Author: Weilin, PANews

Argentinian President Javier Milei has repeatedly recommended the LIBRA token on the social media platform X, and the token's price plummeted after the tweet was deleted. As the farce surrounding the issuance of Libra has unfolded over the past few days, the token market maker Kelsier Ventures and its CEO Hayden Davis have come to light, being accused of being co-founders of the LIBRA token. With the exposure of insider trading, political connections, and various operational plans, Hayden Davis has been labeled a "rugger," including being deeply involved in the meme token MELANIA, named after Trump's wife. In a recent video interview, Hayden Davis responded to various questions related to the founding of LIBRA.

Hayden Davis is one of the key figures in the controversy surrounding the president's token issuance. This article will delve into Hayden Davis and Kelsier Ventures, exploring their backgrounds and the roles they played in the Libra scandal.

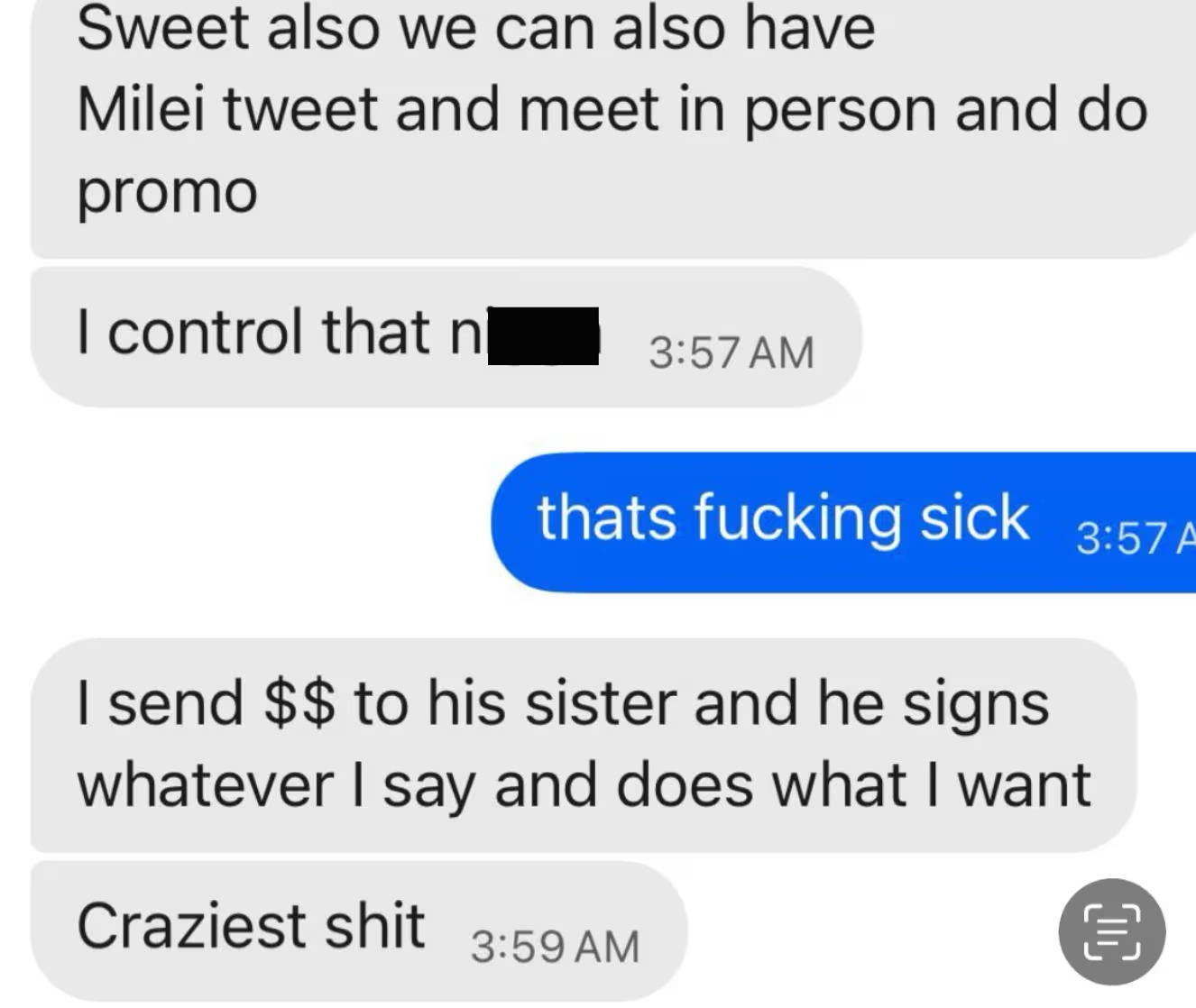

Accused of "Bribing" the President's Sister, Hayden Davis Denies

Hayden Davis is accused of bribing to gain access to the inner circle of Argentinian President Javier Milei.

