Macroeconomic Interpretation: Today, I came across several updates regarding the approval progress of altcoin ETFs, and it seems that the U.S. SEC's attitude towards other cryptocurrency ETFs is subtly shifting. In the wake of the approval of the Bitcoin spot ETF, "non-mainstream players" like Litecoin, XRP, and Dogecoin are sprinting into the regulatory spotlight—Bloomberg analysts jokingly referred to Litecoin as having "run to third base," indicating its lead in progress. Grayscale's XRP and DOGE ETF application amendment documents have been successively received by the SEC, suggesting that the finish line of this regulatory marathon is opening up to more crypto assets.

From market signals, the advancement of altcoin ETFs is certainly not coincidental. Although Bitcoin ETFs still dominate the market's focus, the SEC's "ambiguous attitude" towards Litecoin has triggered a chain reaction: as a "lightweight fork" of Bitcoin, Litecoin's faster transaction speed and lower energy consumption have evidently caught the regulators' attention due to its decade-long reputation in the payment sector. Bloomberg analyst Balchunas's baseball metaphor, while humorous, aligns with Wall Street's tradition of "buying the expectation"—when institutions start betting on the LTC ETF, this "digital silver" may indeed replicate the capital-raising myth of the Bitcoin ETF.

In contrast, the narrative surrounding the Dogecoin ETF is more dramatic. This meme coin, which started as a joke, has made its way to the NYSE application table, and Grayscale's actions can be described as "performance art." However, delving into its logic, the community size of over 5 million DOGE holders and Musk's continued support compel regulators to acknowledge its market influence. Interestingly, the day after the SEC accepted the application, DOGE's price volatility plummeted by 15%, as if the market collectively held its breath waiting for the regulators to "unbox" their decision. If the Dogecoin ETF successfully passes, it will not only create the most absurd financial product comeback in history but may also open Pandora's box for similar coins like SHIB.

XRP's situation resembles a sequel to a legal drama. After three years of litigation with the SEC, the ETF amendment document submitted by Grayscale is seen as a "technical breakthrough" in the industry. By deeply bundling XRP with the custody and compliance framework of the Bitcoin spot ETF, Grayscale is clearly attempting to use "regulatory arbitrage" to break the deadlock. Although the SEC has not revealed its cards, XRP futures open interest surged by 40% after the news broke, indicating that the market is betting on this "Avengers-style" comeback.

The impact of this altcoin ETF race on the crypto market goes far beyond surface-level excitement. From a funding perspective, the "siphoning effect" of the Bitcoin ETF may be diverted—when institutional investors can allocate ETFs in more volatile assets like LTC and DOGE, Bitcoin's status as "digital gold" may face a reevaluation. However, from another angle, the emergence of more compliant products is also accelerating the integration of the crypto market with traditional finance. According to Chainalysis data, the increase in altcoin holdings in institutional wallets over the past three months has reached twice that of Bitcoin, suggesting that this "diversified allocation" trend may give rise to a new market structure.

For regulators, the balance of approval standards is akin to walking a tightrope. If they batch approve altcoin ETFs, it would certainly showcase innovation and inclusivity, but assets like Dogecoin, which lack fundamental support, could spark greater controversy. SEC Chairman Gensler's recent statement that "the crypto market needs to be cleaned up" suggests that regulatory standards will not be lowered. Interestingly, all three ETF applications chose to amend terms rather than confront directly, and this "regulatory jiu-jitsu" may be the key to breaking the deadlock—just as a savvy surfer does not fight the waves but instead rides them.

In this transformation, Bitcoin's role increasingly resembles that of the "stabilizing force" in the crypto world. Despite facing pressure from capital diversion, the Coinbase Research Institute points out that whenever favorable news about altcoin ETFs is released, Bitcoin's futures open interest tends to grow simultaneously, indicating that the market views it as a risk-hedging tool. This "big brother-little brother" ecological relationship mirrors the linkage effect between gold and commodities in traditional markets. If more altcoin ETFs are approved, Bitcoin may not fall from its throne; instead, it could leverage higher liquidity to become the "ballast" in institutional portfolios.

The most pressing suspense in the current market is: what kind of chess game is the SEC playing? Observing the operational rhythm, it seems that regulators intend to test the market's capacity through a gradient of approvals—first allowing Bitcoin to establish a framework, then exploring compliance paths for payment tokens like Litecoin, and finally addressing controversial assets like XRP and DOGE. This "gradual pressure" strategy can avoid systemic risks while leaving room for innovation. For investors, rather than getting caught up in the success or failure of a single ETF, it is more beneficial to focus on the paradigm shift behind this regulatory experiment: as cryptocurrencies upgrade from geek toys to financial infrastructure, the entire industry's valuation system will undergo a reset.

