Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.2 trillion, with BTC accounting for 59.94%, valued at $1.92 trillion. The market cap of stablecoins is $225.3 billion, with a 7-day increase of 0.62%, of which USDT accounts for 63.19%.

This week, BTC's price has shown range-bound fluctuations, with the current price at $97,725; ETH has also shown range-bound fluctuations, with the current price at $2,728.

Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen, including: BNX with a 7-day increase of 508%, CAKE with a 7-day increase of 77.65%, AI16Z with a 7-day increase of 54.32%, GRASS with a 7-day increase of 49.89%, and TRUMP with a 7-day increase of 33.55%.

This week, there was a net outflow of $602.4 million from U.S. Bitcoin spot ETFs; a net outflow of $26.3 million from U.S. Ethereum spot ETFs.

On February 14, the "Fear & Greed Index" was at 50 (higher than last week), indicating a neutral sentiment over the past 7 days.

Market Prediction: This week, the market has escaped the panic caused by "U.S. tariff increases." Even though the possibility of a rate cut in March is low, it has not significantly impacted the market. Altcoins have seen a substantial rebound and are currently in a consolidation phase. Both U.S. BTC and ETH spot ETFs have experienced net outflows, while stablecoins have seen a slight increase. Strategy has increased its holdings of BTC by $742.4 million at an average price of approximately $97,255, indicating that long-term holders are still entering the market.

The issuance of the U.S. presidential token TRUMP has created a wealth effect, prompting presidents from countries like Central African Republic and Argentina to follow suit. Currently, there are many opportunities to participate in on-chain MEME projects, but the risks are also high, as many trends are hard to sustain for a day. Hotcoin Research Institute selects popular assets and launches them promptly for user trading options.

Understanding Now

Review of Major Events of the Week

On February 10, Central African Republic President Faustin-Archange Touadéra announced the launch of the Meme coin CAR and disclosed the contract address via his official X account about an hour ago. It is currently unclear whether his account was hacked;

On February 10, the Texas Strategic Bitcoin Reserve Bill (Senate Bill 778) was submitted to the Senate Finance Committee for review on February 7;

On February 10, according to on-chain data, the Trump crypto project WLFI spent 156,667 USDC to increase its holdings of 273,937 Movement (MOVE);

On February 10, Strategy (formerly MicroStrategy) founder Michael Saylor posted on social media that Strategy has increased its holdings by 7,633 BTC at an average price of approximately $97,255, totaling about $742.4 million;

On February 11, North Carolina proposed a strategic Bitcoin reserve bill aimed at becoming the first state in the U.S. to purchase Bitcoin;

On February 12, according to the U.S. Securities and Exchange Commission (SEC) official website, Goldman Sachs submitted a 13F filing disclosing its holdings as of December 31, 2024, including over $1.5 billion in multiple Bitcoin spot ETF shares;

On February 12, the Trump crypto project WLFI announced the launch of the Macro Strategy plan, which aims to establish a strategic token reserve to support leading projects like Bitcoin, Ethereum, and other cryptocurrencies that are reshaping the global financial frontier;

On February 14, the NFT project Doodles announced the launch of its official token DOOD;

On February 14, Coinbase (COIN) released its Q4 2024 financial report, with Q4 revenue reaching $2.3 billion, far exceeding the market expectation of $1.87 billion, and a quarter-on-quarter growth of 88%. Among this, trading revenue was $1.6 billion, a quarter-on-quarter increase of 172%, with quarterly trading volume reaching $439 billion. Annual revenue was $6.6 billion, net profit was $2.6 billion, and adjusted EBITDA reached $3.3 billion.

Macroeconomics

On February 8, the SEC postponed its decision on BlackRock's Ethereum ETF options trading until April 9;

On February 13, after the CPI data was released, according to CME's "FedWatch," the probability of the Federal Reserve cutting rates by 25 basis points in March is only 2.5%, while the probability of maintaining rates is 97.5%; the probability of a cumulative 50 basis points cut by May is 0.2%, and the probability of a cumulative 25 basis points cut is 11.7%, while the probability of maintaining rates is 88.1%;

On February 14, U.S. President Trump announced the decision to impose reciprocal tariffs, expecting that tariffs for many countries will remain unchanged, and not to expect any exemptions or reductions. He will consider countries that adopt a value-added tax system as targets for tariffs, and practices of transporting goods through other countries to evade tariffs will not be accepted. However, the tariff policy will be delayed and may start on April 1;

On February 14, the SEC confirmed receipt of Grayscale's revised application for a spot XRP ETF;

On February 14, the SEC confirmed acceptance of Grayscale and the New York Stock Exchange's 19b-4 application to establish a DOGE ETF.

