Organized by: Luan Peng, ChainCatcher

Important News:

- Binance HODLer Airdrop Launches KAITO

- FTX: Next Round of Repayment Distribution Expected to Start on May 30, 2025

- Kaito AI to Open KAITO Claims Tomorrow

- Vitalik: Has Held a Seat on the Ethereum Foundation's Three-Person Board Since 2017

- Strategy Announces Issuance of $2 Billion Convertible Bonds to Support Future Bitcoin Purchases

- Libra Co-Founder Hayden Davis Denies Bribing Argentine President Milei's Sister

- Sun Yuchen: The Potential of AI and Blockchain Integration is Huge, AI Products Based on DeepSeek Will Be Launched Soon

- Binance to Update Leverage and Margin for Multiple U-Based Perpetual Contracts

“What Important Events Happened in the Last 24 Hours”

Binance HODLer Airdrop Launches KAITO

According to the official announcement, the Binance HODLer airdrop has launched its 9th project, KAITO. From February 6, 2025, 08:00 to February 11, 2025, 07:59 (UTC+8), users who purchase regular and/or flexible products on the earn platform using BNB will receive airdrop allocations. HODLer airdrop information is expected to be available within 12 hours, and the new tokens will be distributed to users' spot wallets one hour before trading begins.

Binance will list KAITO on February 20, 2025, at 21:00 (UTC+8) and will open trading pairs against BTC, USDT, USDC, BNB, FDUSD, and TRY. Seed label trading rules will apply.

FTX: Next Round of Repayment Distribution Expected to Start on May 30, 2025

FTX announced that it has begun the first repayment distribution to approved claim holders in the Convenience Classes of FTX's Chapter 11 reorganization plan. Customers are expected to receive funds within 1 to 3 business days.

The expected registration date for the next round of distributions is April 11, 2025, applicable to holders of approved FTX Class 5 customer equity claims and Class 6 general unsecured claims, as defined in the reorganization plan.

For Convenience Claims approved after the initial registration date but not yet received, the next registration date is also set for April 11, 2025. The next round of distributions is expected to start on May 30, 2025.

Kaito AI to Open KAITO Claims Tomorrow

The AI-based cryptocurrency data analysis platform Kaito AI announced that it will open KAITO claims tomorrow (February 20) at 20:00. The KAITO token economic model will be released before the token claims, and trading will open at 21:00 on the same day.

Vitalik: Has Held a Seat on the Ethereum Foundation's Three-Person Board Since 2017

Vitalik stated that the claim of him holding 3 out of 5 seats on the Ethereum Foundation (EF) board is inaccurate. He clarified that since 2017, he has only held one seat on the three-person board.

Strategy Announces Issuance of $2 Billion Convertible Bonds to Support Future Bitcoin Purchases

According to The Block, Strategy (formerly MicroStrategy) plans to issue $2 billion in zero-interest convertible senior bonds for general corporate purposes, including acquiring Bitcoin. These bonds will mature on March 1, 2030, and can be settled in cash, Class A common stock, or a combination of both. The company also grants initial purchasers an option to buy an additional $300 million in bonds.

Previously, Strategy issued a profit warning in its 10-K filing, primarily due to a $1.79 billion impairment loss on digital assets. The company warned that a significant decline in Bitcoin's market value could affect its ability to repay debts and liquidity, forcing it to sell Bitcoin at unfavorable prices.

In 2024, Strategy acquired approximately 258,320 BTC and currently holds 478,740 BTC, valued at over $46 billion. The company stated that it may rely on equity or debt financing to meet financial obligations in the future, with success depending on Bitcoin's market value.

Libra Co-Founder Hayden Davis Denies Bribing Argentine President Milei's Sister

According to CoinDesk, Libra token co-founder Hayden Davis claimed in a text message last December that he influenced presidential decisions by bribing Karina Milei, sister of Argentine President Javier Milei, stating, "I gave his sister money, and he signed as I wished, acted as I requested."

