Author | defioasis

Editor | Colin Wu

This article is for informational purposes only and does not constitute any financial advice. Readers are advised to strictly comply with the laws and regulations of their respective locations.

Memecoins once attracted significant attention and investment due to their unique culture, humorous image, and community-driven characteristics. The pump fun fair launch mechanism pushed the Meme craze to new heights. However, with the intensification of PvP and the rapid emergence of new projects, the so-called narrative logic, Meme symbols, and community culture have long since vanished. Who shouts the loudest has become key; the identity, status, and background resources of the shouter determine the peak price of Memecoins that can be reached in a short attention span, and once the emotions and attention fade, it all falls apart. With U.S. President Trump and Binance founder CZ stepping in to "shout," Memecoins seem to have reached their peak as pure attention-gaming tools, as there are few figures of higher status than the two. Many users also feel fatigued. As the opposite of fair launches, despite issues like overvaluation and inefficiency, projects with clear business models, real income, and sustainable empowerment potential are expected to stand out in the restless crypto market. This article will review five projects in the current market that have strong real income and are used for empowerment.

Hyperliquid: Trading Fee Revenue for Buybacks

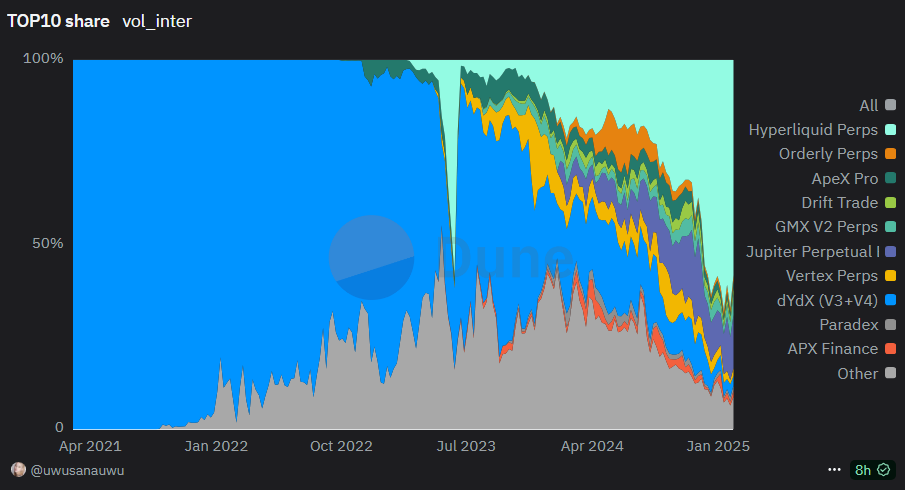

Hyperliquid is an on-chain Perpetual Contract Exchange that has introduced a Dutch auction mechanism to obtain new spot position issuance. Hyperliquid's revenue mainly comes from contract trading fees, HIP-1 auction fees, spot trading fees, and HLP MM PnL. Currently, Hyperliquid has become the largest on-chain derivatives exchange, accounting for about 60% of the market share.

HYPE can be seen as having a dual deflationary mechanism. A portion of Hyperliquid's platform revenue (i.e., USDC fees) will enter the Hyperliquid Assistance Fund to support HYPE buybacks. HypurrScan data shows that as of February 10, since the TGE in early December, the Hyperliquid Assistance Fund has spent approximately 149 million USDC to buy back 14.693 million HYPE, accounting for 1.47% of the total supply, and has realized a profit of about 194 million USD.

On the other hand, the supply will be reduced by destroying HYPE from trading fees; the HYPE portion of the HYPE/USDC spot trading fees is directly destroyed, further reducing the circulating supply. HYPEBurn data shows that as of February 10, 153,100 HYPE have been destroyed in trading fees.

Jupiter: A Diversified Business System Beyond Aggregation and 50% Protocol Revenue for Buybacks

As the largest DEX aggregator on Solana, Jupiter faces almost no competitors due to the hot market on the Solana chain. According to DeFiLlama data, in the last 24 hours, Jupiter's aggregated trading volume reached 3.224 billion USD, which is 7-8 times that of the second-ranked OKX (about 411 million USD).

