BTC: Key Support Broken, Market Sentiment Turns Cautious

Since February 3, Bitcoin's price has been oscillating between $98,000 and $95,000. Although it has failed to break upward pressure in the short term, BTC is forming a descending triangle structure, and the market is clearly preparing for the next move below $95,000.

According to on-chain analysis, Bitcoin's Inter-Exchange Flow Pulse (IFP) has turned negative, indicating that investors' risk appetite is declining, with more Bitcoin flowing back from the futures market to the spot market, suggesting a pessimistic outlook for future trends. Worse still, the futures long position liquidation volume for Bitcoin has reached a two-year high, indicating that investor confidence is gradually collapsing.

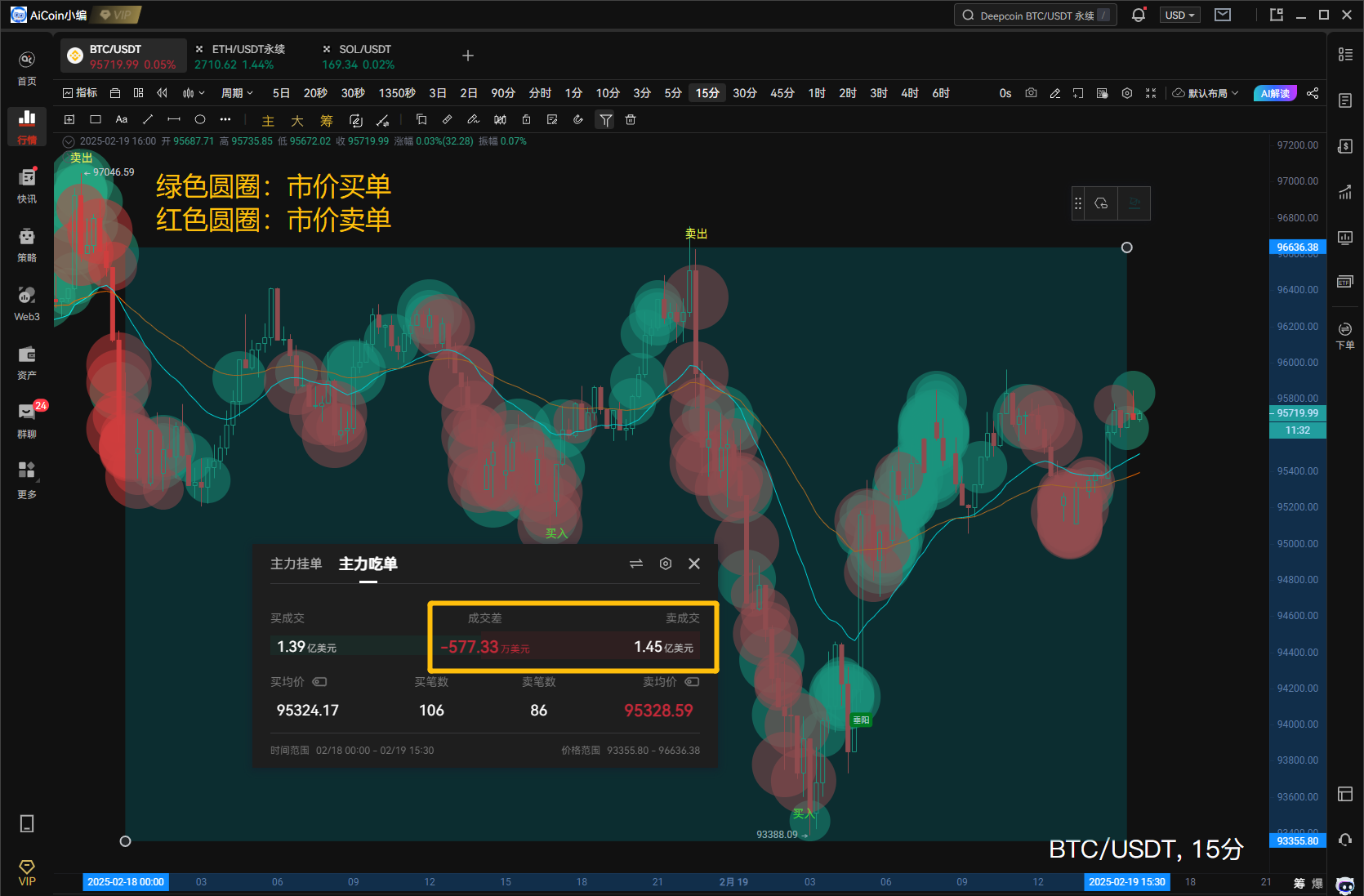

Additionally, according to AiCoin PRO (www.aicoin.com/vip), major players are continuously offloading, with Binance spot whales having sold $145 million at market price from February 18 to date. Especially after the U.S. stock market opened yesterday, major players intensified their selling, offloading $29.98 million, which directly caused BTC's price to fall below the critical support of $94,000.

From a technical perspective, Bitcoin has tested the $95,000 support level five times. Meanwhile, on the daily chart, the EMA24 is attempting to cross below the EMA52, indicating a potential change in short-term direction. If the $95,000 support is broken, BTC may further retrace to the previous support range of $91,000 to $92,000. If the price falls below these areas, BTC will face greater downside risks, potentially dropping to the $75,000 to $80,000 range.

Even so, the market's reaction to the decline has not spiraled out of control, with strong buying support still present. According to PRO data, every time BTC approaches key support, major players tend to limit buy to protect the price. This morning, after Bitcoin fell below $95,000, spot whales on platforms like Binance, OKX, and Coinbase accumulated $52.9 million in buying, leading BTC to quickly return above $94,000.

• Trading Reference: If it stabilizes above $95,390 to $95,565, it is likely to surge to $97,000. If it loses the support area, it may retrace to $94,000 in the short term.

ETH: Strong Rebound Momentum, Market May Reach New Highs

In contrast to Bitcoin's weakness, Ethereum has recently shown relatively strong momentum, with both lows and highs continuously rising, presenting a smoother channel pattern.