Karina Milei is a key figure in the Milei government, currently serving as the Secretary-General of the Argentine Presidency and is the sister of the current Argentine President Javier Milei.

In response, Hayden Davis's spokesperson Michael Padovano stated that Davis does not recall sending such a message, and there is no record of it on his phone.

Davis stated in a statement: "Recent media reports that I paid President Javier Milei or his sister Karina Milei to launch the Libra memecoin are completely false. I have never paid them any fees, nor have they requested any payments from me. Their only concern is to ensure that the benefits of Libra can benefit the Argentine people and economy."

Huobi HTX Global Advisor and TRON founder Sun Yuchen was invited to attend the Hong Kong Consensus Conference's roundtable forum themed "Unlocking DeFi for the Public: A Dialogue with World Liberty Financial and TRON." He stated that the entire cryptocurrency industry has spent a lot of time and effort over the past five years to enter the mainstream financial world. The role of WLFI in connecting traditional finance with cryptocurrency and the Trump administration's support for cryptocurrency is what the industry needs, so the collaboration with WLFI is swift and smooth.

Regarding the current Meme market, Sun Yuchen stated that meme coins are the future of cryptocurrency but need to be operated in the right way. "Recently, we have seen some meme coins' prices plummet, one reason being that they were not launched in the right way. The most successful meme coins, such as Dogecoin and Shiba, developed from the community rather than being overvalued at launch. Currently, many meme coins are overvalued at launch through VC investments, leading to price crashes and loss of market trust."

Sun Yuchen also revealed future development plans during the forum:

The decentralized stablecoin USDD currently has a market value of $200 million, with plans to double its market value in the short term. Meanwhile, it will continue to offer a high yield return of 20%, with ongoing monitoring and optimization.

The potential for AI and blockchain integration is huge, with plans to launch AI products based on DeepSeek in Q2 2025.

Binance to Update Leverage and Margin for Multiple U-Based Perpetual Contracts

According to the official announcement, Binance contracts will update the leverage and margin tiers for BADGERUSDT, BOMEUSDT, 1000FLOKIUSDT, GOATUSDT, OMUSDT, and BNXUSDT U-based perpetual contracts on February 19, 2025, at 17:30 (Beijing time). Existing positions held by users before the update will be affected, and users are advised to prepare accordingly before the adjustments.

The modular real yield layer and Instagram application chain Cygnus have completed a $20 million Pre-Seed round of financing, with participation from Manifold Trading, OKX Ventures, Mirana Ventures, Optimism Foundation Retro Funding, and others. This financing will enable Cygnus to expand its product range and strengthen its influence in key markets, driving the cryptocurrency industry into the era of super applications.

Cygnus is committed to building a modular real yield layer, aiming to allow any blockchain to easily customize its own re-staking network and achieve shared security. Assets from both on-chain and off-chain can be deposited into Cygnus LVS to become liquidity validators, facilitating seamless coordination and economic security.

Cygnus aims to build a transparent and decentralized economic network within emerging ecosystems and establish sustainable models that drive real-world utility and support mass adoption.

Report: Bitcoin Mining Contributes $4 Billion and 31,000 Jobs to the U.S. Economy

According to TheMinerMag, a recent report from the Perryman Group shows that Bitcoin mining has created over 31,000 jobs and generates more than $4.1 billion in total output annually for the U.S. economy. The U.S. accounts for approximately 40% of the global Bitcoin hash rate.

The report emphasizes that Texas is the biggest beneficiary of Bitcoin mining, with estimated annual economic activity of $1.7 billion, creating over 12,200 jobs. Georgia has an average annual output of $316.8 million, while New York contributes $225.9 million.

The report was commissioned by the Texas Blockchain Council and the Digital Chamber, both industry non-profits.

According to Cointelegraph, Hong Kong Financial Secretary Paul Chan stated during a keynote speech at the "Consensus Hong Kong 2025" conference that Hong Kong will maintain a stable, open, and vibrant digital asset market as the Web3 ecosystem continues to develop.

