Following Ethereum, Solana also cannot escape market FUD.

Written by: Tuo Luo Finance

When it comes to the most eye-catching public chain in this bull market, Solana, humorously referred to as the "data center chain," undoubtedly takes the lead. The heavy blow from FTX became the soil for Solana's rebirth. With outstanding performance and precise positioning, SOL rode the wave of MEME to create a rare growth miracle, skyrocketing from $8 to over $290, leaving the market in awe. Active participants, active funds, and active projects constitute a vibrant ecosystem, leading to the frequent appearance of slogans surpassing Ethereum when discussing Solana.

However, recently, the performance of the "king of retail investors" has been less than satisfactory. Over the past month, SOL's price has dropped from a high of $295.83 to the current price of $169, with a maximum decline of over 45%, nearly halving. The sluggish price, the cooling of MEME, and the unlocked tokens starkly contrast with the bustling crowds at the SOL venue during the conference.

This raises the question: Is Solana viable or not?

In terms of price alone, Solana's sluggish performance is mainly attributed to two direct factors: MEME and token unlocking. Previously, SOL had successfully risen through MEME, establishing itself as a major on-chain casino, but recent developments in the MEME space have left the market somewhat disappointed.

The root cause lies in the explosive popularity of celebrity coins, such as Trump Coin, Melania Coin, and the Argentina President-related LIBRA, which have continuously emerged. Celebrities leveraging their influence to harvest profits have left the already liquidity-scarce market feeling overwhelmed. In terms of price performance, Trump Coin has dropped 76% from its peak, with 800,000 people standing guard at the top, while MELANIA has seen a 90% decline, and the less influential LIBRA has plummeted by an astonishing 92%, nearly reaching zero, with nearly 30% of large holders buying at high prices, resulting in over 70,000 addresses being harvested.

The low threshold for token issuance has led presidents to choose their own MEME between Bitcoin and Ethereum, undoubtedly shattering the market's confidence in liquidity injection. This sentiment cannot be expressed to the project parties but is directly reflected in the infrastructure, especially considering the controversies surrounding Jupiter and Meteora in LIBRA, which have also brought unwarranted disaster to Solana.

Of course, Solana is not entirely innocent. Since it became a MEME casino, major institutions, bots, and market makers have profited billions of dollars through MEME on Solana. According to statistics from DeFiLlama founder 0xngmi, total profits range between $3.6 billion and $6.6 billion, with MEV (Maximum Extractable Value) accounting for $1.5 billion to $2 billion, trading bots and applications $1.09 billion, automated market makers between $0 to $2 billion, Trump-related insiders $500 million to $1 billion, and the Pump.fun platform also raking in $492 million.

MEME on Solana has become a cash cow for high-frequency traders, arbitrageurs, and insiders. As the market continues to decline, many have chosen a simpler form of resistance—quitting altogether. According to crypto analyst Ali's monitoring, the number of active addresses on the Solana chain has significantly decreased from 18.5 million in November 2023 to the current 8.4 million, a drop of 54.6%. Data from Nansen shows that the number of active addresses on February 18 was only 5.17 million, a 30-day decline of 22.37%.

With fewer people, the price of the coin is naturally affected, not to mention that even Bitcoin is currently in a semi-dead Schrödinger state. However, to drop 40% in a month and become the worst-performing token among the top 30 by market capitalization, the impact of just the MEME market is not enough.

Token unlocking has become another mountain looming over SOL. As early as last month, anonymous crypto commentator artchick.eth shared the token unlocking schedule for Solana in 2025 on social media, mentioning that Solana's current token inflation rate is 4.715%, but in the next three months (February to April), over 15 million SOL tokens worth more than $7 billion will enter circulation. The largest unlocking event will occur on March 1, when 11.2 million SOL tokens worth approximately $2.06 billion will be unlocked.

SOL unlocking schedule, source: artchick.eth

To trace the source of this unlocking, we must return to FTX. As part of the bankruptcy proceedings, FTX liquidated 41 million SOL in three auctions, with the largest buyer being Galaxy Digital, which acquired 25.52 million SOL at a price of $64 per token, accounting for 62.24% of the total. The second-largest buyer was Pantera, whose buying consortium purchased 13.67 million SOL at a price of $95 per token, yielding a return of 93%. Other buyers acquired 1.8 million SOL at a price of $102 per token.

The unlocking on March 1 is part of the liquidation of SOL, and the only good news is that FTX began repaying debts on February 18, with Kraken completing the first fund distribution for the FTX estate, compensating over 46,000 creditors. While creditors are happy, SOL holders are understandably anxious.

In the current not-so-favorable market, the large unlocking of SOL is bound to be seen as selling pressure, thus undermining investor confidence. Crypto trader RunnerXBT bluntly stated that now is a "dangerous" time to buy Solana. He also emphasized that once the SOL unlocking occurs, companies like Galaxy, Pantera, and Figure will extract unrealized gains of $3 billion, $1 billion, and $150 million, respectively.

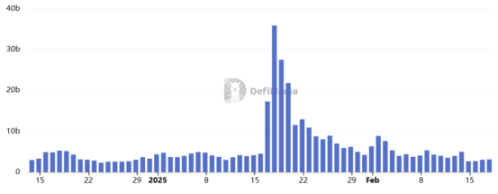

With external turmoil and internal instability, the market quickly took action. Besides selling off for stable assets, shorting has become the only option. Not only has the total open interest and funding rates diverged, but the long-short ratio is also vastly different. As the open interest rises and funding rates turn negative, the current long-short ratio is 4:1, with most positions increasing after SOL dropped to $190, indicating that new buyers are highly bearish. Trading data has also shown a significant contraction, with Solana's on-chain activity plummeting from a peak daily trading volume of $35.5 billion on January 17 to $3.1 billion on February 17.

