As the regulatory framework gradually clarifies, this field is expected to become one of the fastest-growing markets in the future.

Author: Cheeezzyyyy

Translation: Deep Tide TechFlow

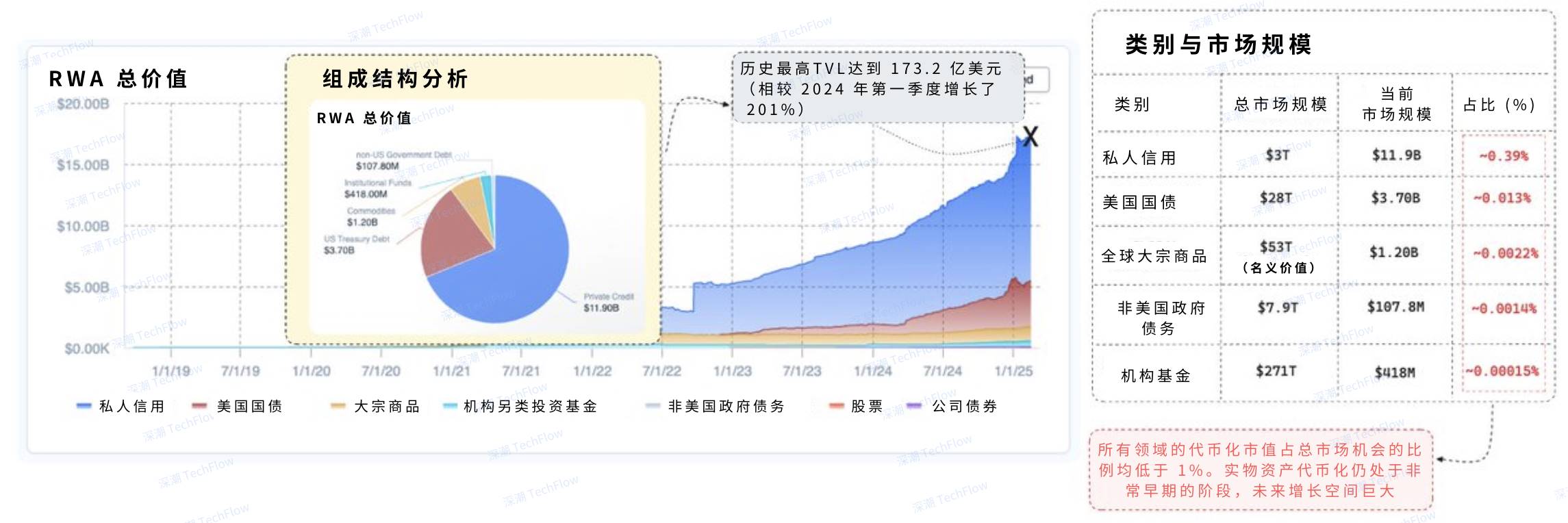

Despite market volatility, RWA continues to maintain a strong growth momentum. Its TVL has reached a historic high of $17.32 billion, achieving a twofold increase since 2024.

However, the market potential in this field remains enormous. Currently, less than 1% of physical assets are tokenized globally, with private credit accounting for about 68% of the market share. This indicates that RWA tokenization still has vast room for growth in the future.

Here are some key insights worth noting.

(Source image from Cheeezzyyyy, translated by Deep Tide TechFlow)

With the increasing interest from institutional investors, the tokenized U.S. Treasury market has shown significant growth, with a total scale reaching $3.6 billion. Here are the performances of some key projects:

@Hashnote_Labs launched $USYC ST-yield, currently the largest tokenized Treasury product by market cap, valued at approximately $1.1 billion.

@BlackRock has a $BUIDL fund with a scale of $650 million, leveraging @OndoFinance's $OUSG to provide investors with a convenient channel for Treasury investments.

@FTI_Global's money market fund (FOBXX) currently manages $580 million, continuing to attract market attention.

The rapid growth of these tokenized Treasury products not only reflects institutional investors' recognition of blockchain technology but also showcases the potential for integration between traditional financial assets and decentralized finance (DeFi).

(Source image from Cheeezzyyyy, translated by Deep Tide TechFlow)

