Preface: Investment carries risks, and operations should be cautious.

Article review takes time, and there may be delays in publication. The article is for reference only, welcome to read!

Article writing time: February 19, 9:22 AM Beijing Time

Market Information

- K33: The Bitcoin market is in an unprecedented "sluggish state" before the U.S. elections;

- Federal Reserve's Daly: Cryptocurrency is an emerging industry, and we do not want to stifle innovation out of fear;

- Federal Reserve's Daly responds to whether there will be further interest rate cuts this year: The world is full of uncertainty;

- JPMorgan: U.S.-listed Bitcoin miners accounted for 29% of the global hash rate in February;

- Bitcoin is favored by hedge funds and banks, and Standard Chartered is optimistic about its long-term growth potential;

Market Review

Last night, after testing the 95,500 position, the market fell again, with the lowest point at 93,321. Subsequently, the daily line closed with a pin bar and rose back to 95,500. The previously mentioned range oscillation was not effectively broken. Yesterday, Bitcoin's highest rebound point was around 96,700, with a maximum profit of about 1,200 points for long positions. Without protection, it basically resulted in a small loss when exiting. Ethereum's lowest point yesterday was 2,604, and the short position exited too early. Currently, the market is still in a range oscillation without breaking out, and it is at the bottom of the oscillation range. In trading, it is still advisable to maintain low long and high short positions;

Market Analysis

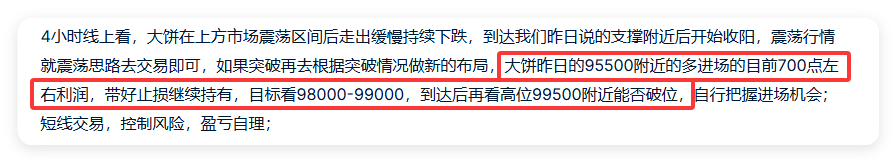

BTC:

From the daily chart, the Bitcoin downtrend oscillation range has not been broken. The support level after the previous rise from 88,909 to 110,000 is around 93,500. After the first wave of decline, it continued to oscillate without a rebound. Now it is testing support again, and the support below is still valid. In trading, one can first look for short-term rebounds and observe the support defense. If there is a rebound, pay attention to the effective breakout situation at the high point of 99,500. Reference points are to go long near 95,000, with a stop loss at the low point of 93,300, and a target of 98,500-99,000. Seize the entry opportunity yourself; for short-term trading, control risks and manage profits and losses independently;

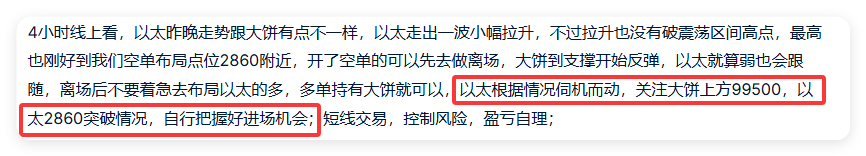

ETH:

From the daily chart, Ethereum has not experienced a deep decline this time, as it did not reach the support level of 2,560. Overall, Ethereum is still in an oscillation phase, and as long as the range is not broken, there will not be significant ups and downs in the market. In trading, maintain a low long and high short strategy. Pay attention to the support level near 2,560. If Bitcoin rebounds, Ethereum will follow. The trading strategy is to go long near 2,600, with a stop loss at 2,520, and a target around 2,850. After breaking above, adjust according to the situation. Seize the entry opportunity yourself; for short-term trading, control risks and manage profits and losses independently;

In summary:

Bitcoin and Ethereum are still operating in a range oscillation, and trading remains low long and high short;

The article is time-sensitive, be aware of risks, and the above is only personal advice for reference!

Follow the WeChat public account "Crypto Lao Zhao" to discuss the market together;

The root of all suffering is the pursuit of certainty. Impermanence is the norm and the way life should be. Always wanting to grasp the market, if you have a 50% certainty, don’t act; if you have 70% certainty, don’t act; you must wait for 100% certainty. Where in the market is there 100% certainty? Trading is about trading risks, trying to make the odds stand on your side. Those who give love will receive love in return; those who bring blessings will receive blessings. Sometimes, learn to take a little loss, be a bit foolish, a bit silly. For example, if the market is bullish, once this is confirmed, don’t be too rigid with your position, lower your position a bit, and then get in first. At worst, it will reverse.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。