Based on the analysis and argumentation of 100 projects.

Author: 0xLaoDong

Core Rules for User Selection by Project Teams

When designing airdrop strategies, project teams rarely rely on a single standard for selection; instead, they evaluate user quality from multiple dimensions to ensure that airdrops are distributed to truly valuable addresses. From the perspective of project teams, they prefer high TVL, high net worth users, and genuinely active users who can participate in ecological construction over the long term. Based on these principles and combined with the strategies of historical airdrop projects, Lao Dong summarizes several core selection dimensions.

1️⃣Interaction-Based Selection Criteria

Transaction Frequency, Volume, and Activity: Reflects the user's level of activity on-chain; frequent trading and deep interactions indicate a certain investment in the ecosystem, but excessively high data may also indicate wash trading behavior. For example, Starknet W has made mistakes in long positions;

Gas Consumption: The total amount of transaction fees paid by users can indirectly reflect their actual participation and contribution. For instance, Zkfair distributes airdrops based on gas consumption, and the current morph distributes points through gas;

Contract Interaction & Creation: Can be used to measure whether users participate in multiple ecological projects, helping to distinguish between genuine users and mere wash traders. For example, arb and zksync both have weighted contract interaction counts;

2️⃣NFT & Asset-Based Selection Criteria

Whitelist, Public Sale, Task Acquisition: Generally, such NFTs are limited in quantity, which can control deflation and serve as a certificate for airdrops, also representing a higher level of user participation in the project. For example, XAI distributes airdrops based on NFTs;

OAT Badges and SBT: As on-chain achievements or non-transferable identity certificates, they can effectively prove the user's long-term contributions and genuine participation. For example, odos's pilot OAT and linea's LXP;

Token Holding Airdrops, NFT Staking: Holding tokens or staking NFTs not only shows the user's trust in the project's assets but may also bring additional incentives, while also helping to assess the user's asset quality and risk control. For example, MOCA and PENGU's NFT airdrop tokens;

3️⃣Point Tasks and Task Platforms

Point Accumulation and Ranking: Completing tasks on platforms like Galxe, Zealy, or the official platform to earn points; the higher the points, the higher the participation level; at the same time, point rankings can serve as an important basis for airdrop distribution. For example, IO's Galaxy point tasks, SCA's point airdrops, and many LSD project point airdrops;

Cross-Ecological Tasks: Requiring users to complete tasks across multiple platforms or ecosystems to more comprehensively assess the user's overall activity and ecological contribution. For example, many Odyssey tasks, move, and linea require completing various ecological tasks to earn rewards;

4️⃣Community and Social Contributions

Twitter/Discord/Telegram Activity: Users complete social tasks in the community, such as tweeting and retweeting, or speaking and participating in discussions on DC and TG, thereby obtaining corresponding identity markers. This type of task is relatively complex and has high airdrop value. For example, the current kaito earns points through Twitter interactions, and the move gorilla role is worth thousands of U. Dogs distribute airdrops based on TG account age and activity;

Early Members (OG Roles) and Invitation Contributions: Users who joined early or were acquired through invitations are more likely to receive airdrops to incentivize long-term participation, such as the thousands of token airdrops for IP's OG roles;

Content Creation and Social Media Interaction: Promotion and discussion on platforms like Twitter, Medium, and YouTube help spread the project while also reflecting the user's sense of recognition for the project. For example, the creator role in move;

5️⃣Node Building and Technical Contributions

- Full Nodes, Mining, Validators: Technical participation such as running nodes, participating in mining, or serving as validators directly supports network security and performance, which is highly valued by project teams. For example, IO's workers use GPUs to mine points, nillion nodes run on CPUs, and grass earns points through IP and traffic;

6⃣GameFi and Entertainment Interaction

- Gold Farming, P2E: Earning tokens through in-game tasks in GameFi projects reflects user participation and indicates the user's reliance on the project's entertainment ecosystem. For example, CATI earns tokens by raising cats. Large games like bigtime allow players to earn tokens through in-game gold farming.

⚔️Attack and Defense: Witch Detection Dissection and Countermeasures

🚨Project Teams' Witch Identification Strategies

In the previous article on data analysis, the proportion of projects explicitly checking for witches among 100 projects in 2024 reached 32%.