Chan pointed out that Hong Kong is heavily investing in related infrastructure and talent development. Currently, Hong Kong Cyberport has gathered over 270 blockchain companies, with more than 120 added in the past 17 months.

Insider: X Platform Negotiating Financing at a $44 Billion Valuation

According to insiders, Elon Musk's social media company X is negotiating with investors to raise funds at a $44 billion valuation, the same price Musk paid to acquire the company in 2022.

This round of financing will be a significant turning point for the social media giant after Musk's acquisition and reforms led to many users and advertisers leaving. The sources stated that negotiations for the new round of X financing are still ongoing, and details may change.

The company may also abandon the financing negotiations. This is the first known investment round since Musk privatized the social media company.

According to CoinDesk, a U.S. federal court detailed the scale of assets owned by SBF before his trial and imprisonment for fraud, as well as how the U.S. government quickly intervened to seize approximately $1 billion in financial assets and two jets.

The final forfeiture order issued by the U.S. Southern District Court of New York on Tuesday formally stripped SBF of ownership of all assets listed in a lengthy property list. Alameda's assets on Binance include: $56 million in XRP, $3.6 million in TRX, $3.4 million in ADA, $2.3 million in BTC, and dozens of other tokens.

The most significant asset is the proceeds from the sale of Robinhood stock—$606 million held by SBF's Emergent Fidelity Technologies.

Other financial assets include:

- 119 million USDT held by Alameda Research on Binance;

- $21 million held by Emergent Fidelity Technologies at Marex;

- $50 million held by FTX Digital Markets at Moonstone Bank;

- $101 million held by FTX Digital Markets at Silvergate;

- $7 million held by SBF and another individual at Flagstar Bank.

The list of seized assets also includes two private jets: a 2009 Bombardier Global 5000 and a 2006 Embraer Legacy.

Court documents also detail over 250 political donations that have been withdrawn from the campaigns and organizations of recipients, including amounts donated by FTX executives at SBF's direction.

Zhao Changpeng: All Tokens Received Will Be Donated, Likely to Those Who Lost on TST or Broccolis

Zhao Changpeng posted on the X platform: "When you try to make money quickly, you often lose everything. When you are generous, you tend to receive more.

I donated 150 BNB (about $100,000) to a college student who invested $50,000 of his own money to help Libra victims.

Now, the address has received more BNB than I donated and has also received more tokens.

I will not keep a single cent of it. I will continue to donate, likely to those who lost on TST or some Broccolis. This is not an endorsement of any token, so please do not overinterpret."

“What Interesting Articles Are Worth Reading in the Last 24 Hours”

On February 12, former ParaFi Capital partner Santiago Roel Santos announced InversionChain on social media. He stated that Inversion will focus on "on-chain real GDP," allowing businesses to fundamentally improve their operations and performance through on-chain integration. Inversion Chain will drive the world's first crypto-native private equity strategy, specifically through the acquisition of traditional companies and anchoring them on the Inversion chain.

Previously, in November last year, Santiago Roel Santos announced the launch of the private equity fund Inversion Capital, which was the embryonic stage of the InversionChain concept. At that time, Santiago had already decided to acquire traditional companies and use crypto technology to transform their operations, emphasizing "acquisition" rather than collaboration and acceptance, indicating that InversionChain will be a customized, sovereign L1.

It is reported that InversionChain will adopt customized chain technology based on Avalanche L1. Besides the founder and the initial project concept, Inversion currently has nothing else, and in Santos's recent posts, he is also recruiting a CTO and other team members. However, this seemingly ambitious project has already taken root.

From Q4 2024 to early 2025, the competitive landscape of Solana's DeFi ecosystem is gradually emerging, primarily reflected in the rise of aggregators, the abstraction of user experience (UX), significant integrations, and the evolving standards of token economics. Although these changes were initially not obvious, recent data has clearly shown their impact, particularly in the redistribution of liquidity, fee generation, and changes in market share.

