Written by: Yuliya, PANews

Since Trump launched the token on January 18, the zero-threshold token issuance mechanism of Pump.Fun has gradually revealed its dual nature: on one hand, it injects liquidity into the market, while on the other, it provides a breeding ground for black and gray industries. The hidden dangers brought by this mechanism are increasing, of course, also providing hackers with more lucrative opportunities. (Using stolen social accounts, providing a CA) Congratulations to those who did not delve into the project behind it, you have successfully boarded.

On February 15, Argentine President Milei's high-profile support for the LIBRA token on social media pushed this project, which had once soared to a market value of $4 billion, to its peak. However, after Milei suddenly deleted the tweet and issued a clarification statement, the LIBRA token experienced a cliff-like plunge, with its market value shrinking to a low of $13 million, evaporating 96% from its peak. According to insiders, as early as a week before the token issuance, there were reports that someone had bribed senior officials close to President Milei with $5 million in exchange for Milei's public support. This incident caused the market's enthusiasm for meme coins to sharply decline, and the year-long Pump.Fun craze is fading. The platform protocol fees plummeted by 84.57% from a historical peak of 72,506 SOL on January 1, and now the daily income is only 11,188 SOL.

Unexpectedly Angering Top White Hat Hackers

When KIP Protocol announced the launch of the "Viva la Libertad" project and bragged about the success of the $LIBRA token, it claimed that the project was led by private enterprises and had nothing to do with President Milei; however, this statement was quickly refuted.

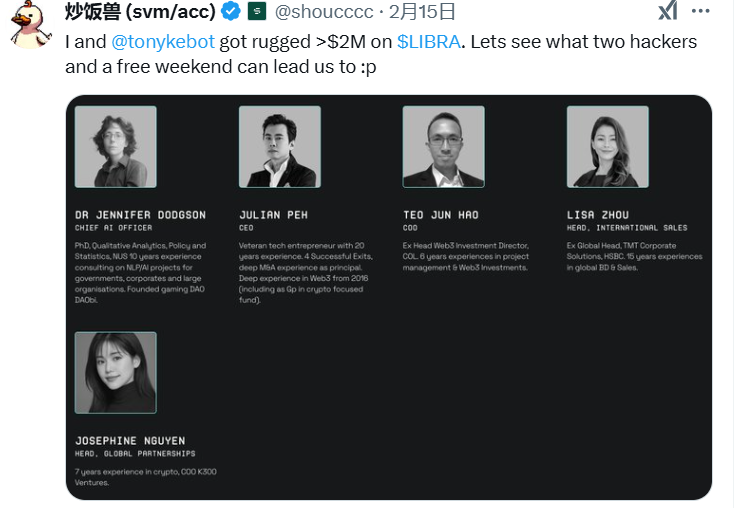

Chaofan Shou, co-founder of Fuzzland, began to criticize KIP Protocol, exclaiming "RNM, refund!" He lamented that he and Solayer engineer @tonykebot lost over $2 million in the LIBRA project and revealed the core member list of the KIP Protocol team behind LIBRA, claiming, "Let's see what two hackers and a free weekend can bring us," implying that action would be taken. (It is reported that Shou enjoys a good reputation in the cybersecurity field, and his team has successfully recovered over $33 million in stolen funds, with bug bounties exceeding $1.9 million in the Web2 security field.)

In the following days, Shou and KIP Protocol co-founder Julian engaged in an online "fight" on Twitter, with Julian saying, "If the project really rug-pulled, then come find me; your loss is your problem, it doesn't mean the project rug-pulled." In response, Shou threatened to trace the responsible parties, stating, "From Vietnam to Singapore to the United States, not a single one can escape." Immediately, Shou exposed Julian's personal identity information and bluntly stated, "Whether you refund or not, running away is running away." He warned, "A $200 million case in the U.S. could face up to 50 years in prison; I advise you to return to Singapore sooner." Although the act of running away is indeed detestable, the author believes that leaking someone else's identity before knowing the outcome is quite inappropriate.

Unveiling the True Nature of the Project Party

After the market turmoil, several Solana ecosystem projects stated, "It has nothing to do with us," distancing themselves from LIBRA. Ben Chow, co-founder of Meteora, stated that he had never purchased, received, or managed any LIBRA tokens; Siong, co-founder of Jupiter, also stated that he had not colluded with projects like $LIBRA and $ENRON to do evil.

