Macroeconomic Interpretation: Beneath the relatively calm surface of the recent cryptocurrency market, the tug-of-war between bulls and bears remains intense. As Trump's Twitter storm gradually loses its former impact, Bitcoin's volatility has hit a multi-year low, and Ethereum's upgrade narrative clashes with the collective weakness of altcoins, seemingly setting the stage for a breakthrough in the next market cycle.

The "Dull Knife Effect" of Trump's Tweets: Has market immunity increased? JPMorgan's latest research reveals an interesting phenomenon: while the social media offensive of the Trump 2.0 era still has market impact, its lethality has significantly diminished. Among the 126 sensitive topic tweets recently posted by the "Twitter President," only 10% triggered significant market fluctuations. Even though tariff-related tweets still hold the top spot for impact (nearly 1/3 caused turbulence), their frequency is far from the peak level of 60 tweets per week during the 2018-2019 trade war. The threat of tariffs on Mexico and Canada in early February briefly caused the peso and Canadian dollar to plunge, but the market seems to have learned the "wolf is coming" routine—two days later, the reversal of the policy delay left traders attempting to profit from the tweets feeling "tricked" once again. Data shows that, based on the most optimistic models, the expected return from such strategies does not exceed 4%, making it a form of "performance art" in contemporary financial markets.

The Risk-On/Risk-Off See-Saw of Gold and BTC: A delicate balance under dollar hegemony. While gold has risen 10% this year due to the "Trump risk premium," Bitcoin has unexpectedly fallen into a low volatility trough. This seemingly contradictory situation actually hides deeper meanings: gold's strength benefits from geopolitical uncertainty but is also constrained by the risk of a stronger dollar due to Federal Reserve monetary policy. The crypto market is clearly waiting for a more definitive signal—whether to dance to gold's risk-averse properties or to be dragged into the mire by tightening dollar liquidity. Interestingly, BTC's market cap share has quietly climbed to a historical high of 53%, creating a "the strong get stronger" pattern reminiscent of a middle-aged man monopolizing the squat rack at the gym, leaving altcoins to merely warm up on the sidelines.

The "Schrodinger's Benefit" of Ethereum's Upgrade: Can Pectra break the curse? The options market's positioning for Ethereum's Pectra upgrade can be likened to a "murder mystery" in the crypto world. Looking back at history, the merge upgrade played out the classic "buy the rumor, sell the news" scenario, while the Shanghai upgrade missed its opportunity due to unfounded supply concerns. Ahead of this upgrade, the volatility of March-expiring options leaning towards bullish characteristics seems to suggest that the market is betting on a "third time's the charm." However, the collective weakness of the altcoin market (with SOL and ETH retreating to pre-election levels) and the aftermath of LIBRA's collapse leave this technical upgrade facing the awkward situation of "a good cook cannot make a meal without rice." To truly activate the market, something more tangible than code updates may be needed—like a sudden announcement from a U.S. congressman declaring they hold ETH, or Musk swapping DOGE for ETH as fuel for a starship.

BTC Volatility Trap: The calm before the storm? As Bitcoin's actual volatility (32%) and implied volatility (50%) both hit multi-year lows, this asset, known for its volatility, suddenly appears more "stable" than bank wealth management products. Within the narrow trading range of $91,000 to $109,000, BTC seems to have entered "hibernation mode." However, historical experience shows that extreme volatility compression often accompanies directional breakthroughs. Like a beach ball pressed underwater, the deeper it is pushed, the stronger the rebound. The current market appears to be "balancing" between Trump's tariffs, Federal Reserve policies, and crypto narratives, but in reality, it is accumulating energy for a breakout. Some analysts jokingly compare Bitcoin now to a top student checking multiple-choice questions repeatedly in the last ten minutes of an exam—calm on the surface, but their brain is frantically calculating the best moment to strike.

At this crossroads of intertwined bullish and bearish factors, the crypto market is waiting for a catalyst to break the balance. It could be an unexpected blow from one of Trump's late-night tweets, a solid confirmation of a shift in Federal Reserve policy, or the sudden explosion of a particular on-chain application. Regardless, as market consensus gradually forms around the judgment that "low volatility is unsustainable," we should be wary: the greatest risk may come from the collective illusion of "no risk." After all, in the crypto world, beneath the calm surface, the fiercest whales often swim.

Data Analysis:

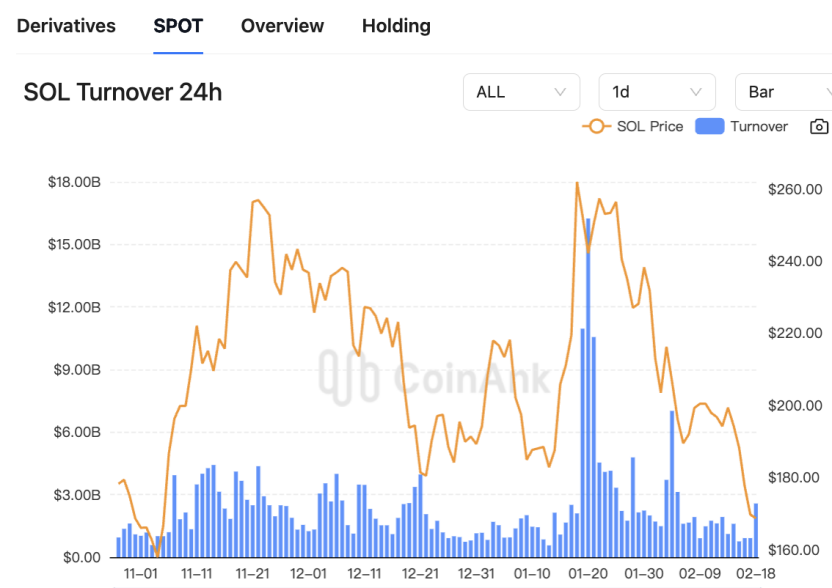

The chart shows Coinank's statistics on SOL trading volume. Additionally, data monitoring indicates that the number of active addresses on the Solana chain has significantly decreased from 18.5 million in November 2023 to 8.4 million currently, a drop of 54.6%.

From the perspective of blockchain ecosystem evolution, we believe that the decline in Solana's active addresses from 18.5 million in November 2023 to 8.4 million in February 2025 (a decrease of 54.6%) reveals a deep connection between the development cycle of public chains and market behavior.

On the short-term factors side, the surge in activity from late 2023 to early 2024 (such as breaking one million addresses in a single day in January 2024) was primarily driven by the airdrop economy, with distributions from projects like WEN and JUP attracting a large number of short-term participants. However, such users often lack the motivation for long-term retention. Although Solana's monthly active addresses surpassed 100 million in October 2024, over 86% of addresses did not hold SOL tokens, exposing the "ineffective active" bubble characteristics.

In terms of structural challenges, the collapse of FTX in 2023 and the SEC's classification dispute over SOL directly impacted market confidence and institutional participation willingness, leading some users to migrate to other ecosystems. The 20% decline in trading volume from peak levels in early 2025 reflects the marginal diminishing efficiency of network usage, possibly due to an increase in low-value transactions under high throughput.

Long-term trend insights suggest that the fluctuations in Solana's activity reflect the dilemma of public chain development: while relying on incentives like airdrops can rapidly expand the user base, it is challenging to build sustainable ecological value. In the future, enhancing developer tools and optimizing asset retention mechanisms (such as staking derivatives) will be necessary to strengthen user stickiness, rather than solely relying on short-term speculative behavior to drive data growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。