Original author: Axel Bitblaze

Original compilation: Deep Tide TechFlow

The retail market is sluggish, sentiment has hit rock bottom, and altcoins have been declining for months—yet this may be the prelude to a new round of opportunities.

Despite the seemingly dire market conditions, I believe this is more of a setup rather than an endpoint.

As key catalytic events gradually emerge, I am confident that the next market rally will be led by utility coins rather than memes.

Here are my views and the potential timeline for this change.

Since December 2024, investors' patience for the "altcoin season" has worn thin.

Starting from the fourth quarter of 2024, the market has actually welcomed several positive news, yet the altcoin market has failed to respond positively.

Currently, market sentiment seems to be in a "depression phase," with retail investors and large holders (whales) selling off their positions.

Does this mean that the "altcoin season" is just a gimmick?

Will this market cycle end without ETH reaching new highs?

Are there any positive factors that could drive capital into the altcoin market?

Next, let’s analyze from the perspective of positive factors and the timeline for the "altcoin season."

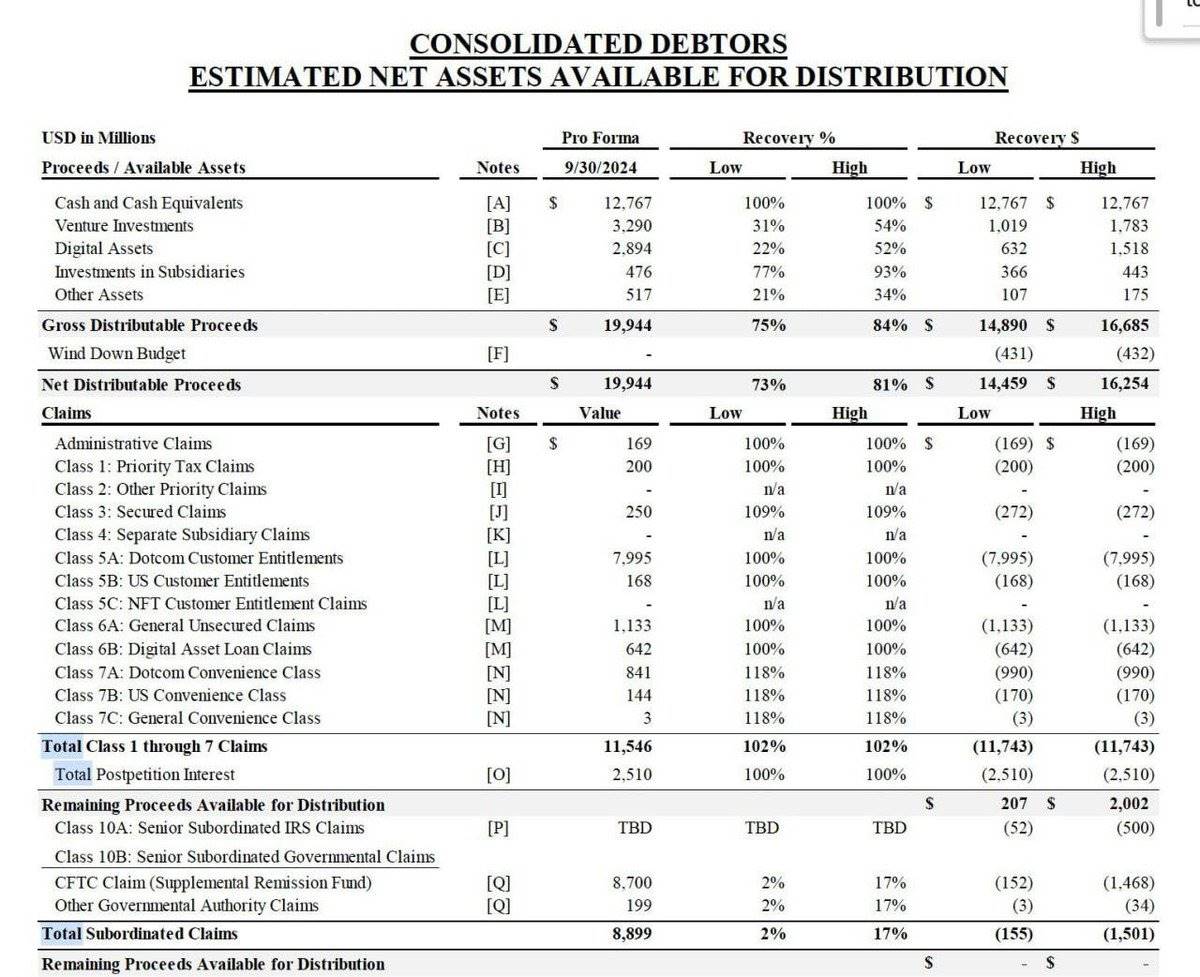

1. FTX Compensation: A New Variable in the Market

Previously, I thought the FTX compensation would be delayed for years like the Mt. Gox incident. However, it turns out that this process is accelerating.