On February 19, Coindesk reported that Hayden Davis had stated in a text message last December that he could "control" President Milei because he had been sending money to Milei's sister, Karina Milei (currently the Secretary General of the Argentinian Presidency). "I send money to his sister, and he will sign anything I say and act according to my wishes." This disclosure is the latest development in the LIBRA token scandal that has been brewing for several days.

However, Davis's spokesperson Michael Padovano immediately responded that the media reports were "politically motivated," and he does not recall sending such a message, nor does he have any related records on his phone.

The situation traces back to the morning of February 15, when Milei recommended a little-known token $LIBRA on the X platform. Within half an hour, its market value surged to $4.24 billion before plummeting to $827 million. However, as more information about insider addresses making huge profits was disclosed, Milei deleted the post a few hours later and denied any association with the cryptocurrency, after which the token's price quickly fell to $0.20. This presidential token issuance farce has since escalated, involving multiple projects including Kelsier Ventures, KIP Protocol, Meteora, and Jupiter.

Kelsier Ventures, as the issuer of Libra, has been implicated in insider trading of various meme tokens including MELANIA, ENRON, and BOB, reaping over $200 million.

The scale of investor losses caused by Libra is significant, further pushing Kelsier Ventures into the spotlight.

According to El Economista, approximately 44,000 users were affected by this "rug pull" incident. Additionally, crypto lawyer wassielawyer disclosed that this number could reach nearly 75,000 users, with total losses around $286 million. However, President Milei stated that the claim of 44,000 people being affected is false, asserting that at most only 5,000 were impacted, and the likelihood of it involving Argentinians is very low. A PANews investigation showed that nearly 30% of large holders bought in at high prices, with early investors becoming the hardest hit.

Involved in Multiple "Rug Pulls," Restaurant Owner Transitions to Crypto Family Business

On February 17, blockchain data company Bubblemaps posted on X, stating, "The team behind LIBRA, MELANIA, and other short-lived tokens is actually the same group. After analyzing cross-chain transfers and timing patterns, we are highly confident that this speculation is correct. It all started with our investigation into sniper activities on MELANIA." On-chain analysis indicates that Kelsier Ventures' wallet played a central role in the scams involving MELANIA, TRUST, KACY, VIBES, and the recently hyped HOOD token.

Kelsier Ventures has previously maintained a mysterious profile. Nevertheless, an industry insider recently contacted by PANews stated, "This Kelsier market maker is notorious in Dubai for being a meme rugger."

Currently, Kelsier Ventures is still actively operating, but its location remains uncertain. A video investigation by BoDoggos Entertainment CEO Nick O'Neil revealed that he received a quote. The service process of Kelsier Ventures is divided into several steps:

- Wash, deploy, snipe

- Market make

- Dump the market make tokens (20%)

- Wash & extract

90% of the "snipers" come from within Kelsier Ventures. They distribute tokens to friends or set up operations for their own bots. Kelsier Ventures has set a 2% token distribution and a maximum daily sales limit of 0.1%. Additionally, there is a daily fee of $3,000 or 20% of the withdrawal amount, whichever is higher.

According to Kelsier Ventures' official Twitter, the company "invests, provides consulting, and brings cutting-edge technologies in blockchain, cryptocurrency, and artificial intelligence to market." Currently, its official website has removed team information, and its homepage appears to have little difference from other Web3 projects.

Public records show that Kelsier Ventures was established in 2021 and is headquartered in Delaware, USA. The company focuses on investing in firms within the financial services industry. Since its inception, Kelsier Ventures has completed five investments, including DeFiTuna, Scallop Group, and UpRock. Additionally, in November 2023, Kelsier participated in the financing of the Bitcoin non-custodial P2P order book service provider Saturn. On June 1, 2024, E Money Network announced on X that it had completed a $3.3 million bridge round of financing, with Kelsier Ventures as one of the lead investors. Kelsier Ventures' latest investment occurred on January 26, 2025, targeting the financial services company DeFiTuna.

