The essence is to compete for Distribution, who can more efficiently acquire users and achieve retention.

Author: YettaS

The last post received a lot of controversy because I mentioned @berachain; yesterday, @cz_binance was also working hard to revitalize @BNBCHAIN with memes; during the AMA with @DoveyWanCN, @forgivenever asked us why we support Movement.

That day, I saw @jinfizzbuzz write about @megaethlabs, and some said it was all hot air to talk about ecology without being on the testnet; in recent days, @solayerlabs and @StoryProtocol's TGE have also not met everyone's expectations. Taking this opportunity, I want to talk about our logic for investing in public chains. Each public chain has its own starting point, and what I say does not represent the truth; discussions are welcome.

How did public chains operate in the past?

The essence of blockchain is the "chain." Since its inception, the preliminary construction of infrastructure has become an industry norm, which directly gave rise to a large number of generic public chains (Generic Public Chain) that use technical differentiation as a selling point. Building the infrastructure first and then attracting dapp developers became a default choice. But we all know that infrastructure itself cannot attract users; what attracts users? It is investment attraction, ICOs, NFTs, DeFi, and memes—applications that can be engaged with. However, these applications do not emerge spontaneously. How did early public chains break through?

By relying on the charisma of founders, massive financing news, large-scale marketing and promotion, and the huge wealth effect of TGE. Nowadays, the marketing of these public chains is trivial in the face of EoS; the genius BM played ICO for a year, raising 4 billion dollars, and then there was nothing more. Why does this seemingly air-filled path exist? Because public attention is limited; when a chain is obscure, no applications or users will proactively come to your ecosystem, which is precisely why VC needs to continuously invest in new public chains.

What problems do current public chains face?

The current market valuation logic for public chains is in a state of extreme distortion.

On one hand, the market is increasingly skeptical of the "infrastructure first" model because there are very few Generic Public Chains that have successfully built ecosystems. This is also one of the reasons investors have lost trust in VCs—massive capital has been bet on so many public chains, but most have failed to deliver on growth promises. The image below from @defi_monk directly points out this issue.

On the other hand, public chains remain the highest ceiling direction for valuation in the entire industry. So far, no Dapp has proven it can outlive public chains.

Ethereum has evolved over 10 years, and Solana has gone through two complete cycles, with Dapps on them still active.

In other words, although the market questions the high valuation of public chains, it remains the high-ceiling track closest to "long-termism."

So people have a love-hate relationship with this model; they hate that it has such a high valuation with nothing to show, but love that if done well, it has such a high ceiling to benchmark against.

This is actually a historical legacy issue in our industry that needs transformation.

How to transform?

Now another path has emerged, the App Specific Chain, which started with the phenomenon of @AxieInfinity. They created @Ronin_Network to try to guide application layer users to the chain ecosystem, but the problem is that they haven't succeeded, and their own application has lost popularity.

This cycle saw this model further ignited by @HyperliquidX, and then we can see:

- @Uniswap — Unichain

- @JupiterExchange — Jupnet

- @OndoFinance — Ondo Chain

- @ethena_labs — Ethena Chain

Taking Ethena, which I am most familiar with, as an example, their next application is Ethereal, a perp based on USDe, starting to build an ecosystem around their core assets and applications. This might be a bit like Hangzhou? After Alibaba emerged, the entire e-commerce industry rose in Hangzhou.

This paradigm shift can be said to be because applications are the real touchpoint that can push the industry to the masses, or it can be seen as market segmentation under commercial maturity, with everyone using different methods to challenge the traditional valuation system of the industry.

What are these two models competing for?