Against this backdrop, SOL has predictably declined, dropping from $290 on January 19 to a low of $160, a 45% drop in January, which is not an exaggeration to describe as a complete rout. Is the king of retail investors, Solana, about to fall?

Interestingly, at the recent Consensus Conference, the Side Event hosted by Solana was still bustling with activity. Some represent attention, and attention in the crypto space means capital flow, contrasting sharply with the activities of inscriptions and NFTs, where once-popular concepts now have only a few participants.

In this regard, most industry insiders still seem to show considerable interest in Solana. Ultimately, despite the complaints, the Solana ecosystem remains relatively robust. Looking at its ecosystem, it encompasses payments, DeFi, LSD, Meme, gaming, NFTs, and DePIN, with many star projects clustered together. In terms of total TVL, Solana's TVL has reached $8.24 billion. Although the gap compared to Ethereum's $57.3 billion is vast, it has successfully risen from obscurity in 2023 to the second position among public chains, accounting for 7.72% of the total TVL. It is worth mentioning that in the past two weeks, influenced by the unlocking, Solana's TVL has decreased by 19%, with Jito, Kamino, Marinade Finance, and Sanctum experiencing rapid outflows.

A single-chain can return to its peak from below $10, and besides the so-called technical and positioning advantages, the power of capital is the true invisible hand. Strong Western capital from A16z, Multicoin, Galaxy, Pantera, etc., provides strong backing, allowing Solana to thrive in various payment fields. In previous institutional predictions for 2025, there was no exception in expressing high confidence in SOL.

Returning to the fundamentals, aside from the increasingly declining MEME being difficult to repair, the impact of token unlocking remains relatively controllable in the short term. This unlocking has already begun gradually since early February, and the market has long anticipated it. The upcoming unlocking only accounts for 2.31% of the total supply and market capitalization, compared to the current spot trading volume of around $3.6 billion in 24 hours, the selling pressure is not particularly strong. Of course, if capital parties choose to sell a large amount in the market at once, SOL will undoubtedly face a sharp decline. However, for personal profit considerations, capital parties are unlikely to choose this method and will often control the frequency of sales. Even if they do sell a large amount at once, they will likely opt for over-the-counter (OTC) transactions to minimize market impact and maximize personal interests. However, it is not entirely optimistic; in addition to the unlocking on March 1, there will be more selling pressure later this year.

From a positive news perspective, there will still be a wave of speculation around SOL ETFs. Currently, five institutions have submitted applications for SOL's spot ETF: Grayscale, Bitwise, VanEck, 21Shares, and Canary Capital. Although last year's SOL ETF failed, with the new regulatory bodies coming into power, SOL ETFs have seen a glimmer of hope. The SEC has already accepted the 19b-4 application for the Grayscale Solana ETF, with the most recent approval date being March 30. However, according to standard procedures, the SEC usually continues to postpone the acceptance of applications, with a maximum time frame of 240 days. Given that the securities nature of SOL has been explicitly named, subsequent approvals still need to be observed. In terms of possibilities, Litecoin and Dogecoin have a relatively higher probability of approval, but regardless, as long as the ETF is still under review, the narrative will not cease.

On the other hand, this does not mean that Solana is without problems. From the current structure, although DeFi and DePin are also thriving, Solana is indeed highly dependent on the MEME ecosystem. According to data released by Messari for the fourth quarter of 2024, Solana's application revenue surged from $268 million in the third quarter to $840 million by the end of the fourth quarter, a staggering growth of 213%, primarily attributed to MEME. Among them, Pump.fun generated revenue of $235 million in the fourth quarter, while the DeFi trading terminal Photon and the decentralized exchange Raydium recorded revenues of $140 million and $74 million, respectively.

Objectively speaking, although MEME has become an enduring and important narrative segment in crypto with long-term effects, ultimately, the frenzy around MEME stems from the industry's ongoing sluggish economic cycle. In other words, MEME is more like a lottery effect in the crypto market, a wealth-seeking behavior of betting small to gain big. The MEME cycle is, in fact, a phase product under conditions of insufficient liquidity. However, the market has grown weary of VC-style profit-seeking, and despite seemingly fair launches, instances of MEME front-running, insider trading, and market manipulation are everywhere. This high-frequency, wave-like harvesting has, to some extent, severely damaged the industry ecosystem. Take LIBRA as an example; the team behind it even attempted to establish contact with the Nigerian president, suggesting that perhaps presidential tokens could soon be everywhere, making scarcity a moot point.

In this context, Solana's high dependency on MEME inevitably leads to fluctuations alongside MEME. The recent fallout from LIBRA has resulted in market anger directed at Jupiter and Meteora, as well as a blow to SOL, confirming this point. As market speculation is suppressed, the associated SOL is also bound to suffer, compounded by the critical expectation of unlocking and selling pressure, leading to a continuous decline in SOL.

Indeed, at this stage, Solana remains one of the public chains with the most active funds in the market. Emotional outbursts are unlikely to last long, and Solana, backed by capital, is still "building." However, in a crypto market filled with FUD, the time left for SOL may not be as long as one might imagine.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。