The ascension of the "understanding king" is destined to signify the prosperity of the cryptocurrency market, but beneath the surface of this prosperity, there will inevitably be undercurrents. The Sa Sister team reviewed several significant judicial rulings related to cryptocurrencies from the mainland a few days ago, and today, the Sa Sister team shifts its focus from the mainland to Hong Kong, discussing the recent judicial precedents established by the Hong Kong High Court in the field of cryptocurrency.

01. Hong Kong High Court Issues Injunctions to Cryptocurrency Wallets Using Blockchain?

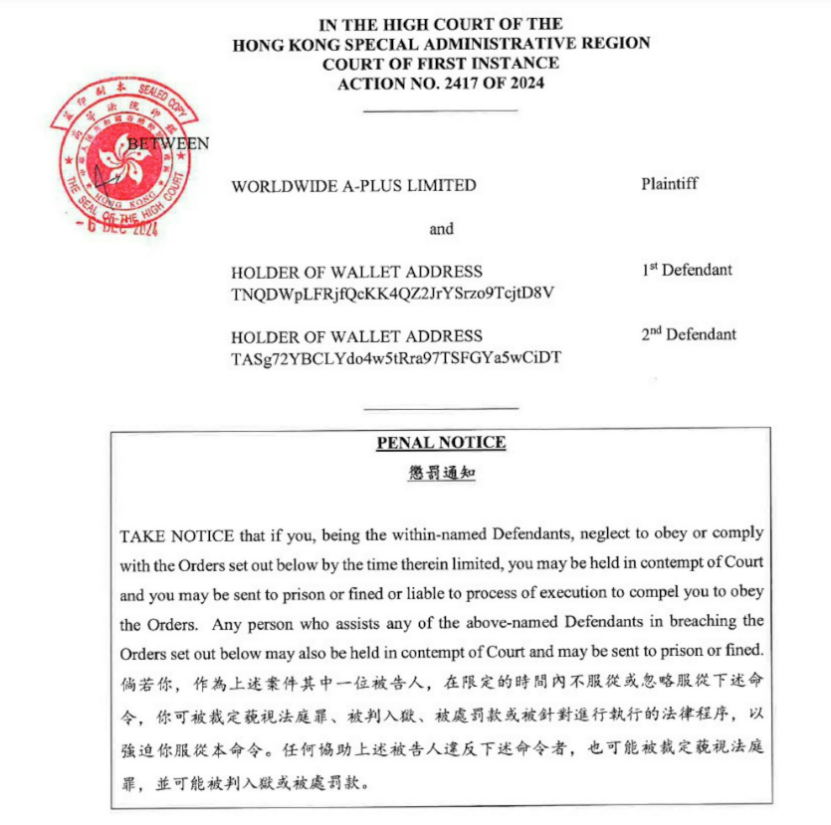

The injunction issued by the Hong Kong High Court at the end of last year is likely familiar to old friends in the cryptocurrency circle.

The case itself is not complicated. The plaintiff, Company W, is a private limited company established in Hong Kong in March 2015, primarily engaged in marketing consulting. The company was defrauded of nearly 2.6 million USDT in a telecom scam last December. After realizing they had been scammed, the company's representative immediately contacted the Hong Kong High Court through a lawyer, requesting an injunction to freeze the assets in two Tron wallet addresses that held the illicit funds.

Just a few days later, Deputy Judge Douglas Lam of the Hong Kong High Court issued the asset freeze injunction shown above and sent it to the two wallet addresses involved through a technology company named M. The entire process was seamless. Since all cryptocurrency transaction details are recorded on the blockchain, if anyone transacts with the aforementioned two cryptocurrency wallets, they will see the injunction recorded on the blockchain. This approach can be seen as a form of "inscription" technology, akin to engraving the words "illicit funds" on the involved cryptocurrency wallets.

According to Hong Kong law, violating an injunction can be deemed contempt of court, resulting in imprisonment or fines. This injunction effectively blocked the liquidity of the cryptocurrencies in the two involved wallets, preventing the plaintiff from incurring further losses.