In airdrop activities, the core essence of project teams checking for witches is also a selection method to filter out high-quality, genuine, and highly contributive addresses, avoiding airdrops being occupied by large-scale, low-quality addresses. This is not solely aimed at studios; even individual users may be treated as witch addresses due to reasons such as inability to maintain interactions. Just as project teams continuously optimize selection rules, some studios can still achieve good results.

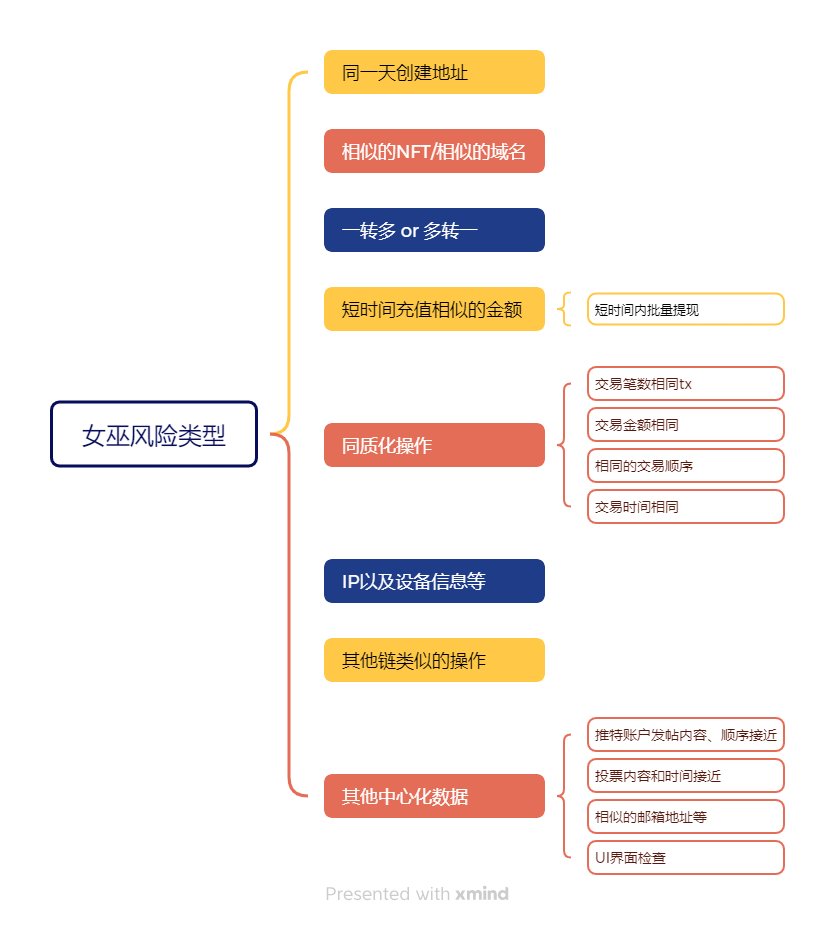

Therefore, understanding the methods project teams use to check for witches and adopting corresponding defensive strategies is key to ensuring good results. Here, Lao Dong lists some obvious types of witch risk:

📕 Witch Defense Tactics Manual

1️⃣ Address Creation & Abnormal Fund Flow

Project teams will prioritize checking the creation time, recharge paths, and fund aggregation of addresses. Such address aggregation behavior is one of the easiest ways to be flagged as a witch, with main tactics including:

Creating multiple addresses on the same day: If a large number of new addresses are created and recharged on the same day, they are likely to be marked as batch witch accounts.

One-to-many or many-to-one transfers: Transferring funds from the same address to multiple small accounts, or aggregating funds from multiple addresses into the same wallet, is viewed as abnormal fund distribution.

Similar amounts recharged in a short time: If multiple addresses recharge similar or close amounts at similar times, they may be judged as operated by the same controller.

Batch withdrawals in a short time: If funds from multiple addresses are simultaneously withdrawn to the same wallet, it is considered high-risk behavior.

💡 Prevention Strategies:

When creating new addresses, create a small number of accounts each day and randomly select recharge times to avoid concentrated operations.

Use CEX (Binance, OKX, etc.) sub-accounts as transfer stations to avoid direct on-chain aggregation.

Randomize the amounts and times of fund recharges to avoid fixed amounts and fixed times for batch operations.

When withdrawing, space out the time intervals and try to use different CEX sub-addresses for withdrawals.

2️⃣ Abnormal On-Chain Interaction Behavior

Project teams will analyze the interaction patterns of addresses, collectively referred to as homogenized interactions, focusing on the following behaviors:

Similar NFTs or domain names: If multiple addresses receive the same NFT or domain name, they are easily recognized as batch operations.

