Preface: Investment carries risks, and operations should be cautious.

Article review takes time, and there may be delays in publication. The article is for reference only, welcome to read!

Article writing time: February 18, 12:09 Beijing time

Market Information

- Bernstein: Investors should prepare for further increases in Bitcoin;

- Bernstein: The Bitcoin bull market will continue as institutional investors enter the market;

- Federal Reserve's Harker: There are currently no plans to launch a Federal Reserve digital dollar;

- The audit of U.S. gold reserves has sparked controversy, with the crypto community supporting Bitcoin as a store of value;

- Bitwise Chief Investment Officer: This year will mark a watershed moment for Bitcoin adoption, with more companies and countries expected to increase their holdings;

Market Review

Yesterday, we suggested a trading strategy based on market fluctuations. As of now, Bitcoin has shown a continuous short-term decline, with the lowest point at 95150, which provided us with an entry point. Those who have positioned themselves currently have a profit of 700 points and can continue to hold; Ethereum's movement is different from Bitcoin's. Ethereum initially experienced a slight rebound, but it did not break through, with the highest point at 2848. Our strategy for Ethereum yesterday was to go long at the lower levels and short on the rebound, with the upper point around 2860, which has basically reached the shorting point. Those who have positioned themselves currently have a profit of around 100 points. Although the target for the day was 2560, with Bitcoin reaching support, Ethereum shorts can take profits and exit for now, while paying attention to Bitcoin's rebound strength. Overall, the market is still in a fluctuating range, and trading is yielding small profits. In a fluctuating market, do not be greedy; wait for a breakout to reassess. The market is to be observed as it moves;

Market Analysis

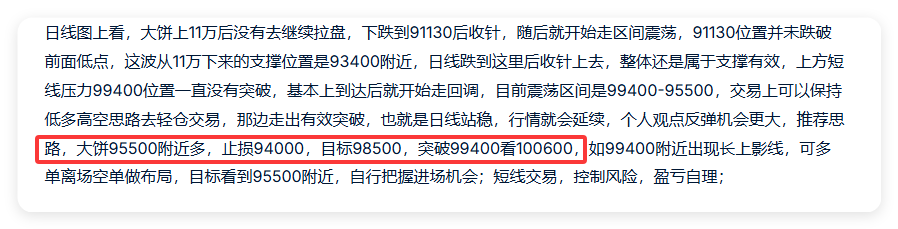

BTC:

Looking at the 4-hour chart, Bitcoin has shown a slow and continuous decline after fluctuating in the upper market range. After reaching the support level we mentioned yesterday, it began to close positively. In a fluctuating market, trade based on the fluctuations. If there is a breakout, make new arrangements based on the breakout situation. The long positions entered around 95500 yesterday currently have a profit of about 700 points. Maintain a good stop-loss and continue to hold, targeting 98000-99000. After reaching that, observe whether it can break through the high point around 99500. Seize the entry opportunities as you see fit; for short-term trading, control risks and manage your own profits and losses;

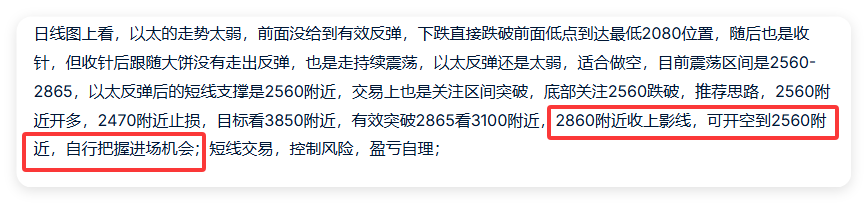

ETH:

Looking at the 4-hour chart, Ethereum's movement last night was somewhat different from Bitcoin's. Ethereum experienced a slight rise, but it did not break the high point of the fluctuating range, reaching our short position entry point around 2860. Those who opened short positions can consider exiting. As Bitcoin starts to rebound from support, even if Ethereum is weak, it will follow. After exiting, do not rush to position in Ethereum longs; holding long positions in Bitcoin is sufficient. Ethereum should act according to the situation, paying attention to Bitcoin's upper level of 99500 and Ethereum's breakout situation at 2860. Seize the entry opportunities as you see fit; for short-term trading, control risks and manage your own profits and losses;

In summary:

Both Bitcoin and Ethereum are still showing fluctuating trends, and trading should continue to maintain low longs and high shorts;

The article is time-sensitive, be aware of risks, the above is only personal advice, for reference only!

Follow the WeChat public account Crypto Lao Zhao to discuss the market together;

All sources of suffering stem from the pursuit of certainty. Impermanence is the norm and the way life should be. Always wanting to grasp the market, if you have a 50% certainty, don’t act; if you have 70% certainty, don’t act; you must wait for 100% certainty. Where in the market is there 100% certainty? Trading is about trading risks, trying to make the odds stand on your side. Those who give love will receive love in return; blessings come to those who give. Sometimes, learn to take a little loss, be a bit foolish, a bit clumsy. For example, if the market is bullish, once that is confirmed, don’t be too rigid with your position, lower your leverage a bit, and then get in first. At worst, it will reverse.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。