02. Why This Matter is Significant

Due to the anonymity of blockchain technology and cryptocurrencies, the cost for law enforcement agencies to trace the real individuals behind cryptocurrency wallets is extremely high (high cost does not mean impossible; in fact, police in countries like the U.S. and China have the capability to trace the real individuals behind cryptocurrency wallets, but the cost and losses are disproportionate, so in minor criminal cases involving cryptocurrencies, relevant technologies and manpower are often not utilized due to cost considerations).

In most civil disputes involving cryptocurrencies in Hong Kong, the aggrieved party often only knows the other party's cryptocurrency wallet address and cannot ascertain their true identity, making it extremely difficult to file a lawsuit and seek legal remedies. The Hong Kong High Court's approval to issue injunctions directly to the two wallet addresses via blockchain technology directly addresses the issue of "knowing only the wallet, not the real person" in cryptocurrency disputes. The content of the injunction also indicates that the Hong Kong High Court directly listed the two wallet addresses in the "Defendant" section, effectively resolving the litigation challenges posed by the anonymity of cryptocurrencies.

03. Will Cryptocurrencies No Longer Be "Safe"?

Recently, during discussions with old friends, one expressed a sentiment: choosing to invest in cryptocurrencies is partly due to the promising investment outlook and partly because the anonymity of wallets can make assets "safer." If one finds themselves embroiled in legal disputes, at least some assets can be "preserved." Many friends share this perspective. If "safety" is understood as not reducing the risk of theft or damage, but rather allowing cryptocurrency holders to escape the entanglements of judicial authorities as much as possible, then the Sa Sister team can straightforwardly say—indeed, cryptocurrencies are no longer "safe."

This time, the Hong Kong High Court directly named cryptocurrency wallet addresses as defendants and issued injunctions through a technology company to those wallet addresses, creating a precedent worldwide—regardless of whether exchanges or stablecoin issuers cooperate, judicial authorities can still issue judicial orders directly to wallet addresses, broadcasting to all addresses intending to transact with the involved wallets—if you dare to trade, it is illegal and will face corresponding penalties.

From now on, Hong Kong's judicial authorities can issue injunctions not only to identifiable individuals or companies in cryptocurrency disputes but also to anonymous wallets. It must be acknowledged that Hong Kong has taken the lead in the technology of issuing tokenized legal notices, and it is believed that in the future, foreigners involved in cryptocurrency disputes can also issue similar injunctions through Hong Kong's technology companies and law enforcement agencies to recover losses. The space for escaping judicial control and sanctions by utilizing the anonymity of cryptocurrencies is becoming increasingly limited.

04. In Conclusion

Finally, the Sa Sister team will take everyone through a review of the significant judicial developments in Hong Kong's cryptocurrency sector over the years, appreciating the steps taken by Hong Kong's judicial authorities to help establish the city as a cryptocurrency hub.

The first step: Recognizing cryptocurrencies as "property." The most important milestone in the protection of cryptocurrencies by Hong Kong's judicial authorities can be said to be the Gatecoin case in early 2023. In this case, the Hong Kong original court first ruled that cryptocurrencies are considered "property" under Hong Kong law, thus subject to the relevant laws protecting private property. The Gatecoin case provided legal certainty and indicated that the judicial stance of Hong Kong courts aligns with that of other major common law jurisdictions (including the UK, British Virgin Islands, Singapore, Australia, New Zealand, Canada, and the U.S.) in viewing cryptocurrencies as "property." This is one of the most significant achievements of Hong Kong's judicial authorities in the cryptocurrency field in recent years.

The second step: The introduction of the stablecoin bill. Stablecoins serve as a bridge between traditional finance and blockchain technology. Hong Kong's stablecoin bill proposes a relatively comprehensive compliance path and requirements for fiat-backed stablecoins, directly safeguarding the financial security of stablecoin holders and institutions. This step is crucial in connecting Hong Kong's traditional financial sector with the fintech sector.

The third step: Ensuring cryptocurrency asset protection through blockchain technology. This step is what this article discusses. Based on the inherent anonymity of blockchain, it does not require the plaintiff to know the defendant's true identity; as long as there is a wallet address, an injunction can still be sent to that wallet address. This step can be seen as an important enhancement of judicial protection. It also represents a significant change in traditional judicial systems within the fintech sector, directly breaking the previous dilemma in Hong Kong where the inability to identify cryptocurrency fraudsters prevented legal remedies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。