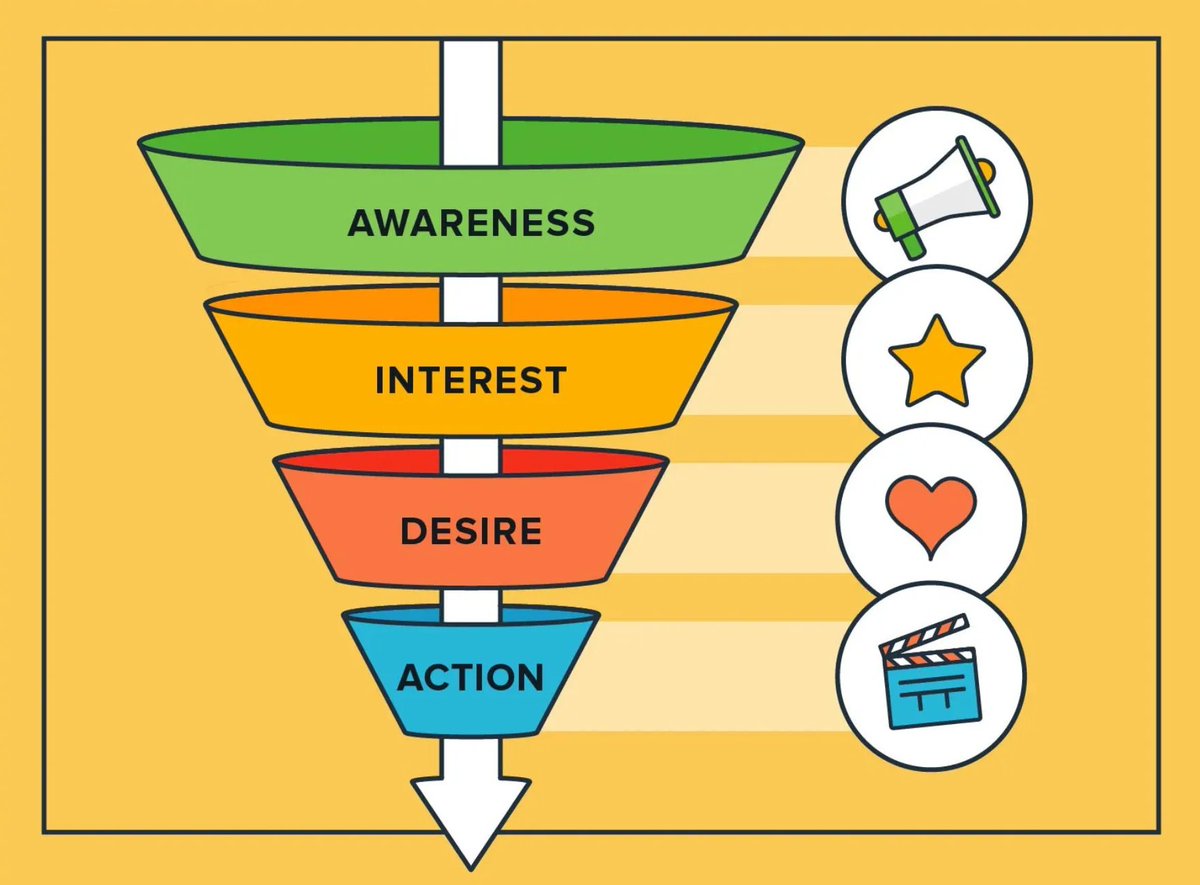

In the public chain ecosystem, Chains rely on large-scale infrastructure promotion, financing narratives, and then attract Dapp developers to settle in, ultimately achieving user retention through application ecosystems. Dapps, on the other hand, directly acquire users through real application scenarios and gradually build their own ecosystems under user migration and synergy effects, eventually evolving into a chain.

From "virtual" to "real," and from "real" to "virtual," they ultimately converge. What is the essence behind this? The essence is to compete for Distribution, who can more efficiently acquire users and achieve retention.

In Web2, the barriers to Distribution are far higher than those of products because the marginal cost of most products approaches zero, while the competitive barriers of distribution channels are extremely high.

Distribution means monopoly of traffic entry + platform network effects + data monopoly, which together shape the core competitiveness of Web2 companies.

Take TikTok as an example:

- Monopoly of traffic entry: TikTok seized the short video trend, becoming a new generation of traffic entry

- Platform network effects: Established a two-sided market of creators—audience—advertisers, with increasing user stickiness as content supply grows

- Data monopoly: Massive user data trains recommendation algorithms, continuously improving distribution accuracy and forming a strong data barrier

Why did we invest in Hooked back then? We always said it was a web2.5 product because Tap to earn is actually a long-proven effective customer acquisition model that can gain huge external traffic, but it was ultimately disproven by one point: the user traffic quality brought by airdrops is low, and the conversion rate is insufficient. Even if it efficiently acquires traffic, it cannot achieve retention. This is also the reason we later chose to pass on all Telegram tap-to-earn projects—changing the channel while keeping the model unchanged still results in low user quality.

Returning to the essence of this business, the Distribution logic exists in web3 as well, just with different methods of user acquisition.

In the past, Generic Public Chains lacked mature product support and could not rely on products to acquire traffic, let alone monopolistic effects. Therefore, their way of occupying Awareness mainly relied on:

- Sense of technological pioneering: Attracting early developers and geeks

- Charisma of founders and cultural uniqueness: Shaping a sense of identity and forming communities

- Financing and Token incentives: Driving user growth in the short term

However, the success or failure of this model entirely depends on the "strength of consensus"—when shaped strongly, it can build an ecological moat; when shaped weakly, as market winds change, traffic will dissipate.

Now, with more and more App Specific Chains, it indicates that Web3 is gradually returning to the business model of Web2—driven by actual applications, completing efficient conversion and long-term retention through market segmentation and refined operation of private traffic.

I tend to believe that the growth logic of this model is healthier and more aligned with the evolution direction of the real business world.

What will the future hold?

The coexistence of these two paths reflects, to some extent, that the industry is still in its early stages—no single model has formed an absolute monopoly, and a paradigmatic shift has yet to occur.

All investments are essentially judgments about "momentum." At this moment, where are we? Generic Public Chains have not yet been disproven, but with the sharp rise in demand for breaking out of circles, relying solely on technical narratives or financing narratives has become difficult to gather enough consensus; at the same time, the paradigm leap from building super dapps to building chains has not yet been validated. This is not just a switch from product to infrastructure, but a leap from PMF-driven product thinking to the ability to shape culture and build ecosystems, and founders capable of such cross-evolution are few and far between.

Both have opportunities and challenges, but the real distinction lies in the fact that they require completely different capabilities from founders. The core of venture capital is to bet on market pricing based on these judgments about "momentum," "events," and "people," placing bets in the face of high uncertainty, bearing the risk of failure in exchange for extreme risk returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。