Going out has this downside; updates are often late. However, not going out and not interacting with friends makes it hard to improve understanding comprehensively. Although the market sentiment isn't great today, and everyone is saying that the market will drop during meetings, short-term price changes are inherently difficult to predict. What we do know is that there hasn't been any significant negative sentiment affecting the market today.

Of course, I know what everyone wants to say. On one hand, investor sentiment isn't very friendly, as the U.S. stock market has seen declines. On the other hand, the unlocking issue of #SOL has intensified in the past two days. The market's panic has caused SOL to drop, dragging the entire cryptocurrency market down. Many friends have indeed asked me whether the unlocking issue will have any impact.

I think it can be divided into two parts. One is the emotional impact, which is undoubtedly significant. A large amount of SOL will be unlocked on March 1, and it's not just at this fixed time; in fact, linear unlocking has already started since February. The average cost of these tokens is around $70. (Galaxy Digital's cost is $64, while other institutions are at $94, but Galaxy Digital bought two-thirds of it.)

However, it's important to note that only about 35% of the tokens are being unlocked this time. So, if these institutions were to sell all their SOL, it could indeed create a significant drop. But for the institutions, it’s likely to be a loss. If they really want to sell, they can do so through OTC methods rather than directly crashing the market. Therefore, I personally feel that this concern is somewhat overblown. Even if OTC sales will impact the market, institutions are not foolish; they seek to maximize profits, not to dump everything at once, especially since there are more tokens that haven't been unlocked.

As for the second part regarding the potential market crash, in my personal judgment, the likelihood of a market sell-off is very low. Even the purchase of $MSTR was done through OTC to avoid overly impacting market trends; these institutions are not foolish.

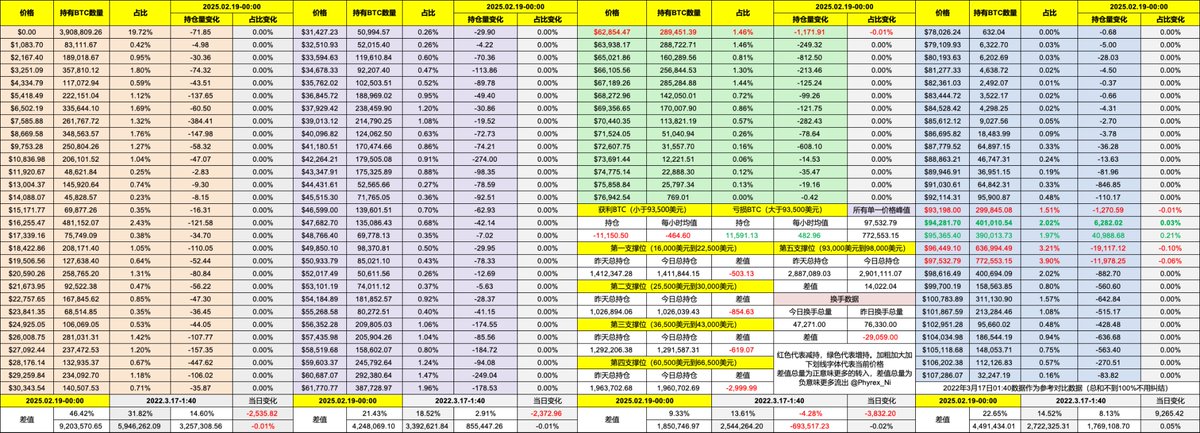

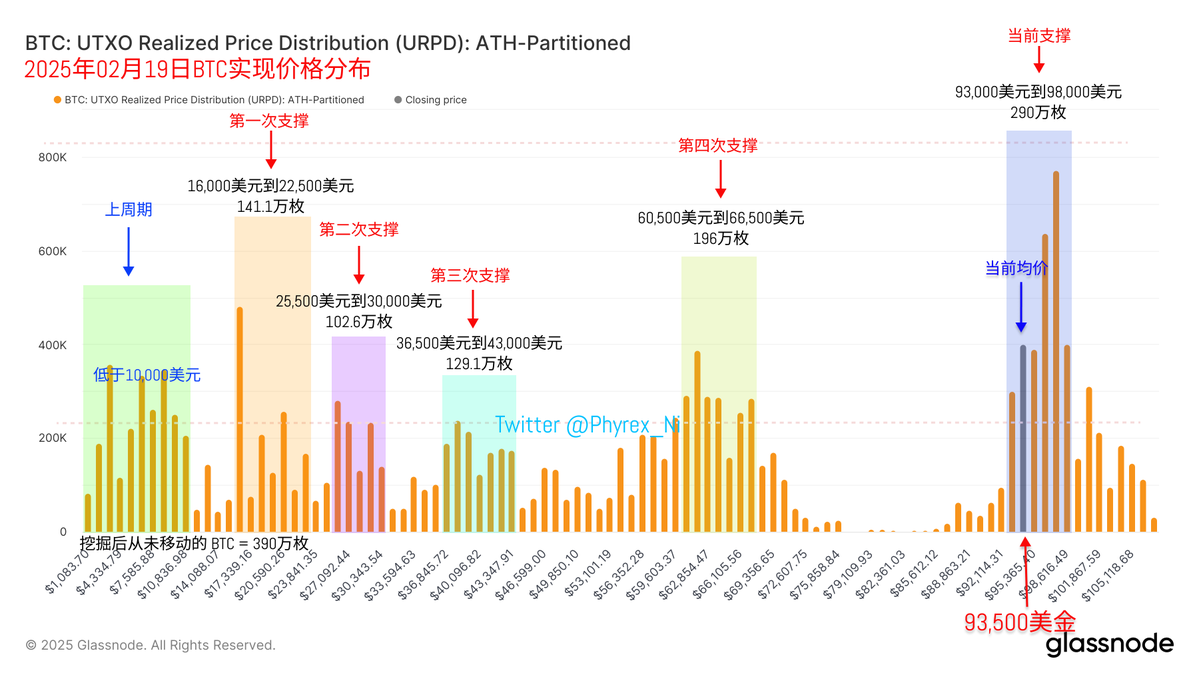

Looking back at the data for #Bitcoin, we can indeed see that the price of BTC has dropped due to user sentiment or cascading liquidations, even falling below $94,000. However, from the data, we haven't found signs of investor panic. In fact, the on-chain turnover of BTC is even lower than yesterday. Such a low turnover rate is certainly not indicative of a large institution's sell-off.

Moreover, the data shows that nearly 70% of the turnover consists of exiting loss-making investors, making it even less likely that this is due to institutional selling. More importantly, there are no significant signs of large investors reducing their holdings between $93,000 and $98,000, indicating that support remains very solid.

Overall, it seems that the drop is triggered by sentiment. Additionally, from the price perspective, we can clearly see that even though SOL's price dropped, it was during the Asian time zone, and after entering the U.S. time zone, SOL basically stopped falling.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。