1. Technical Analysis: Halving Effect and Historical Cycle Patterns

1. Importance of the Halving Cycle

Bitcoin's design includes a "halving" mechanism, which reduces miner rewards by half approximately every four years. Historical data shows that bull markets often reach their peak about 530 days after a halving. Based on this pattern, some analysts believe that after the 2024 halving, Bitcoin is expected to reach a price peak around October 2025, providing an opportunity for long-term capital to enter.

2. Price Multiples and Cycle Comparisons

In past bull market cycles, Bitcoin has seen increases of 30 times and 8 times. Although market conditions vary, some conservative predictions suggest that if the current cycle achieves only a 2x growth, Bitcoin's price could reach $130,000; conversely, by comparing past bull market peaks, there are views that Bitcoin could achieve an increase of about 3.5 times, pushing the price to around $240,000.

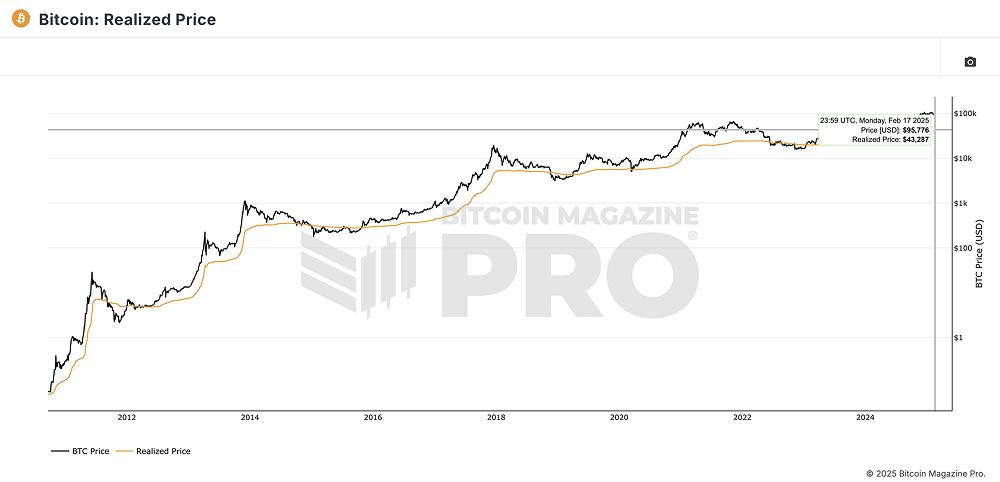

Additionally, the analysis of Bitcoin's realized price (the total of the last movement prices of all circulating Bitcoins divided by the total circulating supply) indicates that the current realized price of about $43,000 multiplied by 4 suggests a potential peak of around $170,000; using a power law curve model analysis, it may even indicate that after breaking historical peaks, Bitcoin's price could exceed $400,000.

3. Technical Indicators and Market Behavior

The current Bitcoin candlestick chart shows sideways fluctuations with many upper and lower shadows, indicating that the battle between bulls and bears remains intense. Investors need to pay attention to changes in trading volume, especially in price behavior at key support levels (such as around $95,000) and resistance levels (like the $97,000 to $98,000 range). A significant breakout with increased volume may signal that the market is transitioning from a consolidation phase into a new bull market.

2. Expert Predictions: Market Expectations and Multiple Scenarios

1. Summary of Predictions from Multiple Institutions

- Well-known experts like Tom Lee predict that under the current policy environment and continuous inflow of institutional funds, Bitcoin's price will steadily rise in 2025, potentially reaching $250,000 in an optimistic scenario.

- BitMEX founder Arthur Hayes is more conservative, predicting a price around $175,000.

- The market generally believes that combining technical and fundamental factors, Bitcoin's reasonable range in 2025 is expected to be between $150,000 and $200,000; in a pessimistic scenario, it may hover between $100,000 and $150,000, while in an extremely optimistic case, some models suggest the price could break $200,000.

2. Views from Authoritative Media and Research Institutions

Reports from Barrons, MarketWatch, and Investopedia indicate that Bitcoin recently breaking the $100,000 mark has become an important sign of market confidence. For example, Barrons points out that investors are optimistic about Bitcoin's prospects, with some analysts believing that Bitcoin could ultimately achieve the goal of breaking $200,000; MarketWatch's analysis emphasizes that due to institutional ETFs continuously attracting large amounts of capital, Bitcoin may continue to rise in the coming months.