The technical outlook for Ethereum is quite interesting. Analyst Bottom Sniper points out that the current ETH weekly trend aligns with the WXY correction pattern, which typically indicates that the market's decline has ended, and a new high may be on the horizon. In simple terms, Ethereum may have completed its adjustment and is set to enter a new upward cycle.

At the same time, ETH's performance relative to Bitcoin is also good, with the ETH/BTC RSI(6) forming a bullish divergence, and strong support at 0.02337 (with a significant increase in trading volume). Therefore, ETH still has considerable upside potential and is expected to continue strengthening in the short term.

If Ethereum can break through the key resistance level of $2,850, it is likely to continue rising along its historical trajectory, with target prices potentially between $3,000 and $4,000.

• Trading Reference: Support at $2,685, target at $2,775 to $2,800.

SOL: Weakened Price Performance, Facing Unlocking Pressure

Compared to BTC and ETH, SOL has recently shown relatively weak performance, with the current price having retraced over 45% from its recent high of $295.83. The reason for this decline is not only due to the hype around meme coins but also a significant drop in Solana's on-chain activity and the activity of decentralized applications (DApps).

Data shows that Solana DEX trading volume has plummeted by 91% in the past 30 days, and deposits on Solana DApps have simultaneously decreased by 19% in two weeks, indicating that Solana's ecosystem is experiencing neglect. Particularly, the SOL/ETH ratio for Solana has changed significantly, dropping from a high of 0.09395 to 0.062, suggesting that market interest in Solana is waning.

Additionally, Solana faces significant unlocking pressure, with over 11 million SOL (valued at approximately $2 billion) expected to enter the market by March 2025, which will undoubtedly exacerbate its price downward pressure.

Possibly influenced by SOL's weakness, Solana ecosystem projects like RAY, WIF, and JUP have collectively weakened, with RAY and WIF testing key support levels on the daily chart, presenting potential bottom-fishing opportunities.

• Trading Reference: A head and shoulders bottom may form in the 45-minute cycle; bulls are advised to consider breaking above $170, targeting $182, while bears can focus on resistance level breakouts, targeting $148.

The above content is for sharing only and does not constitute any investment advice. If you have any questions, you can join the 【PRO CLUB】 group to contact the editor~

Please recognize AiCoin's official website: www.aicoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。