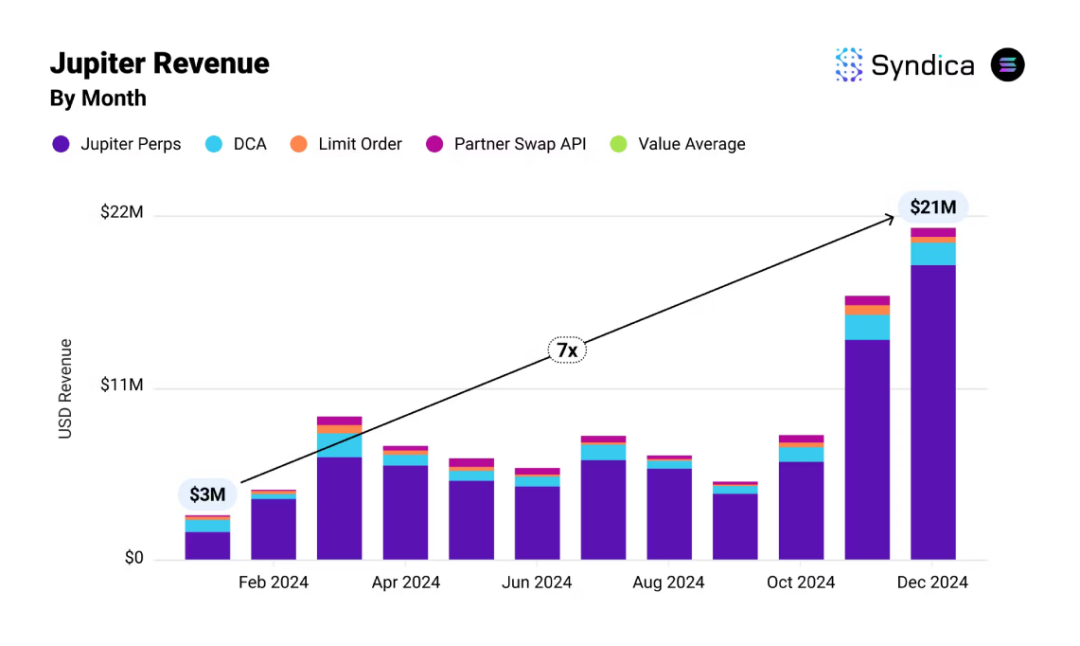

Unlike other aggregators that only focus on aggregation products, Jupiter is actively expanding other businesses, including Jupiter Perp, DCA, Swap API, and fiat channels, with the largest business revenue coming from Jupiter Perp. Although Jupiter Perp has a much smaller market share in the multi-chain on-chain contract trading market compared to Hyperliquid, it holds an absolute leading position on the Solana network.

According to Syndica data, in December 2024, Jupiter's protocol revenue reached 21 million USD, setting a historical high, which is more than 7 times higher than in January of the same year; throughout 2024, Jupiter's protocol revenue reached 102 million USD.

In late January of this year, Jupiter officially announced that 50% of the protocol revenue would be used to buy back JUP, which, based on the 2024 annual revenue, amounts to approximately 50.1 million USD for buybacks.

