The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smokescreens!

Hello everyone, it’s a new day again. Yesterday I talked about the overall trend, and perhaps I was too pessimistic, causing many users to start panicking. After discussing the 120,000 high point, the exit of contract users also made many spot users question me, saying that the 150,000-180,000 level I mentioned before would not come? The three elements of a bull market I previously mentioned are the same; unless these three elements are achieved, there will be no absolute high point. Every major positive news can only push Bitcoin up by ten thousand points. If the three elements are achieved, at least we will touch the 150,000 level. The overall trend has not changed significantly; it’s just that the strategic part on the long-term level needs adjustment. Recent news observations are just to see which states can achieve strategic reserves first, which is still extremely important. As long as we reach 120,000, it will come; there is no need to panic too much. Regarding the interest rate cut issue, I need to discuss it in detail with everyone. Many analysts in the market believe that there will only be one interest rate cut this year, which is also influenced by the Federal Reserve's smokescreen.

My understanding, which I mentioned last year, is that there will be at least two cuts, or even more. Especially with the recent impact on the high-tech sector, causing a loss of AI-related stocks in the US, the probability of an interest rate cut will only increase. Moreover, everyone knows that all data before May or June may have issues. The only truly referenceable data will be released after June, which means that in half a year, we will see real employment and non-farm issues. The consideration for interest rate cuts can only be seen at that time. What I said about not considering interest rate cuts at the beginning of the year is indeed true for the plans in the first half of the year, so the impact can almost be ignored. Always remember, Trump is a president who supports interest rate cuts, and Powell's epic 50 basis point cut was also initiated during Trump's term; do not overlook Trump's presence. Last year's dot plot showed two interest rate cuts this year, and the adjustments in the financial sector can only confuse everyone in a smokescreen form. They can only release accurate data after discussions. At the beginning of the year, the Federal Reserve itself could not determine how many times it would cut rates, so we should not worry unnecessarily and estimate two cuts as a baseline.

Returning to the recent trend, I have talked too much about long-term plans, and I believe more users are concerned about short-term fluctuations. Many friends study technical indicators and see that Bitcoin has been showing a downward trend for nearly two months, combined with many analysts' so-called four-year cycle, the short-term view is basically bearish. I rarely mention linear technology; it is not without merit, but understanding linear aspects should mainly serve as an auxiliary. The wave of interest rate cuts combined with the fact that it has already been listed can be said to have almost set a lower limit for Bitcoin. Based on past trends, since Trump took office, Bitcoin surged to the 110,000 position and should have already corrected, even deeply to the level before the increase; this is the volatility that blockchain should have. I have mentioned before that blockchain is almost like tech stocks, belonging to future investments, and the nature of technology is to win through public opinion. The recent explosive growth in the AI field shows that investing in a 6 million company has already reached a valuation of over 10 billion. At the same time, the losses to American tech stocks have indirectly caused a loss of over 100 billion. This is the market generated by the combination of technology and finance, and the volatility will be very severe. However, Bitcoin has remained relatively stable during this public opinion storm, benefiting from its bottom-supporting ability after being listed.

Since the lower limit has been determined, the current trend cannot be blamed on short-term downward fluctuations. In my view, the current volatility is about clearing bubbles, but it should not be too forceful. After all, the strategic planning will not exceed three months, and nearly three states have almost completed their deployments, just waiting for the right time to announce. Overall, the US's interest rate cuts this year and various positive news later will not change my deployment plan for the year. I still see Bitcoin reaching the 120,000-150,000 level unchanged. Currently, the short-term fluctuations in the cryptocurrency market will be affected unless the US announces that the Bitcoin strategic reserve plan will not be implemented for the time being. If this news appears, it may cause a halving phenomenon in the current coin price. Therefore, my planning must focus on strategic deployment, prioritizing the US's plans. Everyone must not be blinded by technical aspects; at least for the entire month of February, the inflow of funds is greater than the reserves in January. The outflow of domestic funds has basically been completed, and large transactions will not appear temporarily. The negative technical news has also begun to be digested. Today, I will also present my deployment plan to everyone!

