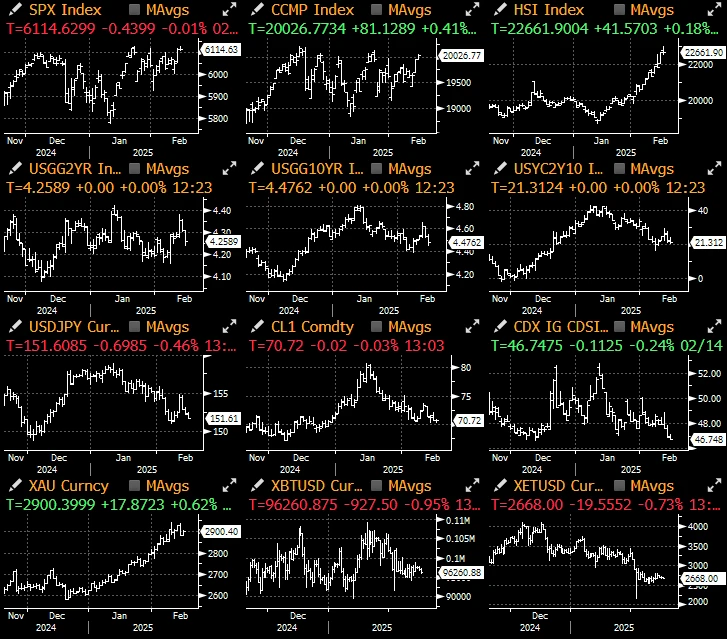

The macro market has entered a low-volatility consolidation phase, with market sentiment returning to the familiar "Goldilocks" mode. The stock and bond markets are gradually rising under mild economic data and declining volatility.

The Trump administration has once again released new developments regarding tariffs, but the market's reaction has been relatively lukewarm, indicating that it is becoming increasingly immune to such news. The latest reciprocal tariff policy has been postponed to April 1 and will be reviewed for major trading partners such as Canada, Mexico, India, and China.

Overall, despite many speculations about Trump's policies during his second term, the performance of Trump-related trades has not been good this year, significantly lagging behind major indices. The US dollar and oil prices have sharply retreated, while emerging market stocks and currencies have performed relatively strongly.

