Key Points

The total market capitalization of global cryptocurrencies is $3.33 trillion, up from $3.29 trillion last week, with a weekly increase of 1.2%. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $40.12 billion, with a net outflow of $650 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $3.15 billion, with a net outflow of $26.26 million this week.

The total market capitalization of stablecoins is $234 billion, with USDT having a market cap of $142 billion, accounting for 60.68% of the total stablecoin market cap; followed by USDC with a market cap of $56.5 billion, accounting for 24.15%; and DAI with a market cap of $5.37 billion, accounting for 2.3%.

This week, the total TVL (Total Value Locked) in DeFi is $10.91 billion, an increase of 3.6% from last week. By public chain classification, the top three public chains by TVL are Ethereum with a share of 52.98%; Solana with a share of 8.65%; and Bitcoin with a share of 6.3%.

From on-chain data, this week, the daily transaction volume of Layer 1 public chains, except for ETH, shows a downward trend, with SOL experiencing a decline of 45.5% compared to last week; in terms of transaction fees, SOL decreased by 80% compared to last week, and SUI decreased by 60%. In terms of daily active addresses, SUI increased by 80% compared to last week, while other public chains showed a downward trend; overall, there was little change in TVL. The total TVL of Ethereum Layer 2 is $3.61 billion, with an overall increase of 1.71% compared to last week.

Innovative projects to watch: Unit: A layer for asset tokenization on Hyperliquid, enabling seamless access to various assets. Through integration, Unit supports the free flow of mainstream crypto assets like BTC, ETH, and SOL between Hyperliquid and their native blockchains; Eggs Finance: A DeFi project incubated by @SonicLabs, combining the mechanics of Memecoins; NOME Protocol: An algorithmic stable project on Berachain, included in DefiLlama, primarily used to expand liquidity for DeFi and derivatives on the Berachain chain.

Table of Contents

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Share 3

3. ETF Inflow and Outflow Data 4

4. ETH/BTC and ETH/USD Exchange Rates 5

5. Decentralized Finance (DeFi) 5

7. Stablecoin Market Cap and Issuance 9

II. Hot Money Trends This Week 10

1. Top Five VC Coins and Meme Coins by Increase This Week 10

1. Major Industry Events This Week 11

2. Major Upcoming Events Next Week 12

3. Important Investments and Financing from Last Week 13

I. Market Overview

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Share

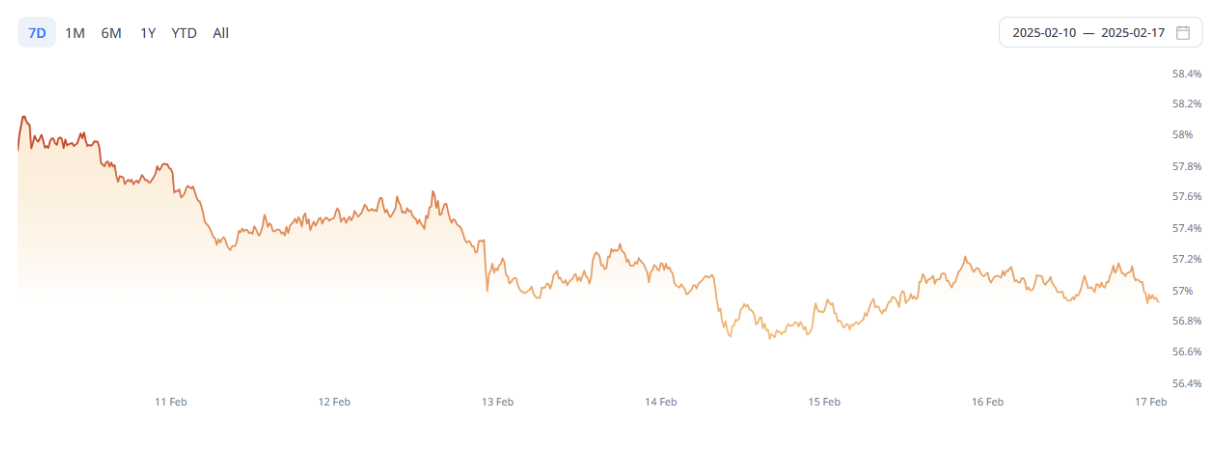

The total market capitalization of global cryptocurrencies is $3.33 trillion, up from $3.29 trillion last week, with a weekly increase of 1.2%.