Starting from February 18, 2025, FTX will initiate the first round of compensation, with a total amount expected to be between $7 billion and $8 billion, primarily distributed in stablecoins.

What does this mean for the altcoin market?

First, most of FTX's traders are high-risk investors who primarily hold altcoins in their portfolios.

Second, current market data shows that most altcoins (including ETH) are severely undervalued compared to BTC.

Looking back at the market situation during the FTX collapse, BTC was priced around $16,000, SOL was about $20, and ETH was around $2,500.

Now, as funds flow back into the market, many investors will reassess the current market environment and realize that ETH is undervalued.

In addition to ETH, many altcoins have significantly lagged behind BTC in terms of price recovery from the cycle's bottom.

Coupled with the increasingly friendly policy environment towards cryptocurrencies from the U.S. government, I believe most of this capital will flow into the altcoin market, especially those tokens with practical application value, rather than purely speculative memes.

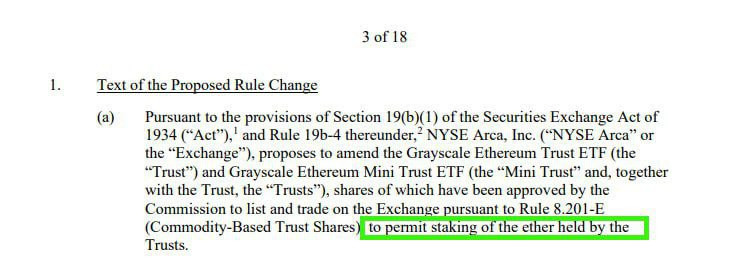

2. ETH ETF Staking Function: A New Attraction for Institutional Funds

For a long time, ETH holders have been looking forward to applications related to the ETH ETF staking function. Now, this process has finally begun.

In the past three days, Grayscale and 21Shares have submitted applications to the U.S. Securities and Exchange Commission (SEC) to allow their Ethereum ETFs to stake the ETH they hold.

Although BlackRock has not submitted a similar application, I expect this to happen in the next 2–3 weeks.

Currently, the motivation for institutional investors to choose ETH ETFs over BTC ETFs is limited. However, once the staking function is approved, ETH ETFs will be able to offer an annualized yield of 3%–4%. Such yields are undoubtedly attractive to traditional financial institutions (TradFi) and will draw more institutional funds into the ETH market.

