"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis articles, but they may be hidden among the information flow and trending news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and saving from the content published in the past 7 days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment and Entrepreneurship

Understanding the Crypto Market Cycle: What Makes This Cycle Different?

The biggest difference in this cycle is the role of institutional capital, with institutions adopting a strong push for Bitcoin.

Market dilution: The number of altcoins has surged, shrinking profit margins.

Retail liquidity is being attracted to new mechanisms outside of traditional spot trading (on-chain).

Should We Escape the Crypto Market Now? Nearly 20% of Indicators Have Topped and Receded

Biteye analyzed 15 commonly used escape indicators and found that one-fifth of them have already reached the escape zone in 2024, including: Bitcoin Rhodl ratio, USDT current financial management, and altcoin season index.

Crypto Market Interpretation: Is the Bull Still Here? Is There a "Rescue Day" for Altcoins?

The Altcoin Casino: How to Find Your Table?

Currently, Bitcoin's capital flow has completely decoupled from other cryptocurrencies, forming an independent ecosystem.

Comparing the altcoin market to a casino, it is only a good time to participate when there is ample capital flow in the casino (i.e., high net inflow). Choosing the right table (i.e., investment target) is equally important.

The sources of capital inflow in the altcoin market include new capital inflow, token buybacks, and destruction. Outflows of casino funds include large capital withdrawal events, tool-driven continuous capital withdrawals, Cabal withdrawals, presale models, VC token unlocks, and deleveraging.

Frequently used L1s (like SOL and ETH) and products that can generate high income (like HYPE) have the potential to create positive-sum games.

As for the situation in 2025: too many tables, but too few players. In the future, the altcoin market may be triggered by some unexpected events.

From HODL to Daily Meme: How to Find a Way to Survive in a Highly Fragmented Market?

The traditional "buy and hold long-term" strategy, which worked in early cycles, is no longer applicable. Holding periods have become shorter, shrinking from weeks to just days. If the portfolio does not heavily invest in BTC and SOL, it may suffer significant losses.

The current market presents multiple narrative-driven small cycles, each with its own peaks and troughs.

Key factors that previously drove bull markets, such as loose monetary policy and retail investor enthusiasm, seem less significant in the current environment. Capital is more circulating within the crypto ecosystem.

Most institutions struggle to truly understand the core of projects, suitable for short-term execution rather than brand building. In contrast, excellent internal marketing talent has more long-term value, able to delve into the industry, learn proactively, and build genuine industry connections. Ultimately, the success or failure of marketing depends on the initiative of the project itself, not the commitments of institutions.

Airdrop Opportunities and Interaction Guides

Review of 5 Zero-Cost Interactive AI Projects (with Detailed Guide)

Sahara AI, O XYZ, ChainOpera, Fraction AI, Singularity.

Meme

Arthur Hayes: The Future of Political Memecoins

With the advancement of technology, information can be disseminated faster and cheaper to a larger audience, and the connection between politicians and the people they govern has become more direct. As rulers become more humanized, they must adapt to how they communicate their political agendas to the public. Humanization is not always beneficial for politicians, as the public quickly realizes they are as foolish as they are.

Political Memecoins provide zero-knowledge proofs of political popularity. Specifically, as an individual, you can now privately support politicians by purchasing their memecoins. Politicians can understand the true opinions of the public. The rise of Polymarket exemplifies this phenomenon. If the goal is to have a globally accessible, easy-to-understand, and impossible-to-ban measure of popularity, then trading political Memecoins on DEX is the perfect tool, possessing the three attributes of global accessibility, ease of understanding, and impossibility of prohibition.

Memecoins are the best political participation tools ever. They directly link economic benefits to each voter's voting support, rather than just to large campaign donors.

Ethereum and Scalability

In-Depth Exploration of Ethereum's Issuance and Destruction: A Cat-and-Mouse Dynamic

BTC and ETH are expected to win the internet currency war, with decisive factors being credible neutrality, security, and scarcity. Since Ethereum's merge, ETH has become scarcer than BTC.