Similar transaction frequencies: If multiple addresses have similar interaction counts and interaction contracts, they are likely to be judged as bot operations.

Identical transaction sequences & amounts: If the interaction order, amounts, and transaction targets of addresses are the same, they are likely to be identified as batch accounts.

Fixed-time interactions: If multiple addresses' interaction times are concentrated within a certain period (e.g., completing tasks within 24 hours), the risk is high.

💡 Prevention Strategies:

Use different accounts to complete different tasks, spacing out interaction times to avoid simultaneous identical operations.

Insert "smoke bomb projects" during interactions, such as participating in some DEX interactions, lending, and other low-cost dapps to make on-chain behavior appear more natural.

Randomly interact with different contracts; do not have all accounts interact with the same DEX, bridge, or contract. Select a portion of addresses to interact with a portion of contracts.

Space out interaction times throughout the day, using random times for interactions instead of fixed times for batch synchronous operations.

3️⃣ IP and Off-Chain Data Analysis

In addition to on-chain data, project teams will also analyze IP addresses, UI interface interactions, browser fingerprints, and social media data to screen for witches through off-chain data:

Same IP / Same Device: If multiple accounts use the same IP or the same browser fingerprint, the risk of being detected as operated by the same person is extremely high;

Similar social media behavior: If multiple Twitter accounts have similar posting content, liking sequences, and interaction patterns, they are likely to be excluded by project teams. Cases of DC inactivity leading to being kicked from channels;

Email associations: If multiple accounts use similar email naming conventions, it may trigger risk control;

UI interface checks: Directly interacting through contract interactions without using the project's UI interface may trigger risk control for some projects, such as Electric Sheep;

💡 Prevention Strategies:

Use proxy IPs and fingerprint browsers to change device information;

When nurturing accounts, pay attention to the randomness of social interactions to avoid homogenized content;

Register with different emails to avoid overly similar email naming;

Try to use front-end interaction scripts to avoid being detected through the UI interface;

🎯Gradient Strategy: Reasonable Account Allocation to Reduce Detection Risks

To improve airdrop success rates, it is recommended to adopt a gradient strategy, categorizing different types of accounts to avoid all accounts using the same model and being collectively banned.

Currently, project teams are increasingly favoring premium accounts, with the lowest and highest addresses on ZK differing by 100 times in rewards, STRK differing by 20 times, and ARB differing by 16.32 times.

From the perspective of ZK, creating 100 premium accounts is equivalent to the earnings of 10,000 low-quality accounts, which can reduce effort in operations while also lowering the risk of being flagged as witches.

However, low-quality accounts and lottery accounts are also necessary. For example, Tensor and Magic Eden are victories for low-quality accounts, while HMSTR is a victory for lottery accounts, shining brightly. Different strategies lead to completely different outcomes.

✅ Premium Accounts (no cost considerations, focus on nurturing accounts) - Achieve at least the top 1% in various dimensions

High-quality interactions, participation in multiple ecosystems, binding social accounts, and providing human proof, such as Gitcoin;

Personal use wallets, small but premium, increasing contributions to the on-chain ecosystem;

Simulating real user behavior, long-term operations, avoiding one-time airdrop grabs;

✅ Low-Quality Accounts (minimum airdrop threshold, moderate operations) - Achieve at least the top 20% in various dimensions

Only participate in core airdrop tasks, avoiding obvious witch operations;

Moderate trading, avoiding overly frequent or regular interactions;

✅ Lottery Accounts (batch accounts, low-cost trial and error)

Only perform simple, cost-effective tasks, strictly controlling costs;

May adopt more aggressive and bold strategies, but will not affect main accounts;

🧠Conclusion

In the current environment of rapid development of AI + on-chain analysis technology, witch detection methods are becoming increasingly precise, and simple batch operations are becoming less effective.

Therefore, for studios, witch operations need to have higher randomness and realism, while flexibly adjusting strategies, combining gradient accounts, decentralized interactions, and optimizing fund paths to reduce the probability of being banned.

For individuals, if there is no operational capability of a studio team, it is recommended to focus on a small number of premium accounts, refining operations by participating in multiple ecosystems, increasing social activity, and building a real identity chain to enhance airdrop returns. Only by knowing oneself and the enemy, mastering core selection logic, and flexibly adjusting operational methods can one remain undefeated in airdrop activities!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。