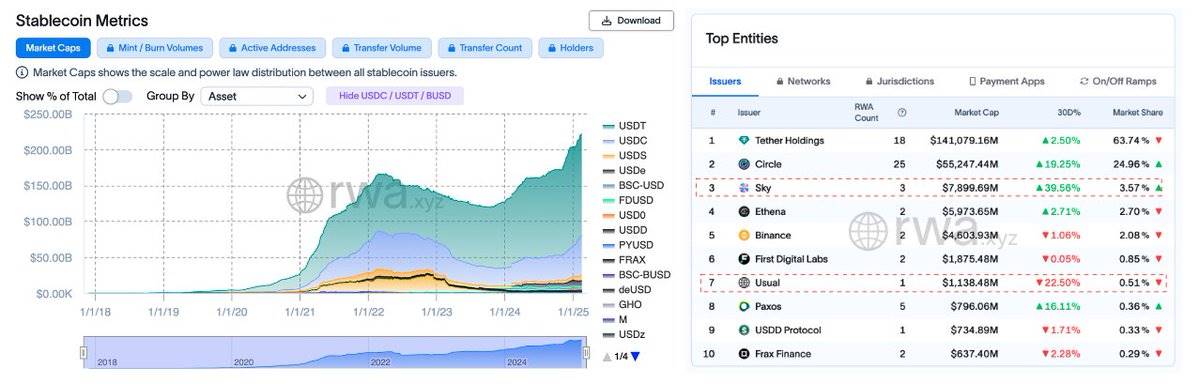

Tokenizing RWA into yield-bearing stablecoins has become one of the most popular applications currently. Several well-known protocols are actively promoting development in this area, including:

@SkyEcosystem launched $USDS

@usualmoney launched $USD0

It is worth mentioning that many issuers are utilizing their held Treasury assets to generate stablecoins through tokenization, creating passive income for investors. This model not only introduces a reliable source of income for stablecoins but also further promotes the deep integration of traditional assets with blockchain technology.

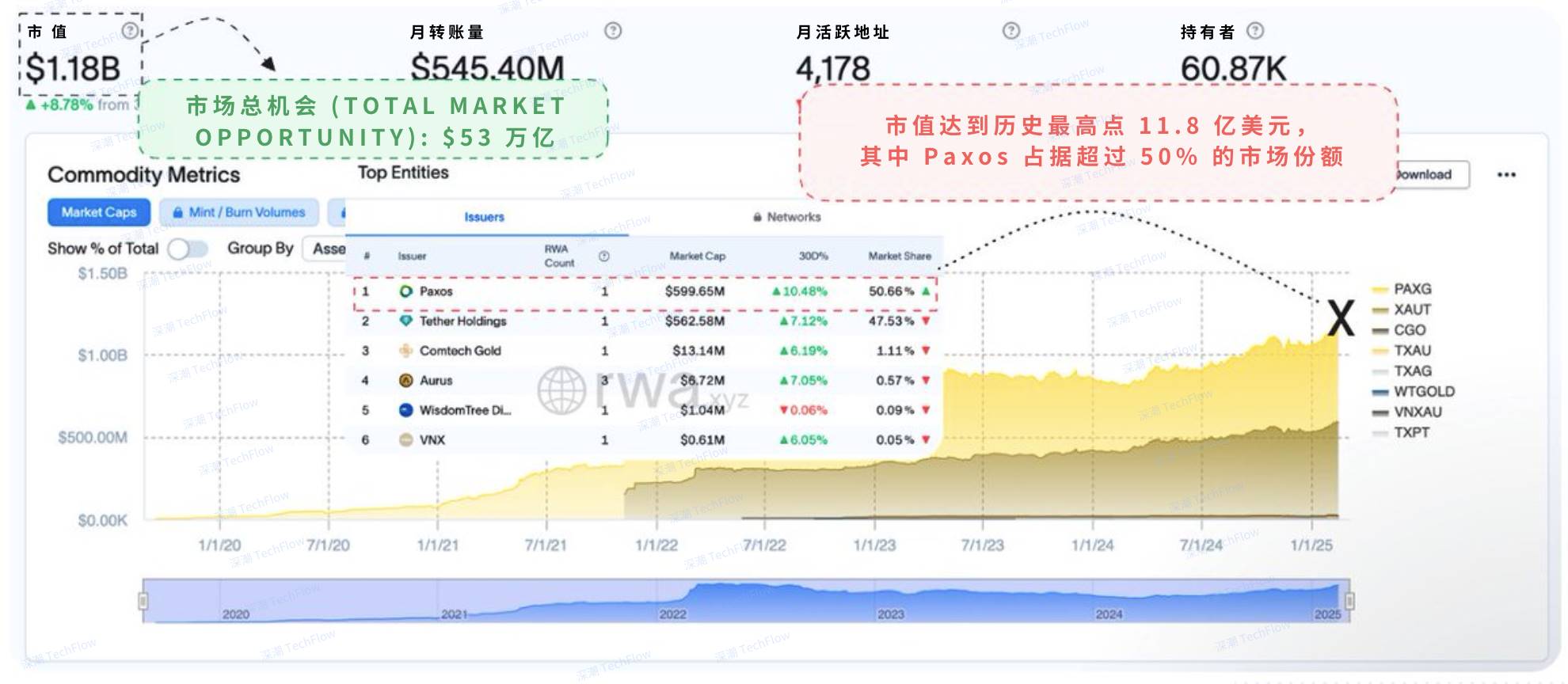

Among all markets, the scale opportunity for commodities ranks at the forefront, with a total nominal value of up to $53 trillion. However, the current value of tokenized commodities is only about $1.18 billion, accounting for just 0.0022% of the total addressable market (TAM). In this field, @Paxos holds approximately $600 million in tokenized assets, capturing 50.66% of the market share, making it the industry leader.