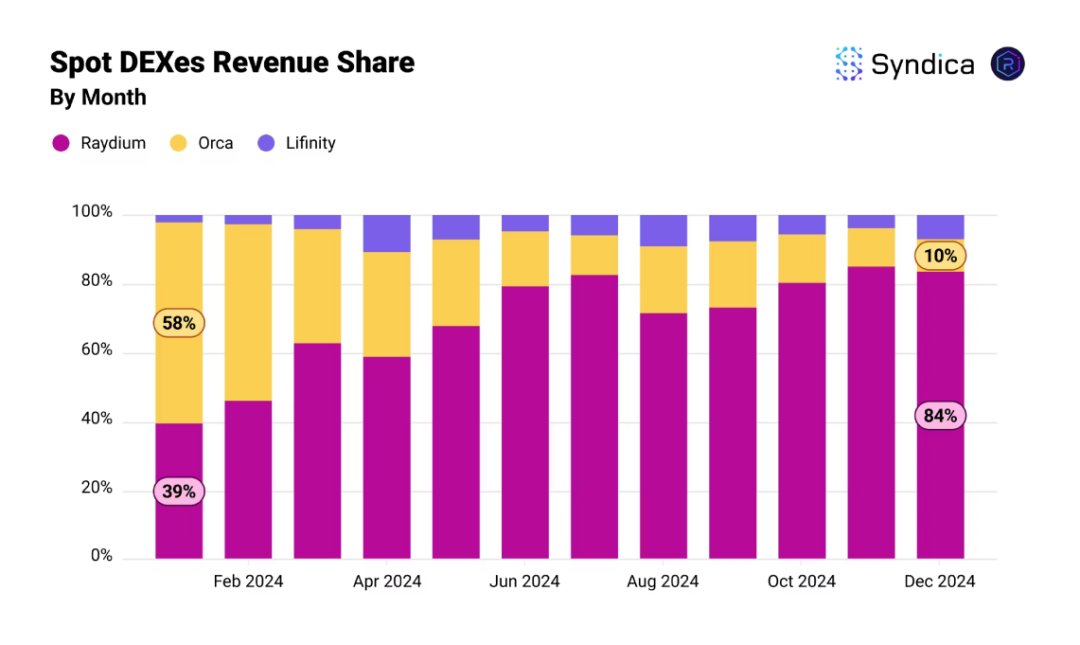

Raydium: The Largest DEX on Solana with 12% of Each Trading Fee for Buybacks

In the second half of 2024, Solana surpassed Ethereum DEX to become the network with the highest on-chain trading volume. Solana DEX trading volume exceeded 630 billion USD throughout 2024, with Raydium rising from less than 40% market share at the beginning of the year to over 80% in Q4, becoming the absolute leader.

Compared to Jupiter, Raydium's revenue model is much simpler. Each transaction in the Raydium Pool incurs a trading fee, for example, the standard AMM Pool trading fee is 0.25%, while the CLMM Pool has different levels of trading fees ranging from 0.01% to 2%. Of the collected trading fees, 84% is allocated to LPs, 12% is used for RAY buybacks, and 4% goes to the treasury.

DeFiLlama data shows that Raydium captured approximately 664.4 million USD in fees in 2024, which corresponds to about 79.728 million USD used for buybacks throughout the year.

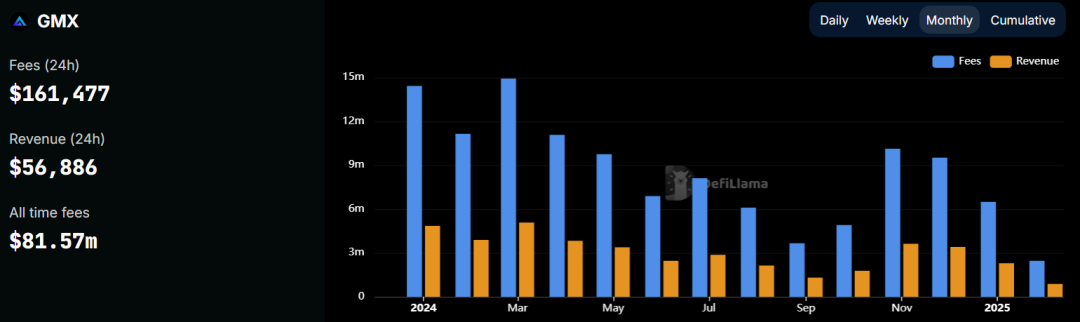

GMX: AMM Perp Representative with Staking Rewards

As one of the early on-chain derivatives exchanges, GMX uses an automated market maker (AMM) model for perpetual contract trading, unlike the current mainstream order book model. Users provide assets (such as ETH, BTC, stablecoins) to GMX's GLP pool, acting as counterparties for GMX Traders. However, compared to the order book model, AMM Perp is less suitable for running strategies and is more suited for low-frequency trading, resulting in GMX showing characteristics of high open interest but low daily trading volume. Despite challenges from order book Perps like Hyperliquid, DeFiLlama data shows that GMX still captured approximately 111 million USD in fees in 2024, with five months capturing fees exceeding 10 million USD.

