Liquidity management has shifted from isolated competition among dApps to a collaborative, integrated process.

Written by: Injective Research

Translated by: Xianrang GodRealmX

Over the past decade, innovations in blockchain, DeFi, and on-chain financial systems have made significant progress, with "liquidity" being the cornerstone that facilitates the iteration of blockchain-related technologies and user growth. However, to this day, traditional liquidity management solutions have led to the formation of isolated liquidity pools among different dApp applications, resulting in extremely low capital utilization efficiency and hindering the iteration of the DeFi industry.

In this article, we will introduce a new concept: Liquidity Availability. We will explain and explore the concept of liquidity availability in its contextual environment to highlight its important position in the crypto ecosystem. We will also discuss the supporting technologies and mechanism designs required for liquidity availability solutions, as well as the problems they can solve that are currently troubling people.

What is Liquidity Availability?

Liquidity Availability refers to the assurance of a certain level of liquidity required for a transaction to be successfully executed at any given moment and under certain constraints. The ability to provide sufficient liquidity is what constitutes liquidity availability. At the application level, liquidity availability primarily manifests as Application-Specific Liquidity, which is limited to a specific dApp and cannot be used for other purposes. Specifically, there are the following constraints:

Liquidity within a dApp cannot be utilized by other applications on the same public chain and cannot be used in scenarios unrelated to the specific purpose of that dApp (such as token pairs on a DEX), leading to liquidity fragmentation within the public chain ecosystem. Even within a single dApp, liquidity is often locked in specific pools for a single function, such as an ETH/BTC exchange liquidity pool. This means that the dApp cannot reallocate this portion of liquidity or use it for other use cases within the dApp, thereby limiting flexibility and reducing capital utilization efficiency.

Most of the time, dApps attract liquidity providers (LPs) to deposit their assets into designated repositories, usually within smart contracts, and each repository only supports specific trading use cases. Common scenarios include liquidity pools for asset exchanges, lending protocols providing over-collateralized loans, insurance pools, and staking pools for liquid staking derivatives (LSD), among others. This itself is a manifestation of liquidity fragmentation, and in today's multi-chain application system, this fragmentation issue is becoming increasingly severe, with liquidity ultimately being highly dispersed across multiple public chains.

Therefore, TVL, as a metric for measuring dApp liquidity, cannot accurately reflect liquidity availability. TVL aggregates the total amount of liquidity deposited by users into dApps, but this liquidity is severely fragmented across various use cases and does not fully meet broader trading needs. However, within the current system, TVL can serve as a rough indicator for comparing the status of different dApps.

Currently, at the public chain level, liquidity availability is still confined within various independent dApps, and a public chain cannot utilize the total liquidity of dApps within its ecosystem to enhance the overall liquidity availability of the ecosystem. Interoperability solutions have superficially become the focus of the industry to improve liquidity availability, with various technologies being explored, such as cross-chain liquidity aggregators, unified liquidity pools, atomic swaps, liquidity routing, and tokenized liquidity bridges. Although this has somewhat improved liquidity availability, the fragmentation issue remains fundamentally unresolved.

Why is this important?

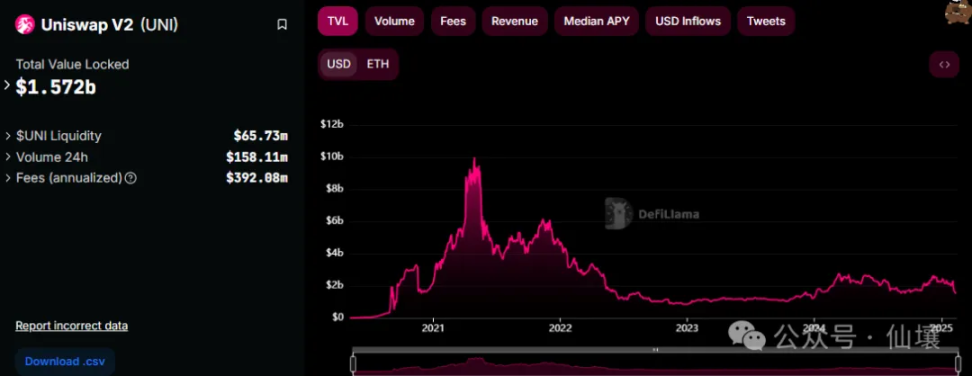

Liquidity isolation and fragmentation bring inherent disadvantages, limiting ecosystem growth and resulting in low capital utilization. For example, the TVL on the Ethereum chain is approximately $160 billion, with Uniswap V2 accounting for about $1.6 billion, which is further dispersed across 400,000 token pools. Other applications on the Ethereum chain cannot utilize the liquidity of Uniswap V2, and even Uniswap itself cannot freely utilize funds across different token pools, highlighting the importance of the concept of liquidity availability.

