Conveying the Way of Trading, Enjoying a Wise Life.

Key Points!

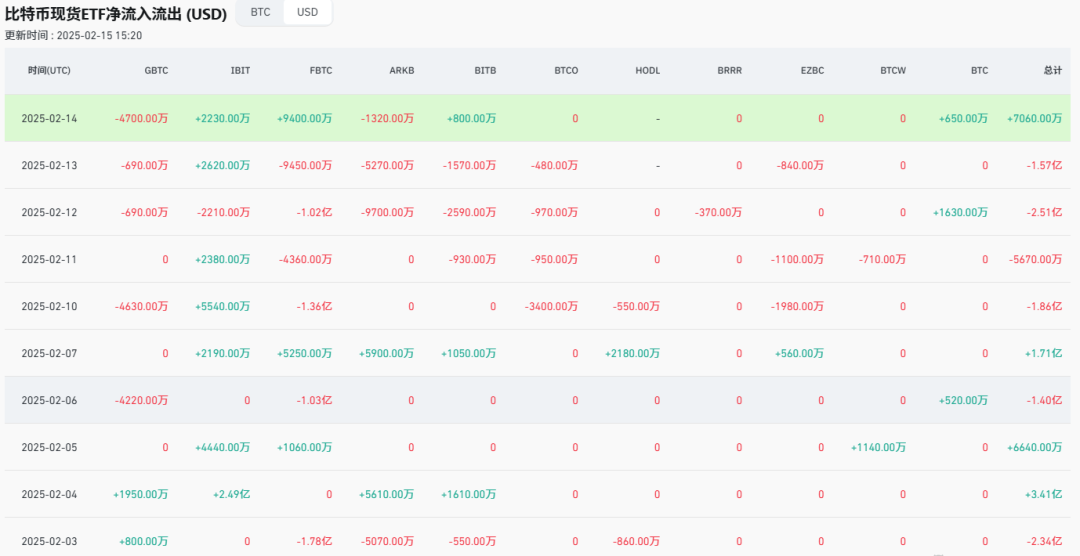

Behind the altcoin bottom-fishing rebound, BTC's ETF has seen a continuous net outflow of 600 million USD. Although there was a net inflow yesterday, the funds were only over 70 million USD, which is a rare phenomenon in recent months.

Recently, Bitcoin has been consolidating above 100,000 USD, while altcoins have been in a continuous decline, causing retail investors heavily invested in altcoins to suffer greatly, and they must maintain their faith because BTC is consolidating at a high level, which does not mean that a bull market does not exist.

However, there are ongoing controversies. Some say Bitcoin is a continuation pattern, and after consolidation, it will continue to rise to 150,000 USD. This key point dominated before the New Year, but in February, it faced a harsh reality check. Another viewpoint is that it is a top formation for distribution, the key is whether 92K will effectively break; if it breaks, it will lead to a rapid decline, with blood flowing like a river.

If we add the data of Bitcoin ETF net outflows, Brother Jiu's viewpoint is: the first step is Bitcoin covering the altcoin distribution, and the second step is the altcoin bottom rebound covering Bitcoin distribution. We cannot be complacent. Those who need to reduce positions and lower their holdings must do so and wait for a new round of layout opportunities.

Altcoin Opportunities

ETH has not seen a significant rise, but it has not broken below 2620 USD. The upper resistance level is 2820 USD; breaking this level will open up upward space. The previously scheduled Prague upgrade on March 6 has been postponed to April 8, this asset's price performance will be stronger than Bitcoin in the future. You may not believe this, but the ETF is gradually flowing in, while Bitcoin is seeing the opposite; the reason Bitcoin keeps consolidating below 30,000 points without breaking through may be that a certain mysterious big player is collecting enough chips.

Support at 2620 USD is a buy point; if it breaks, exit. Resistance levels are 2820 and 3030.

Yesterday's round of increases was led by Trump Coin, which rose by 50%, while the oversold WIF rose by 35%. Other non-meme coins like LISTA and MOVE also performed quite well.

Trump saw a significant increase yesterday, with a support level at 19.677, which can be used as an entry point. However, if the stop-loss level of 19 USD is broken, temporarily exit the position. It is important to note that on April 9, 2025, 4 million coins will be unlocked, and on July 19, 50 million coins will be unlocked.

WIF rebounded from an oversold condition yesterday, with a massive volume at the bottom. It belongs to the meme token on the Solana chain, having dropped from a high of 4.8 USD to 0.55 USD in the past two days, a decline of 90%. Like most altcoins, the drop has reached bear market levels.

MOVE rose by 13% yesterday, which is not outstanding, but the daily chart clearly shows a bullish divergence at the bottom. Support is at 0.55-0.57; if it breaks 0.53, exit. Another important reason is that Trump's son’s "World Freedom Currency" organization has been continuously buying MOVE, purchasing from 0.73 USD to 0.60 USD, indicating confidence in MOVE's future price trend.

LISTA is a token from the Binance ecosystem, with a support level at 0.2839; if it breaks, exit. It has recently broken through the bottom area and is now above 0.2839 USD, having doubled from the bottom, so there is no reason not to pay attention to it.

For the above assets, be cautious not to over-invest; have a medium to long-term layout time, and do not rush in all at once. Wait for a positive response from the macroeconomic environment before building positions on the right side.

【Crypto Investment VIP Golden Circle Limited Time Open】

In the era of getting rich through cryptocurrency, are you still a "feeling trader" like a chive?

We have created【Five Major Ace Services】for investors who refuse to be mediocre, directly addressing three major pain points:

❌ Can't understand market trends, always chasing highs and cutting losses?

❌ Only have a superficial understanding of technical analysis, holding positions feels like a roller coaster?

❌ Always buying at peaks and selling at troughs, missing out on millions in profits?

Join VPI to enjoy five explosive-level benefits:

1️⃣ 【Real-time Trading Plans】Top mentors customize offensive and defensive strategies, providing precise daily points + position management, saying goodbye to emotional trading.

2️⃣【Premium Technical Arsenal】20 hours of in-depth analysis of on-chain data/volume-price relationships/candlestick patterns, hands-on training to develop trading intuition.

3️⃣【Top-Taking Warning System】Exclusive "Whale Address Tracking Method" + "Multi-Cycle Resonance Model," capturing crash signals 72 hours in advance.

4️⃣【Investment Philosophy Training Book】The first practical guide revealing the "Philosophy of Cryptocurrency Trading and Investment" (VIP exclusive).

5️⃣【Weekly Opportunity Radar】Institution-level market analysis, live breakdown of ambush points every Saturday at 8 PM.

Special benefit: The first 100 sign-ups will receive the "Top and Bottom Signal Ten Golden Rules" crypto column, teaching you to use "counterintuitive thinking" to lock in excess profits during surges!

Join to escape the fate of being a chive, and let every BTC work hard for you!

For more information, you can follow our media account【No. 7 Crypto Academy】or contact our assistant to join the VIP. You can also gain access to our bottom-fishing and top-taking column content through sharing, commenting, and liking.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。