Original: The DeFi Investor

Compiled by: Yuliya, PANews

Despite the recent sluggish performance of the cryptocurrency market, there are still profit opportunities that do not rely on the rise in token prices. In fact, beyond traditional traders and investors, many participants have achieved considerable returns in this field through other means. This article will delve into three profit models that do not depend on market trends from a technical and strategic perspective.

1. Airdrops and Yield Farming

In the current DeFi ecosystem, liquidity mining and airdrop mechanisms centered around leading assets like BTC, ETH, and SOL are becoming increasingly sophisticated. Taking the Pendle protocol as an example, its smart contracts support locking stablecoin assets to obtain a fixed annual percentage yield (APY) of 19%, as well as a fixed annual return of 12% on BTC assets. By optimizing strategy combinations and capital utilization efficiency, professional operators can achieve annual yields of 50-80% on stablecoins.

2. Short Arbitrage on High FDV New Coins

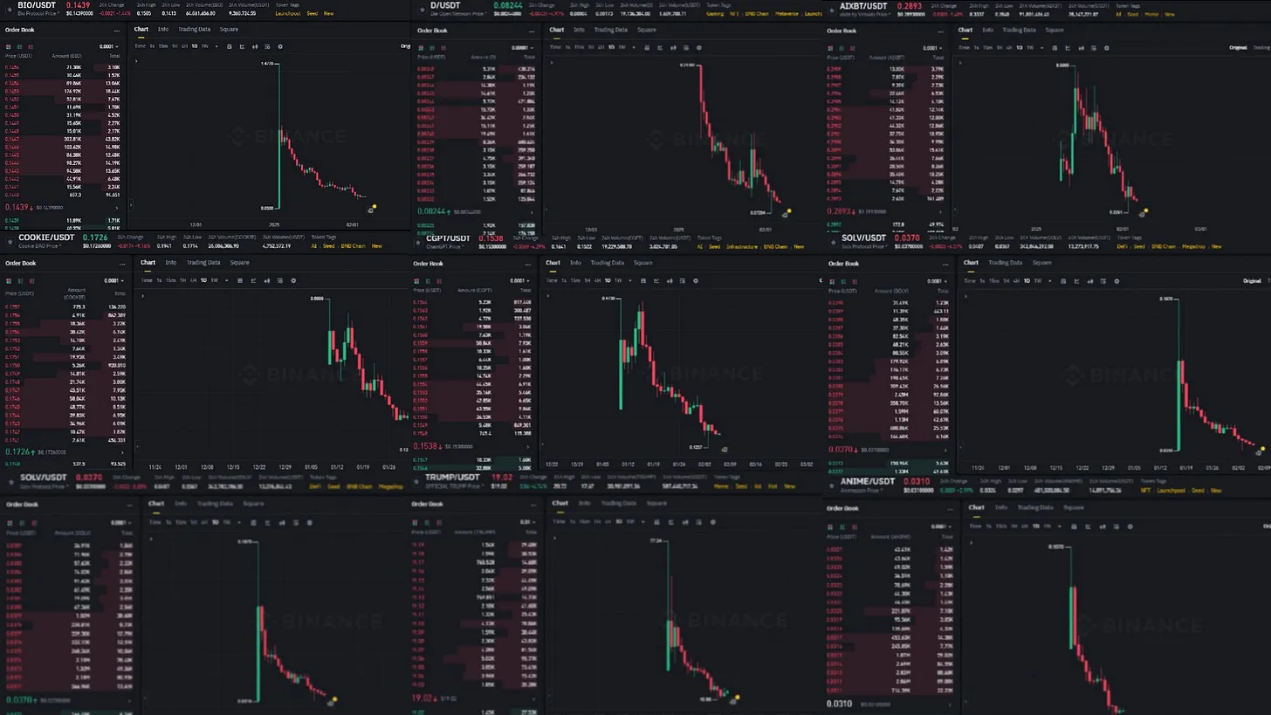

New tokens recently listed on Binance

Technical analysis of new tokens launched on Binance indicates that the vast majority of tokens show a significant downward trend after the TGE. This market phenomenon primarily stems from two core factors:

- Severe token decentralization: On-chain data shows that tens of thousands of tokens are issued daily.

