⚡️Recently, the wind has blown to BSC. In addition to MEME, the subsequent DeFi and other ecological fields will inevitably follow suit! I just discovered that @lista_dao's slisBNB has opened a pool on Pendle. In this market, finding ways to maximize your $BNB earnings is definitely a choice that won't go wrong.

slisBNB is currently the DeFi BNB recognized by Binance to participate in Binance Launchpool + megadrop + Hodler airdrop.

After some research, there are a few ways to play this—

1⃣ PT (suitable for lazy people + low-risk preference)

Buy PT with the slisBNB earned from staking in Lista. Currently, about 0.95 slisBNB = 1 PT clisBNB. After the expiration at the end of April, you can exchange it back for slisBNB worth 1 BNB at a 1:1 ratio.

This means you give up BNB mining + staking earnings and buy a fixed-term investment at a discount, which can yield a fixed interest of 17% upon maturity, with capital protection and no risk.

2⃣ YT (suitable for those who are bullish on long-term BNB earnings + familiar with market fluctuations and have a high-risk preference)

YT represents all the earnings of slisBNB during this period (Launchpool + megadrop + Hodler airdrop + BNB staking earnings).

When you buy YT, you are betting that the future earnings from BNB will be higher than now. As long as the earnings from 1 BNB > your purchase cost, you are making a profit.

Therefore, it is suitable to buy YT when the Implied APY is relatively low, and then sell at the right time. If leveraged well, it can amplify annualized returns by several times.

3⃣ LP (suitable for those who want to both earn and hold, with a medium-risk preference)

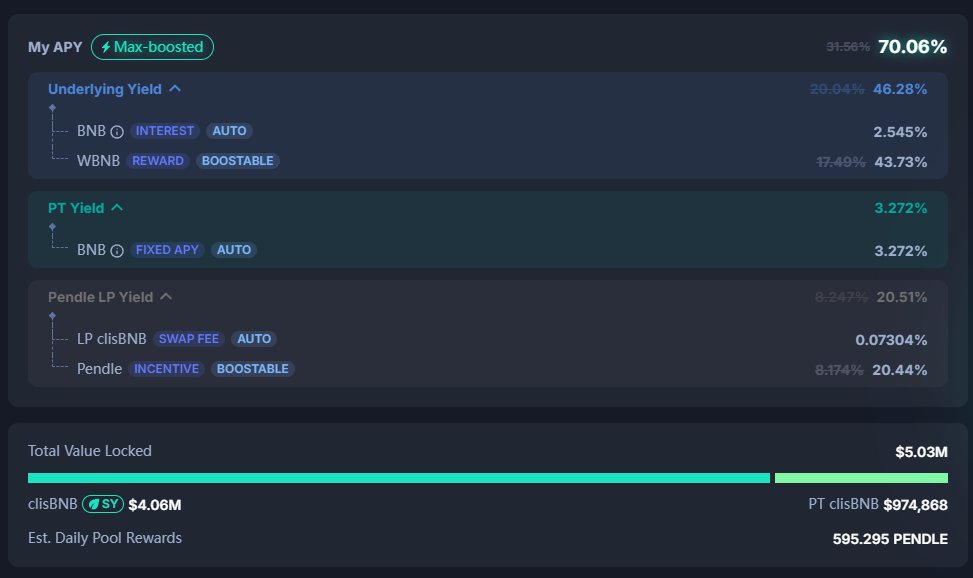

LP = a certain proportion of PT + slisBNB, which is relatively balanced. You earn PT earnings + all slisBNB earnings (BNB staking earnings + Launchpool + megadrop + Hodler airdrop) + transaction fee sharing + $pendle rewards.

The annualized return of the LP pool is variable, fluctuating with TVL, currently at an APY of 70%.

Summary—

The slisBNB pool on Pendle essentially amplifies the yield of BNB, requiring no KYC and no numerous restrictions. Your slisBNB can participate in on-chain earnings, making it quite flexible.

I think BSC is quite hot right now, and it can be considered for allocation. Each of the three methods has its advantages, so everyone can consider the yield strategy that suits them best!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。