Author: ChandlerZ, Foresight News

At the beginning of 2025, global capital markets are experiencing a stark contrast. Recently, the price of spot gold has repeatedly hit new highs. As of February 16, COMEX gold futures prices surged to $2968 per ounce, with a maximum increase of nearly 10% within the year, just a step away from the $3000 mark.

Meanwhile, after Bitcoin broke the $100,000 high, it has been oscillating in the $90,000 to $110,000 range, showing weakness that contradicts its new identity as a safe-haven asset. This volatility not only exposes the differences in pricing logic between the two types of assets but also points to a re-evaluation of risk metrics by global capital in the "Trump 2.0 era."

Bitcoin VS Gold: From Safe-Haven Narrative to Functional Differentiation

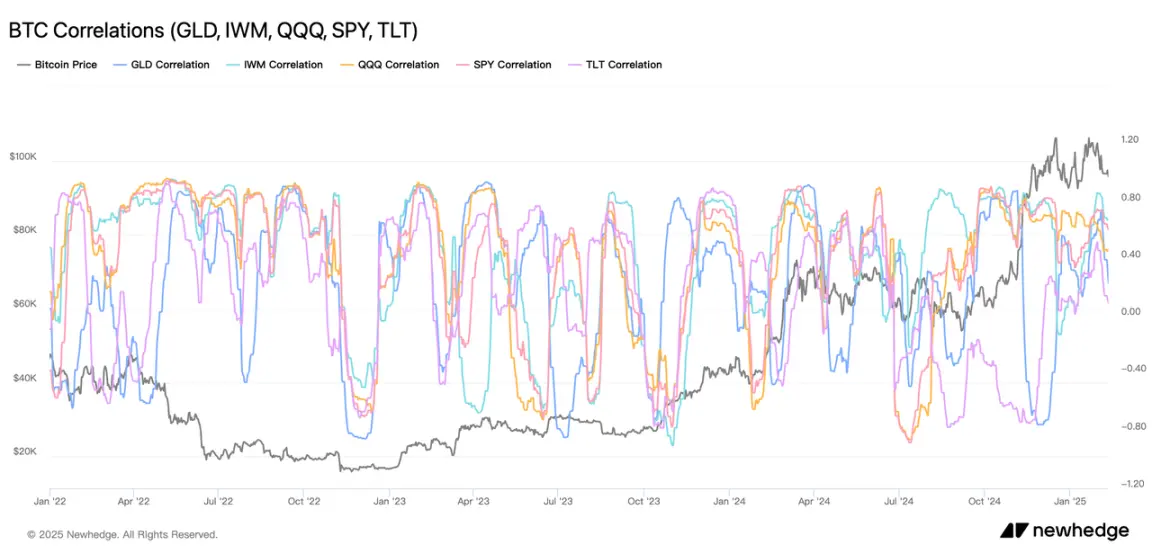

The evolution of Bitcoin's correlation with U.S. stocks and gold is essentially a process of shifting identity recognition in its financialization journey. Measured by the correlation coefficient between Bitcoin and traditional assets, its correlation exhibits significant dynamic changes.

