Author: shushu, BlockBeats

On January 31, Argentine President Milei posted a tweet on his X account stating, "He is providing me with advice on the impact and application of blockchain technology and artificial intelligence in the country," accompanied by a photo with a young man in a suit wearing gold-rimmed glasses.

This person is Hayden Mark Davis, a key figure in the LIBRA token issuance controversy.

Who is Hayden Mark Davis?

Hayden Mark Davis's LinkedIn profile shows that he has been the CEO of Kelsier since October 2020; since May of the same year, he has been the founder of Luxury Drip, a company with an unclear industry (although there is an Italian brand of the same name in the urban fashion sector); according to Davis, he has been an entrepreneur since August 2017, running a company called Leaders Elevate. A Google search for this latter company leads to a coaching-focused business, whose founder is another person named Tom Davis, who lives in Barcelona.

Hayden Mark Davis's personal account still fails to reveal his story. The last photo was uploaded by Javier Milei from the presidential office, while another dates back to February 2022, showing the young man with several others named Davis, with their names labeled. Thomas Davis and Gideon Davis appear as CEO and co-founder of Kelsier, respectively. This account has now been locked as a private account.

According to a web snapshot, Kelsier Ventures has deleted team member information.

Kelsier Ventures Operations Revealed

The following content comes from an investigative video by BoDoggos Entertainment CEO Nick O'Neil:

In this video, I want to delve into Kelsier Ventures, which is still actively providing token issuance services, despite one of their founders, Hayden, currently facing risks and being embroiled in an international scandal. What I can learn today is the entire process of how Kelsier conducts token issuance, including fees, how the company is involved in money laundering, token washing, and internal manipulation for friends and family. Next, I will switch to my computer screen to show my understanding of Kelsier Ventures and their current operations, gradually analyzing the four key components of Kelsier Ventures.

Shipping

I interacted with team members to understand their actual charging and operational processes. First, Kelsier Ventures is still actively operating, and Hayden is currently in an undisclosed location; while I have a rough idea of where he is, I do not want to disclose that information.

Today, I received a quote from the team, and their core business model is clearly still to operate discreetly. You will soon see what I mean by the "launch and squeeze" process, which is designed to extract as much money as possible from their tokens. When you pay for their services, they will discuss how to shuffle deployment and target "sniping." I will elaborate on the fee structure later, but essentially, they want this entire process to go untracked and will engage in "money laundering" operations during the entry and exit.

Some may call it wire fraud; I don't know how they would define it themselves, leaving it to the judicial system to judge. But from my understanding, it can basically be considered as such.

They will also engage in market making after the token issuance and provide different options. This includes short-term operations, notably Melania, and long-term market making, which requires them to use 20% of the tokens for market making. The "shuffling" process I mentioned earlier is completed during these operations, extracting funds from them.

Fee Structure

Next, let's look at pricing. The prices are actually quite standard. If you have interacted with market makers in this field, you will know this is straightforward. They charge 2% of the token share and plan to sell these tokens in the future.

I saw a recently leaked internal video mentioning that this ratio might be 1%. In fact, they may distribute this 2% share to different people, but in any case, they are charging this 2% token share and plan to liquidate a maximum of 1.1% of it daily. That is to say, if you provide 2% of the tokens, and the service period is 20 days.

Calculating at a daily service fee of $3,000, or charging 20% based on the amount you withdraw. If you ask them to sell $1 million today, they will charge a 20% service fee, which is $200,000. So the fee structure is based on higher amounts.