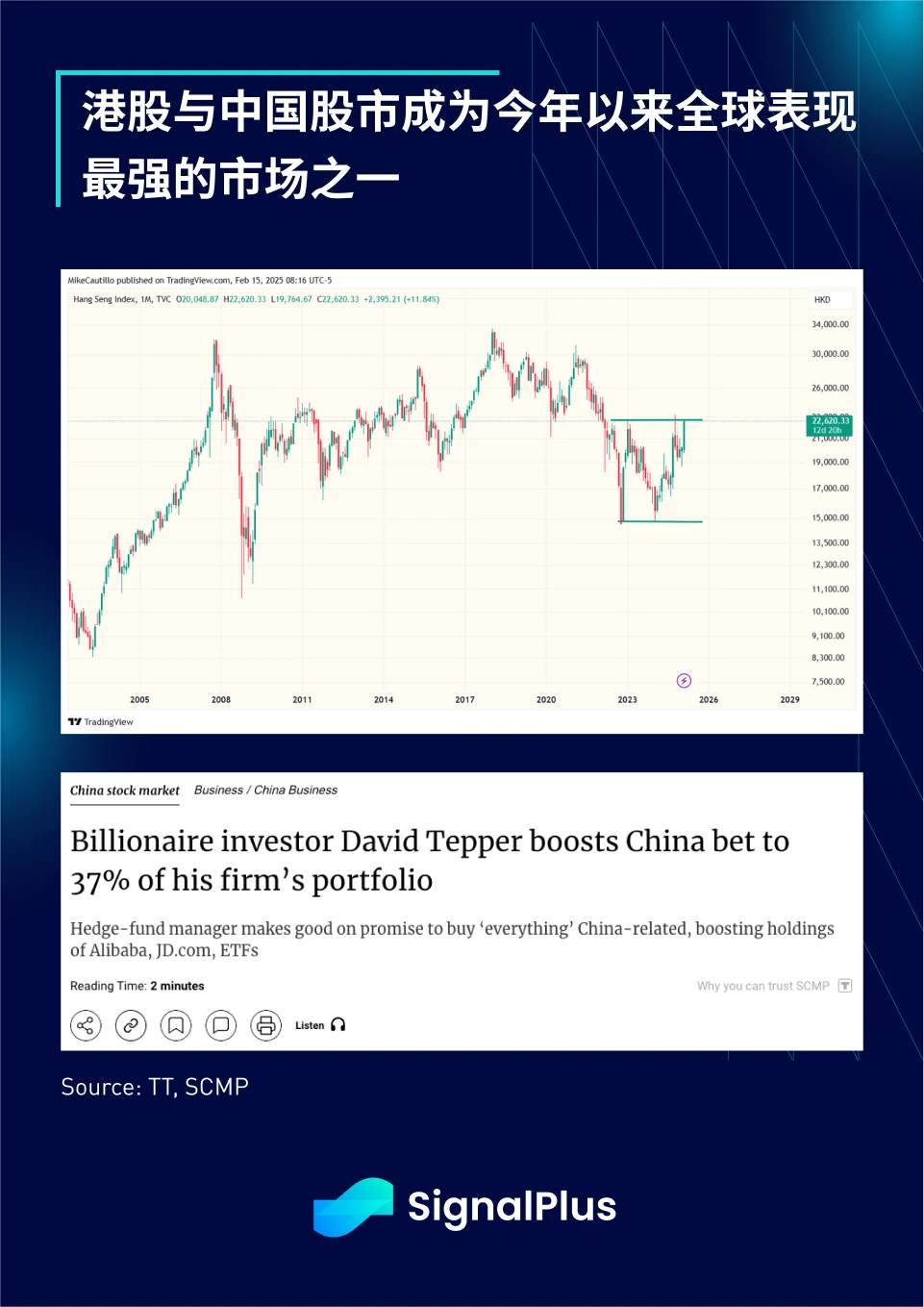

Notably, the Chinese stock market has performed exceptionally well, initially driven by the DeepSeek AI craze, and more recently due to warming relations between the government and domestic tech companies. The Hang Seng Index (HSI) seems poised to break out of a years-long downtrend, and major companies like Alibaba are beginning to attract the attention of US fund managers and institutional investors.

US economic data has been mediocre, with last week's CPI data exceeding expectations, while last Friday's retail sales data was weak, causing market expectations for a rate cut in June to rise to around 60%. Chairman Powell made every effort to downplay market concerns about inflation during a recent Congressional Financial Services Committee hearing:

"The CPI data is above almost all predictions, but I want to remind everyone of two points. First, we will not be overly optimistic because of one or two good data points, nor overly pessimistic because of one or two bad data points. Second, our inflation target focuses on the Personal Consumption Expenditures (PCE) price index because we believe it better reflects the inflation situation." - Powell, February 13, 2024

