Author: Stable Dog Diary

First of all, this cycle is very difficult. But the fact is, each cycle is harder than the previous one. You have to compete with a larger crowd, and the number of experienced participants is also increasing. If you didn't hold a significant amount of BTC or SOL during the bear market, you probably haven't made any money and are feeling overwhelmed.

So, why is this cycle so difficult?

1. Post-Traumatic Stress Disorder

We have examples of two large altcoin cycles, most of which fell by 90-95%, and the entire industry was infected due to the liquidation of Luna and FTX, causing prices to potentially drop even lower than they should have. This post-traumatic stress disorder has deeply affected the natives of cryptocurrency.

No one wants to hold anything long-term because they never want to lose a significant amount of money in their portfolio again. The emotional swings of participants are more intense, and everyone is constantly looking for the top of the cycle.

The psychological impact is not limited to trading behavior; it also affects the construction and investment methods of the entire ecosystem. Projects now face stricter scrutiny, and the trust threshold has increased exponentially. This has both positive and negative effects: while it helps filter out obvious scams, it also makes it harder for legitimate projects to gain attention.

2. Innovation

There are more iterative innovations, and the infrastructure is continuously improving, but there hasn't been a 0->1 and jaw-dropping breakthrough like DeFi. This makes it easier for people to argue that cryptocurrency has made no progress, leading to more statements like "cryptocurrency is doing nothing."

The innovation landscape has shifted from revolutionary breakthroughs to incremental improvements. While this is a natural evolution of any technology, it poses challenges for a narrative-driven market.

We still lack breakthrough applications that are necessary to bring cryptocurrency to hundreds of millions of on-chain users.

3. Regulation

The corrupt SEC has caused severe damage. They have hindered the development of the industry and prevented certain sectors (like DeFi) that could have had more PMF and a broader audience from advancing further. They have also prevented all governance tokens from passing any value to holders, leading to the notion that "all these tokens are useless," which is somewhat true.

The SEC has driven away builders (see Andre Cronje's description of how the SEC forced him to resign), blocked TradFi from interacting with the industry, and ultimately forced the industry to raise funds from venture capital firms, creating poor supply and price discovery dynamics where value is entirely captured by a few.

4. Financial Nihilism

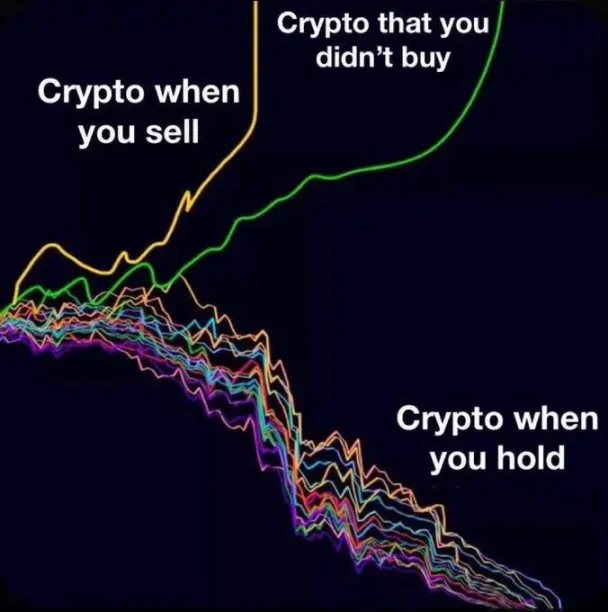

All of the above factors have led to financial nihilism becoming a significant factor in this cycle. "Useless governance tokens" and the high FDV, low float dynamics caused by the SEC have prompted many crypto natives to turn to memecoins in search of "fairer" opportunities.

In today's society, asset prices are soaring, fiat currency is constantly depreciating, wages are not keeping up, and young people have to gamble to get rich, which is a fact, making memecoin lotteries very appealing. Lotteries are always attractive because they offer hope.

