Master Talks Hot Topics:

First, let's talk about Abu Dhabi's sovereign fund Mubadala investing $460 million in Bitcoin spot ETFs, which is one of the factors pushing Bitcoin's price to $98k. Although the price has slightly retreated now, it has still provided a small stimulus to the market.

After all, sovereign nations are starting to invest in cryptocurrencies, especially this wealthy country, it feels like a big player in the financial world has given us a little buff, who wouldn't be happy?

Next, let's discuss the National Bank of Dubai and Citibank, both of which have announced that they can accept cryptocurrency custody. Although the details are not yet fully clear, with Bitcoin starting to be accepted for custody, it is estimated that more banks will join in the future. Will custody + collateralized lending be launched soon?

As for whether Bitcoin should enter a bear market now? This has been a question many fans have asked me, and opinions vary. How is a bear market defined? Is it based on the length of the adjustment period or the magnitude of the decline? For example, the adjustment from March to November last year lasted more than half a year and dropped by 33%. Does that count as a bear market?

Actually, it’s hard to determine, but from a historical perspective, if this time it really touches the cycle peak, then the decline won't be as severe as previous bear markets, after all, the market's recognition of Bitcoin and the consensus in the financial world are different now.

Even if we encounter a black swan event like the pandemic in 2020, the price may drop, but it will quickly be bought back by the market. So, I personally believe that Bitcoin's price is unlikely to drop significantly to the depths of previous bear markets.

Now, let's talk about altcoins. Everyone knows that for altcoin markets to heat up, two conditions must be met: liquidity and an enticing story, and it’s best if this story cannot be easily debunked in the short term.

Liquidity seems to be less rampant than in 2021, but to be honest, does the crypto space still lack sufficient liquidity? The total market cap of the entire crypto space is still less than that of a single Nvidia stock, with 60% still in Bitcoin.

So, is there not enough money in the world to speculate on altcoins? Just look at the recent Hang Seng Tech Index, DAX Index, and gold prices; they all need liquidity overflow, while altcoins? They seem to be in a neglected corner.

The problem with altcoins is not liquidity, but rather the lack of a sufficiently "sexy" story that can attract market funds towards them. The previous hype stories have already been debunked, and the new stories are not even believed by insiders in the crypto space.

So when will the altcoin season come? It will either be when liquidity is so abundant that money cannot be placed anywhere else, or when a certain story suddenly becomes popular, giving everyone a new belief in altcoins, thinking they can be speculated on again.

Master Looks at Trends:

Resistance Levels Reference:

First Resistance Level: 98800

Second Resistance Level: 98200

Support Levels Reference:

First Support Level: 97400

Second Support Level: 96800

Today's Suggestions:

Bitcoin is currently forming a convergence in a downward range and is testing the top of the converging triangle. Before the rebound, the K-line experienced a sharp decline. There have been frequent washout actions, and although I personally have high expectations for Bitcoin's rise, the market sentiment over the weekend remains unstable, so I suggest adopting a conservative trading strategy for short-term trades.

Although it broke through the top of the converging triangle in the morning, we still need to pay attention to the movements within the box. If it holds the first support, the possibility of a rebound in the short term still exists, and the rebound view can be maintained. If it breaks this support, short-term traders can also look for entry opportunities around the 60-day moving average.

As the lows gradually rise, the support also needs to be adjusted upwards, so when entering the market, the second support can be referenced, and the movements of the 20-day and 60-day moving averages should be monitored to determine the timing for entry.

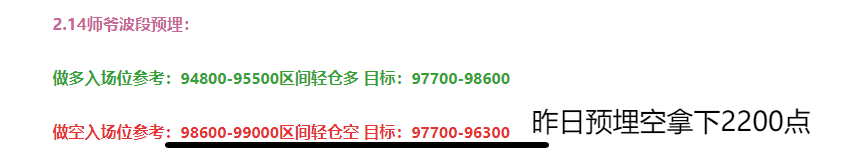

2.15 Master’s Wave Strategy:

Long Entry Reference: Lightly buy in the 96500-96800 range, Target: 98200-98800

Short Entry Reference: Lightly sell in the 98800-99200 range, Target: 98200-97400. If the bulls are strong, a direct short can be placed near 101000, Target looking at 1000-15000 points.

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen), with the same name across the internet. For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about K-lines, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with quality experience projects like community live broadcasts!

Warm reminder: This article is only written by Master Chen on the official account (as shown above), and other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。