Recently, the Bitcoin market has been unusually quiet. Since the end of November last year, BTC has been oscillating between $91,000 and $109,000 without any breakout. This kind of market silence is often a sign of a storm brewing. Senior analyst Van Straten describes Bitcoin's current state as a compressed spring, which, once released, could lead to significant volatility. So, will the market break upwards this time, or will it face a major correction?

Volatility Drops to Historic Lows, Major Market Movement on the Horizon

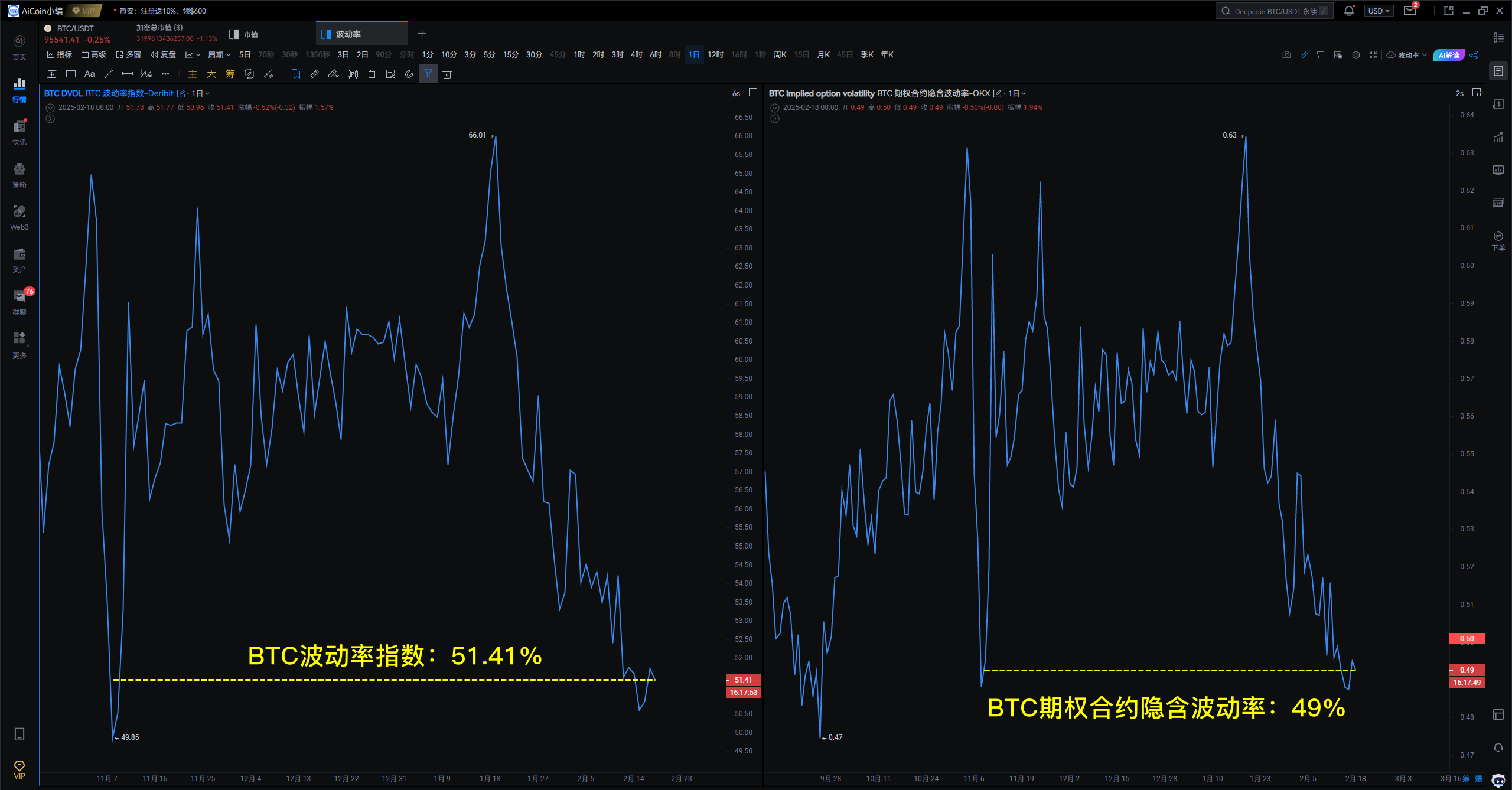

From the data, Bitcoin's volatility has been compressed to its limits.