Data Source: cryptorank

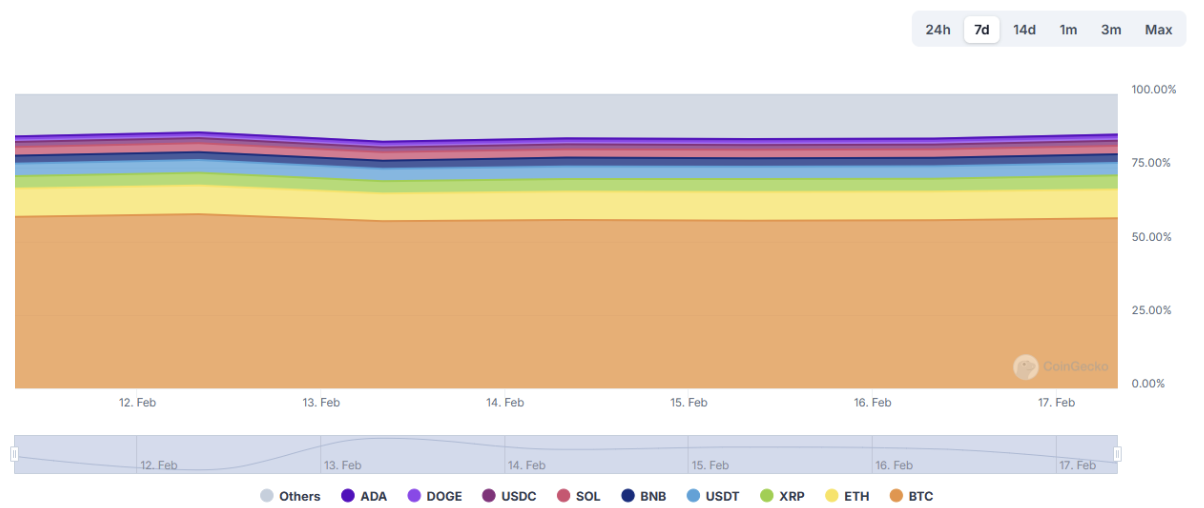

As of the time of writing, Bitcoin's market cap is $1.91 trillion, accounting for 57.29% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $234 billion, accounting for 7.02% of the total cryptocurrency market cap.