Kelsier Ventures' website previously indicated that Hayden Davis's father, Tom Davis, is the chairman of the company. He had previously served time in prison and later operated a chain of restaurants on the East Coast of the United States. During a business expansion visit to Dubai, he read about Dubai's plan to establish a "crypto valley," which inspired him to start a blockchain company in Dubai. Subsequently, he began to connect with top figures in the crypto field, building networks and getting involved in venture capital funds, investing in several early projects. Early on, Tom referred to himself as the CEO of Kelsier Ventures. Kelsier Ventures' COO Gideon Davis is presumed to be Hayden Davis's brother. In 2022, as a college student, he began to engage in the crypto industry, working on the DeFi project Unlock and its metaverse project NeoNexus. However, the project claimed to have run out of funds in March 2022 and failed to continue operations, with the community accusing it of a "soft rug."

Hayden Mark Davis's LinkedIn page is currently inaccessible. However, according to public reports, his previous information indicated that he had been the CEO of Kelsier since October 2020. Since May of the same year, he became the founder of Luxury Drip, a company with an unclear industry. According to Davis, he began his entrepreneurial journey in August 2017, running a company called Leaders Elevate, which appears to be another family business of the Davis family.

Admits to Participating in MELANIA Sniping, Claims Libra is Not a Rug but a Failed Plan

In addition to releasing a video statement after the incident, Hayden Mark Davis also accepted an interview with crypto blogger Coffeezilla. He stated, "In the original LIBRA launch plan, Milei would release another video, and then some other high-profile individuals would interact with him. So at that time, our idea was whether we could drive away the 'snipers' by extracting liquidity while keeping the funds to prevent the project from completely collapsing after the price dropped, and then let Milei release the second video and reinvest the funds to replicate a 'blowout feast' like TRUMP. I don't know why Milei deleted the first post; I suspect he faced immense political pressure, which led to his panic. Given his position, I completely understand his feelings."

Despite the token's crash, he stated, "People say this is another rug, but that's not an objective fact; there are still tens of millions of dollars in liquidity locked, and the token's market value is still $300 million. This is not a rug; it was just a failed plan. As the custodian, the account I control still holds $100 million, but I really wish someone would tell me how to handle it. I don't want to be the target; I haven't benefited from this, but my life is in danger because of it."

When discussing insider trading, host Coffeezilla remarked that people's frustration lies not in being angry because of your trading skills, but because you know information that the public does not and have traded on that information. In the public market, this is illegal and constitutes insider trading.

Hayden Davis said, "But in the meme market, this is not illegal. This is what happens in every transaction. These are the rules here; people know this, agree to it, and make money off it. If you want to blame this, you have to blame everything else. To be honest, I actually don't oppose this. But I think for the vast majority of people betting on meme tokens, especially for retail traders who got in early, this is the game of the market. This is not a capital market; this is a casino."

In the interview, Davis also admitted to participating in the sniping of the First Lady token MELANIA.

Investment Projects "Avoiding Suspicion" Refunds, Legal Storms May Follow

As a result of the Libra token issuance scandal, on February 17, Moty, the founder of DefiTuna, publicly announced on the X platform that DefiTuna had refunded $30,000 to Kelsier, an investor who invested in the project on January 16, 2025, and severed all ties with them.

Moreover, the Libra incident has also triggered legal risks. On February 15, the Argentinian presidency announced that Milei had instructed the anti-corruption office to immediately participate in an investigation to determine whether any members of the Argentinian government, including Milei himself, had engaged in improper conduct in this incident. The opposition plans to impeach Milei.

On February 17, an Argentinian law firm filed a criminal lawsuit with the U.S. Department of Justice (DOJ) and the Federal Bureau of Investigation (FBI), accusing the masterminds behind the collapse of the LIBRA token and calling for an investigation into President Milei's role. In another legal battle, the Civic Coalition ARI also filed a criminal lawsuit on February 17, demanding the DOJ investigate the bribery and fraud allegations allegedly promoted by President Milei, adding that "the government cannot be both the athlete and the referee."

As the LIBRA token scandal continues to unfold, the roles and motivations of Hayden Davis and Kelsier Ventures have become the focus of public and regulatory scrutiny. Although Davis attempts to clarify his position, emphasizing that his actions comply with market rules, doubts about his alleged market manipulation and insider trading have not dissipated. As more evidence emerges, this incident could have far-reaching implications for the regulatory environment of the cryptocurrency market. PANews will continue to track and monitor the latest developments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。