In the field of digital asset investment, Ethereum (ETH), as the second cryptocurrency after Bitcoin, has always attracted significant market attention. It is not only a decentralized application platform but also a core representative of the "Blockchain 2.0" era. However, the recent price trends of Ethereum have led some investors to exclaim, "I can't take it anymore," even mocking Ethereum. So, in 2025, does Ethereum still hold investment value? This article will delve into the investment value of Ethereum, combining the latest market dynamics and technological development trends to explore its future potential.

1. Analysis of Ethereum's Investment Value

1. Pioneer of Smart Contracts: The Cornerstone of Blockchain Innovation

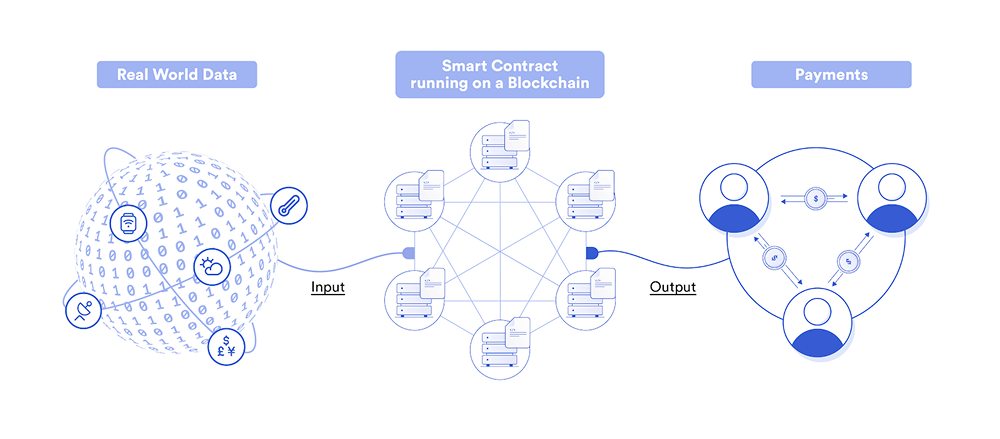

The launch of Ethereum marked the expansion of blockchain from simple transaction records to smart contract applications, with its powerful Ethereum Virtual Machine (EVM) supporting developers in building decentralized applications (DApps), thus promoting the widespread application of blockchain technology.

- Implementation of Smart Contracts: In 1994, Nick Szabo proposed the concept of smart contracts, and Ethereum truly realized it in 2015.

- Beyond Financial Transactions: Ethereum is not just a cryptocurrency; it is a programmable blockchain platform that promotes the implementation of Web3, DeFi, NFTs, and other applications.

- Early Applications: One of Ethereum's earliest smart contracts, the "Greeter" contract, laid the foundation for the prosperity of the DApp ecosystem.

2. Iterative Upgrades: Technological Evolution and Expansion

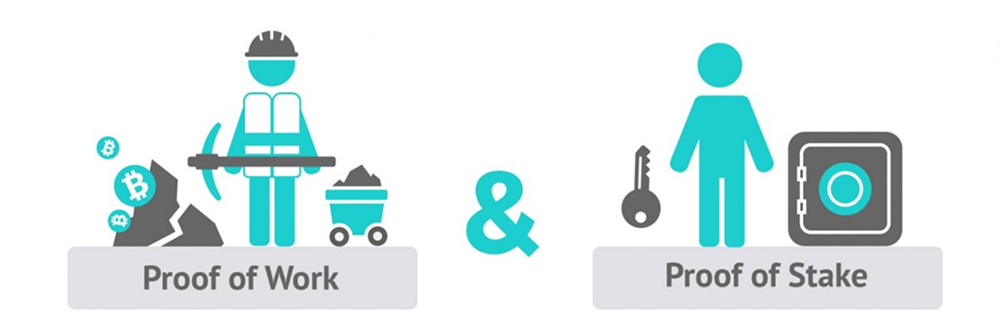

Ethereum continues to upgrade to enhance efficiency and scalability, transitioning from PoW to PoS, significantly reducing energy consumption and enhancing network security.

- The Merge (2022): Completed the transition from Proof of Work (PoW) to Proof of Stake (PoS), improving network energy efficiency and paving the way for scalability.

- Pectra Upgrade (2025): Improves transaction efficiency and enhances wallet social recovery features, further optimizing user experience.

