From stablecoins to intent execution layers, innovation is entering the fast lane.

Written by: Delphi Digital

Compiled by: Yuliya, PANews

As the market refocuses on practical value, decentralized finance (DeFi) is regaining momentum. From stablecoins to intent execution layers, innovation is entering the fast lane. Here are 10 key insights into the future development of DeFi.

1. Consumer-grade DeFi applications are on the way

Crypto payment cards are evolving from simple withdrawal channels to self-custody smart contract wallets that can interact directly with DeFi protocols. New crypto payment cards like Gnosis Pay, Argent, and Fuse support programmable spending, automatic recharges, and integration with lending protocols, bringing the vision of a bankless future closer than ever.

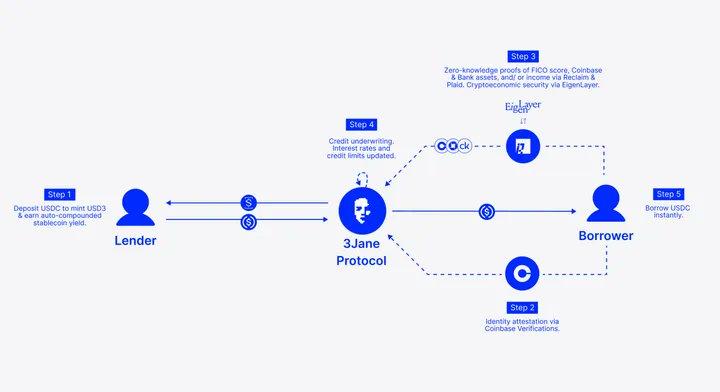

2. zkTLS opens new frontiers for DeFi

Zero-knowledge TLS (zkTLS) technology allows users to prove sensitive data on-chain without exposing private information. Projects like 3Jane (credit lending), Camp Network (custom user experience), and Showdown (Web2 gaming) are leveraging zkTLS technology to expand DeFi into new markets. This could drive on-chain credit scoring and low-collateral lending into the mainstream.

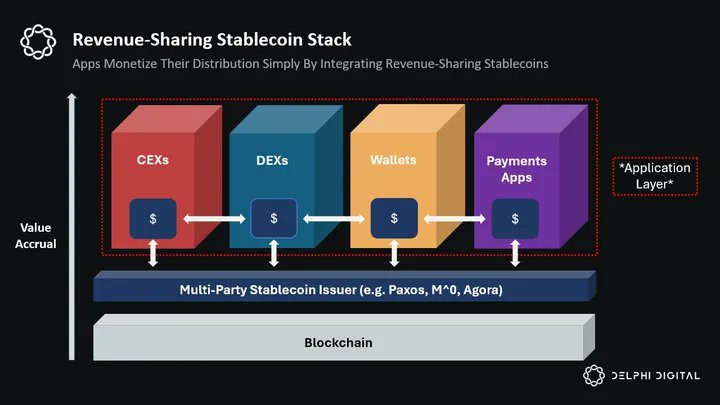

3. Revenue-sharing stablecoins reshape the market landscape

Stablecoin issuers generate massive income through reserve interest, but DeFi projects are disrupting this model. New stablecoins and applications like M^0, Agora, and Paxos USDG share revenue, incentivizing wallets and DeFi platforms to integrate. This model could drive the decentralization of stablecoin issuance and reshape the competitive landscape by rewarding distribution partners rather than relying solely on network effects.

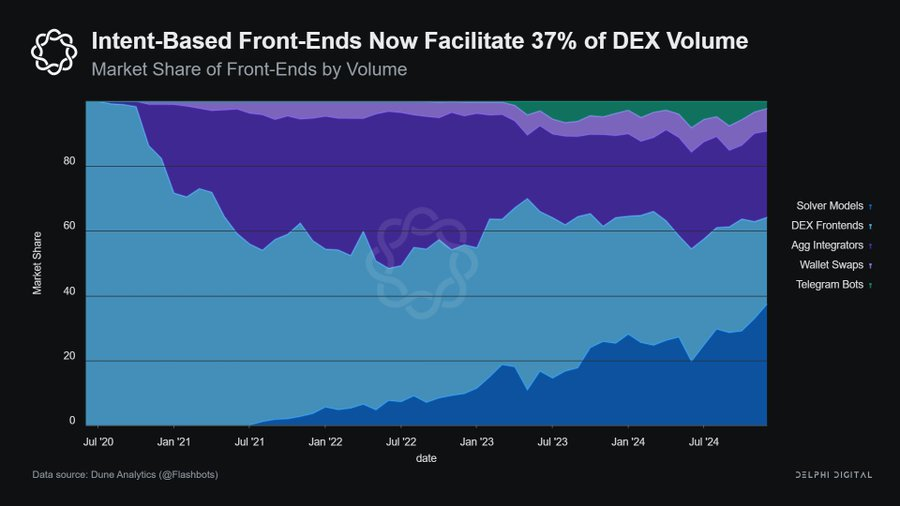

4. DeFi value shifts from protocol layers to front-end

The value of DeFi protocols is shifting towards entities that control exclusive order flows, particularly wallets and intent-driven front-ends. Platforms like Jupiter and Phantom are positioning themselves to monetize order flows, aiming to reshape the value distribution in DeFi. As the MEV supply chain matures, the competitive focus will shift from DEXs to front-ends, with distribution capabilities becoming key to value capture.

