From February 18 to 20, 2025, the annual event in the global blockchain and cryptocurrency field—Consensus Conference—will be held for the first time outside the United States, at the Hong Kong Convention and Exhibition Centre (HKCEC). This conference brings together industry leaders, policymakers, and investors from around the world to discuss the future development direction of digital assets, blockchain technology, and the Web3 ecosystem.

Hong Kong: The New Hub for Digital Assets in Asia

The Hong Kong Special Administrative Region government showcased its ambition to become the digital asset center of Asia at this conference. The Chief Executive Officer of the Hong Kong Securities and Futures Commission (SFC), Ashley Alder, stated that Hong Kong is actively evaluating the approval of new cryptocurrency and virtual asset products, including derivatives and margin loan services targeted at specific investors. She emphasized, "We are considering providing derivative products for professional investors and margin loan services for specific clients." This initiative aims to expand the range of digital asset services in Hong Kong and consolidate its leading position in the region.

Additionally, the Financial Secretary of Hong Kong, Paul Chan, revealed at the conference that Hong Kong regulators have issued nine licenses for digital asset trading platforms, with another eight applications currently under review. He also mentioned that the government is accelerating the development of a regulatory framework for stablecoins to ensure market stability and investor confidence. Since proposing the plan to become a virtual asset hub in 2022, Hong Kong has launched several innovative initiatives, including Asia's first spot cryptocurrency exchange-traded fund (ETF), demonstrating its proactive attitude in the digital asset field.

Perspectives from Global Industry Leaders

The conference attracted over 270 speakers from around the world, most of whom are founders, CEOs, and senior executives of their companies. They shared unique insights into the future of the industry.

John Cahill, Head of Digital Assets at Morgan Stanley, stated at the "Institutional Investment Summit," "The tokenization of real-world assets (RWA) is not a trend, but an inevitability." He emphasized that traditional financial institutions are gradually fragmenting and enhancing the liquidity of traditional assets such as real estate, bonds, and stocks through blockchain technology to meet investors' demands for diversified asset allocation.

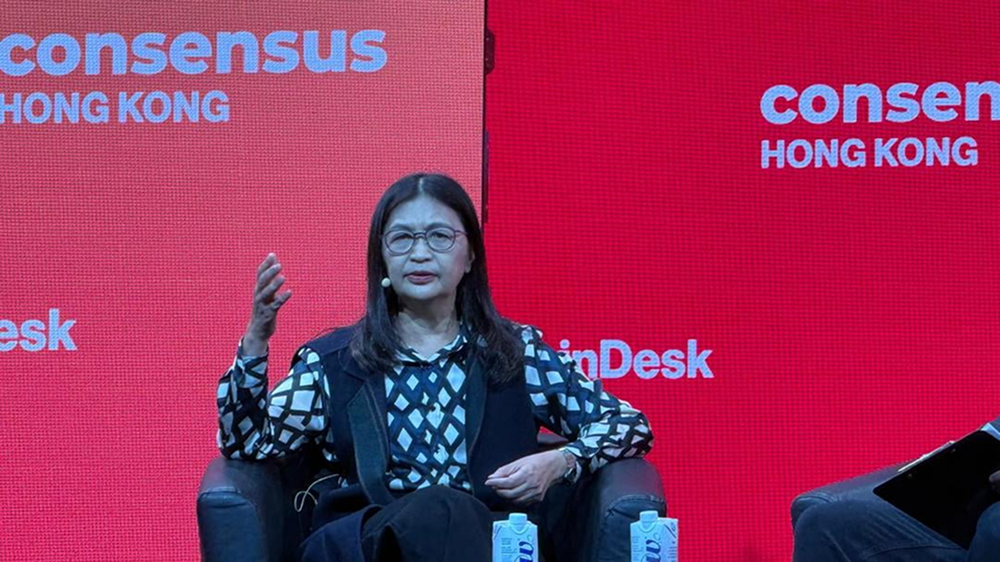

Lily Liu, Chair of the Solana Foundation, launched the "Global Internet Finance Index" at the conference, aimed at measuring the level of adoption of blockchain and cryptocurrency worldwide. She pointed out, "This index will provide important references for investors and developers, helping them understand the dynamics and opportunities in the global market."

Sun Yuchen, founder of TRON, was invited to attend the conference and delivered a keynote speech titled "TRON: A Year of Strong Momentum." He also participated in a roundtable forum titled "TRON and T3 FCU: Driving Global Applications While Balancing Decentralization, Security, and Scalability," sharing TRON's experience in promoting applications globally.

Capital Influx: From RWA to Sovereign Fund's Crypto Layout

New World Development and Animoca Brands jointly launched the "MetaLand" platform during the conference, allowing investors to subscribe to fractionalized NFTs of commercial real estate with a minimum investment of HKD 1,000, and achieve passive income through on-chain distributed rental income. The project raised USD 230 million in its first phase, with 93% of the funds coming from Asian family offices, showcasing the immense potential of integrating traditional real estate with blockchain technology.

The Oman Investment Authority (OIA) disclosed its crypto asset allocation strategy for the first time: 5% invested in Bitcoin and Ethereum spot ETFs; 3% participating in DeFi lending through Maple Finance; and 2% allocated to RWA infrastructure protocols. This "core + satellite" investment strategy reflects the cautious yet proactive layout of sovereign funds in the crypto field.

New dynamics in the stablecoin market: Circle announced a partnership with Hong Kong's three major note-issuing banks to launch the HKDCoin, a stablecoin pegged 1:1 to the Hong Kong dollar. This move directly challenges Tether's dominance in the Asian market. In response, Tether also launched a stablecoin pegged to offshore RMB, CNHC, to consolidate its market share. This series of actions signals a new round of competition in the stablecoin market, which may have profound implications for the global digital currency ecosystem.

Hong Kong's Strategic Position and Future Outlook

The President of CoinDesk stated in an interview, "Asia is a key market in the global Web3 space, with tens of millions of cryptocurrency users and blockchain developers, as well as governments at the forefront of regulatory innovation. Hong Kong has successfully established its strategic position as a digital asset hub in this vibrant region." He emphasized that the choice to hold the Consensus conference in Hong Kong is due to its unique geographical location and policy advantages, which help connect the blockchain ecosystems of the East and West.

The successful hosting of this conference marks a further enhancement of Hong Kong's influence in the global digital asset field. As policies from various countries gradually clarify and technology continues to innovate, Hong Kong is expected to become a core hub for global digital assets and blockchain technology in the future, injecting new vitality into the industry's development.

Conclusion

The Consensus Hong Kong 2025 conference not only showcased the latest dynamics and trends in the global blockchain and cryptocurrency field but also highlighted Hong Kong's strategic position as the digital asset center of Asia. The active participation and insights from leaders across various sectors have pointed the way for the future development of the industry. It is foreseeable that with the improvement of policies and technological advancements, digital assets and blockchain technology will usher in new development opportunities globally, with Hong Kong playing a crucial role in this process.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。