⚠️ Supreme Procuratorate | More Effective Punishment for Criminal Activities Using Virtual Currency to Illegally Transfer Assets Abroad, Evade Taxes, and Fraudulently Obtain Export Tax Rebates

The original text is as follows:

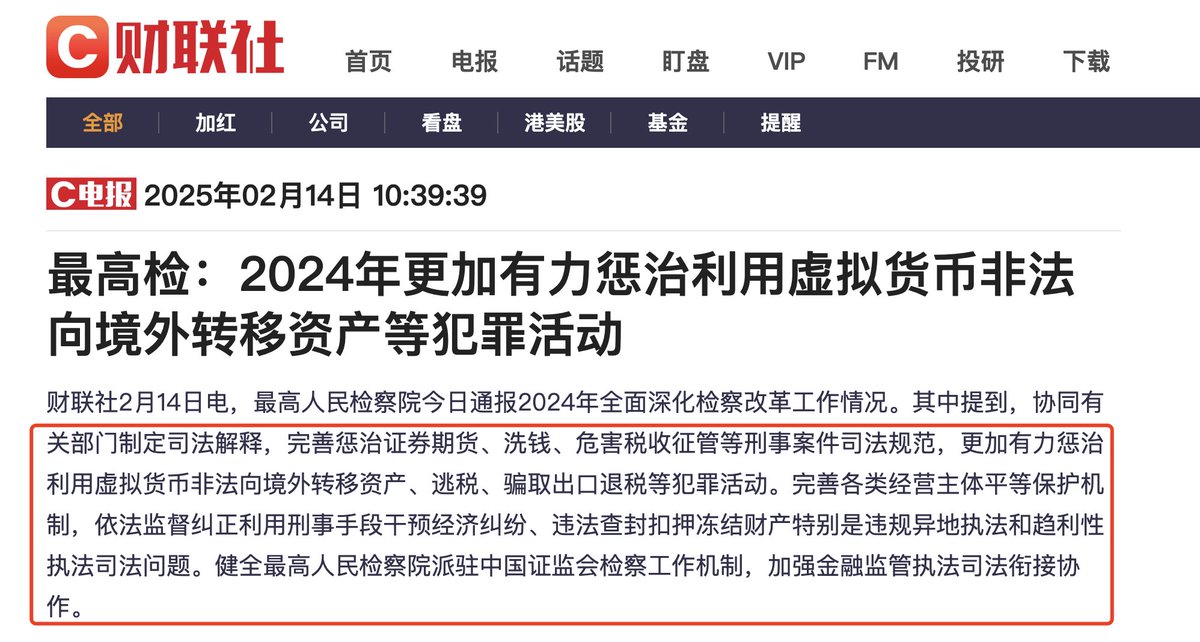

Supreme Procuratorate: In 2024, more effective punishment for criminal activities using virtual currency to illegally transfer assets abroad:

According to a report from Financial Associated Press on February 14, the Supreme People's Procuratorate announced today the progress of comprehensive deepening of procuratorial reform work in 2024. It mentioned that it will collaborate with relevant departments to formulate judicial interpretations, improve judicial norms for punishing criminal cases related to securities and futures, money laundering, and harming tax collection and management, and more effectively punish criminal activities using virtual currency to illegally transfer assets abroad, evade taxes, and fraudulently obtain export tax rebates. It will improve the equal protection mechanism for various business entities and legally supervise and correct the use of criminal means to intervene in economic disputes, illegal seizure and freezing of assets, especially issues related to illegal cross-regional law enforcement and profit-driven law enforcement. It will also improve the mechanism for the Supreme People's Procuratorate stationed at the China Securities Regulatory Commission to strengthen cooperation in financial regulatory law enforcement and judicial coordination.

1️⃣ Let's interpret this news first:

The main text states: The Supreme Procuratorate mentioned in the comprehensive deepening of procuratorial reform work in 2024 that it will collaborate with relevant departments to formulate judicial interpretations, improve judicial norms for punishing criminal cases related to securities and futures, money laundering, and harming tax collection and management,

and more effectively punish criminal activities using virtual currency to illegally transfer assets abroad, evade taxes, and fraudulently obtain export tax rebates.

The key point we need to focus on is this highlighted sentence: more effectively punish criminal activities using virtual currency to illegally transfer assets abroad, evade taxes, and fraudulently obtain export tax rebates.

