Master's Discussion on Hot Topics:

Yesterday, Bitcoin strongly broke through 95.7k, revealing downward space. Personally, I expect it to drop another 5000 points. It has already plunged to around 93350 in the early morning, which is a strong resistance level above 90k and can also be considered a support level in the downtrend.

Typically, in such situations, it directly pierces through and then continues to test the 9k mark. Looking at today's rebound trend, we still need to continue shorting at highs. For short-term trading, one can try to catch a bottom, but remember not to easily go in heavy. Only consider going long at low positions when the 5-day moving average turns upward.

Continuing to talk about this year's altcoins, I really do not recommend getting involved. Even when the season for altcoins appears, it is usually short-lived, with risks outweighing rewards. Being overly attached can lead to losses, especially since if Bitcoin continues to oscillate around 90k, it essentially becomes the only faith in the market.

Ethereum and other altcoins seem to have fallen off a cliff, many altcoins have already dropped to the lower middle band of the monthly line. If Bitcoin breaks below 90k and enters the next bear market, altcoins will likely shrink by 90% within a year when Bitcoin corrects from 90k to 60-40k, and 80% of projects will die in each bear market.

Over the years, my deepest realization is that Bitcoin is the only one worth trusting; altcoins are merely supporting players, and this will likely continue in the future. Therefore, the best strategy now is to keep positions as small as possible, and consider short-term trading with Bitcoin and Ethereum.

Because in the current environment, the strong dollar is causing market corrections. There will definitely not be another crazy bull market like the previous rounds; the dollar needs to drop significantly, and the exchange rate must fall below 7.15 for a new round of upward momentum to emerge.

So, I can only wait patiently now. Bitcoin is like oscillating between two extremes. Whichever side, bulls or bears, has stronger power will break in the opposite direction; if both sides are evenly matched, Bitcoin will continue to oscillate and consolidate.

Altcoins will fluctuate more than Bitcoin, but opportunities are limited, so it's best to remain patient and not make hasty decisions. I have always been bullish, so I believe Bitcoin still has one last wave of tail-end movement. However, many people do not understand that after a short-term decline, the market is being driven by panic selling.

For bulls, this is actually a good opportunity, as panic selling also releases trading opportunities. Unlike the current market conditions that make it difficult to make big moves, there is actually no particularly negative news today.

The market sentiment is not good mainly due to some uncertainties, such as the decline in US stocks and the SOL unlocking issue, which has indeed caused some panic in the market, but these are only temporary impacts and will not deal a decisive blow to the market in the short term.

Speaking of the SOL unlocking issue, I personally think most people are actually over-worried. Indeed, a large amount of SOL will be unlocked on March 1, and linear unlocking has started since February, which may cause market fluctuations, especially since the cost of these unlocked chips is around 70 dollars.

So if these institutions really dump SOL, the market may indeed drop, but this is not a direct market crash. Institutions need to maximize profits and will not choose to sell all at once. Therefore, there is no need to worry too much; most of the unlocked chips have not been sold yet, and the selling pressure in the market is actually limited.

Master's Trend Analysis:

Resistance Level Reference:

First Resistance Level: 96700

Second Resistance Level: 96200

Support Level Reference:

First Support Level: 95200

Second Support Level: 94500

Today's Suggestions:

Bitcoin rebounded shortly after breaking through the second upward trend line yesterday, with the second upward trend line turning into resistance. After a slight rebound, it continued to decline. After dropping to 93K, it initiated a V-shaped rebound, testing the area of the second upward trend line again.

The adjustment phase after the V-shaped rebound is very important, so it is recommended to pay attention to whether the price closes above the low point of the V-shaped rebound. The current first resistance is a strong resistance, and it can be set as a key level in the short term.

This area is also a dense selling zone and overlaps with the moving averages. To break through this area, it needs to be accompanied by an increase in trading volume and upward momentum. Since the current trend still leans towards downward, short-term short positions can be laid out in the resistance zone.

From the current bullish perspective, the support range to pay attention to is between 95~95.2K. If the V-shaped rebound ends and enters an adjustment period, if it tests near the support line again, one can consider a short-term rebound strategy.

To analyze whether the current adjustment has ended, especially if a candlestick bottom forms above the low point of 93.8K. If the adjustment range ends and forms a lower shadow line, it will be an entry opportunity. It is not recommended to enter the market in the resistance zone today, but rather to wait for opportunities after the adjustment range.

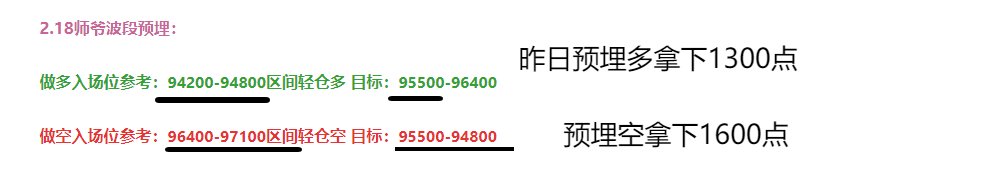

2.19 Master's Wave Strategy:

Long Entry Reference: Not currently referenced

Short Entry Reference: Light short in the 96200-96700 range, Target: 95200-94500

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen), with the same name across the internet. For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above), and other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。