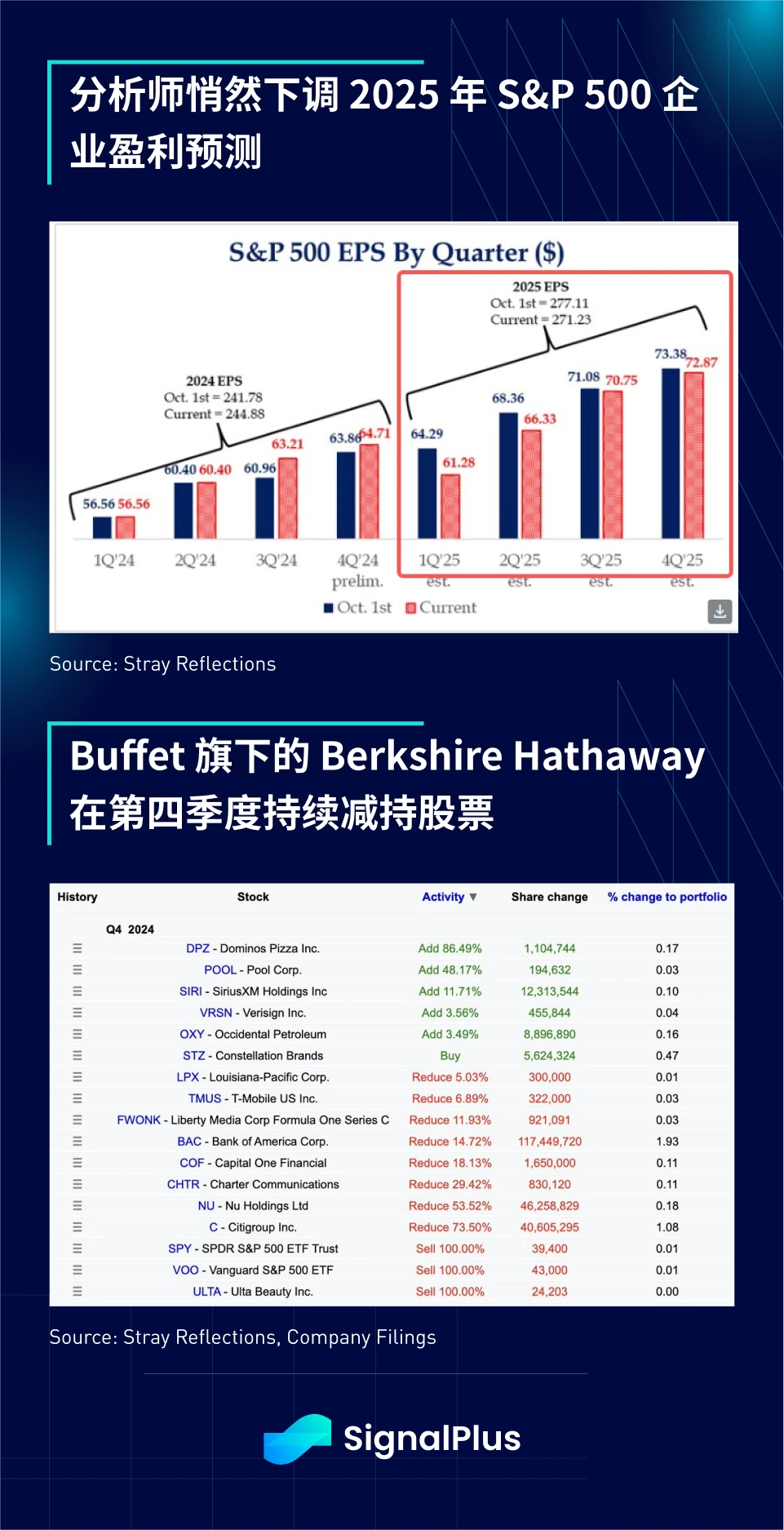

However, in this seemingly stable market environment, the EPS forecast for S&P 500 companies in 2025 has been significantly revised downwards. Additionally, Warren Buffet has been gradually reducing his stock exposure, completely selling off his SPX ETF holdings in the fourth quarter of last year, including a significant reduction in bank stocks.