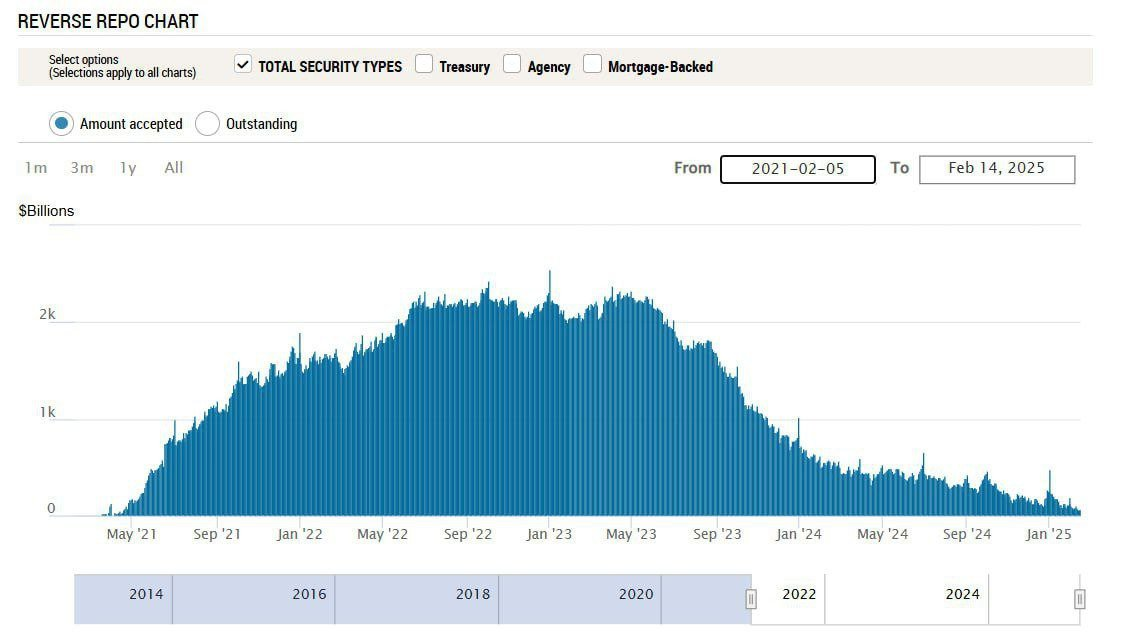

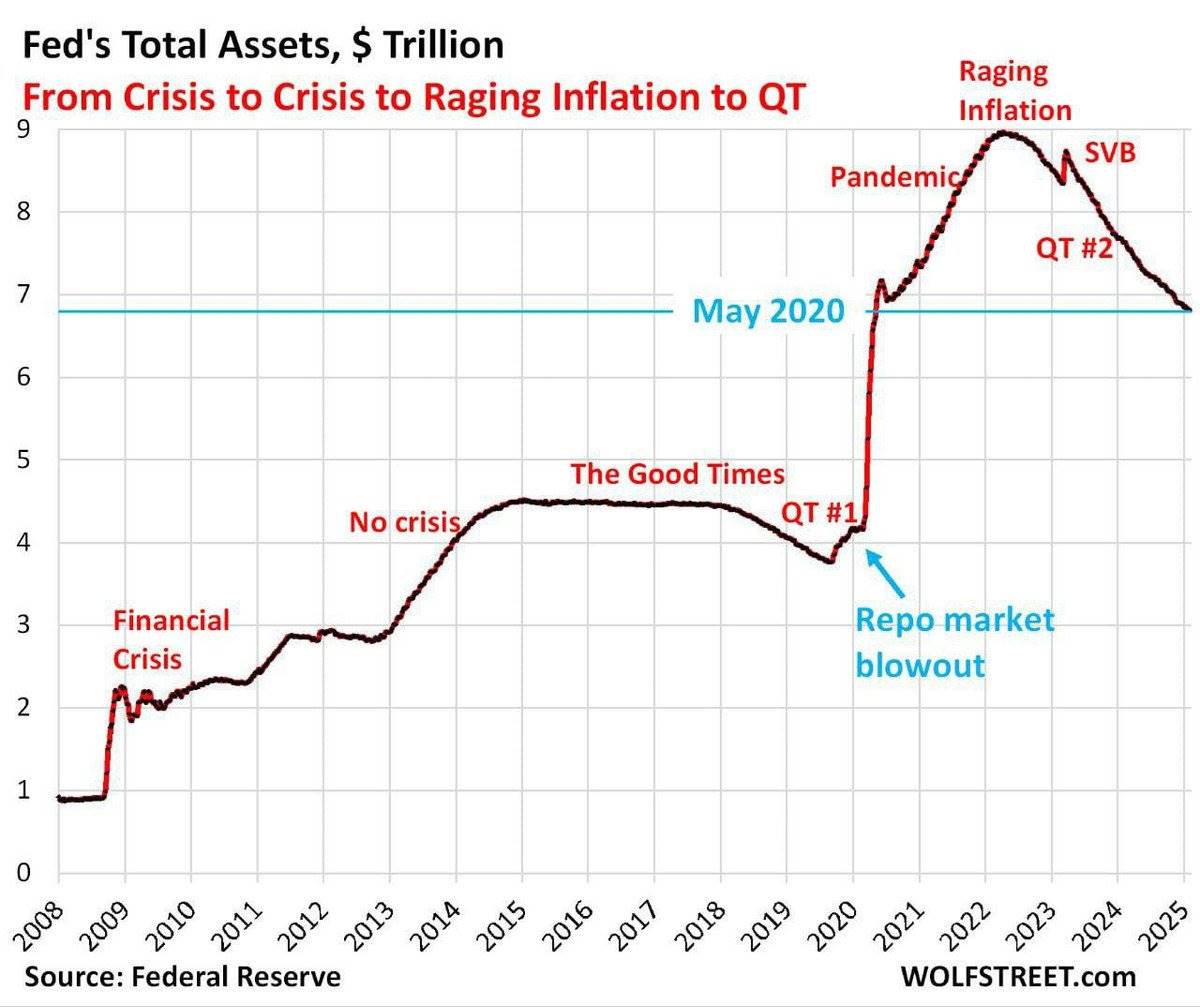

3. Decline of the Federal Reserve's Reverse Repo Program (RRP): A Turning Point for Market Liquidity?

The Federal Reserve's reverse repo program (RRP) is an important tool for regulating liquidity in the financial system. When RRP balances decline, it usually indicates that excess liquidity is decreasing.

This phenomenon typically occurs during the Federal Reserve's quantitative tightening (QT) process, which is currently happening.

As of now, the Federal Reserve's RRP balance has decreased by $2.5 trillion from its peak, returning to levels seen in April 2021.

What does this mean for the market?

The end of quantitative tightening (QT) seems to be on the horizon.

Notably, during the period when the Federal Reserve implemented quantitative tightening, there has never been an "altcoin season."