3. Market Sentiment and Volatility Expectations

Experts generally believe that as a highly volatile asset, Bitcoin's price fluctuations will be accompanied by significant short-term volatility. However, in the long term, limited supply and increasing institutional participation will provide fundamental support for price increases. As representatives from institutions like Kraken and MicroStrategy have stated, Bitcoin's scarcity, fixed total supply, and ongoing technical optimizations (such as the Lightning Network and other scaling solutions) will drive its long-term value steadily upward.

3. Fundamental Drivers: Policy, Macroeconomics, and Institutional Participation

1. Policy Regulation and Strategic Reserves

In the United States, the policy direction of the new government has a significant impact on the crypto market. Some analyses suggest that if the Trump administration fulfills its pro-cryptocurrency policies and even establishes a strategic Bitcoin reserve, it will inject a large amount of long-term capital into the market, further enhancing Bitcoin's market position. Currently, the successful launch of spot Bitcoin ETFs also provides institutional investors with convenient entry channels, a trend that is expected to continue driving Bitcoin's price upward.

2. Macroeconomic Factors and Interest Rate Environment

Global economic uncertainty, inflationary pressures, and central bank monetary policy adjustments have profound effects on Bitcoin's attribute as "digital gold." As the Federal Reserve and other institutions may lower interest rates in the future to address economic weakness, coupled with easing inflation levels and rising risk appetite, investor demand for safe-haven assets will shift towards digital assets, including Bitcoin. Multiple international financial institutions predict that as interest rates decline, Bitcoin's appeal as an inflation hedge will further increase.

3. Institutional Capital and ETF Effects

The continuous influx of institutional capital is seen as a key driver of Bitcoin's long-term rise. Reports from institutions like Standard Chartered and VanEck mention that as Bitcoin ETFs continue to mature, the allocation ratio of institutional investors to digital assets will keep increasing, which will not only improve market liquidity but also further solidify Bitcoin's position in the global financial market. Meanwhile, the ongoing accumulation by large companies like MicroStrategy also indicates market confidence in Bitcoin's future trajectory.

4. Future Outlook and Risk Warnings

1. Dual Scenarios of Optimism and Pessimism

Overall, most experts and institutions predict that Bitcoin's price will fluctuate between $150,000 and $200,000 in 2025. However, due to the market's inherent uncertainties, there is a possibility of larger increases or significant corrections in extreme cases. In an optimistic scenario, if institutional funds continue to pour in and regulatory policies become more lenient, Bitcoin could potentially break $250,000; while the pessimistic scenario warns investors that short-term market adjustments and policy uncertainties may cause prices to retreat below $100,000.

2. Market Volatility and Investment Risks

The Bitcoin market has historically been highly volatile, with rapid price fluctuations possible in the short term. Investors need to closely monitor global macroeconomic dynamics, changes in regulatory policies across countries, and trends in technical indicators. Strict position management, reasonable stop-loss settings, and timely judgment of market sentiment are key to surviving in a highly volatile market. Additionally, although both technical and fundamental aspects indicate a long-term upward trend, historical experience shows that each significant rebound may be accompanied by a certain degree of adjustment, and risk warnings should not be ignored.

3. Long-term Investment Strategy Recommendations

For investors optimistic about Bitcoin's long-term development prospects, it is recommended to build positions gradually, allocate positions moderately, and pay attention to key technical indicators and policy news. Utilizing strategies like range trading and grid trading can capture profit opportunities from short-term fluctuations during consolidation; at the same time, combining long-term holding strategies will help mitigate risks during market adjustments. Especially after the halving effect in 2024 is released, waiting for the market to validate signals of a new bull market before gradually increasing positions will be a wise choice for stable investment.

Conclusion

Considering the technical, fundamental, and institutional and policy-driven factors, the Bitcoin market is at a critical turning point in 2025. Historical patterns indicate that technical analysis tools such as the halving effect, price multiples, and cycle comparisons all show that Bitcoin has significant upward potential; while regulatory easing, institutional capital inflow, and changes in the global economic environment provide solid support for long-term increases. Although market volatility remains high and adjustments may occur in the short term, in the medium to long term, Bitcoin's status as digital gold and its fixed supply advantage will drive its value steadily upward.

In summary, authoritative media, top institutions, and numerous market experts generally believe that Bitcoin's price in 2025 is expected to hover between $150,000 and $200,000, and even break higher targets under specific conditions. In light of this outlook, investors should remain cautious and flexible to seize the future golden era amid turbulence.

Disclaimer: The above content does not constitute investment advice.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。