- Imbalanced valuation system: Project teams tend to achieve early investor cash-outs through overvaluation models.

As the market often says, "Opportunities often lie within chaos." This market inefficiency provides professional traders with significant shorting opportunities. Derivatives trading platforms like Hyperliquid offer effective trading channels for short strategies by quickly launching perpetual contracts for new tokens. However, it is important to note that due to the high volatility characteristics of newly issued tokens, a low-leverage strategy is recommended to optimize the risk-reward ratio, and to accumulate strategic experience through small-scale trials.

3. Funding Rate Arbitrage (Delta Neutral Strategy)

In the pricing mechanism of the perpetual contract market, the funding rate serves as a periodic settlement mechanism for both long and short positions, providing significant profit space for arbitrageurs.

- When the funding rate is positive, longs need to pay fees to shorts;

- When the funding rate is negative, shorts pay longs.

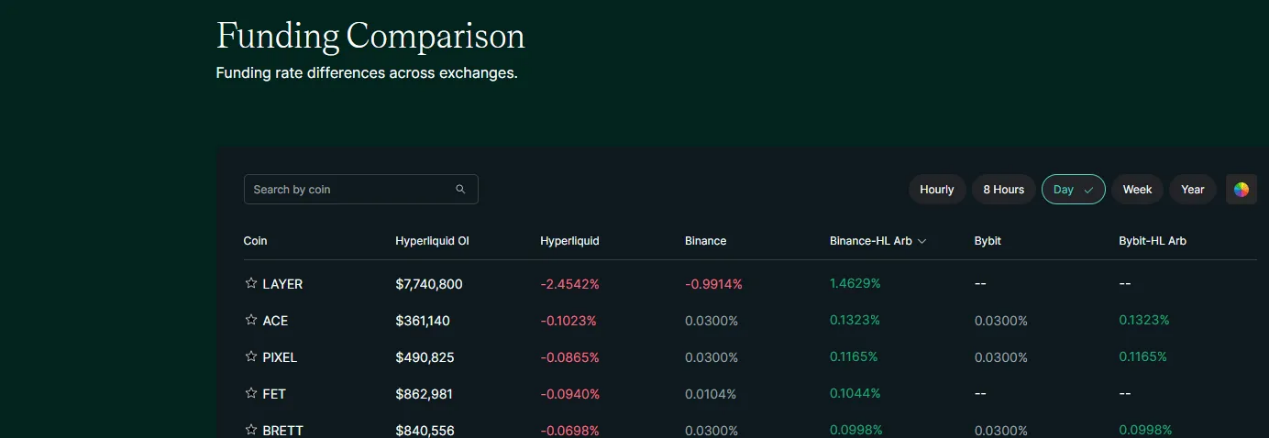

Professional traders can capture funding rate spreads by constructing Delta neutral portfolios. Specifically, when observing a significantly positive funding rate, one can simultaneously establish a $1,000 long position in BTC spot and a $1,000 short position in contracts (the funding rate can be monitored through the Coinglass platform), thereby obtaining stable returns through a market-neutral strategy.

Currently, protocols like Ethena and Resolv have developed automated funding rate arbitrage systems to provide users with passive income. However, through manual operation of multi-variety arbitrage strategies, although time-consuming, it may still yield higher returns. Investors can use the "Funding Comparison" feature on the Hyperliquid platform to find arbitrage opportunities.

Conclusion

Even during market downturns, there are still numerous opportunities in the cryptocurrency space. Contrary to common perception, there are still many inefficiencies in the crypto market, providing rich profit space for arbitrageurs. It is recommended that every participant should find a specific area they excel in and can profit from, and continuously refine their skills to strive to become an expert in that field.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。