30% of the fees captured from GMX V1 trades and 27% from V2 will be distributed as rewards to GMX stakers. Based on the 2024 annual fees, this amounts to approximately 30-33 million USD in fee dividends. Currently, 64% of GMX in circulation is staked, valued at approximately 145 million USD.

Banana Gun: A Challenged Veteran TG Trading Bot with Holder Dividends

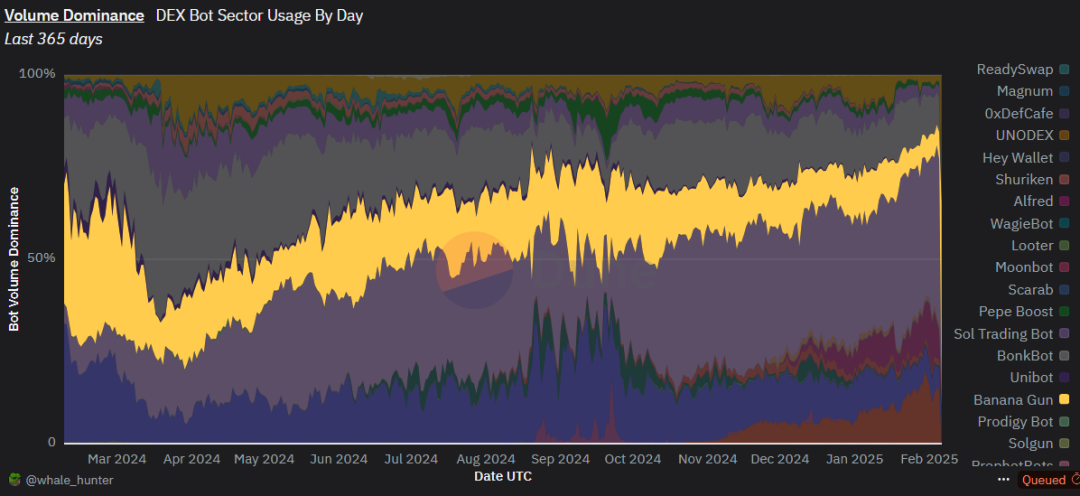

As one of the first Telegram bots to employ vampire attacks, Banana Gun captured nearly 9 million USD in fee revenue in March 2024 alone, once holding over 30% market share in the multi-chain network TG trading bot sector. However, with a significant increase in competitors in the TG trading bot space, on-chain Meme trading shifting from Ethereum to Solana, and platform-based Meme trading tools like BullX, Photon, and GMGN posing challenges to TG Bots, Banana Gun's market share has gradually slipped to 5%-10%.

Despite the decline in market share, the overall on-chain trading volume has significantly expanded, making Banana Gun one of the most profitable applications in 2024. Banana Gun charges a 0.5% fee for manual purchases and limit orders on Ethereum, and a 1% fee for automatic sniping on Ethereum and other chains. DeFiLlama data shows that Banana Gun's fee revenue reached 57.8 million USD throughout 2024.

Holders of BANANA who enter Banana Gun through referral links only need to hold more than 50 BANANA in their wallets to automatically accumulate 40% of Banana Gun's trading fees every 4 hours, which corresponds to distributing 23.12 million USD of 2024 revenue to holders in the form of ETH/SOL or BANANA, with the option to choose BANANA coming from the buyback of trading fees in the secondary market.

Additionally, users trading with Banana Gun receive a small amount of BANANA as a reward through the Banana Bonus trading cashback. The goal of Banana Gun is to create an ecological cycle for BANANA and TG Bot, turning traders into holders and holders into traders.

Currently, most on-chain protocols willing to share protocol revenue or conduct buybacks are related to asset trading, including spot trading, perpetual trading, and aggregation trading. This demonstrates that on-chain asset trading can generate strong income, motivating teams to empower, compared to centralized exchanges with fees ranging from 0.02% to 0.075%, on-chain tax rates of up to 1% are common.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。