Original Author: vik0nchain, Cyber Capital Researcher

Original Compilation: Luffy, Foresight News

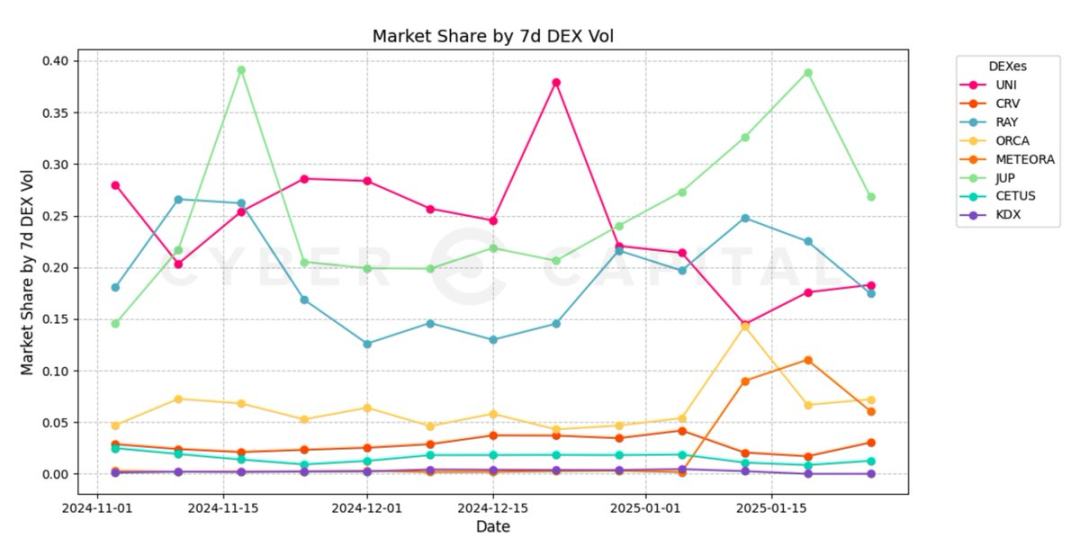

From the fourth quarter of 2024 to early 2025, the competitive landscape of Solana's DeFi ecosystem is gradually emerging, primarily reflected in the rise of aggregators, the abstraction of user experience (UX), significant integrations, and the evolving standards of token economics. Although these changes were initially not obvious, recent data has clearly shown their impact, particularly in the redistribution of liquidity, fee generation, and changes in market share.

This analysis delves into the liquidity positioning of major decentralized exchanges (DEX) based on Solana—Raydium, Jupiter, Orca, and Meteora—highlighting their advantages, disadvantages, and potential investment impacts relative to existing and emerging competitors.

Investment Analysis Framework

Raydium (RAY) Outlook: Optimistic with Deep Liquidity and Buyback Advantages

Dominance in Liquidity and Trading Volume: Raydium remains the most liquid and frequently used decentralized exchange in the Solana ecosystem. Over 55% of trades routed through Jupiter are settled on Raydium. Additionally, Raydium holds a leading market position among decentralized exchanges across all blockchains, often surpassing the long-dominant Uniswap, while its fully diluted valuation (FDV) and market cap are only about one-third of Uniswap's.

Raydium/Uniswap Fully Diluted Valuation Ratio: $2.872828346 billion / $9.102379018 billion = 31.5%

Raydium/Uniswap Market Cap Ratio: $1.505604427 billion / $5.465824531 billion = 27.5%

Pump.fun Integration: Key partnerships, including the integration with Pump.fun, have enhanced trading volume and protocol stickiness due to the migration of all new Meme pools to Raydium.