This analysis delves into the liquidity positioning of major decentralized exchanges (DEXs) based on Solana—Raydium, Jupiter, Orca, and Meteora—highlighting their advantages, disadvantages, and potential investment impacts relative to existing and emerging competitors.

New BROCCOLI Hits $50M in Half an Hour, Reviewing the "Broccoli War" Triggered by This Donation

On the afternoon of February 18, the previously quiet narrative of "CZ's Dog" suddenly became active, with a new $BROCCOLI issuance around 6 PM, rapidly rising in a short time to hit a market cap of $50M within an hour and a half, currently stabilizing around $10M. The explosive popularity of this token is not only a renaissance but is also closely related to the recent $LIBRA and "charity relief."

From a holding strategy perspective, institutions have different market expectations and asset allocation directions, with several institutions making large-scale increases in holdings in Q4 2024, particularly BlackRock's IBIT being the most attractive.

OpenSea's Seven-Year Journey: The Former NFT Exchange "King" Chooses to Issue Tokens

On the evening of February 13, OpenSea announced the launch of the OS2 public beta version on X, along with the introduction of the platform token SEA, and hinted at an upcoming airdrop. Although the specific timeline and details have not been disclosed, this announcement undoubtedly stirred the hearts of many veteran players in the crypto space. Within just one hour, the comments and retweets on the post exceeded a thousand, and community discussions surged.

OpenSea CEO Devin Finzer also tweeted to emphasize that "the upcoming OS2 is not just a new product, and SEA is not just a token, but a completely new OpenSea built from the ground up." There have also been rumors that the new version of OpenSea will reference Blur's trading-centric UI.

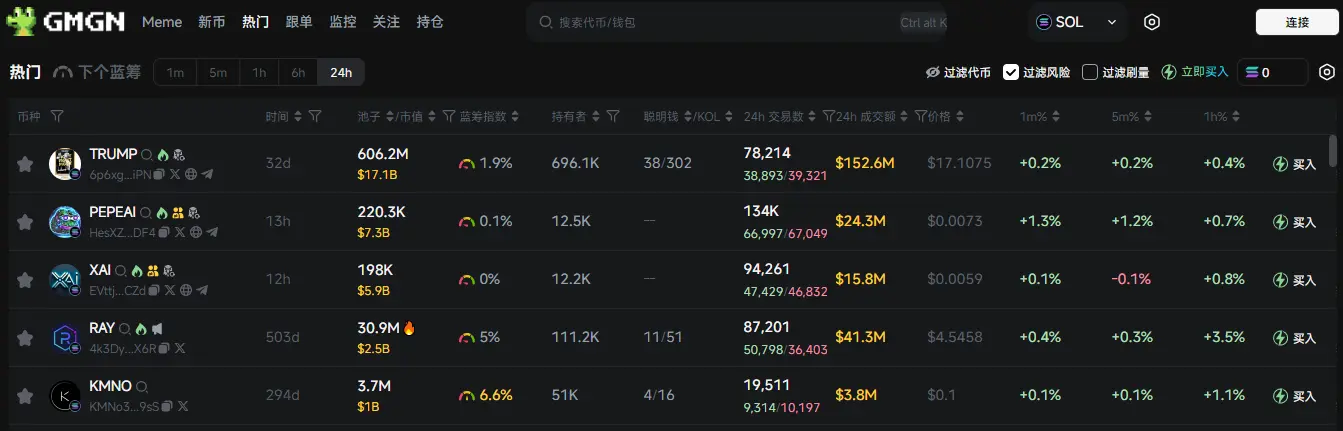

Meme Popularity Rankings

According to the meme token tracking and analysis platform GMGN, as of February 19, 19:50:

The top five popular Ethereum tokens in the past 24 hours are: LINK, SHIB, UNI, USDe, PEPE

The top five popular Solana tokens in the past 24 hours are: TRUMP, PEPEAI, XAI, RAY, KMNO

The top five popular Base tokens in the past 24 hours are: AI, GPS, AERO, B3, VIRTUAL

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。