The ETH Staking ETF is about to launch, expected to add approximately 2 million ETH in staking. The introduction of staking functionality will change the market landscape and significantly drive the growth of ETH ETF asset management scale.

Author: @tomwanhh

Translation: Baihua Blockchain

The ETH Staking ETF is about to launch: approximately 2 million ETH in staking is expected.

This article analyzes its potential impact:

- ETH ETF inflows and issuers

- Ethereum staking ecosystem

- Future impact of PoS ETFs

1. Current Status of ETH ETFs: Weak Inflows

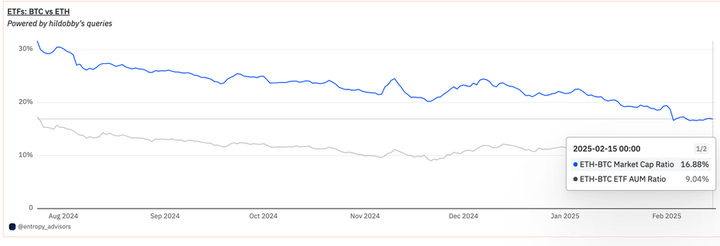

According to market capitalization ratios, ETH ETFs should account for 16% of the $114 billion asset management scale of BTC ETFs, but currently, it is only 52% of the expected scale.

What is missing? Staking.

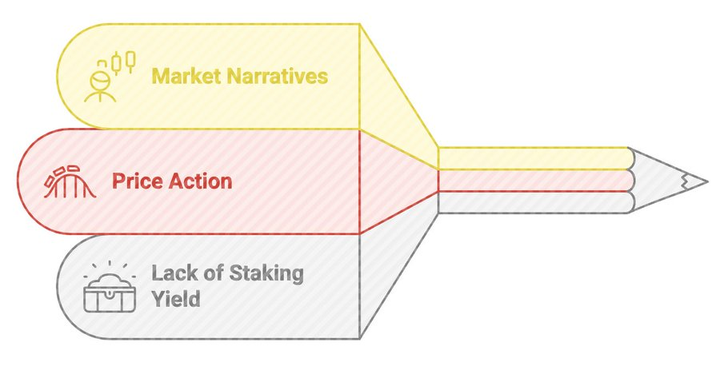

Narratives and price trends will undoubtedly affect fund inflows, but the fundamental issue is the lack of** staking.**

In the crypto community, the distinction between Bitcoin and Ethereum is very clear: one is digital gold, the other is a global computer. However, in the suit-and-tie financial circle, cryptocurrencies typically only account for 5% of their overall portfolios.

They are still trying to understand Bitcoin and need more time to grasp Ethereum. A simple way to differentiate is through yield.

In Europe, institutional-grade Ethereum* staking* is already quite mature. With the launch of the US ETH ETF, the motivation for investors to switch to non-staking ETFs is low.

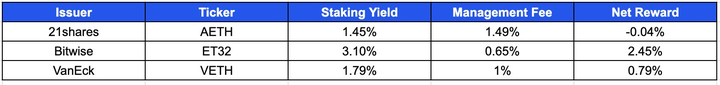

Even if staking rewards are not enough to fully cover costs, they can nearly offset these expenses.

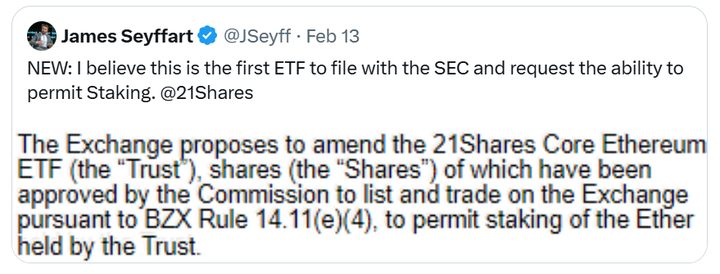

However, this situation is about to change. @21Shares has submitted a request to enable staking. The situation is not just limited to this:

- The SEC's crypto task force has invited @buffalu__, @RebeccaRettig1, and @KyleSamani to discuss staking, including LST (Liquid Staking Tokens).

- The Pectra upgrade is expected in April, which will shorten the unbonding period for Ethereum staking, a significant barrier when staking was initially introduced.

After joining staking, I expect the asset management scale (AUM) of ETH ETFs to potentially catch up with the market capitalization ratio of Bitcoin and Ethereum, reaching $19 billion (an increase of $9 billion).

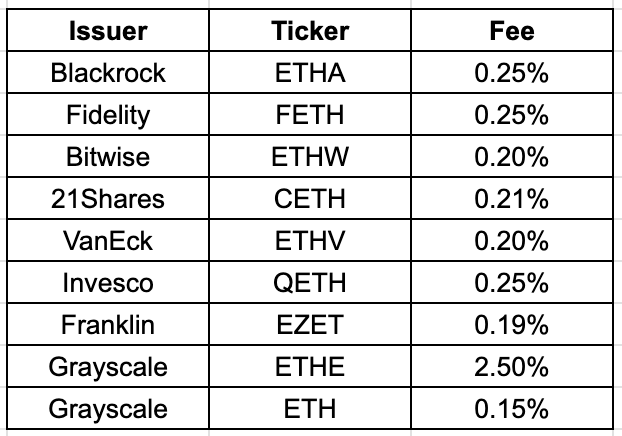

The competition for crypto* ETFs* in the US is extremely fierce, with management fees close to 0%. With the introduction of* staking* yields, investors not only do not have to pay fees but may also earn 1%-3% from staking.