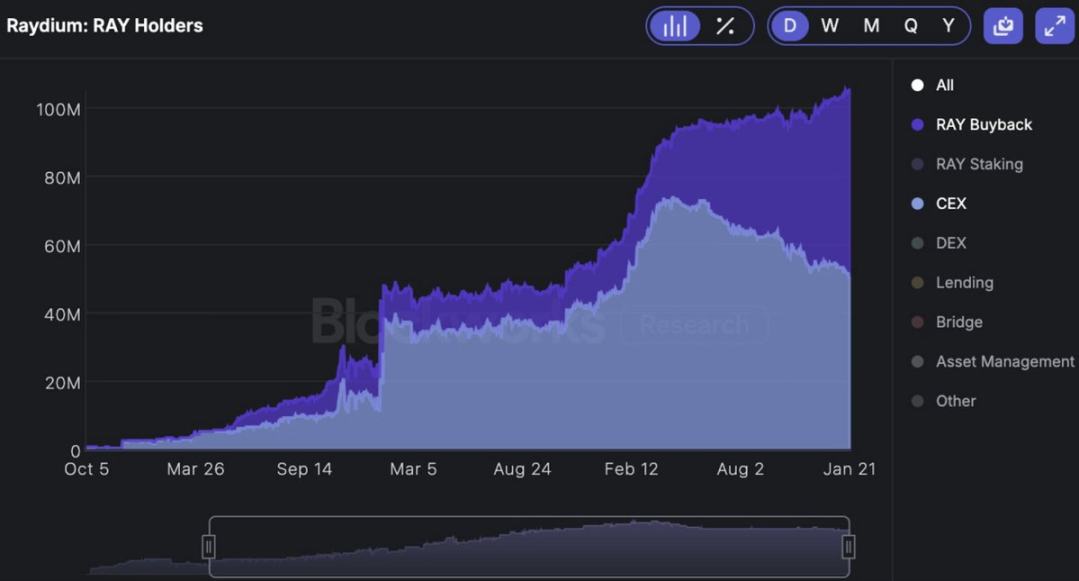

Token Buyback: Raydium's 12% fee buyback program has repurchased over 10% of the total supply of tokens, significantly alleviating sell pressure. Notably, the amount repurchased by Raydium far exceeds that held by centralized exchanges.

Jupiter (JUP) Outlook: Optimistic as a Market-Leading Aggregator

Liquidity Aggregation Advantage: Jupiter plays a key role as the dominant aggregator on Solana.

Acquisition of Moonshot: The acquisition of Moonshot allows Jupiter to integrate deposit/withdrawal channels within its decentralized exchange, enhancing competitiveness by simplifying the user experience.

Unlocking Pressure: Jupiter faces a 127% increase in supply due to token unlocks, which brings mid-term inflation risks. Although a buyback mechanism was recently announced, internal estimates suggest an annual buyback rate of 2.4%, which provides some support for the token economy but has limited impact in competition with Raydium.

Business Model: Since aggregator fees are charged on top of the underlying protocol fees, the aggregator model faces challenges in low-fee dimensions.

Lack of Competitors: As the first aggregator on Solana, Jupiter lacks strong competitors.

Meteora Outlook: Optimistic as an Emerging Liquidity Aggregator

Efficient Liquidity Aggregation: Unlike standalone decentralized exchanges, aggregators like Meteora inherently have lower downside risk and more stable capital efficiency.

Token Issuance Catalyst: The successful issuance of Meteora tokens could change liquidity preferences and provide long-term support for its market positioning. Unlike industry LP leader Kamino, MET points are not publicly displayed on the user interface. Additionally, since the MET points system was first announced over a year ago, there has been no official statement regarding airdrops. Although liquidity providers can earn higher yields elsewhere in the ecosystem (e.g., lulo.fi), market positioning and airdrop expectations may be the main drivers for liquidity providers.