With the maturation of technology and the growth of institutional interest, the tokenized commodities market is expected to experience exponential expansion in the coming years.

(Source image from Cheeezzyyyy, translated by Deep Tide TechFlow)

For institutional investors, the total scale of the global market portfolio reaches $271 trillion, while the current historical high of tokenized assets is only $418 million, led by @Securitize. This indicates a significant potential for future capital inflows.

As the regulatory framework gradually clarifies, this field is expected to become one of the fastest-growing markets in the future, bringing more opportunities for investors and the industry.

(Source image from Cheeezzyyyy, translated by Deep Tide TechFlow)

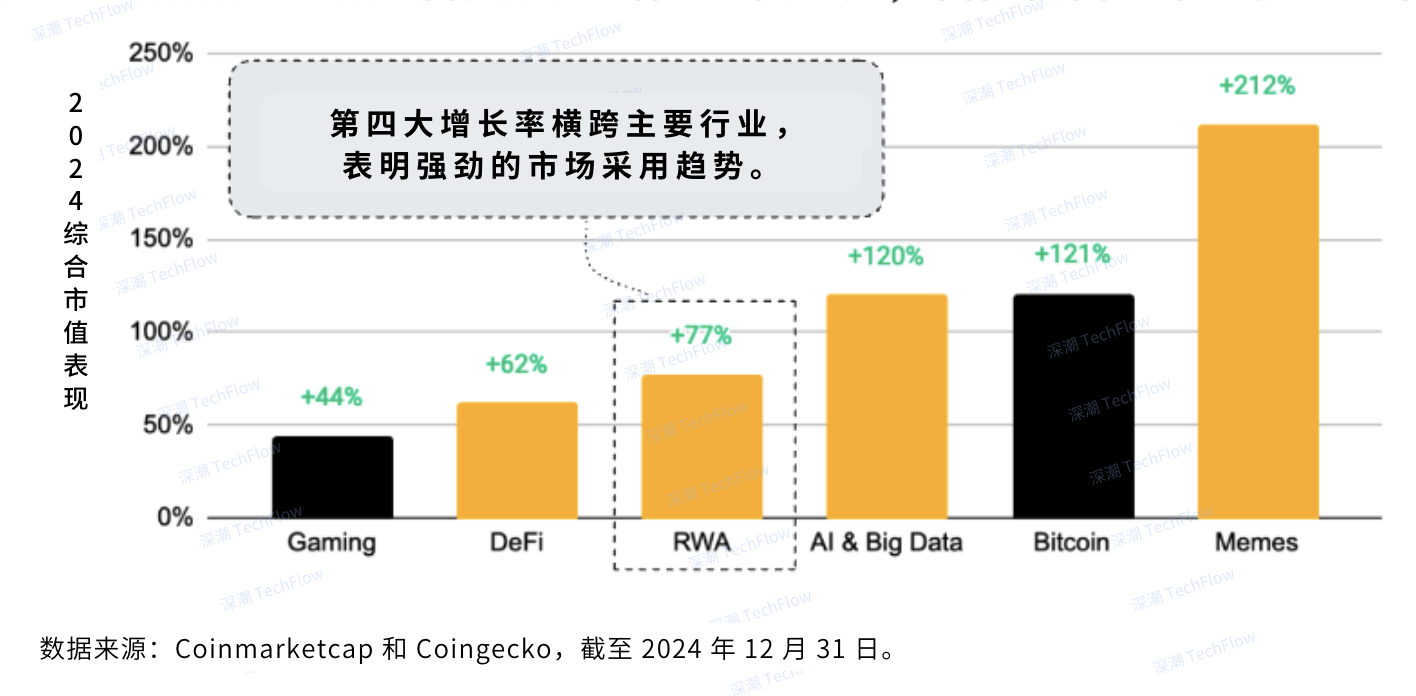

Although various sub-industries of Real World Assets (RWA) are still in the early stages of growth exploration, from a market potential perspective, this is undoubtedly a trillion-dollar opportunity, and we are just getting started.

The current market cap of tokenization remains very limited, only in the range of millions or as low as billions of dollars. This is merely the beginning of exponential growth.

(Source image from Cheeezzyyyy, translated by Deep Tide TechFlow)

Therefore, the RWA market is expected to achieve more robust growth, primarily due to strong fundamental support and the increasingly important role of on-chain asset issuance models in the financial sector.

In 2024, the market cap growth performance of the RWA industry ranks fourth among all industries, with an increase of 77%.

I believe that by 2025, RWA is likely to be among the top three performers.

(Source image from Cheeezzyyyy, translated by Deep Tide TechFlow)

Looking ahead, as more countries and funds recognize the potential of this market, the value structure of tokenized RWA will undergo significant changes.

At the same time, with the gradual improvement of the regulatory framework, many regions are showing a higher acceptance of blockchain-based financial infrastructure.

In the future, this field will be filled with exciting opportunities!

(Source image from Cheeezzyyyy, translated by Deep Tide TechFlow)

Original link: https://x.com/0xCheeezzyyyy/status/1891375920768028707

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。