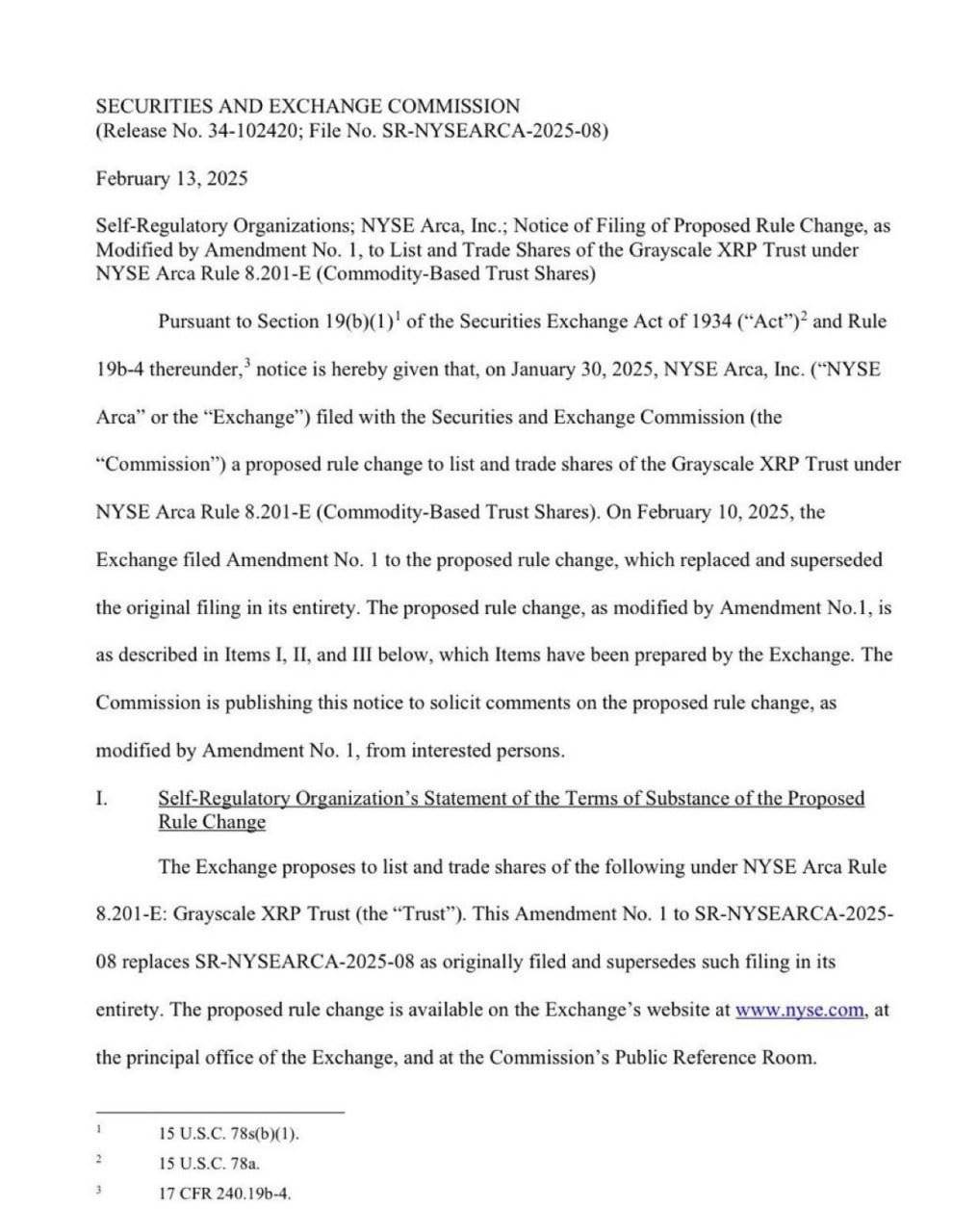

4. Regulatory Breakthrough for Altcoin ETFs: A New Dawn?

Since January 20, 2025, the SEC has begun collaborating with issuers of altcoin ETFs.

In recent days, the SEC has officially accepted spot ETF applications for XRP, DOGE, and SOL.

While this does not guarantee that these applications will be approved, it indicates that the U.S. altcoin market may soon welcome a clearer regulatory environment. This will positively impact the restoration of market confidence.

5. Deterioration of Market Sentiment: Crisis or Opportunity?

Current market sentiment is at a low point:

Competition among developers and project founders is intensifying.

Supporters of ETH have even begun removing their .eth identifiers to express dissatisfaction with the market.

Supporters of Bitcoin are selling off spot BTC to buy ETFs instead.

