Be Cautious in the Beginning to Ensure Success in the End

Hello everyone, I am the trader Gege. It has been a while since I updated a long article on Bitcoin. I took a look at the market and would like to share some thoughts on the future.

Before we begin, let me briefly mention the short-term trading of my assistant. The short-term trading has been consistently updated, but during the Spring Festival, it was also in a period of rest and adjustment, so updates were relatively few. This week, the support level for buying was set at 2580-2550, and there were still some gains.

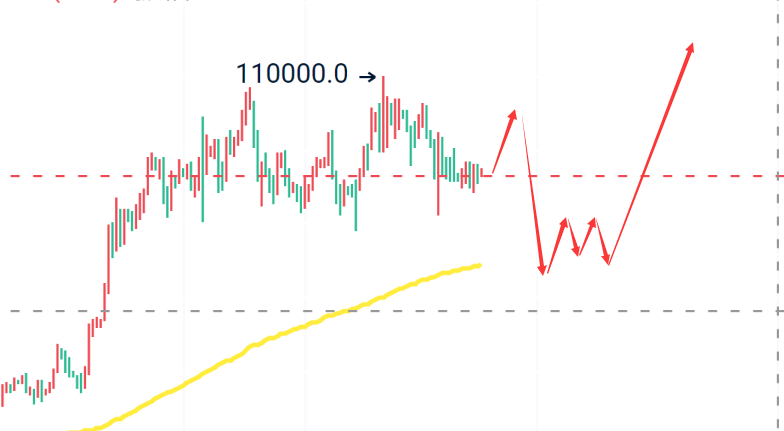

Back to Bitcoin, let's discuss from a technical perspective. Since the spike to 110,000, there has been a pullback into adjustment, and it has not broken below 90,000. The weekly candlestick has formed a short-term topping structure, and the indicators currently do not show any significant signals supporting a strong upward trend.

On the daily level, there has been a continuous oscillation above the lower band for several days. From a structural perspective, this can be seen as either a bottoming formation or a continuation adjustment phase of a downward trend. Therefore, the current market direction is unclear, with a 55% probability for both bullish and bearish outcomes.

Today's article will start from my subjective viewpoint, providing some preliminary estimates. This is not for short-term reference but is suitable for making trend predictions in advance. Once the price is reached, one can enter with a trial-and-error mindset, acting only when the probability is high, which makes the cost of trial and error acceptable.

I will first provide my view on the market trend and then refer to entry positions based on that view. Firstly, I assume that the bull market has not ended and I am optimistic about a subsequent phase of a crazy bull market, which is the bullish tail.

From the current price perspective, there are two possible scenarios. The first scenario is a rebound to the 103,000-105,000 range, followed by a pullback to the 85,000-83,000 range. This area is also near the daily EMA200. In an extreme case, it might slightly break below 80,000, hitting the 79,000-77,000 area to form a bottom before starting a rebound to 130,000-150,000. The second scenario is a pullback first, following the same price movement as above.

Based on the above estimation, the first thing to do is wait. Wait for the market to reach the price before deciding to enter based on the closing conditions of the candlesticks at that time. The trend differs from short-term trading. If the price is reached, then attempt to enter; if not, do not participate and focus on short-term trading instead, which will be updated separately.

Specific operational suggestions for the trend: Short at 103,000-105,000, Long at 85,000-83,000, and if it reaches 79,000-77,000, leverage can be added for spot trading.

PS: You might say that such operational suggestions have prices that are too high or too low. Please take a closer look at the reasoning; this is the estimated trend for the larger cycle.

The suggestions are for reference only. Ensure proper risk control when entering the market, and manage profit and stop-loss spaces on your own. Specific strategies should be consulted based on real-time conditions.

Alright, friends, we will see you next time. I wish everyone success in their trading endeavors and smooth sailing in the crypto world! More real-time suggestions will be sent internally. Today's brief update ends here. For more real-time advice on Bitcoin, find Gege.

Written by/ I am trader Gege, a friend willing to help you rise again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。