- Future Upgrade Roadmap for Ethereum: Includes The Surge, The Scourge, The Verge, etc., aimed at enhancing scalability, decentralization, and security.

3. DeFi and DApp Ecosystem: The Core of Blockchain Finance

Ethereum is the core platform for decentralized finance (DeFi) and DApp applications, hosting a large number of financial and non-financial applications.

- Prosperity of the DeFi Ecosystem: Mainstream DeFi protocols such as Uniswap, Curve, MakerDAO, and Aave are all based on Ethereum, covering decentralized trading, lending, yield aggregation, and more.

- Preferred DApp Applications: DApps in areas such as NFTs, gaming, and social media are active on Ethereum, with high recognition from developers and users.

- Layer 2 Expansion Solutions: Layer 2 solutions like Optimism, Arbitrum, and zkSync significantly enhance transaction speed and reduce gas fees.

4. Recognition from Traditional Finance and Institutional Investors

In recent years, institutional investors and publicly listed companies have shown increasing interest in Ethereum.

- Institutional Entry: In Q4 2024, the institutional holding ratio of Ethereum ETFs increased from 4.8% to 14.5%.

- Financial Giants' Layout: Traditional financial institutions like BlackRock and Fidelity have launched Ethereum ETFs, indicating mainstream financial market recognition of ETH.

- Treasury Management: Companies like Oxbridge Re Holdings have included ETH in their reserve assets to hedge against inflation risks.

- The CFO of IntChains stated: Ethereum is viewed as "digital oil," with its blockchain infrastructure supporting numerous applications, and its future growth potential is considered far greater than that of Bitcoin. Compared to Bitcoin, the "digital gold," Ethereum has broader application prospects, its current valuation is underestimated, and it has significant room for future breakthroughs. Industry trends indicate that blockchain will be application-driven, and Ethereum is at the core of this transformation. In the long run, Ethereum is not only part of asset allocation but is also believed to drive corporate value growth due to its continuous upgrades and the efforts of its development team.

2. Competition and Challenges for Ethereum

1. Competition from Emerging Public Chains

Although Ethereum dominates the blockchain space, emerging public chains like Solana, Avalanche, and Polkadot pose challenges in terms of transaction speed and cost.

- TPS Comparison: Solana's TPS can reach 65,000, Avalanche around 4,500, while Ethereum's mainnet only achieves 15-30.

- Low-Cost Competition: Solana attracts users with low gas fees, and Avalanche's Subnet offers greater flexibility.

- Ethereum's Response Strategy: Enhancing performance through Layer 2 networks (such as Polygon and Arbitrum) to increase ecosystem stickiness.

2. Development Progress and Milestone Delays

Major upgrades for Ethereum involve extensive technical adjustments, and the development cycle is relatively long, making the market sensitive to changes in its progress.

- Pectra Upgrade Delay: The Pectra upgrade, originally scheduled for the end of 2024, has been postponed to early 2025 due to testing requirements.

- Complexity of Upgrades: Changes to Ethereum's protocol involve numerous technical adjustments, and testing and implementation may introduce uncertainties.

- Community Governance and Accelerated Optimization: The Ethereum developer community has reached a consensus to accelerate the protocol iteration speed to enhance competitiveness.

3. High Volatility in the Crypto Market

As a crypto asset, ETH still faces market volatility risks, and investors need to be aware of the potential for sharp price fluctuations.

- Market Sentiment Impact: Macroeconomic factors, regulatory policies, and technological developments can all affect ETH prices.

- Volatility Management: Institutional and individual investors can reduce risks through diversification and setting stop-loss strategies.

3. Summary and Outlook

Overall, Ethereum, with its technological innovation, ecosystem expansion, and institutional recognition, still possesses long-term investment value. The maturity of Layer 2 solutions, the advancement of the Pectra upgrade, and the approval of ETFs may become important factors driving ETH's value growth.

However, Ethereum faces competition from emerging public chains, delays in development progress, and market volatility risks, so investors need to carefully assess the market environment and grasp long-term development trends.

In the future, Ethereum's continuous upgrades and ecosystem expansion will determine its position in the blockchain industry, and its technological advantages and wide application scenarios may support its role as a cornerstone of the Web3 era.

Disclaimer: The above content does not constitute investment advice.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。