- The actual volatility over the past two weeks is only 32%, marking a multi-year low.

- The volatility index has dropped to around 51%, at a low level for nearly a quarter.

- The implied volatility of options has also fallen below 50%, similarly close to a quarterly low.

In other words, Bitcoin has entered an extreme state of ultra-low volatility, and history tells us that every time this occurs, a wave of intense market movement follows. Volatility always returns to the mean, and the longer the market "holds back," the more explosive the eventual breakout will be.

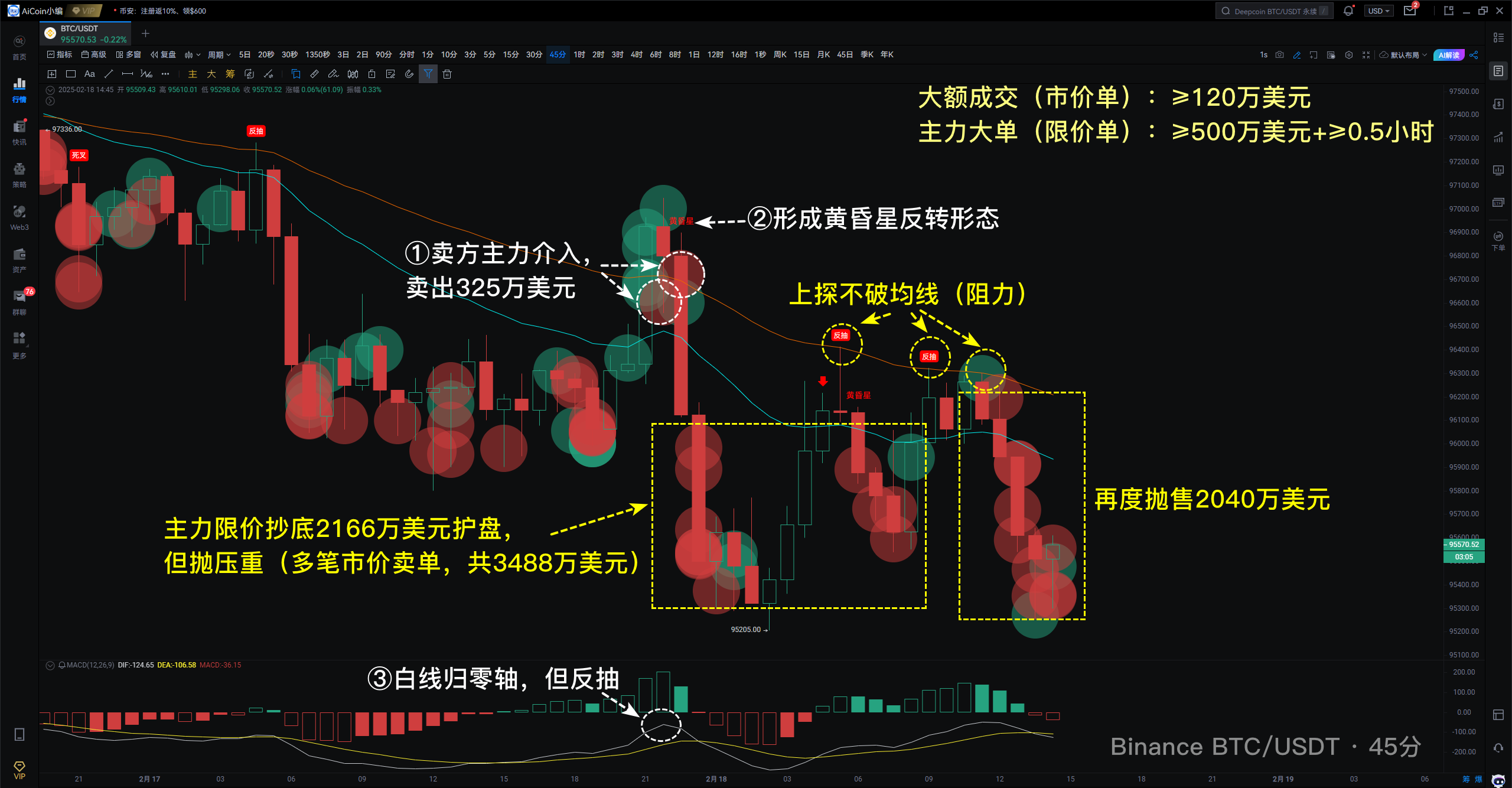

Short-term Capital Movements: Large Players Selling, Market Facing Tests

Last night, Bitcoin attempted to break through $97,000 but failed to hold. More critically, large players on Binance took the opportunity to dump, directly selling $3.25 million in BTC, causing the market to quickly retreat. At the same time, the K-line formed a "Evening Star" pattern (a type of top reversal signal), and the MACD also formed a pullback near the zero axis.

Large player trading situation:

- Buy orders: Limit buy of $21.66 million in BTC

- Sell orders: Market sell of $55.28 million in BTC

From this comparison, selling pressure still dominates, and short-term market sentiment is cautious. As of the time of writing, BTC is once again supported by the EMA52 moving average. If Bitcoin cannot effectively stabilize between $94,000 and $95,000, it may further test the mid-term support area of $91,000 - $92,000.

- Recommendation: Limit operations during the oscillating market, act only when reaching key support/resistance, and closely monitor large player capital flows to avoid blindly chasing highs and lows. Track major player movements immediately: https://www.aicoin.com/vip