The crypto industry has consistently failed to effectively address the aforementioned issues, creating an environment of unsustainable growth. Different dApps and even public chains need to compete fiercely to accumulate liquidity for themselves, while overall net growth requires the continuous introduction of new capital.

In such an environment, the priorities of project teams often conflict with the long-term development needs of the industry. The most urgent task for project teams is not to rapidly release and iterate products but to compete for liquidity and TVL. This phenomenon is particularly pronounced during bear markets. A player-versus-player (PvP) ecosystem has thus developed, where the dApp with higher TVL can access more resources. Additionally, dApp project teams often tend to slow down the frequency of product updates to retain existing TVL, as each update may require users to migrate funds on-chain.

Overall, the aforementioned distorted phenomena have a decelerating effect on the overall growth of the crypto industry. For newly launched projects, they need to find ways to obtain dApp-specific liquidity and cannot directly borrow liquidity from elsewhere, which is a significant obstacle. These issues have already created ripple effects in the industry, with larger dApps growing faster than new projects. This trend leads the market to gradually become centralized, resulting in monopolistic phenomena commonly seen in traditional industries. As long as dApp-specific liquidity remains rooted in the current system, this trend will continue and may worsen over time.

Summarizing the above phenomena, we believe that the underdevelopment of liquidity availability has embedded dApp-specific liquidity into the DNA of the Web3 system. The negative effects of this paradigm have permeated the entire industry, and addressing this systemic issue requires focusing on its root causes. In this context, liquidity availability is the core concept we need to pay attention to.

Liquidity Availability in Traditional Finance (TradFi)

Liquidity availability is not only a key concept in blockchain and DeFi but also an important concept in traditional finance (TradFi). The degree of liquidity availability in traditional finance is vastly different from that in Web3, and understanding these differences helps us grasp the practical significance of liquidity availability and understand how much value blockchain can provide to a broad economic system.

The traditional financial system includes banks and non-bank lending institutions, insurance companies, securities markets, and investment funds. It also encompasses clearing counterparties, payment providers, central banks, as well as financial regulatory agencies and regulators. Together, these institutions form a framework that allows people to conduct economic transactions, enables central banks to implement monetary policy, and allows users or financial institutions to invest savings in various activities, thereby supporting economic growth. Each component within the framework plays a unique role in promoting liquidity availability within the system, ensuring that necessary liquidity is provided for any transaction.

In traditional finance, there is often a mature mechanism system to enhance liquidity availability, with related metrics including the quantity of liquid assets, transaction settlement speed and efficiency, and the availability of credit and financial services. The following components play important roles in maintaining and enhancing liquidity availability:

Credit System — It is the foundation of liquidity, providing loans and agreeing to future repayment by borrowers, thus timely meeting liquidity demands. For example, credit cards offer revolving credit limits, providing continuous liquidity for consumers and businesses. Additionally, the credit system allows borrowers to shift future consumption behavior to the present, enabling lenders to defer consumption behavior to the future. This dynamic adjustment has not yet been realized in the DeFi system. In summary, the credit system can enhance the total amount of liquid assets available in the economy, ensuring that liquidity is available to meet various transaction needs at all times.

Insurance Mechanism — By spreading risk and providing financial protection, it reduces users' property losses and further enhances liquidity availability. The existence of insurance allows individuals and businesses to effectively hedge against market volatility, maintaining liquidity even under adverse conditions. The insurance industry stabilizes the amount of liquid assets held by different institutions at different times, providing necessary funds to users immediately when needed.

Refinancing — Refers to borrowers replacing current loans with new loan arrangements, allowing them to borrow at lower interest rates, more favorable terms, or change loan durations. This can improve liquidity management practices, achieve continuous liquidity optimization, and ensure that borrowers can effectively meet their liquidity needs. Overall, refinancing solutions can provide debtors with necessary liquidity, enhance credit availability, and increase the scale of liquid assets in the financial system.

Clearinghouses — Centralized traders and market makers act as intermediaries between buyers and sellers in financial markets, playing a crucial role. They settle transactions, collect margins, and reduce counterparty risk, ensuring that various trading activities are executed efficiently and safely. For example, the Depository Trust & Clearing Corporation (DTCC) in the U.S. handles most securities transactions, providing a stable and reliable infrastructure for liquidity availability. Clearinghouses absorb the risks of exchanges, whereas various DeFi protocols concentrate all funds on a single platform.

Interbank Lending Market — For example, the federal funds market in the U.S. significantly facilitates the distribution of liquidity within the banking system. Benchmarks such as the Secured Overnight Financing Rate (SOFR) influence borrowing costs across the entire financial market, allowing liquidity to be effectively allocated to where it is most needed. This infrastructure prevents liquidity from being isolated, increasing the number of liquid assets available within the entire banking system and improving the availability of credit.

Custodial Services — Financial institutions enhance liquidity availability by providing asset management services to high-net-worth clients. Custodial services can enhance the overall stability of financial markets and reduce the risk of liquidity shortages. Similar to dApp-specific liquidity in DeFi, custodial services establish trust by proving the availability of funds, thereby accelerating the completion of various transactions. Although custodial services hold a place in the traditional financial system, they are not suitable for all types of financial transactions due to their inherent limitations.