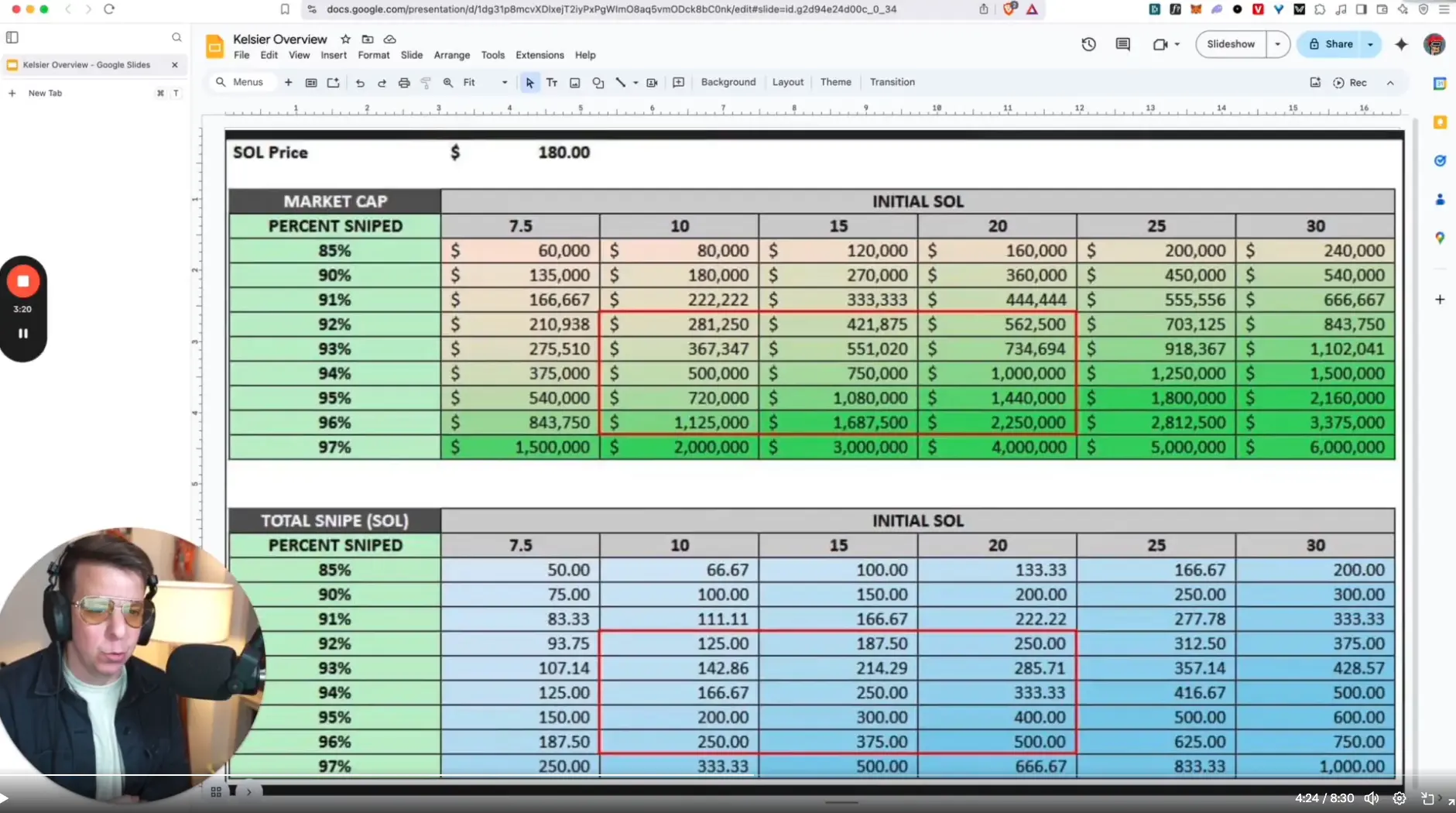

However, there is also a cost to initiate these operations, which is a chart they use internally and provide to clients, showing today's latest pricing.

I do not intend to delve into this here, as it is not important, but I will give an example. Suppose you want to set the market value of the token at $1 million and plan to conduct a 94% token "shuffle." They typically execute this "shuffle" operation at each issuance, with a ratio generally between 85% and 97%. If you look at the issuance of the Melania token, you will find it falls within this range. In this way, they are essentially entering the market before it officially opens, basically "jumping the gun" on all other buyers.

For a million-dollar market value, suppose you spend 333.33 Sol to initiate this process, that is 333.33 multiplied by $180, totaling $60,000, plus 20 Sol as initial costs, and other fees, resulting in a final cost of $63,500.

Why choose a higher market price? That may be due to high demand, wanting to start from a high price. Of course, for some smaller projects, the market pricing is lower, but for larger projects like Trump tokens and Melania coins, the prices will be higher, and their shuffling ratio will also be larger.

From my perspective, this practice can almost be considered illegal, but that is their structure. I suggest you take a closer look at this chart to understand how they operate.

Finally, I want to mention a key point, which I will further demonstrate in the video. According to my sources, 90% of the "snipers" come from within Kelsier. They distribute tokens to friends or set up operations for their bots. While I cannot confirm this, it seems to be how they operate, which is absurd.

As I said, they are still continuing to do these things. The entire system's operational foundation is money laundering, pre-sale, market making, with short-term being the typical "pump and dump" (like the Melania token), and then long-term market making, which has also been mentioned in conversations between Hayden and Dave Portnoy, where they ultimately use the money they earn to buy back tokens, eventually "dumping" them in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。