ETF

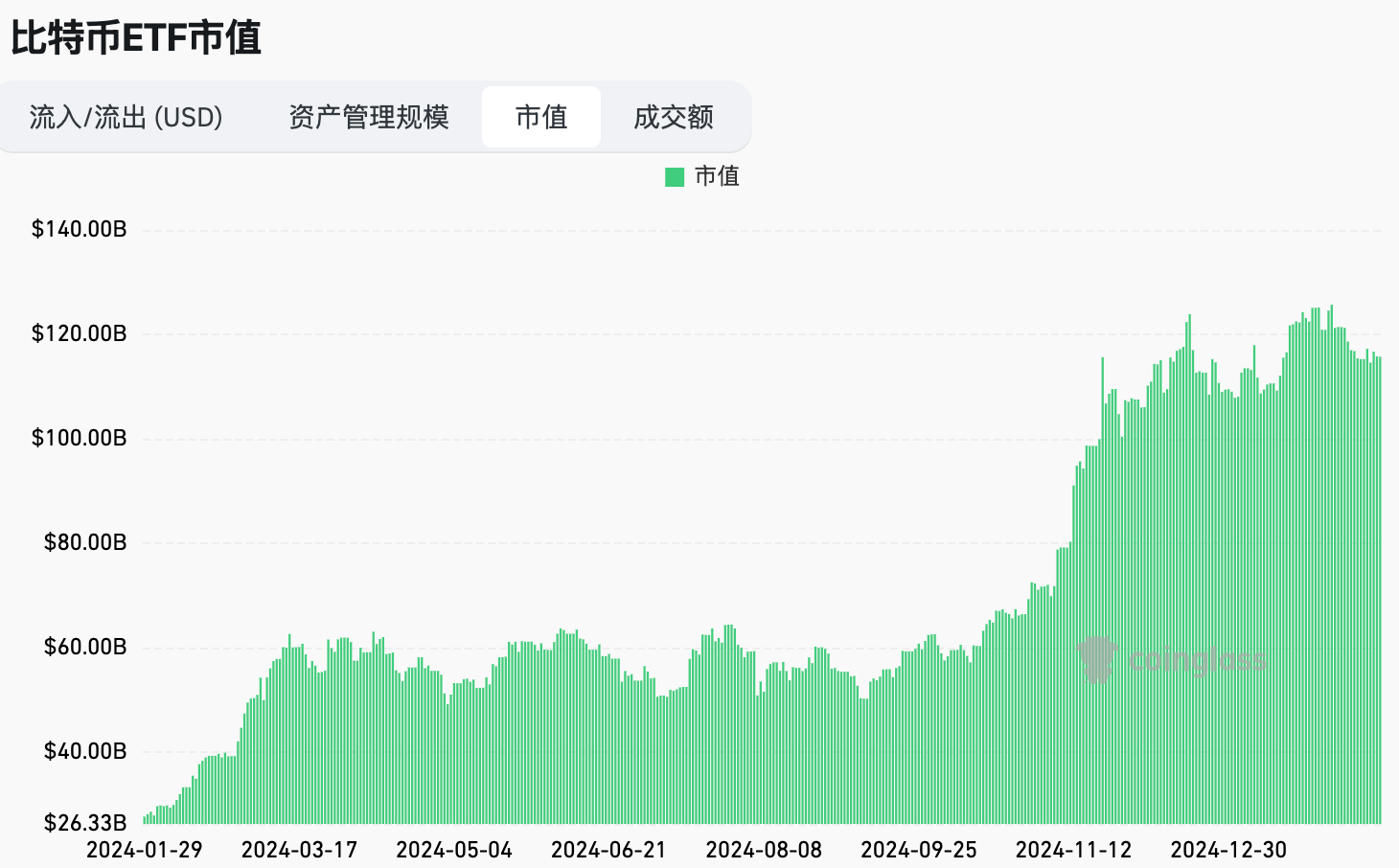

According to statistics, from February 10 to February 14, there was a net outflow of $602.4 million from U.S. Bitcoin spot ETFs; as of February 14, GBTC (Grayscale) had a total outflow of $21.967 billion, currently holding $19.472 billion, while IBIT (BlackRock) currently holds $57.087 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $115.748 billion.

There was a net outflow of $26.3 million from U.S. Ethereum spot ETFs.

Envisioning the Future

Upcoming Events

CoinDesk will hold Consensus Hong Kong from February 18 to 20, 2025, in Hong Kong;

ETHDenver 2025 will be held from February 23 to March 2, 2025, in Denver, USA.

Project Progress

The points activity of the consumer-grade public chain Morph will last until February 20, 2025, with 10% of its tokens allocated for community airdrops and ecological activity growth, totaling 1.6 million points. The activity will continue until February 20, 2025. Users can earn points through cross-chain asset transfers, paying gas fees, and inviting new users;

According to Cointelegraph, Telegram now requires third-party crypto wallets to use TON Connect and has restricted mini-programs to the TON blockchain, making TON the only supported blockchain network by Telegram.

Important Events

Coinbase Derivatives has applied to list SOL and HBAR token futures contracts on February 18 or later, with the standard contract size for SOL being 100 SOL (approximately $24,000) and the mini contract size being 5 SOL; HBAR contract size is 5,000 tokens. These contracts will be cash-settled monthly and cleared by CFTC-registered derivatives clearing organization Nodal Clear, LLC;

FTX will begin initial distributions to allowed claim holders in its Chapter 11 restructuring category on February 18, 2025. Initial distributions are limited to claim holders allowed in the planned convenience category before the completion of the distribution. Eligible creditors should receive their distributions within 1 to 3 business days starting from February 18, 2025.

Token Unlocking

ApeCoin (APE) will unlock 15.38 million tokens on February 17, valued at approximately $11.5 million, accounting for 1.54% of the circulating supply;

Polyhedra Network (ZKJ) will unlock 15.5 million tokens on February 19, valued at approximately $32.22 million, accounting for 1.55% of the circulating supply;

Immutable (IMX) will unlock 24.52 million tokens on February 21, valued at approximately $20.16 million, accounting for 1.23% of the circulating supply.

About Us

Hotcoin Research, as the core investment research department of Hotcoin, is dedicated to providing detailed and professional analysis for the cryptocurrency market. Our goal is to offer clear market insights and practical operational guidelines for investors at different levels. Our professional content includes the "Play to Earn Web3" tutorial series, in-depth analysis of cryptocurrency industry trends, detailed breakdowns of potential projects, and real-time market observations. Whether you are a novice exploring the crypto space for the first time or a seasoned investor seeking in-depth insights, Hotcoin will be your reliable partner in understanding and seizing market opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://www.hotcoin.com/ X: x.com/Hotcoin_Academy Mail:labs@hotcoin.com Medium:medium.com/@hotcoinglobalofficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。