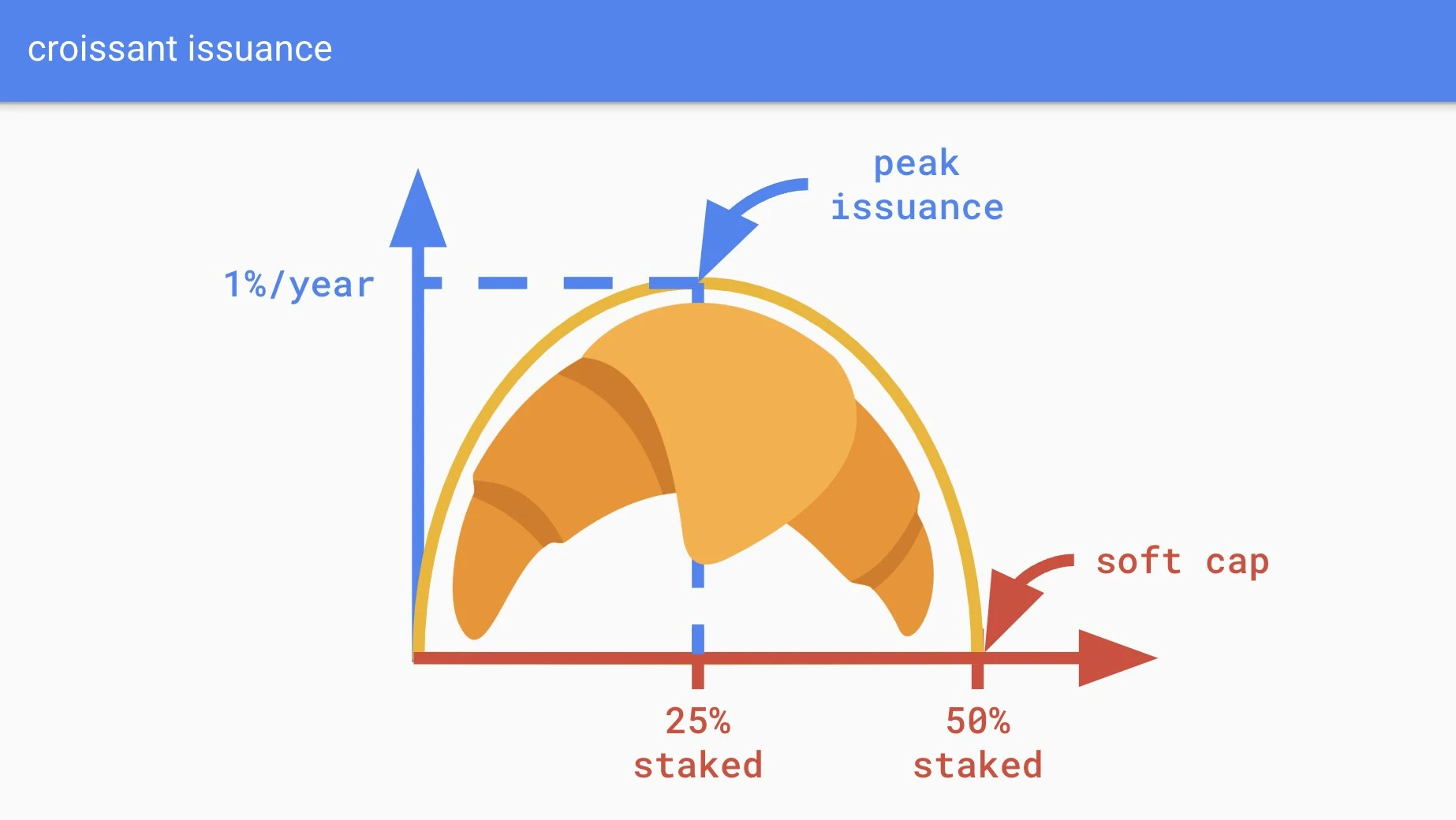

The current issuance curve of ETH is a trap. When most ETH is staked, it faces losses.

The issuance curve should be driven by competition among stakers to discover a fair issuance rate—rather than arbitrarily setting a 2% lower limit. This means that as the amount of staked ETH increases, the issuance curve must ultimately decline and return to zero.

Croissant Issuance

A sustainable way to destroy a large amount of ETH is to expand data availability. In the coming years, the supply and demand will engage in a cat-and-mouse game until the complete deployment of Danksharding is achieved.

Is No One Bottom-Fishing ETH? A Look at the Whale Bottom-Fishing List

The article organizes transactions on the Ethereum chain from February 3 to 10, where single swaps exceeded $200,000, revealing that whales have made significant purchases of multiple tokens.

These data indicate that despite overall market volatility, whales are actively positioning themselves in specific tokens, possibly signaling their confidence in these projects or expectations for future market trends.

Multi-Ecosystem and Cross-Chain

Exploring Opportunities in Solana's Re-Staking Market: Perhaps Greater Potential than Ethereum

Re-staking allows staked assets to be reused across multiple decentralized services, or as Jito calls it, Node Consensus Networks (NCNs). It enhances the security and integrity of decentralized services, allowing them to leverage the economic security of L1 without expending significant resources to design their own security models (which are often more fragile). For stakers, it also improves capital efficiency, as a single asset can simultaneously provide security for multiple decentralized services, potentially yielding higher capital returns.

Solana's maturity is sufficient to support re-staking; re-staking on Solana has greater potential than on Ethereum; re-staking can drive innovation in the Solana network and optimize capital efficiency for DeFi users.

Dissecting the SVM Arms Race: Insights into the Competition Among Solayer, SOON, and Sonic SVM

The article dissects the deep logic of this SVM arms race from three dimensions: underlying architecture, ecological strategy, and market positioning.