5. 2025 will be the year of DEX growth and aggregator-driven trading

With rising DEX trading volumes and aggregators redefining execution methods, on-chain trading is undergoing a significant transformation.

Angstrom is dedicated to solving MEV and LVR issues;

Bunni v2 enhances passive liquidity strategies;

Whetstone Research innovates token issuance mechanisms through Doppler.

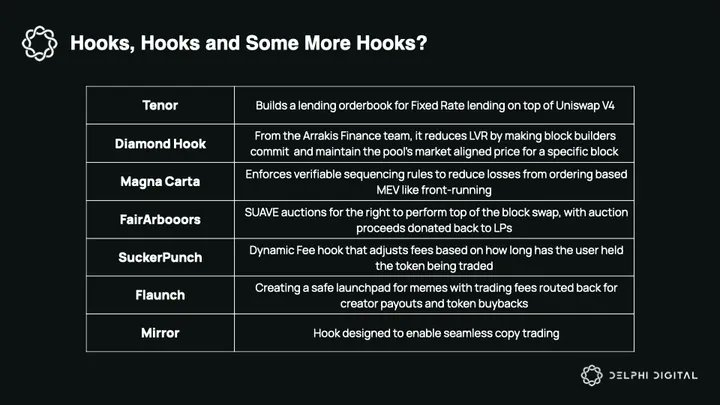

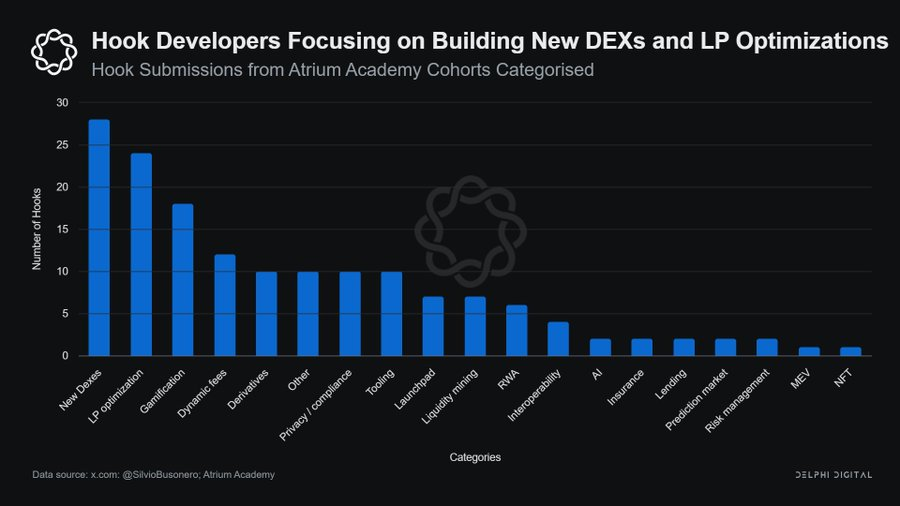

6. Uniswap's strategic layout

Uniswap is transforming from a single DEX into a liquidity infrastructure for DeFi:

Uniswap Labs v4's Hooks feature supports AMM customization, automatic LP management, and advanced order types;

Unichain, a blockchain specifically for DeFi, features high speed and MEV resistance;

UniswapX is expected to become a major intent execution layer in the DeFi space.

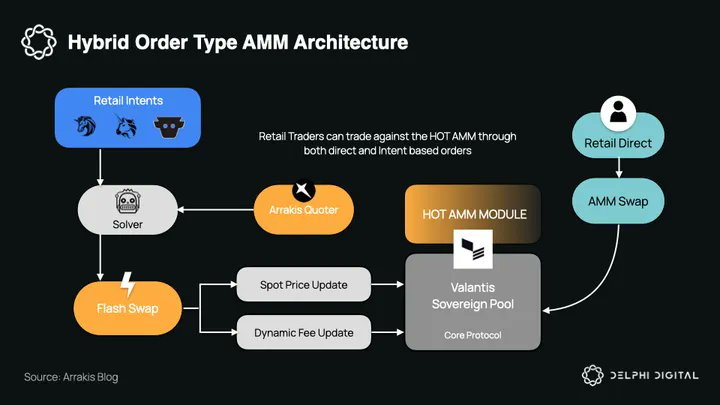

7. The paradigm shift in DeFi trading

DeFi trading is evolving towards modular, intent-driven, and high-speed execution. A new generation of DEX architectures is emerging to optimize liquidity, execution quality, and MEV protection:

Valantis Labs offers a modular DEX framework that supports flexible exchange development;

Arrakis Finance integrates off-chain order flows through RFQ, protecting LPs from MEV impacts;

Fluid utilizes "smart collateral" for leveraged market making and automated fee optimization;

Order book DEXs: High-performance public chains like Monad, Sui, and Aptos are achieving efficient order book trading.

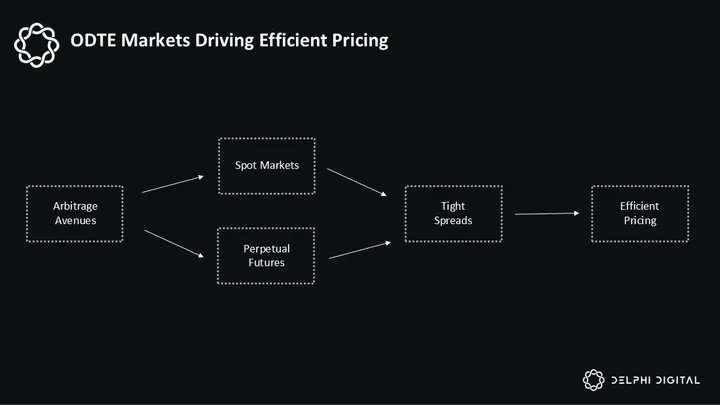

8. The evolution of prediction markets

Prediction markets are no longer just speculative ventures, such as:

Limitless Exchange's on-chain 0DTE derivatives provide efficient pricing and leverage;

Truemarkets ensures fair outcomes through its Truth Oracle+AI-driven verification and decentralized governance.

As these models develop, prediction markets may become a core component of on-chain finance.

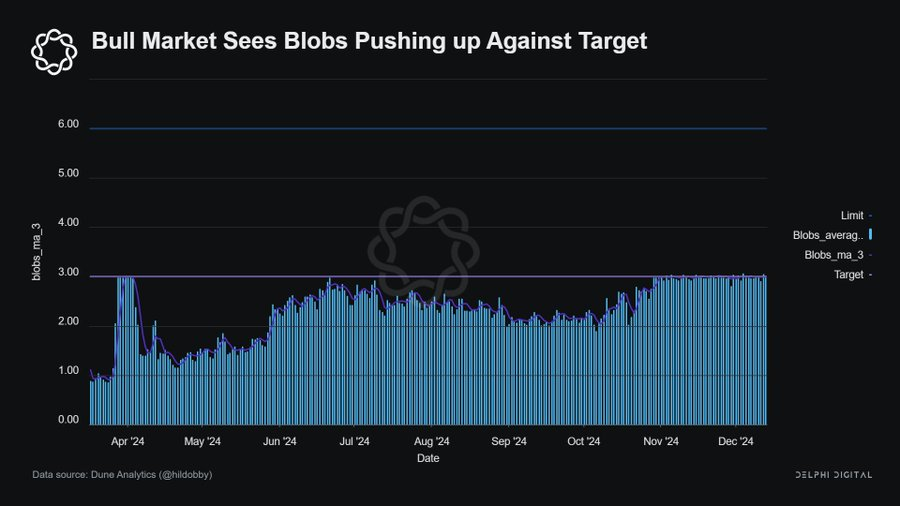

9. The development of Starknet

Although Starknet still faces challenges, low-cost transactions, staking mechanisms, and an expanding ecosystem lay the foundation for its growth.

Key catalysts:

Bitcoin rollups may position Starknet as a leader in BTC Layer 2;

Lower blob costs provide a relative scaling advantage over other L2s;

On-chain gaming is becoming a new driver of adoption.

10. Challenges and innovations

Despite rapid developments in the DeFi space, several key challenges remain.

High entry barriers: Limited support from centralized exchanges forces users to cross-chain through Ethereum or rely on intermediary services;

Insufficient token incentives: Many top protocols lack token or points programs, leading to low user participation.

However, these challenges indicate that DeFi still has significant room for innovation and development potential in the following areas:

Low-collateral lending products

Lending aggregators

Interest rate derivatives

On-chain securitization protocols

Advanced prediction markets

Looking ahead, the next wave of DeFi will focus on enhancing efficiency, risk management, and the development of more advanced financial tools.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。