Market data and analysis for February 19, 2025, show the following characteristics and trends in the cryptocurrency market today:

- Ethereum Shows Resilience

Despite an overall market decline, Ethereum (ETH) has remained relatively stable, even experiencing slight increases during certain periods. The exchange rate of Ethereum compared to Bitcoin has also risen, peaking at 0.029, indicating strong resistance to downturns. Additionally, market sentiment towards Ethereum is gradually becoming more bullish, with decreasing exchange balances suggesting that investors prefer long-term holding over short-term trading.

- Overall Trend in the Cryptocurrency Market

Recently, the cryptocurrency market has shown some topping signals, including over 90% of Bitcoin's supply being in profit, which is typically a sign of price peaks. Furthermore, the market's consensus on cryptocurrencies is overly optimistic, with the successful issuance of Bitcoin ETFs and participation from institutional investors further boosting market sentiment. However, macroeconomic uncertainties (such as U.S. fiscal policy) may negatively impact the market.

- Divergence in Altcoin Performance

Today, some altcoins performed well, such as MKR rising by 12%, LTC by 7%, and BERA by 8%. However, overall market sentiment remains fearful, especially as Bitcoin's price dropped to $93,000, prompting some investors to sell off.

- Future Outlook

Citigroup points out that the performance of the cryptocurrency market in 2025 will depend on six key factors, including ETF activities, regulatory policies, and the development of the stablecoin market. Although the market may face adjustments in the short term, the long-term position of cryptocurrencies in multi-asset portfolios is expected to improve.

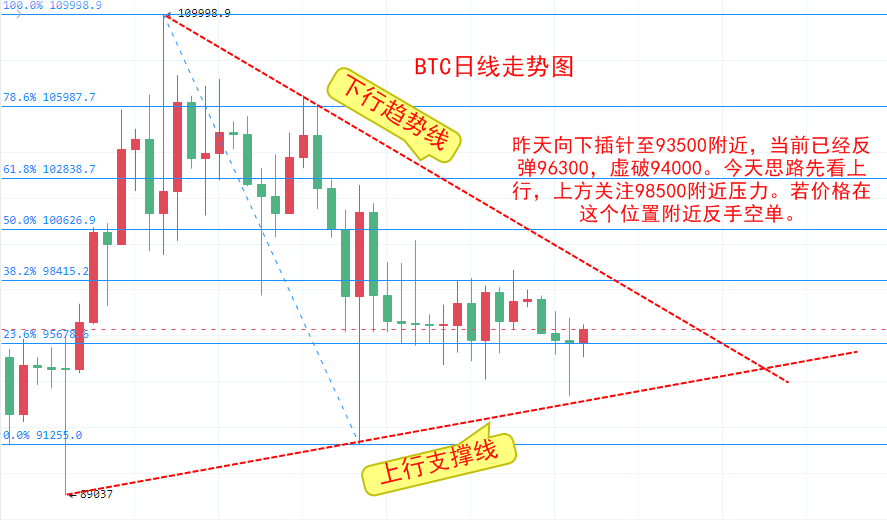

- Technical Analysis of Intraday Contracts

For BTC, we observe a state of triangular convergence on the daily chart, with the overall trend still leaning downward. Yesterday, it dipped to around $93,500, and has currently rebounded to $96,300, briefly breaking below $94,000. Today's strategy is to look for a rebound, with resistance around $98,500. If the price approaches this level, consider taking a short position. For short positions, reference $98,400 for entry, with a stop loss at $104,000 and a target of $95,000.

For ETH, today we focus on resistance around $2,850 and support at $2,500. The recent trend has not moved out of this range, and the overall trend still leans downward. Although ETH has performed better than BTC in recent days, the strategy is to treat it as a fluctuating market, placing short positions around $2,800, with a stop loss at $2,860 and a target of $2,600.

Today's Summary

The cryptocurrency market today shows a divergent trend, with some coins like XCP performing poorly, while Ethereum and certain altcoins show relative strength. Although market sentiment is optimistic, it is essential to be cautious of risks posed by macroeconomic and policy changes. Investors should closely monitor market dynamics and allocate assets wisely to cope with volatility.

Market conditions change in real-time, and there may be delays in article publication. The strategy points are for reference only and should not be used as the basis for entry. Investment carries risks, and profits and losses are the investor's responsibility. For daily real-time market analysis, join our experience exchange group and practical discussion group for real-time guidance. Live broadcasts explaining real-time market conditions will be held at irregular times in the evening.

For more real-time market analysis, please follow the public account: Chu Yuechen

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。