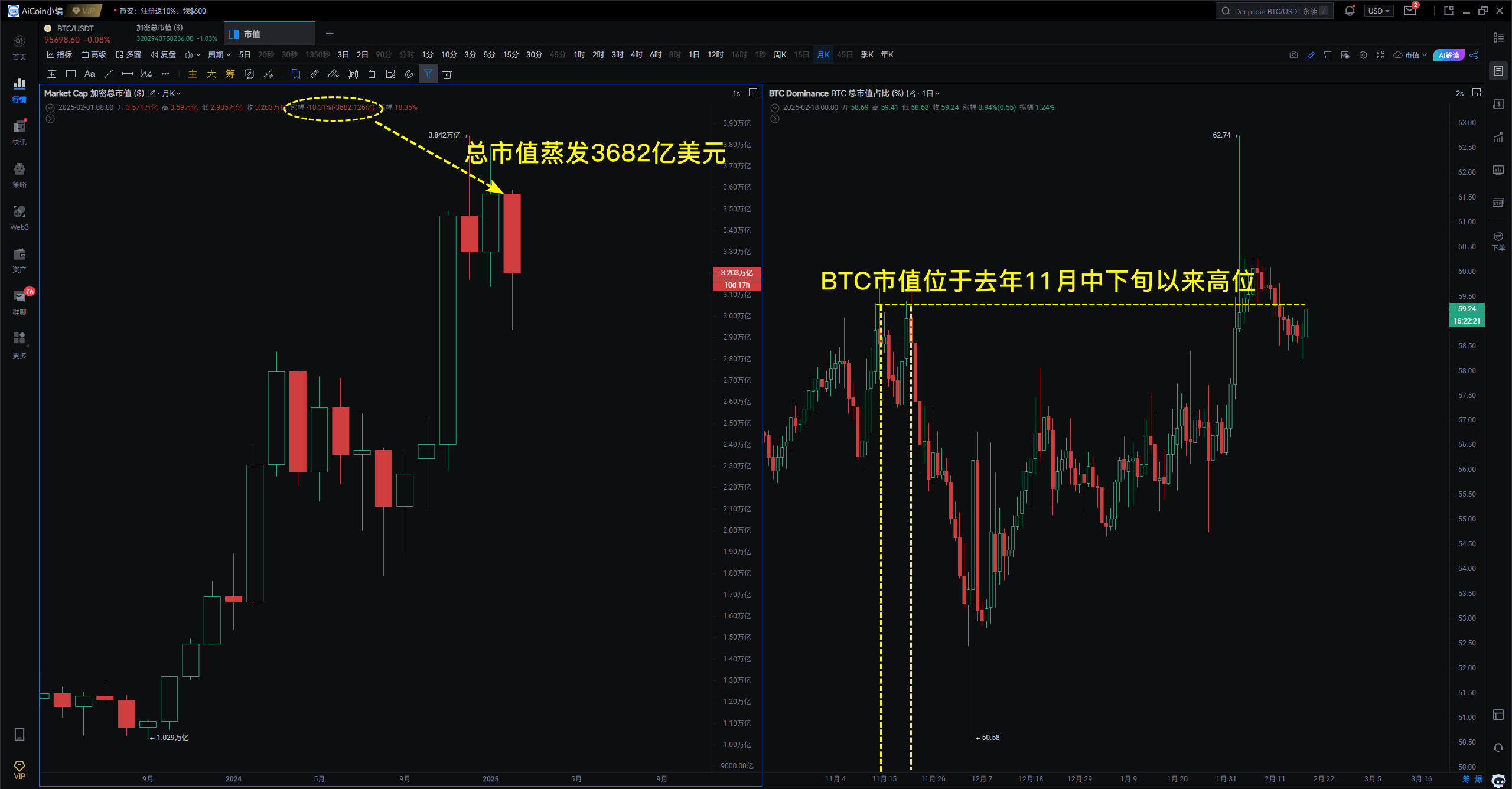

Bitcoin Consolidates for 81 Days, Market Awaits Clear Signals

According to the Bitfinex Alpha report, Bitcoin has been oscillating in the $91,000 - $102,000 range for a full 81 days, with market sentiment becoming cautious. Despite the escalation of the global trade war and geopolitical tensions, BTC has not shown any clear directional movement.

- Bitcoin ETF capital flow: A net outflow of $580 million in the past week.

- Cryptocurrency market loss: $375.4 billion evaporated in 18 days.

- BTC market cap share: 59.25%, close to the level during last November's bull run.

Funds have quietly started to flow back into Bitcoin, while the altcoin market has faced greater selling pressure, especially Meme coins like PEPE and WIF, which have plummeted over 45% in the past month. This situation indicates that investors are beginning to return to a risk-averse mode, and Bitcoin's stability is once again being validated.

Ethereum ETF Attracts Capital Against the Trend, ETH Inflows Exceed Bitcoin

In contrast to the outflow of funds from Bitcoin, Ethereum is becoming a new favorite among institutions. Data shows that since the beginning of this month, the net inflow of capital into Ethereum spot ETFs has reached $393 million, a sevenfold increase compared to January! The core driving force behind this is arbitrage trading and the significant upgrade coming for Ethereum.

Meanwhile, the ETH/BTC exchange rate may have bottomed out, currently reported at 0.02801. If it breaks through this month's high, the market may see a trend reversal. This means that Ethereum could experience a wave of movement that is relatively stronger than Bitcoin, and altcoins may explode in tandem!

BTC Oscillates and Adjusts, Is There an Opportunity for ETH?

Currently, Bitcoin is still oscillating around $95,000, and the market has not reached a consensus on the short-term direction. However, from the broader environment, ETH seems to be gradually shaking off its downturn and attracting new capital interest.

📌 Bitcoin Focus: Short-term oscillation is key, waiting for signals of capital inflow

- Short-term support at $95,000, mid-term support at $92,000

- Short-term resistance at $97,500, mid-term resistance at $100,000

- The trend lacks direction, and short-term trading requires patience for a breakout

📌 Ethereum Focus: Increased institutional buying, short-term upward opportunities exist

- ETF capital continues to flow in, institutional interest is clearly rebounding

- The upcoming Pectra upgrade may drive a new round of capital inflow

- Short-term target at $2,800, mid-term target at $3,500

The above content is for sharing only. If you have any questions, you can join the 【PRO CLUB】 group to contact the editor~

AiCoin official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。