At this moment, the crypto market resembles a child waiting for Christmas gifts—only the gift box may contain either candy or a prank toy. The only certainty is that regardless of what type of surprise the SEC ultimately delivers, this ETF frenzy is reshaping the rules of the game: when mainstream institutions begin to vote for altcoins with real money, the crypto world may indeed shed its "marginal market" label.

Data Analysis:

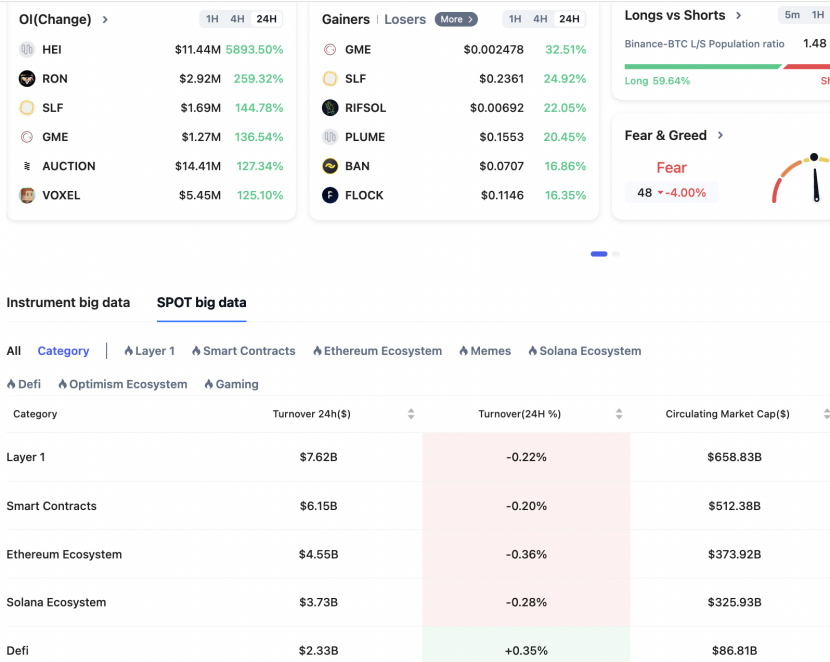

According to CoinAnk data, the overall crypto market experienced a pullback today, while the PayFi sector rose against the trend by 2.96%, with #XRP increasing by 3.38%, #LTC rising by 2.54%, and #TEL surging by 13.22%. The Hyperliquid ecosystem rose by 3.70%.

The Meme sector fell by 1.06%, but the #TRUMP coin rose by 3.79%; the DeFi sector dropped by 1.87%, the L1 sector fell by 1.97%, the L2 sector decreased by 2.27%, and the CeFi sector declined by 4.13%, with BNB down by 4.51%.

We believe that from the perspective of market structure differentiation, today's pullback in the crypto market and the strength of the PayFi sector reflect a rebalancing logic of funds under regulatory expectations and narrative shifts. The 2.96% increase in the PayFi sector, particularly the strong performance of payment tokens like XRP and LTC, may be related to the Trump administration's push for crypto-friendly policies and the accelerated implementation of cross-border payment scenarios, while Telcoin's (TEL) 13.22% surge may benefit from explosive growth in mobile payment demand in emerging markets. The 3.70% rise in the Hyperliquid ecosystem may reflect market recognition of optimized liquidity in derivatives.

In contrast, while the Meme coins overall fell by 1.06%, the Trump-themed coin TRUMP rose by 3.79%, continuing the speculative characteristics driven by political narratives. The widespread decline in DeFi and Layer 1/2 sectors highlights market concerns about short-term bottlenecks in high-leverage protocols and scaling technologies. Notably, the CeFi sector plummeted by 4.13%, with BNB down by 4.51%, likely impacted by the dual blow of the U.S. SEC tightening exchange regulations and users migrating to decentralized platforms.

Overall, the migration of funds from high-risk sectors to payment infrastructure with practical use cases reflects a more rational market under macro uncertainty. However, whether the short-term strength of PayFi can be sustained will depend on the efficiency of policy implementation and the substantial increase in on-chain payment penetration.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。