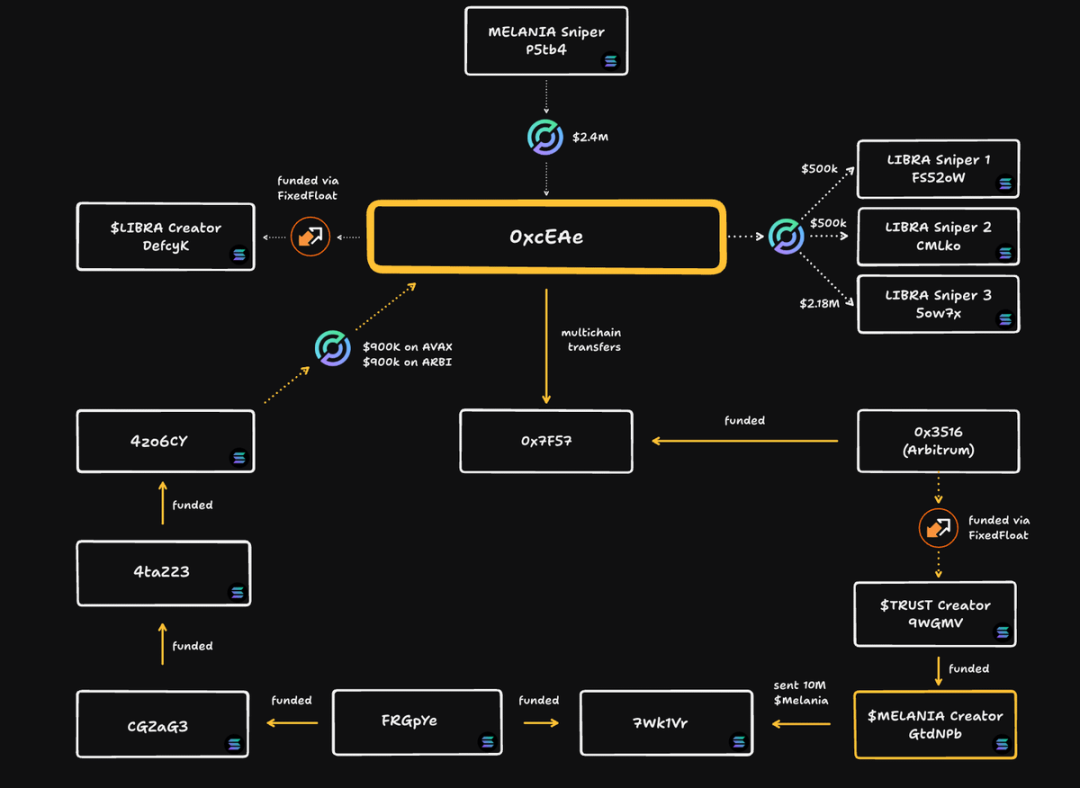

A survey by blockchain analysis company Bubblemaps shows that there is a close connection between LIBRA and the previously controversial MELANIA token project. The early sniper wallets of the two projects are highly overlapping, both employing similar "pump and dump" tactics.

- Utilizing cross-chain protocols (CCTP) to transfer funds between different public chains

- Conducting "front-running trades" through multiple associated wallets

- Withdrawing approximately $87 million from liquidity pools

In an interview with YouTuber Coffeezilla, Hayden Davis admitted that the team engaged in sniper trading during the launches of both LIBRA and MELANIA projects but emphasized that the intention behind the operations was to protect project liquidity, not to profit from it. Core members of the LIBRA project include:

- Hayden Davis (Founder of Kelsier Ventures)

- Julian Peh (Founder of KIP Protocol)

- Mauricio Novelli (Argentine Technology Forum)

- Manuel Godoy (Argentine Technology Forum)

Hayden stated that the issuance of LIBRA tokens was not a "scam," but rather a market crash caused by a failed plan. He currently holds $100 million in funds and is seeking solutions. He revealed that sniper operations have become a common phenomenon in the meme coin space, and most projects' issuance phases are exploited by insiders or high-frequency traders.

Reflection on the Incident

The chain reaction triggered by the incident continues to ferment:

- Market Level: Bitcoin's market share has risen to a four-year high of 60%, with QCP Capital analyzing that the LIBRA project's "runaway" scandal may long suppress the market for altcoins and meme coins;

- Judicial Level: Currently, the Argentine government has established a cross-departmental investigation team, jointly investigating with financial regulatory and anti-money laundering agencies. Former central bank governors and others have filed lawsuits, accusing Milei of playing a key role in the project and being involved in fraud;

- Industry Reflection: Zhu Su, co-founder of Three Arrows Capital, believes that the main mistake of the Libra team was withdrawing liquidity from the Meteora pool and engaging in short-term arbitrage operations; otherwise, it would have operated similarly to the TRUMP token.

This cryptocurrency drama, which combines political endorsement, hacker confrontation, and capital manipulation, exposes three major real dilemmas in the Web3 world:

- Government endorsement does not equate to project credibility

- Insider trading and market manipulation remain prevalent in the cryptocurrency market

- The power of community self-governance, especially the participation of technical experts, may be more effective than traditional regulation

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。