with high volatility.

Conclusion

As of February 19, 2025, the cryptocurrency ETF market is experiencing a new wave of enthusiasm, with multiple institutions submitting spot ETF applications for ADA (Cardano), XRP, SOL (Solana), LTC (Litecoin), and DOGE (Dogecoin), further integrating crypto assets into traditional finance. Asset management giants like Grayscale, Bitwise, and VanEck are leading the applications, with varying progress: LTC and ADA have a higher probability of approval due to technological maturity and regulatory friendliness, while SOL and XRP need to overcome the "security" definition controversy, and DOGE faces greater uncertainty due to its meme nature. The review periods are mainly concentrated from March to May 2025, and the open attitude of the new SEC leadership injects optimistic expectations into the approval process.

In terms of asset performance, the overall market correction over the past month has led to declines in the range of 20% to 30%. The feasibility analysis indicates that regulatory easing, market demand, and technological maturity are key driving factors for ETF approvals, but legal risks remain a major challenge. In the coming months, investors and industry observers should closely monitor the SEC's final responses, as cryptocurrency ETFs may become an important barometer for the crypto market in 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。