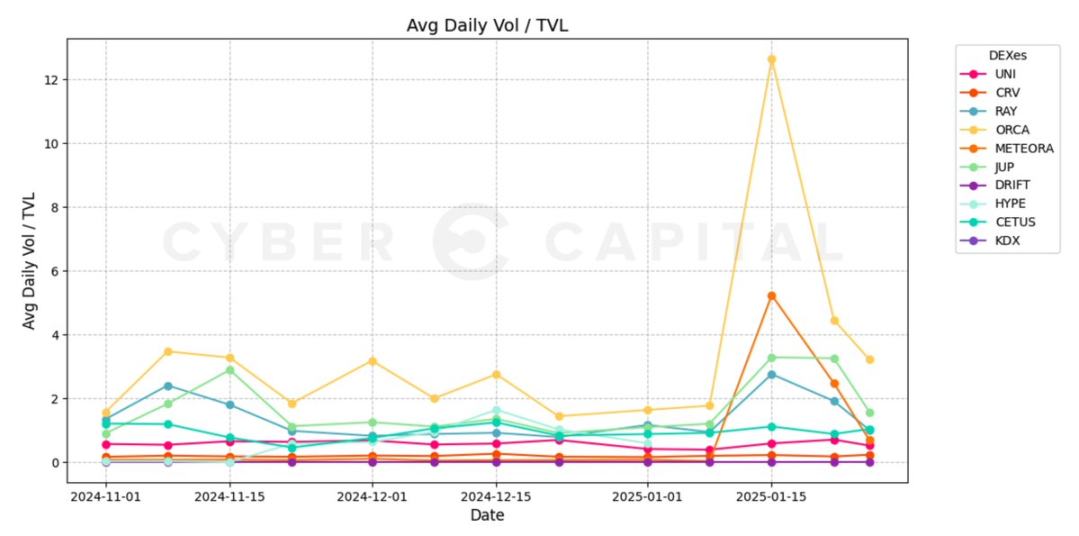

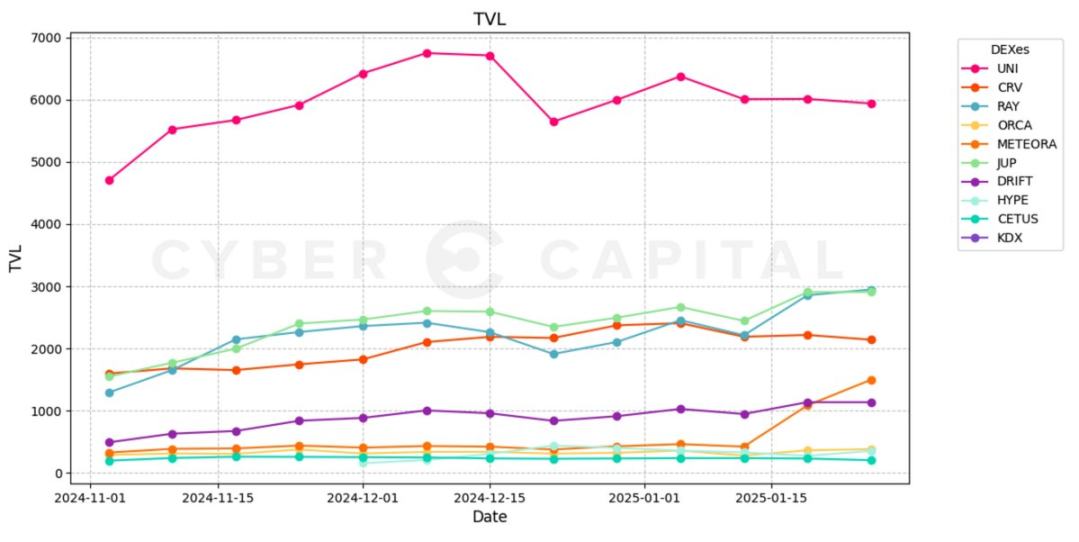

Total Value Locked (TVL) Retention: Meteora has achieved growth through significant events such as the Pengu airdrop and the launch of Trump and Melania-related Memecoins. While the trading volume/total value locked (Vol/TVL) ratio of many trading pairs increased during the Memecoin launch due to temporary demand, Meteora's total locked value has continued to rise after the events, indicating good retention.

Integration Development: Virtuals migrated to Solana in the first quarter of 2024 and announced integration with Meteora's liquidity pool.

Orca Outlook: Pessimistic with Insufficient Liquidity Retention

Insufficient Liquidity Depth: Despite being highly efficient, Orca's pool size is significantly smaller than Raydium's, leading to higher slippage for large trades.

Market Positioning Issues: Jupiter's routing mechanism prioritizes trading platforms with deeper liquidity, making emerging low-liquidity decentralized exchanges and liquidity pools less attractive.

The emergence of Meteora as a liquidity aggregator further limits the competitive survival of non-dominant decentralized exchanges within the routing framework, as routing only occurs when slippage costs are lower than Meteora's fee premium, which is extremely rare outside of surges in market demand.

Limited Incentives for Liquidity Providers: Orca lacks strong liquidity mining strategies, resulting in low retention rates for long-term liquidity providers.

Inefficient Capital Allocation: Unlike Meteora, Orca has not implemented automated yield optimization, requiring manual management of LPs, leading to a more cumbersome user experience.

Unfavorable Liquidity Trends: The upcoming Meteora token may completely attract liquidity providers away from Orca, making its situation even more difficult.

Insufficient Integrations: Failing to partner with Pump.fun at the beginning of 2024 and recently missing out on collaboration with Virtuals highlights its competitive disadvantage in acquiring emerging retail-driven application order flows. Without upcoming catalysts to reverse this trend, liquidity migration may continue.