Today, simply copying the EVM architecture + TPS numbers can no longer meet the evolutionary needs of Web3. The blockchain war has shifted from a "narrative battle" to an "execution environment revolution," especially as the Solana Virtual Machine (SVM) completes architectural upgrades and attracts new developers. Its essence is not to replace a public chain but to potentially reconstruct the entire technical paradigm of smart contract execution layers. SVM supports parallel processing of transactions, extending Solana's influence.

After Solayer, Where to Move Idle SOL for Maximum Profit?

Meteora, Fragmetric, Sanctum, Perena.

The secondary market includes BNX, CAKE, BAKE.

Binance Alpha features BOB, KOMA, BANANA, CGPT, MONKY.

Four.meme origins include Queen YI, CZ, binancedog, cakedog.

The reasons AO has been overlooked may include: this token issuance did not bring much expectation to the market; while network activity has indeed increased, it still maintains a relatively low overall level.

However, the AO ecosystem is still in its very early stages.

Also recommended: 《Review of 32 BNB Chain Ecosystem Projects Listed on Binance: Average Increase of Nearly 26%》《Interpreting the BNB Chain 2025 Roadmap: Anti-MEV Protection, AI Priority, Meme Coin Support》。

DeFi

Current Development Status of DeFi Segments: Overall Oligopolistic Structure

The core of DeFi is to provide more innovative and efficient systems that address the inefficiencies of TradFi through validated PMF (Product-Market Fit). DeFi is also composed of several key areas, which typically follow an oligopolistic structure.

As DeFi enters the next expansion phase, we will see more new verticals introducing untapped markets, even integrating into CeFi.

Weekly Hot Topics Recap

In the past week, the President of the Central African Republic issued a token; CZ released a photo of the pet dog Broccoli (Background), and a large number of similarly named Memes engaged in fierce competition;

Additionally, in terms of policy and macro markets, the Federal Reserve's monetary policy report: plans to stop balance sheet reduction at the appropriate time; Federal Reserve Chairman Powell: the Fed does not need to rush to cut interest rates; Trump has instructed Musk to review the U.S. Department of Defense's spending; market news: lawsuits have been filed by various states in the U.S. to block Musk's government efficiency reform (DOGE) from accessing government payment systems; crypto companies like Uniswap and Kraken are hiring well-connected Washington lobbyists or policy experts; the SEC has accepted the Solana spot ETF applications from 21Shares, Bitwise, Canary, and VanEck; the SEC has received DOGE ETF applications submitted by Grayscale and NYSE; Binance and the SEC submitted a joint motion to pause the lawsuit for 60 days due to the SEC's cryptocurrency working group potentially intervening in the case; Hong Kong's investment immigration has officially recognized Bitcoin and Ethereum as proof of assets; the former deputy director of Beijing's Financial Bureau has been sentenced to 11 years for alleged Bitcoin money laundering;

In terms of opinions and voices, Bloomberg: Wall Street banks are betting on the crypto industry IPO boom, expanding related businesses; Dragonfly partner: Bitcoin dominates, altcoins are sluggish, but the Meme cycle is not over yet; Bitwise Chief Investment Officer: Retail sentiment is low, which may indicate a huge opportunity for altcoins; analysis: after Powell stated that the Fed does not need to rush to cut interest rates, the altcoin market reacted calmly, possibly indicating it has bottomed out; CZ: TST is unrelated to BNB Chain or any Binance-related team, and it involves issues of Binance logo infringement; CZ: users need to manage risks themselves, and if they cannot bear downward volatility, they should not engage with Memes; Coinbase Chief Policy Officer discusses the process for listing Meme coins: avoiding token narratives as much as possible, using strict standards to maintain rigor; StarkWare co-founder: Starknet is about to become the first network to settle simultaneously on Bitcoin and Ethereum; Kanye: someone offered me $2 million to launch a Meme coin, but I declined; the law firm suing Pump Fun claims it is facing violent threats and doxxing;

Regarding institutions, large companies, and leading projects, WLFI launched a strategic token reserve "Macro Strategy" supporting Bitcoin, Ethereum, and other crypto projects; OpenSea Foundation: will soon launch the SEA token; Solayer opened LAYER airdrop claims; Story's initial incentive plan announced: accounting for 10% of total IP, strict anti-witch measures will be implemented from the mainnet launch date; Story's mainnet launched, and IP airdrop claims have started; Pi Network will launch its mainnet on February 20; Arweave's computing platform AO mainnet launched and introduced a native token, with 36% allocated to AR holders; crypto KOL: rumors suggest pump.fun plans to adopt a Dutch auction model to publicly raise funds on multiple exchanges Doodles officially announced the issuance of tokens and listing on Solana;

In terms of security, Slow Mist's Yu Xian: the Central African President's token CAR is high risk, beware of toxic issues on the official website; four.meme: currently under malicious attack, the team has suspended token trading on DEX, internal fund security… well, another abstract week.

Attached is the portal for the "Weekly Editor's Picks" series.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。