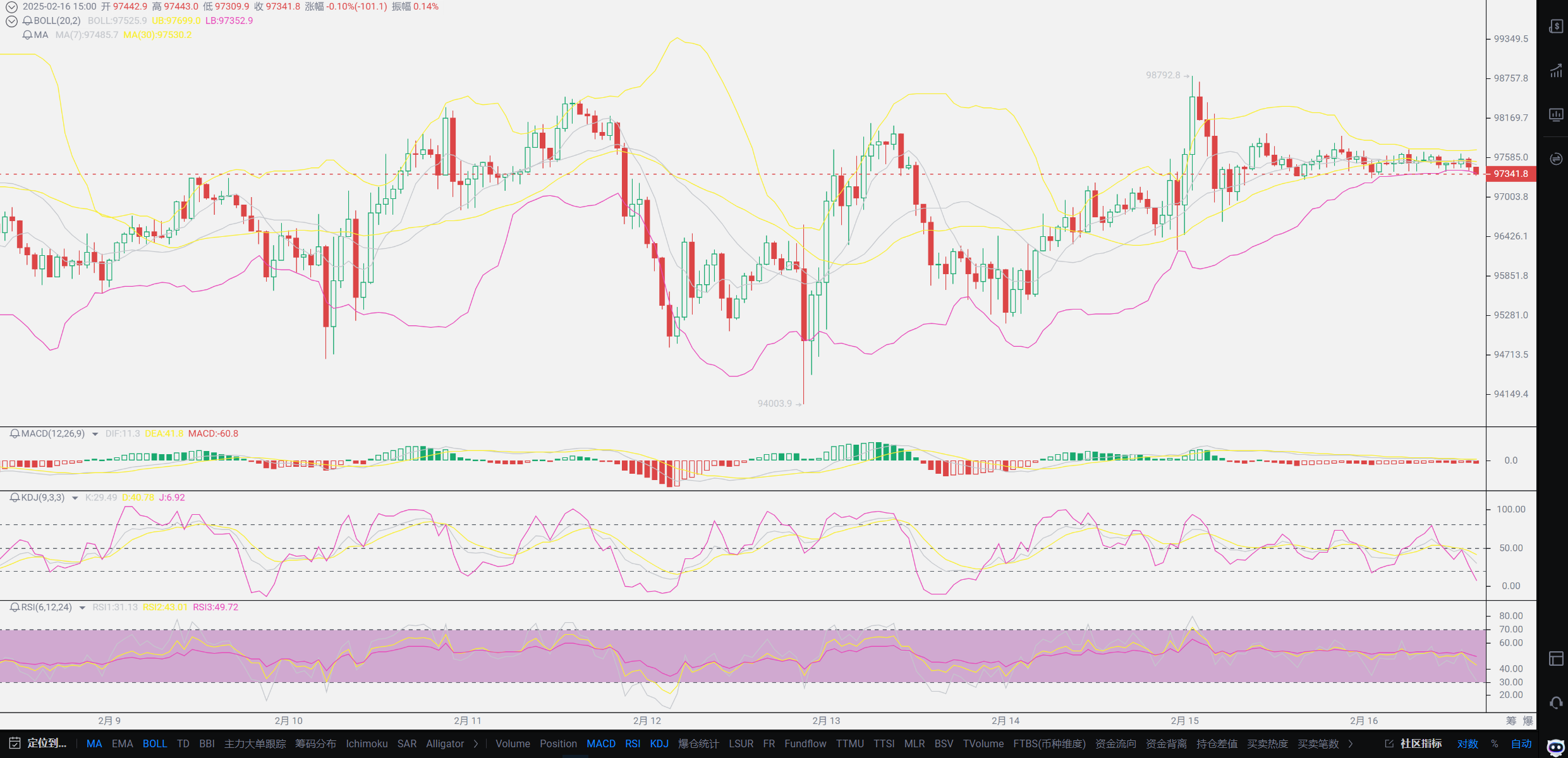

In summary, all the Bitcoin I entered at the 70,000 level remains untouched, still waiting for a higher position to appear. In the short-term contract direction, the current positions are mainly around 96,000, and everyone can choose to hold around this level. Ethereum is basically a mess, with an average price around 3,000, and it can be said that Ethereum is mainly at a loss at this stage. I have not considered entering Ethereum contracts for the time being. The average price of SOL is around 180, and it has not moved at high or low levels. Spot considerations are all about exiting this year, while contract considerations will be planned after reserves. I should also clarify that there is no clear exit timing for contracts; if you can achieve your psychological expected returns, you should be prepared to exit. For those who have not yet entered the market, you can consider arranging to enter in batches. The short-term trend I mentioned earlier is likely to be mainly bearish, but it will not create new lows; everyone should have a measure in their hearts. My investment philosophy differs somewhat from yours; when the bears come, what I foresee is mainly to ambush long positions, as the main theme this year is still growth. This article is somewhat pieced together; if you have any questions, feel free to ask me directly. As the Year of the Snake approaches and the New Year has just passed, everyone needs to be vigilant, especially not to go to unfamiliar platforms. Online investments also have issues. It is best to choose professional platforms. There are many trading investment platforms in Hong Kong that will involve the cryptocurrency market. Remember that currently compliant investments are mainly based on indices, and no other financial investment platforms can directly intervene in the cryptocurrency market. It is extremely important to raise personal fraud awareness. In my next article, I will explain the difference between purchasing power and GOP and their impact on the cryptocurrency market. Interested users can pay attention!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's Message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and plans for the big picture, not focusing on one piece or one area, aiming for the final victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。