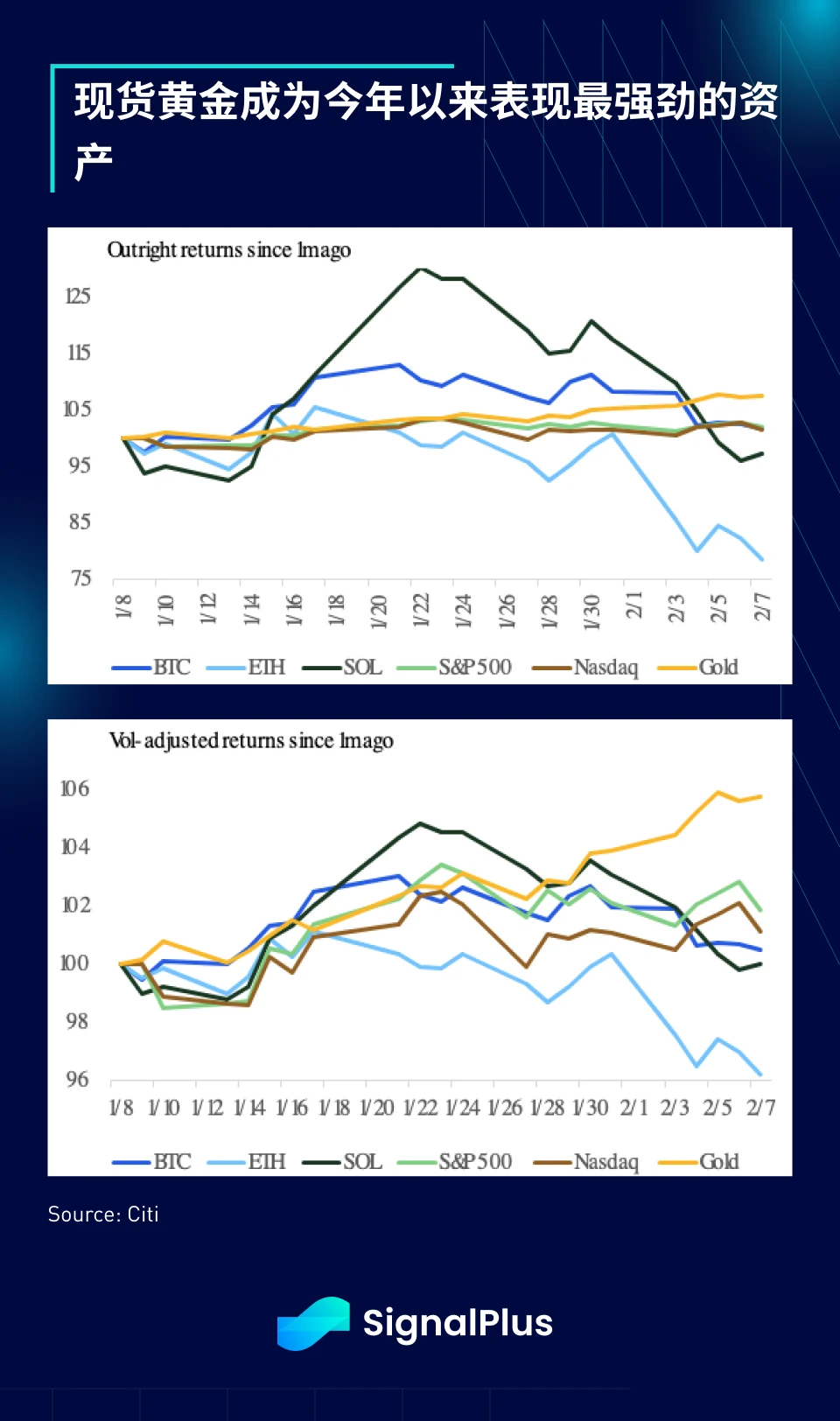

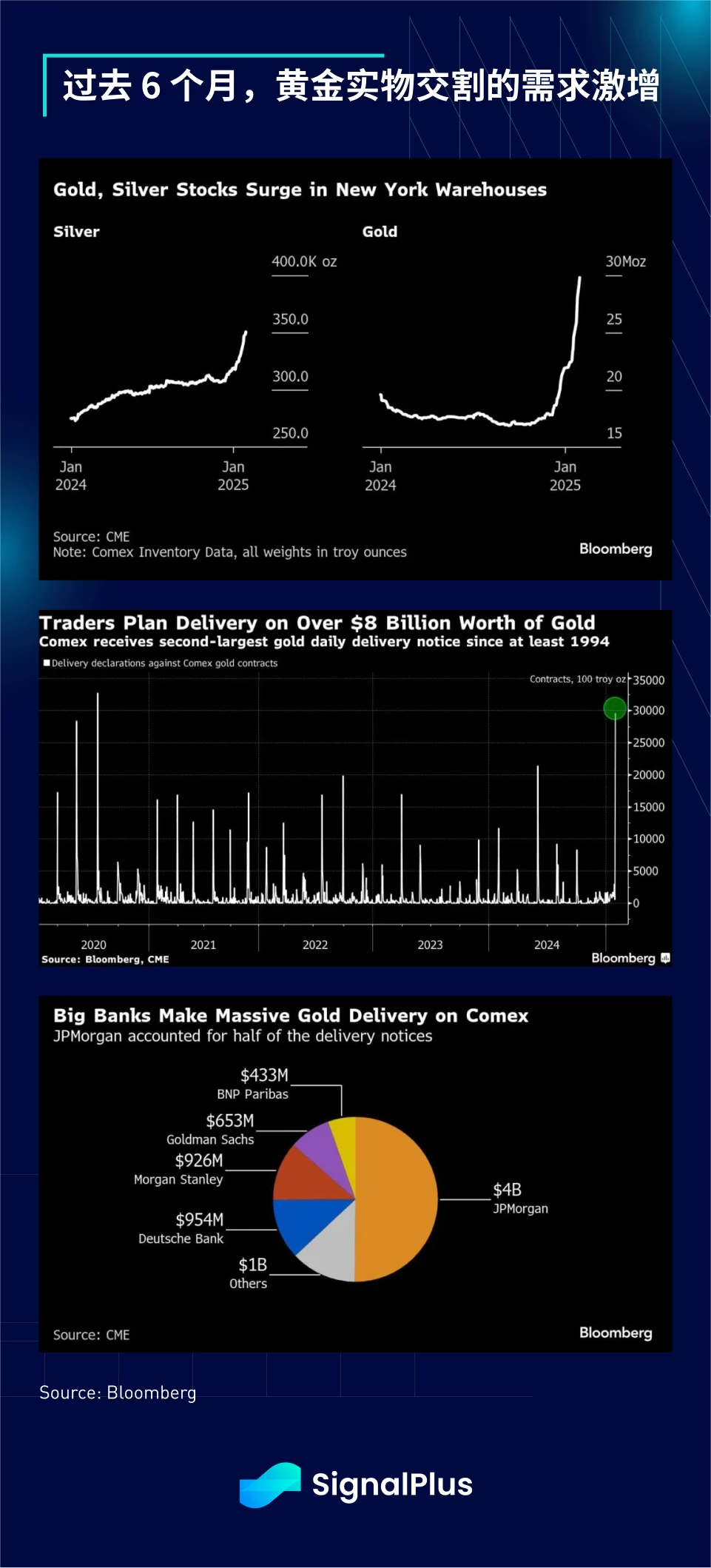

Although the stock market has not seen significant gains year-to-date, the demand for physical gold delivery at major exchanges has surged, causing gold prices to soar. According to Bloomberg, the amount of gold transferred to US COMEX-approved warehouses by financial institutions has increased by over 70% compared to usual, with approximately 300-400 tons of gold shipped from London to New York over the past eight months.

The market is concerned that Trump's tariff policy will drive up import prices, leading traders to start hoarding gold, while the Federal Reserve's indifference to inflation has further fueled demand for gold.

In the cryptocurrency market, unlike the stable performance of gold, ETH is struggling in distress, with its price down 20% this year and actual volatility around 60-70%, making it the worst-performing asset among all major cryptocurrencies and indices.

The only silver lining is that market sentiment towards ETH has become extremely pessimistic, while Trump's World Liberty Financial has continued to buy ETH during this downturn. Is ETH about to experience a dead cat bounce?