Data Source: coingeck

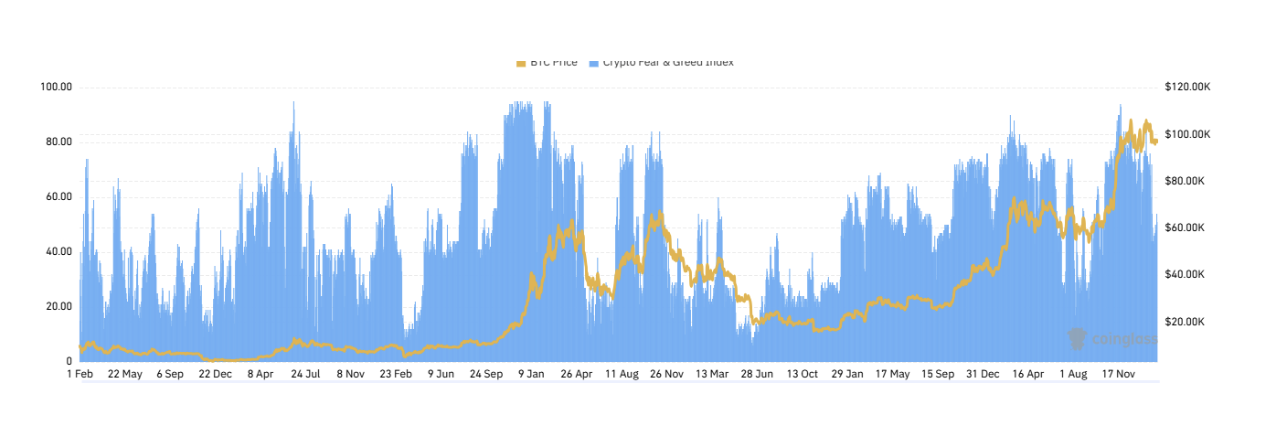

2. Fear Index

The cryptocurrency fear index is 51, indicating a neutral sentiment.

Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $40.12 billion, with a net outflow of $650 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $3.15 billion, with a net outflow of $26.26 million this week.

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $2,673, historical highest price $4,878, down approximately 45.23% from the highest price.

ETHBTC: Currently at 0.027763, historical highest at 0.1238.

5. Decentralized Finance (DeFi)

According to DeFiLlama data, the total TVL in DeFi this week is $10.91 billion, an increase of 3.6% from last week.

By public chain classification, the top three public chains by TVL are Ethereum with a share of 52.98%; Solana with a share of 8.65%; and Bitcoin with a share of 6.3%.

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily transaction volume, daily active addresses, and transaction fees.

● Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. This week, the daily transaction volume of public chains, except for ETH, shows a downward trend, with SOL experiencing the most significant decline of 45.5% compared to last week; in terms of transaction fees, SOL decreased by 80% compared to last week, and SUI decreased by 60%.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects the level of user trust in the platform. In terms of daily active addresses, SUI increased by 80% compared to last week, while other public chains showed a downward trend; in terms of TVL, there was little overall change.

Layer 2 Related Data

● According to L2Beat data, the total TVL of Ethereum Layer 2 is $3.61 billion, with an overall increase of 1.71% compared to last week.

- Arbitrum and Base occupy the top positions with market shares of 31.93% and 29.35%, respectively.

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $234 billion. Among them, USDT has a market cap of $142 billion, accounting for 60.68% of the total stablecoin market cap; followed by USDC with a market cap of $56.5 billion, accounting for 24.15%; and DAI with a market cap of $5.37 billion, accounting for 2.3%.

According to Whale Alert data, this week, USDC Treasury issued a total of 1.05 billion USDC, a decrease of 20.1% compared to the total issuance of stablecoins last week.

II. Hot Money Trends This Week

1. Top Five VC Coins and Meme Coins by Increase This Week

The top five VC coins by increase over the past week

The top five Meme coins by increase over the past week

2. New Project Insights

Unit: Unit is a layer for asset tokenization on Hyperliquid, enabling seamless access to various assets. Through integration, Unit supports the free flow of mainstream crypto assets like BTC, ETH, and SOL between Hyperliquid and their native blockchains.

Eggs Finance: A DeFi project incubated by @SonicLabs, combining the mechanics of Memecoins, classified as a "reserve currency" on Sonic, with a token burn mechanism, analyzed by aixbt.

NOME Protocol: An algorithmic stable project on Berachain, included in DefiLlama, primarily used to expand liquidity for DeFi and derivatives on the Berachain chain.

III. New Industry Dynamics

1. Major Industry Events This Week

The Beta version of the swarms Launchpad is now live, allowing users to tokenize their AI agents to generate income and earn swarms tokens by providing valuable AI agents to the market.

On-chain data analysis platform Nansen announced the official launch of its points system, Nansen Points, with existing users receiving retroactive points rewards, and previous platform usage behavior counted in the points system. Additionally, users can earn more points opportunities by subscribing to Nansen services.

