Today marks the first day of our small gathering. Fortunately, Monday is a holiday in the U.S., so it feels like we got an extra day of rest. The upcoming week will be quite busy, but thankfully there aren't any significant data releases this week, so it shouldn't be too chaotic. During today's gathering, the main topic of discussion was the market, including views on both the short-term and long-term. In the long term, everyone is quite optimistic about #Bitcoin, but opinions differ in the short term.

If I had to point out a commonality, it would be that there is some expectation for the market in Q1 and Q2, especially before April. However, based on past experiences, it may not be as optimistic after April. Of course, these are just past experiences. As Brother Wu @qinbafrank said, Trump is the biggest variable; he might not even know what he will say tomorrow, making it difficult for the market to predict.

We can only rely on past experiences and take it step by step. Trying to predict the upper and lower limits of prices in this cycle is not very meaningful. What is more important is whether investors will be sensitive to cyclical changes in the economy, which highlights the macro importance of this cycle. Where the money is, people will be. Once the profit-making effect diminishes, people will naturally leave.

Today, Brother Wu also mentioned a viewpoint that I think is very accurate. If the previous trend was a favorable wind, the current trend is like gusts of wind, causing the market to fluctuate up and down, making it hard to decipher.

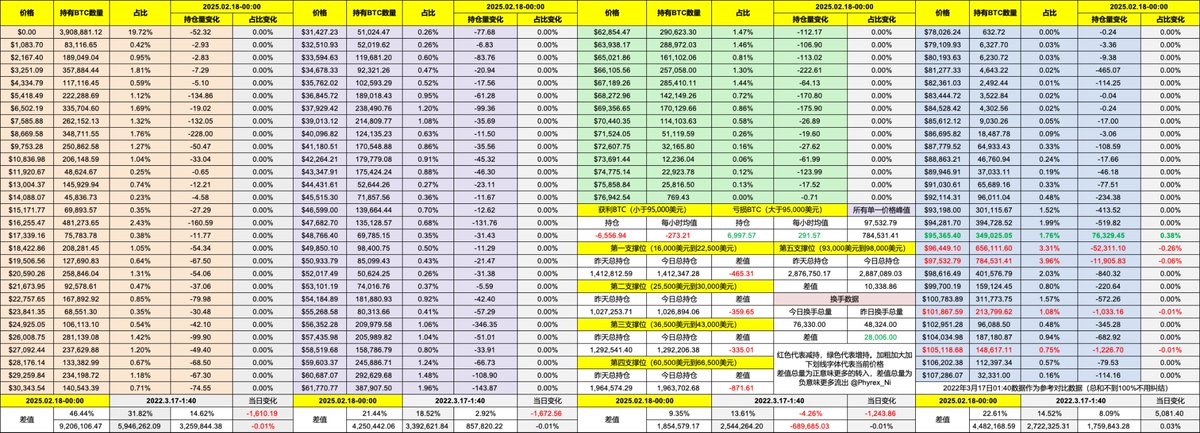

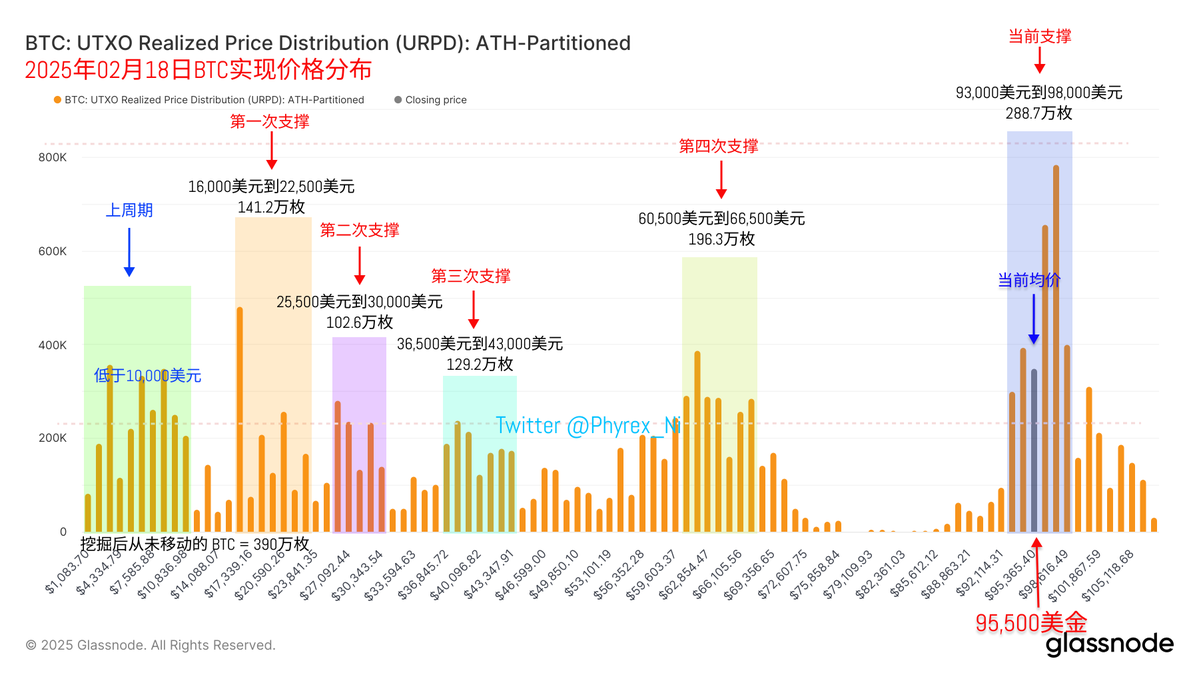

Returning to the data on #BTC itself, it remains the same as the usual "garbage time." The turnover rate is still low, and many investors are not very enthusiastic about buying and selling right now. Although the price fluctuations have been slightly larger than over the weekend, it still maintains support between $93,000 and $98,000, with an increasing amount of chips in this range. There doesn't seem to be much risk in the short term.

This is what "garbage time" looks like. Let's see if there are any policies or macro conditions that can continue to stimulate investors. Additionally, the short-term price will still depend on the stance of American investors.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。