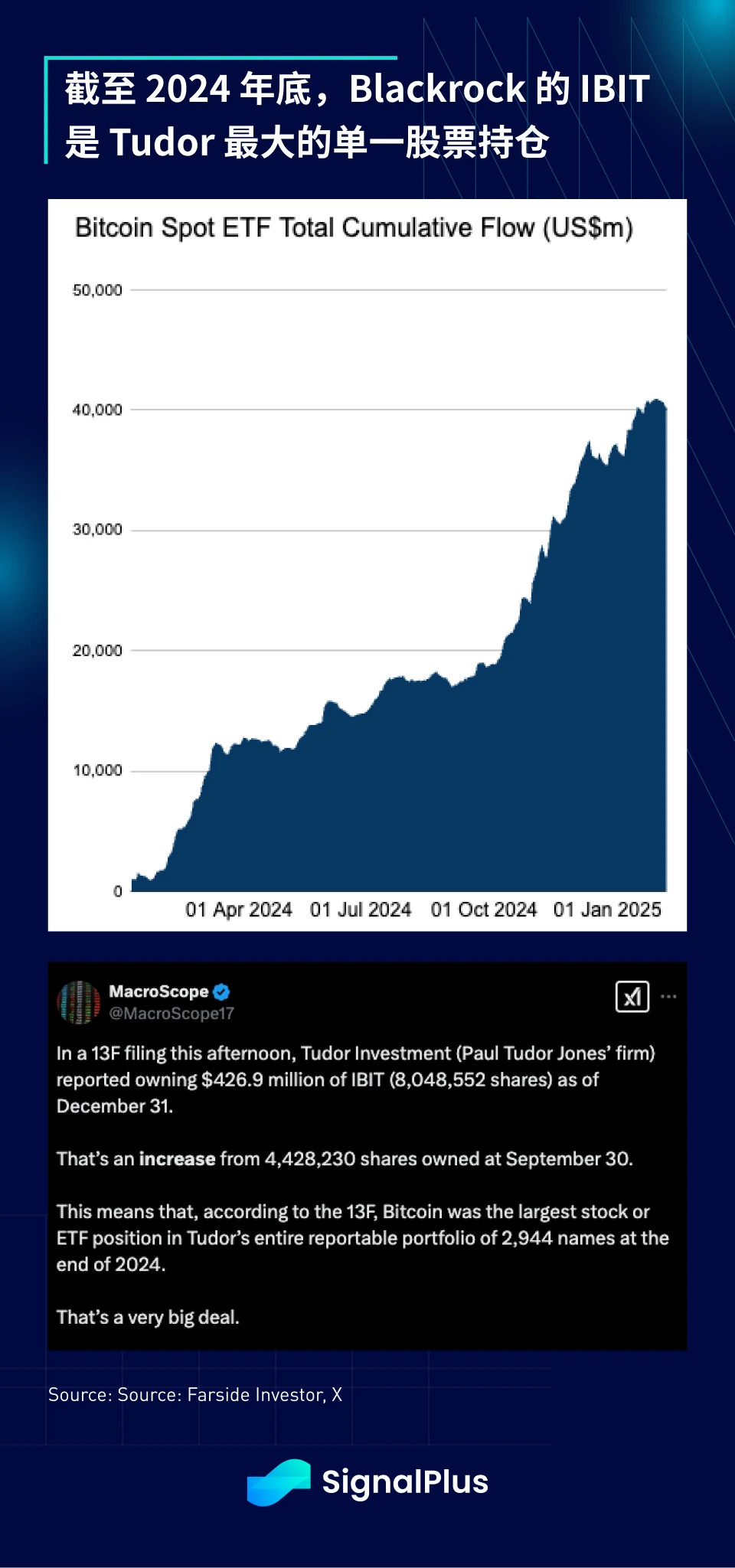

On the other hand, while BTC prices are still fluctuating around $100,000, the cumulative inflow of funds into BTC ETFs remains stable. Tudor Investment's 13F filing shows that as of the end of 2024, the IBIT ETF is the fund's largest single stock holding (with assets under management of $12 billion).

Finally, FTX will finally begin repayments this week (starting with small accounts). Whether this capital will flow back into the cryptocurrency market is worth our attention.

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant's WeChat, please remove the spaces between the English and numbers: SignalPlus 123), Telegram group, and Discord community to interact and exchange with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。