These factors have led to Orca's inability to retain the additional user base gained during peak network demand.

Key Catalysts and Risks

Catalysts to Watch

RAY Buyback vs. Centralized Exchange Holdings: The buyback rate of RAY has now surpassed the total amount of RAY held by centralized exchanges, reinforcing token scarcity.

Total Value Locked Growth Trend: The continued dominance of Raydium, Jupiter, and Meteora indicates the sustainability of long-term liquidity. The stickiness of emerging protocols under high-pressure market conditions is noteworthy and should not be overlooked.

Partnerships: Just as the integration with Pumpfun brought significant liquidity to Raydium, the integration of Meteora with Virtuals may have a similar effect. Given the impact of such large-scale collaborations on liquidity and total locked value, partnerships with lesser-known participants are closely watched.

Meteora's Token Issuance: This event could mark a turning point in the liquidity distribution of decentralized exchanges on Solana.

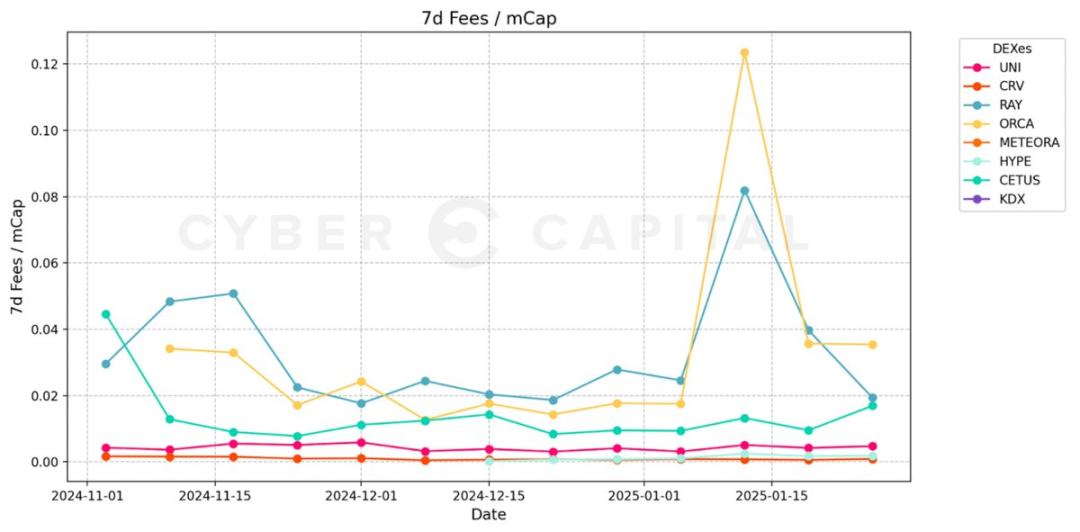

Fee vs. Market Cap Ratio: Orca has shown extremely high efficiency in months of strong demand, but its insufficient liquidity retention hinders long-term competitiveness. On the other hand, JUP faces the opposite situation, constrained by its business model. Compared to the latest "hot project" Hyperliquid, Raydium generates ten times the fees at one-eighth of the fully diluted valuation.

Risks

Inflation Pressure on JUP: Although Jupiter's aggregator position is solid, its large token supply may create short-term price pressure.

Decline in Orca's Market Share: If the trend of liquidity provider migration continues, Orca may face ongoing liquidity loss.

Risks of Meteora Airdrop and Token Economics Execution: Despite strong early growth in total locked value, its token economics and incentive structure remain untested.

Conclusion and Investment Outlook

The landscape of decentralized exchanges on Solana is shifting towards greater efficiency and deeper liquidity concentration. Raydium's excellent liquidity positioning, proactive buyback mechanism, and market dominance make it a highly confident investment choice among decentralized exchanges. Jupiter's role as an aggregator remains crucial and provides competitive barriers, but token supply dilution poses resistance in the short term. Orca, once a competitive player, faces severe challenges in liquidity retention and capital efficiency, becoming an increasingly fragile asset, indicating a struggle to secure key integrations and compete directly with mature players. Meteora is expected to rise following the successful launch of its upcoming token. Based on our current theory, investment positions in decentralized exchanges should focus on leading decentralized exchanges, decentralized exchange aggregators, and liquidity aggregators within a given ecosystem, while emerging participants that meet catalyst criteria may also hold small positions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。