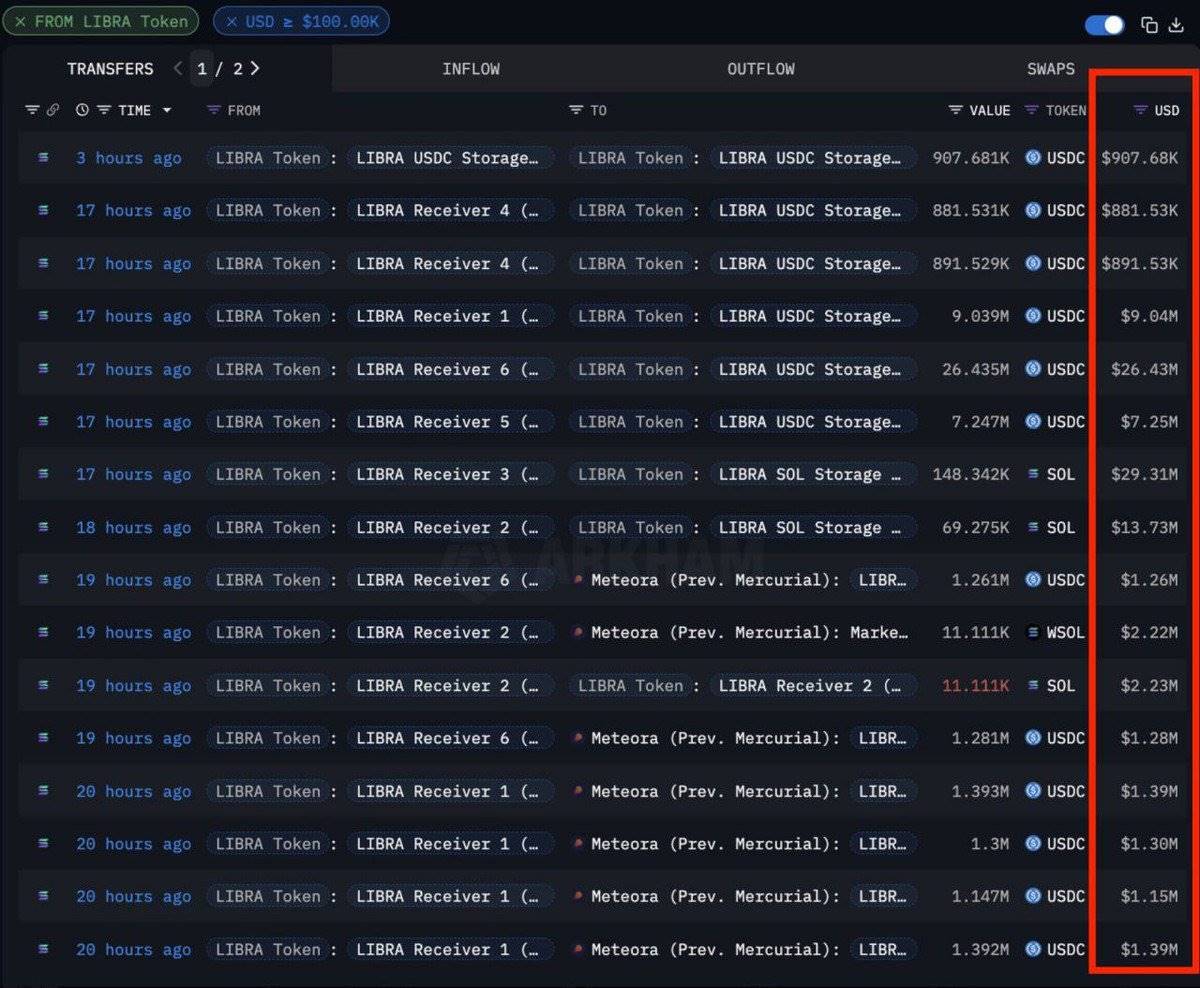

Some countries have even started issuing memes to cash out hundreds of millions from retail investors.

In this context, the trading performance of altcoins is sluggish, as if the market is undergoing a massive trust crisis.

However, history shows that extreme market sentiment often precedes significant turning points.

After experiencing the collapses of Luna and FTX, the current market sentiment is even more pessimistic.

As someone who has gone through the collapses of Luna and FTX, I can say that the current market sentiment is even worse than it was then.

Currently, 99% of retail investors' portfolios have either gone to zero or have dropped 90%–95% from their peak.

This is a typical signal of market capitulation.

The sell-off at the price level has been completed, and now the market is experiencing "time capitulation"—where investors lose patience due to prolonged losses.

Nevertheless, many people overlook a series of positive changes happening within the industry due to heavy losses, including:

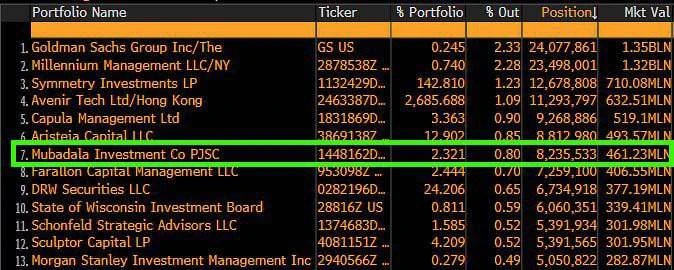

The Abu Dhabi sovereign wealth fund is making large-scale purchases of Bitcoin (BTC).

Several banks in the U.S. are preparing to launch cryptocurrency custody services.

Goldman Sachs has invested billions of dollars in purchasing BTC.

The U.S. is expected to introduce cryptocurrency regulatory policies within the next 60–90 days.

Additionally:

A company under Trump has announced plans to purchase BTC and other crypto assets.

World Liberty Financial is continuously using a time-weighted average price (TWAP) strategy to buy altcoins.

More than 22 U.S. states have submitted bills to plan to include Bitcoin in state reserves.