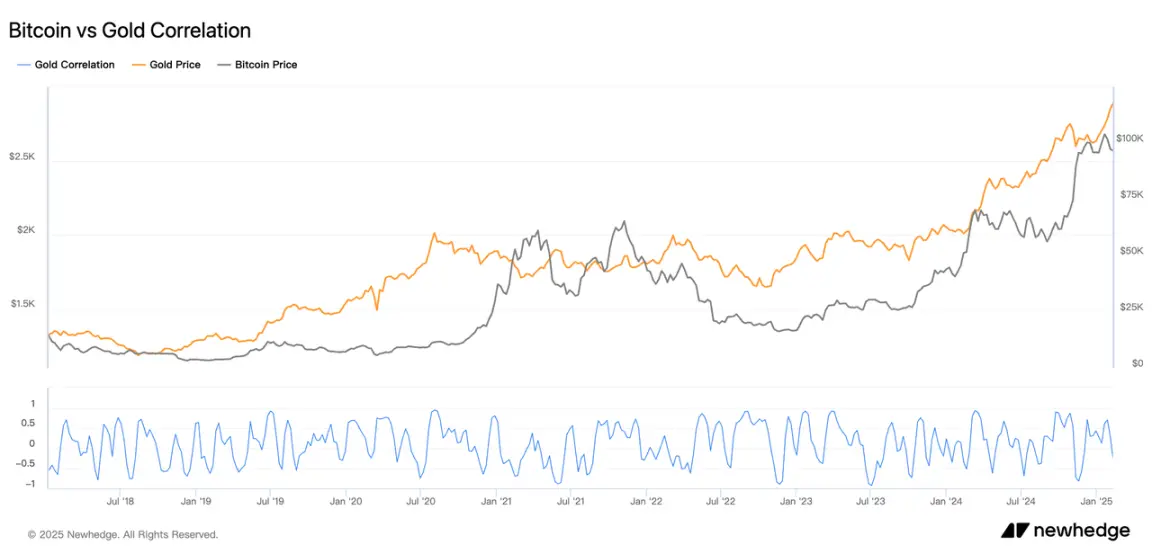

Gold, as a traditional safe-haven asset, has a relatively complex relationship with Bitcoin. From a long-term data perspective, the correlation between Bitcoin and gold shows significant instability, frequently fluctuating between positive and negative ranges. In the early days, the correlation coefficient between the two was often negative, with Bitcoin seen as gold's "digital substitute." However, during the market turmoil after 2022, both assets have shown synchronized movements multiple times. By late 2024, the correlation trended towards positive, but volatility remained evident.

This contradiction stems from the differences in their attributes: gold's safe-haven function relies on its physical properties and historical consensus, while Bitcoin's digital gold narrative depends more on market sentiment and technological expectations. When Bitcoin reached its historical high in 2021, gold prices were at a temporary low. Starting in 2024, both assets began to rise simultaneously due to factors such as central bank gold purchases and the approval of Bitcoin ETFs. It is evident that their correlation is driven by episodic events rather than an inherent value logic.

U.S. Stock Correlation: A Double Helix Structure Under Liquidity Siphoning

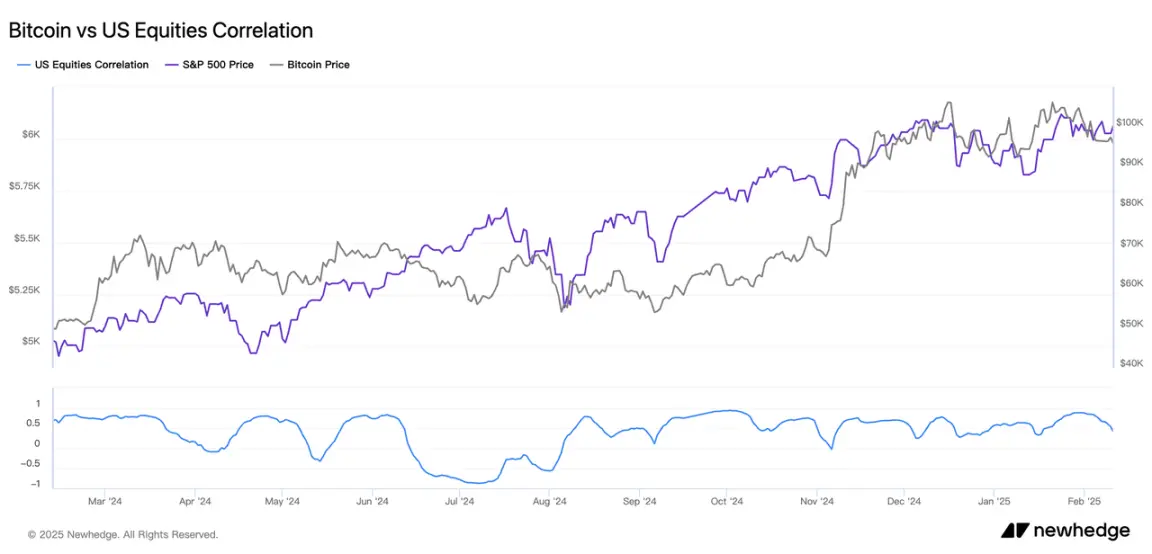

In terms of U.S. stocks, Bitcoin is often classified as a "risk asset," with its price movements showing a significant positive correlation with the tech-heavy Nasdaq index. This correlation peaked in 2021, with both hitting historical highs before retracing, and then synchronously rebounding at the end of 2022, demonstrating a consistency in market behavior driven by risk appetite.