Because gambling has PMF in cryptocurrency, and we have better technology for gambling (like Solana and Pump.fun), the number of tokens issued has surged. This is because many people want to engage in super gambling. There is demand for this.

"Trench" has always been a term in cryptocurrency, but in this cycle, it has become a widely understood term.

This nihilistic attitude is reflected in several aspects:

- The rise of "degenerate" culture becoming mainstream

- Shortening investment horizons

- Greater focus on short-term trading rather than long-term investing

- Normalization of extreme leverage and risk-taking behavior

- A "who cares" attitude towards fundamental analysis

5. Experience from the Previous Cycle is a Hindrance

Past cycles have told you that you can buy some altcoins during a bear market and eventually get returns by outperforming BTC.

Almost no one is an excellent trader, so this has been the best option for most people in the past. Overall, even the worst alternatives have a chance.

This cycle is a trader's market, where sellers are more suited than holders. Traders have even gained the largest profits in this cycle through HYPE airdrops.

The first hype cycle of AI Agents is an example. This may be the first time people feel, "This is the new thing we've been looking for." It is still in the early stages, and long-term winners may not have emerged yet.

6. BTC has New Buyers, While Altcoins Mostly Do Not

The divergence between Bitcoin and everything else has never been so apparent.

BTC has unlocked bids from TradFi. It now has an incredible new source of passive demand, as central banks are discussing adding it to their balance sheets.

Altcoins are finding it harder to compete with BTC than ever before, which makes sense because BTC has a clear target with a market cap comparable to gold.

Altcoins indeed do not have new buyers. Some retail investors returned at BTC's new highs (but they bought XRP), but overall, the flow of new retail investors is insufficient, and cryptocurrency still has a reputation problem.

7. The Role of ETH is Changing

The decline of BTC's dominance is largely influenced by the growth of ETH's market cap. Many believe that the trigger for "altcoins" is the rise of ETH, but this heuristic approach has not worked so far in this cycle, as ETH has performed very poorly for fundamental reasons.

I still believe that fundamentals will always play a role in the long term, but you must truly understand the projects you support and how they will genuinely outperform BTC. There are candidates, but currently, there are only a few.

Look for projects with the following characteristics:

- Clear revenue models

- Actual product-market fit

- Sustainable token economics

- Strong narratives to complement the fundamentals (for me, AI and RWA are suitable)

I believe that with the loosening of U.S. regulations, those with stronger fundamentals and PMF can ultimately add value to their tokens, which are lower-risk investments. Revenue printing protocols have now been established and are working well. This is very different from the "greater fool" theory that previously dominated many token models.

You can choose to become a better trader, try to develop an edge, and focus on making more short-term trades, as this market indeed offers many consistent short-term setups. On-chain will provide greater multiples, but the tolerance for downside risk will also be lower.

For most people without a clear edge, a barbell portfolio remains a viable approach. BTC and SOL (70-80%), and allocate less for more speculative investments. Regularly rebalance to maintain these ratios.

You need to understand how much time you have for cryptocurrency and adjust your strategy accordingly. If you are an ordinary person with a job, it is not feasible to compete in the trenches with a Zoomer who sits there for 16 hours a day. This time, passively holding underperforming alternatives and waiting for your turn is also not feasible.

Another strategy is to try to combine different areas. Have a solid asset base portfolio, then consider chasing airdrops (now harder, but lower-risk opportunities still exist), or identify emerging ecosystems and prepare early (like HyperLiquid, Movement, Berachain, etc.), or focus on a selected category.

I still believe that the altcoin market will grow this year. The current situation is already determined, and we are still related to global liquidity, but those that truly outperform BTC and SOL will be limited to a few sectors and a smaller number of altcoins. The rotation speed of altcoins will continue to accelerate.

If we print money like crazy, we might see a situation closer to previous traditional altcoin seasons, but I think this is unlikely. Even in that case, most altcoins will only provide market-average returns. This year, we will still launch some large altcoins, and liquidity will continue to disperse.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。