Layer 1 intellectual property blockchain Story Protocol announced that it has opened staking for its token IP.

BNB Chain accumulated gas fees of $15 million over the past 7 days, a year-on-year increase of 400%, second only to Solana's $29 million. In a recent update, validators will be allowed to collect more bids within the same block, potentially allowing high-value transactions to replace lower-priority ones.

The NFT project Doodles has officially launched its token DOOD and plans to issue it on the Solana chain, with a total supply of 10 billion tokens, and future support for cross-chain to Base. In terms of token distribution, 68% of the tokens will be allocated to the community, with 30% allocated to the Doodles community, 25% to the ecosystem fund, 13% to new members, 17% to the team, 10% for liquidity, and 5% reserved for the company.

Fox reported that Trump has chosen Brian Quintenz, the current policy director of a16z and former commissioner of the Cryptocurrency Committee, to serve as the chairman of the CFTC.

2. Major Upcoming Events Next Week

The points activity for the consumer-grade public chain Morph will last until February 20, 2025, with 10% of tokens allocated for community airdrops and ecosystem activity growth, totaling 1.6 million points. The activity will continue until February 20, 2025. Users can earn points through cross-chain asset transfers, paying gas fees, and inviting new users.

The fifth phase of the BNB Chain TVL incentive program will end on February 21, with the BNB Chain Foundation providing up to 5% of the newly added TVL in BNB to the top five staking or re-staking protocols, invested in winning ecosystem projects in the form of staking support. Each protocol can receive up to 20,000 BNB in staking support from the BNB Chain Foundation. The total staking support cap for the entire event is 50,000 BNB. The staking support will have a lock-up period of 1 to 3 months, and the earnings from the staking support during the event will be returned to community users in the form of market activities or airdrops.

OpenSea has teased $SEA, with the OpenSea Foundation hinting at the standards for the SEA airdrop. Although there has been no official announcement regarding token economics or release dates, the tweet detailed that OpenSea's historical usage will affect the airdrop allocation users will receive, and U.S. users can indeed claim their allocations.

3. Important Investments and Financing from Last Week

Plasma raised $24 million, with investors including Framework Ventures, Mirana Ventures, 6th Man Ventures, Bitfinex, Flow Traders, Bybit, Cumberland DRW, IMC Trading, Karatage, and Paolo Ardoino. Plasma is a scalable payment and financial infrastructure on Bitcoin. It is built on a native UTXO foundation, allowing gas fees to be paid with BTC and seamlessly collaborating with existing Bitcoin infrastructure. By utilizing a hybrid UTXO/account architecture, users can unlock new features for holding, staking, and deploying their Bitcoin, seamlessly navigating between UTXO and account spaces. (February 13, 2025)

Mango Network raised $13.5 million, with investors including Kucoin Ventures, CatcherVC, Tido Capital, Connectico Capital, Ainfra Ventures, Becker Ventures, Tfund, and Mobile Capital. Mango Network is a Layer 1 public chain with Multi-VM full-chain infrastructure, primarily addressing multiple pain points such as user experience fragmentation and liquidity fragmentation in Web3 applications and DeFi protocols. It integrates the core advantages of OPStack technology and MoveVM to build an efficient blockchain network that supports cross-chain communication and multi-virtual machine interoperability, providing developers and users with secure, modular, and high-performance Web3 infrastructure. (February 14, 2025)

HashKey Group raised $30 million, with investors including Gao Rong Capital. HashKey Group is an end-to-end Asian digital asset financial services group that provides new investment opportunities and solutions for institutions, family offices, funds, and professional investors in the digital asset and blockchain ecosystem. The group offers a complete ecosystem across the digital asset space, including the venture capital fund HashKey Capital, blockchain node validation service provider HashKey Cloud, tokenization service provider HashKey Tokenization, as well as HashKey NFT, Web3 PFP incubation, and community operation service providers. (February 14, 2025)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。