The correlation between Bitcoin and the S&P 500 index shows a milder positive correlation, with the correlation coefficient mostly maintained between 0 and 0.5. Bitcoin's price increase is significantly greater than that of the S&P 500, with price co-movement being clearer in high-point areas. This relationship became particularly evident in late 2024, when expectations for a dovish shift from the Federal Reserve boosted risk assets broadly.

During the period when the Federal Reserve signaled interest rate cuts, this correlation even exceeded the negative correlation strength traditionally seen between tech stocks and bonds. The strength of their association has surpassed the group effect among traditional tech stocks, suggesting that cryptocurrencies are systematically embedding themselves into the growth stock valuation framework. However, it is worth noting that this positive correlation exhibits significant asymmetry: during market downturns, the correlation coefficient of declines between Bitcoin and U.S. stocks is not high, revealing the characteristic of excess risk premium under high volatility.

This phenomenon can be explained from the perspectives of market psychology and liquidity. When global economic expectations improve, investors' risk appetite increases, leading to capital flowing into both U.S. stocks and Bitcoin; conversely, when market risk aversion rises, both may come under pressure. According to QUICK FactSet data, the total market value of stocks worldwide, denominated in U.S. dollars, increased by $13.6 trillion compared to the end of 2023, reaching $121.8 trillion, while Bitcoin's increase during the same period exceeded 150%, confirming the joint push of liquidity easing and risk appetite for both. However, the high valuation of U.S. stocks also implies a risk of correction; if the stock market adjusts, Bitcoin may face synchronized pressure, while gold could benefit from safe-haven demand.

Reshaping Financial Attributes

The changes in the correlation between Bitcoin, U.S. stocks, and gold reflect a structural transformation in the participants of the cryptocurrency market. In the early days, Bitcoin was primarily held by retail investors and geek communities, with its price independent of the traditional financial system. However, after 2020, the involvement of institutional investors accelerated its financialization process, making it more susceptible to sentiment contagion from U.S. stocks. The growth of open interest in Bitcoin futures on the Chicago Mercantile Exchange (CME) further reinforced this pathway. Additionally, institutional variables such as the U.S. SEC's approval of Bitcoin spot ETFs and differences in regulatory policies across countries have long-term impacts on Bitcoin's asset attribute positioning.

The high-level fluctuations of Bitcoin after breaking the $100,000 historical high stem from the interaction of multiple market forces. On one hand, early investors are gradually cashing out profits at high levels, while new funds from institutional channels like ETFs provide strong support, leading to significant price volatility within the range due to the ebb and flow of buying and selling forces.

On the other hand, the current market is still in a period of brewing expectations for easing, with large-scale liquidity injections yet to materialize. The market is mainly rotating existing funds between different price levels, and the lack of sustained incremental capital inflow also limits the upward momentum after breaking new highs. At the same time, the use of leverage tools such as futures and perpetual contracts is more active, with high leverage amplifying price fluctuations and frequent forced liquidations further exacerbating market volatility.

Overall, however, the reflexivity of technological innovation is also nurturing new possibilities. Currently, Bitcoin is being incorporated into the asset-liability management framework of sovereign wealth funds, and appropriate allocation of crypto assets can enhance tail risk defense capabilities while maintaining stable Sharpe ratios. This functional evolution suggests that the correlation between crypto assets and traditional assets will exhibit a more complex hierarchical structure, fluctuating as risk assets during macro stability periods and releasing nonlinear associations during systemic crises, ultimately developing into an independent asset class positioning.

In the myth of Noah's Ark, clean animals enter in pairs, while unclean animals go their own way. The correlation dilemma between Bitcoin and traditional assets resembles a "financial monster" that cannot find companions in the flood of digital civilization. Perhaps this lack of correlation is its true nature, requiring neither a benchmark against millennia-old hard currencies nor an association with technology bubbles, but rather redefining value coordinates as a blockchain-native anomalous asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。