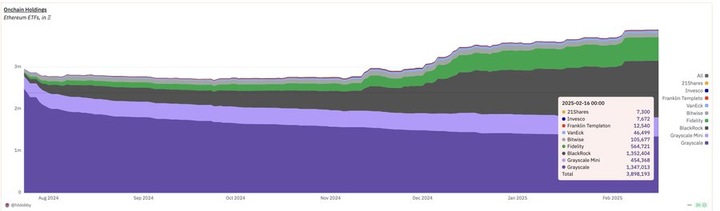

Currently, there are a total of 3.9 million ETH across all ETFs. Assuming a staking rate of 50%, this means approximately 2 million ETH will be staked.

Expecting 100% of the ETH from ETFs to be staked is unrealistic. This is because ETFs need to complete creation and redemption within a maximum of 7 days. Without liquid staking solutions, it is difficult for ETFs to achieve close to 100% utilization.

Therefore, I expect ETFs to start with a lower experimental utilization rate and gradually increase to a utilization rate of 50%-75% as the market matures.

2. Future Impact of PoS ETFs

The introduction of staking may change the market landscape. In Bitcoin ETFs, competition mainly revolves around management fees. For ETH staking ETFs, competition will not only focus on management fees but also on staking yields and liquidity management.

Undoubtedly, giants like Blackrock and Fidelity can obtain competitive pricing from** staking providers. Smaller issuers will need to find ways to either be cost-efficient or have performance advantages.**

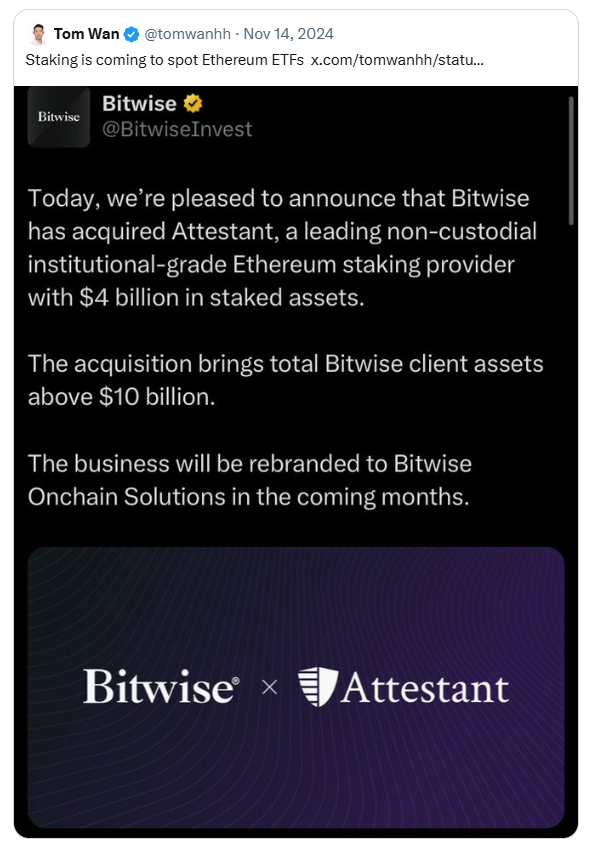

Bitwise made a smart acquisition, utilizing internal solutions, which may be the most cost-effective way. However, it is uncertain whether Attestant will become a whitelisted/compliant provider.

For other issuers, I believe they will turn to common institutional staking providers such as @coinbase, @Figment_io, @BlockdaemonHQ, @P2PValidator, and @Kiln_finance.

Coinbase and other staking pools will become stronger. Although the market share of liquid staking may decline in the short term, its growth is inevitable in the long run.

Pectra will become a catalyst for the development of staking. I expect that within 3 to 12 months after the upgrade, ETH staking ETFs will gradually emerge. How Pectra will benefit ETH staking ETFs:

1) Higher effective balance (32 -> 2048): This will reduce staking costs by decreasing the number of required validators.

2) Lower initial penalty for forfeiture: This will reduce the risk for stakers.

3) Shorter unbonding period: Validators can merge, thereby reducing the number of validators waiting for partial redemptions.

3. ETH ETF Inflows and Issuers

Liquid staking (LST) is clearly superior to traditional staking solutions. LST can not only enter the primary market but also the secondary market. If a large number of redemptions occur, issuers can:

- Sell on trading platforms for immediate liquidity

- Use it as collateral to borrow ETH in the primary market, with mature protocols like Lido, leveraging their liquidity buffer, can even provide faster activation queues and shorter redemption times.

While I believe Lido's stETH, due to its market dominance, liquidity, and institutional products, may become the preferred solution for ETFs, the following liquid staking tokens (LST) should also be considered:

lsETH from @liquid_col, integrated with Figment

cbETH from Coinbase

rETH from @Rocket_Pool, supporting decentralization. If the ETH ETF enables staking functionality, then the SOL ETF could also have staking features at launch.

**Without**** staking**** functionality, investors will miss out on 7%-10% returns.** Additionally, the unbonding period for SOL (about 2.5 days) is much shorter than that of ETH, making enabling staking easier. Article link: https://www.hellobtc.com/kp/du/02/5680.html Source: https://x.com/tomwanhh/status/1891472803817562209

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。