Companies like GameStop plan to include BTC in their balance sheets.

All these positive factors could become important drivers for the next round of cryptocurrency rallies.

Predictions for the Recovery of the Altcoin Market

Currently, most of the tariff-related FUD has dissipated or been postponed for 1–2 months.

The main concern in the current market is that rising inflation may force the Federal Reserve to adopt a more aggressive interest rate hike policy. However, I believe this is unlikely to happen, as the Trump administration continues to call for rate cuts.

The next Federal Open Market Committee (FOMC) meeting will be held in March, and I expect the altcoin market to start rising before then.

Another reason supporting a rebound in altcoins before the end of February is that investors' patience for meme scams has run out, and they are likely to redirect their funds towards altcoins with practical uses.

While the scale of this altcoin season may not match the peaks of 2017 or 2021, it could last 6–8 weeks, forming a local peak similar to the first quarter of 2024.

My Summary and Recommendations

The excessive speculation of memes has indeed delayed the arrival of the altcoin season, but as the meme market bubble bursts, the next round of altcoin rallies may surpass the performance of the fourth quarter of 2024.

Since the market crash in February, I have been actively positioning myself in altcoins with practical uses because I believe the market is about to reverse.

If I were to give investors one piece of advice, it would be: do not chase after seemingly glamorous new memes, but focus on accumulating altcoins that have real application scenarios and strong network effects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。