1. K-Line Pattern Analysis

From the K-line pattern perspective, Bitcoin's price has shown significant fluctuations recently, exhibiting the following characteristics:

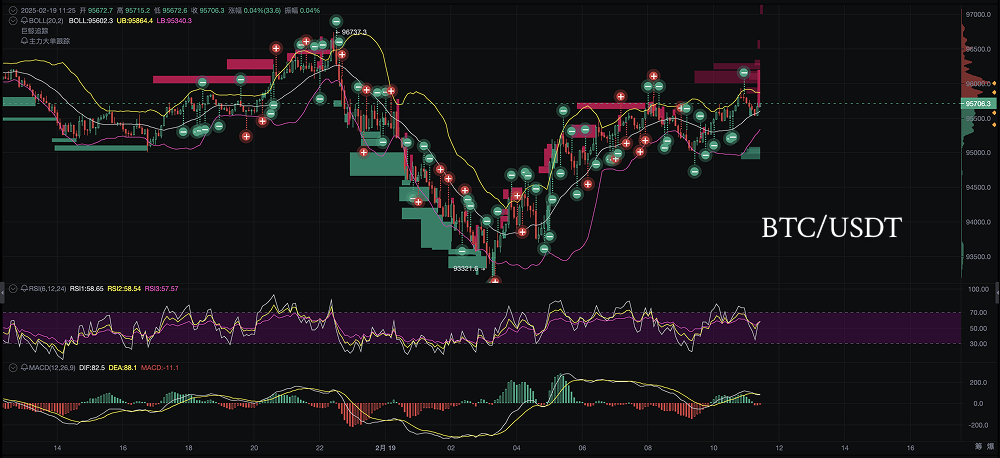

- Top Pattern and Pullback: After reaching a peak at $96,753.91, the price pulled back to a low of $93,388.09, indicating signs of profit-taking by the main players.

- Range Consolidation: The current price is oscillating near the middle band of the Bollinger Bands, with resistance in the $96,000-$97,000 range. A breakout from this range may open up upward potential.

2. Main Players and Whale Tracking Analysis

Data from large order tracking and whale tracking shows:

- Whales Accumulating at Low Levels: When the price dropped to $93,388.09, the green “+” markers significantly increased, indicating that whales were buying heavily at low levels, providing momentum for the subsequent price increase. Data shows that the capital inflow during this period increased by about 45%-50%, concentrated within one hour after the market hit the bottom.

- Main Players Reducing Positions at High Levels: When the price rose to $96,753.91, the red “-” markers increased, indicating that main players were reducing positions at higher price levels, leading to a market pullback. As the price approached $97,000, capital outflow increased by about 60%, showing significant selling pressure.

- Current Market Uncertainty: Currently, capital inflows and outflows are alternating, and the market is in a consolidation phase, with large funds not forming a consistent trend.

Whale and Main Player Behavior Patterns:

- Accumulation, Pumping, Distribution: Recent market behavior shows that whales are accumulating at low levels, pumping the price, and then gradually distributing at high levels.

- Cautious Institutional Attitude: Institutional investors are currently cautious, with no sustained inflow seen above $96,000, possibly waiting to observe market trends.

- Whales Providing Support: Whales' buying at low levels provides support for the market, but institutional selling at high levels may limit short-term gains, leading to continued market consolidation.

3. MACD Indicator Analysis

The MACD (12, 26, 9) indicator shows:

- Short-term Bullish Momentum: The MACD indicator suggests a potential upward trend in the short term. The DIF (62.57) is above the DEA (33.22), and the MACD histogram has turned positive, indicating upward momentum. However, the histogram is relatively short, suggesting that the upward momentum has not yet fully established.

- Previous Bearish Signals: Previously, after the price dropped from $96,753.91, the MACD histogram quickly turned green, with the DIF falling below the DEA, forming a clear death cross, signaling that the market entered a downward channel.

- Current Trend Development in Early Stages: The MACD is in the early stages of a golden cross. If the DIF continues to rise and moves away from the DEA, a strong upward trend may form. Conversely, if the DIF flattens or retreats, the market may enter another adjustment phase.

4. RSI Indicator Analysis

The RSI (6, 12, 24) indicator shows:

- Short-term Buyer Strength Dominates: RSI1 (60.86) is above RSI2 (58.50) and RSI3 (56.53), indicating strong buyer strength in the short term, but it has not yet entered the overbought zone, leaving room for further increases.

- Strong Support at Low Levels: The RSI quickly rebounded after previously hitting a low, indicating strong buying support in the market at low levels.

- Neutral to Strong State: Currently, the RSI is in the 50-70 range, indicating a neutral to strong state. A breakout above 70 should be monitored for short-term pullback risks.

5. Bollinger Bands Analysis

Bollinger Bands analysis shows:

- Price Returning to the Middle Band: The current price is oscillating near the middle band of the Bollinger Bands, facing resistance from the upper band, with unclear short-term direction.

- Bollinger Bands Narrowing: The Bollinger Bands are gradually narrowing, indicating that the market is about to face a directional choice. A breakout above the upper band may lead to a new upward trend, while a breakout below the lower band may result in a pullback.

Comprehensive Analysis and Trading Strategy

Overall Market Assessment: The Bitcoin market is currently in a consolidation phase, with capital flows and technical indicators not providing clear trend signals. Although whales are providing support by accumulating at low levels, institutional selling at high levels creates resistance. The market is waiting for decisive factors to guide its direction.

Key Technical Levels:

- Resistance Level: $97,000 is a key resistance level. A successful breakout accompanied by increased trading volume may open up upward potential to $98,000-$100,000.

- Support Level: $93,300-$94,000 is an important support area. A drop below this area may trigger a new round of declines.

Trading Strategies:

- Breakout Buy: If the price breaks out above $97,000 with increased volume, consider buying in line with the trend, targeting $98,000-$100,000.

- Range Trading: Short-term traders can buy low near $95,000 and sell high near $96,500, engaging in range trading.

- Set Stop Loss: If the price drops below $93,300, consider setting a stop loss to avoid downside risk.

Key Points to Monitor:

- Capital Flows: Closely monitor capital flows in the $95,000-$96,000 range. An increase in buying may indicate an impending breakout above $97,000.

- MACD Confirmation: Watch for whether the MACD golden cross further strengthens, and whether the DIF continues to rise and move away from the DEA to confirm upward momentum.

- Market Sentiment: Pay attention to market sentiment and news events that may affect Bitcoin's price.

Current Market Summary: The Bitcoin market is primarily in a consolidation phase, with institutional investors taking profits at high levels while whales provide support at low levels. The capital flow in the next few hours will be key to determining the short-term trend. In the $95,000-$96,000 range, if buying strength increases, a breakout above $97,000 resistance is likely; conversely, if selling pressure increases, a pullback to the $94,000 support level may occur. Short-term market uncertainty remains, and it is advisable to closely observe market dynamics and make cautious decisions.

Disclaimer: The above content is for reference only and does not constitute investment advice.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。