Keywords include: punish securities and futures, money laundering, harming tax collection, illegally transferring assets abroad, evading taxes, fraudulently obtaining export tax rebates;

Listen carefully, saying these are the key points is because these could all become charges!

2️⃣ Impact and Risk Points for Mainland Cryptocurrency Participants —

- Significant Increase in Legal Risks

Strengthened Criminal Accountability: After virtual currency trading is explicitly listed as a means of money laundering, participants in OTC trading and cross-border asset transfers may face criminal charges due to the mixing of "dirty money" in their funding chains. For example, if a transaction involves funds from telecom fraud or underground banks, even if unaware, one may still be implicated, leading to account freezes or being investigated as a witness, making it difficult to extricate oneself; whether one is aware or not, the legal boundaries are not clear;

"Self-money laundering" offense: According to the 2024 "Interpretation on Several Issues Concerning the Application of Law in Handling Criminal Cases of Money Laundering" by the Supreme People's Court and the Supreme People's Procuratorate, actions transferring criminal proceeds through virtual currency may be deemed "self-money laundering," directly triggering criminal liability;

- Cross-border transactions become key targets for crackdown;

Using virtual currency to evade foreign exchange controls (such as transferring assets abroad or evading taxes) will face stricter investigations.

This matter may have touched us all; there are strict foreign exchange controls domestically. If you convert RMB to USDT and take it abroad for consumption, to some extent, you could already be charged with certain crimes;

Underground banks using virtual currency to achieve a "currency exchange—virtual currency—foreign currency" gray chain may be defined as illegal operation or money laundering crimes, with participants facing penalties of up to life imprisonment.

- Increased Compliance Requirements for Transactions:

Strict scrutiny of funding sources: Cryptocurrency participants need to retain complete transaction records and proof of funding sources to avoid large amounts of funds with unclear origins. If they cannot prove the legality of the funds, they may be presumed to be involved in the case.

Increased risks in OTC trading: Due to high anonymity and complex fund flows, OTC trading has become a law enforcement focus. Frequent or large transactions may trigger monitoring by anti-money laundering systems, leading to account freezes or judicial investigations.

- Uncertainty in Judicial Disposition:

The legal nature of virtual currency remains controversial (such as whether it is considered property or contraband), and judicial determinations may vary across different cases. For example, in civil disputes, it may not be recognized as legal property, but in criminal cases, it may be confiscated as involved property.

- Risks to Personal Accounts and Assets:

Risk of account freezing: Personal bank accounts involved in virtual currency trading may be frozen due to suspicious fund flows, and the unfreezing process is complex, requiring proof of fund legality. This distinction is significant; depending on the case-handling unit encountered, one must rely on luck.

Lack of protection for civil rights: Chinese law does not protect transactions related to virtual currency. If losses occur due to transaction disputes (such as platform shutdowns or fraud), investors find it difficult to seek legal recourse.

- Regarding OTC Withdrawals:

The difficulty of OTC withdrawals will definitely increase, and OTC trading and on-chain transfers may become regulatory focuses, especially involving large amounts of funds or frequent USDT transactions, which are easily suspected of illegal cross-border asset transfers.

In the past, OTC traders, large miners, and on-chain quantitative teams may have used stablecoins like USDT for large-scale fund flows; in the future, there may be stricter investigations and law enforcement.

Large fund transactions with foreign exchanges may attract regulatory attention, and it is advisable to avoid using opaque fund flow methods.

3️⃣ Summary and Recommendations

For mainland cryptocurrency participants, the latest statement from the Supreme Procuratorate means that criminal risks have further escalated, especially for those involved in cross-border, high-frequency, or large transactions. Recommendations include:

1) Strictly scrutinize trading counterparties to avoid contact with funds of unclear origin; avoid large OTC transactions and frequent USDT inflows and outflows, especially with strangers.

2) Retain complete transaction records and proof of fund flows;

3) Avoid participating in any form of cross-border asset transfers or underground bank operations;

4) Pay attention to policy dynamics and adjust investment strategies in a timely manner to avoid legal risks.

Finally, be highly cautious, act low-key, tread carefully, and always remember the potential risks. The domestic market is currently in a cash-strapped situation; do not become a victim!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。