Centralized Traders and Market Makers — For example, large investment banks continuously provide buy and sell orders for financial assets, ensuring that there are always counterparties trading in the market. This practice improves capital utilization efficiency and ensures that there is always sufficient liquidity in the market. Such institutions typically maintain inventories of various assets, enhancing liquidity in the market and allowing various trading orders to be executed quickly and efficiently.

By studying the core components mentioned above in TradFi, we can clearly see that the infrastructure in traditional finance is designed to meet liquidity demands at any given moment, ensuring a robust and efficient financial system. Although the methods for achieving liquidity availability in blockchain differ, their ultimate goals are highly similar to those of traditional financial systems. By drawing on concepts and methods from traditional finance, the crypto ecosystem can more effectively address the issue of liquidity islands, ultimately facilitating a more efficient and robust financial framework.

Full-Chain Liquidity Availability

By introducing the concept of liquidity availability and stepping outside of conventional thinking, we may be able to solve the problems plaguing the Web3 industry. Rather than viewing liquidity availability as an application-level issue (where dApp-specific liquidity is a limiting factor), it is more effective to consider liquidity availability as a public chain-level issue. From this perspective, the success of a transaction is independent of its initiation point, and the location of liquidity is no longer critical.

In traditional finance, mature systems ensure that liquidity is available when needed, preventing economic growth from being hindered or capital efficiency from being compromised. By absorbing inspiration from these financial mechanisms, we can apply unique approaches within the crypto ecosystem to address these issues.

From a practical standpoint, a public chain must have the capability to mobilize its on-chain custodial liquidity for indiscriminate trading services at any time. Therefore, dApps within the network should fundamentally decouple from the liquidity behind them, eliminating reliance on the paradigm of dApp-specific liquidity. In such a system, liquidity availability will be considered purely from the public chain level, driven by the overall growth of its ecosystem. Importantly, this will shift the limiting factors from external dependencies (the performance of dApps) to internal dependencies (the performance of the public chain itself), which the public chain project teams can control and gradually improve.

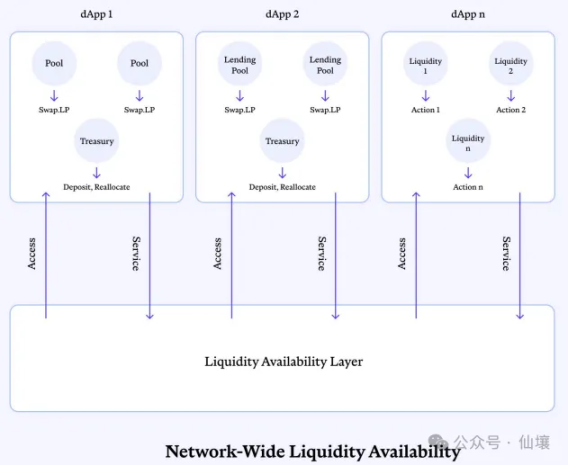

dApp-Specific Liquidity Framework vs. Full-Chain Liquidity Availability Framework

The charts above illustrate the differences between dApp-specific liquidity and full-chain liquidity. Under the full-chain liquidity availability framework, a more efficient and dynamic liquidity system can be formed. Additionally, addressing liquidity issues at the public chain/network level can significantly lower the entry barriers for new projects. Currently, new projects require substantial dApp-specific liquidity, which poses a significant challenge for startup teams, hindering their launch speed and limiting their iteration capabilities.

By ensuring that liquidity is available across the entire public chain, new dApps can launch quickly and innovate freely without the need to independently acquire large-scale liquidity. This will create a more competitive and diverse ecosystem, fostering innovation and providing opportunities for small teams.

Essentially, applying the concept of "full-chain liquidity availability" at the public chain level transforms liquidity management from isolated competition among dApps into a collaborative, integrated process. This paradigm shift can unlock new possibilities for innovation and ecosystem growth in the crypto space, making it more adaptable to changing user demands and more resilient. By drawing on experiences from traditional finance, the crypto ecosystem can develop more complex and efficient liquidity management solutions to address liquidity availability issues.

Key Components of the Full-Chain Liquidity Framework

On the surface, mobilizing all liquidity among dApps on a public chain sounds simple, but it actually brings many challenges that require innovative solutions to achieve efficient end-to-end services.

First, LP-related issues are quite prominent. Providing liquidity for a specific dApp or liquidity pool is often permissionless, and these funds are used for a single scenario. LPs may not agree to have their deposits used for other purposes, let alone for various dApps. Furthermore, LPs who deposit funds into a single dApp can withdraw their deposits at any time. If this model changes, funds could be allocated to high-risk platforms and may not be withdrawn in a timely manner—what should be done then? Existing large dApps are also unlikely to support the idea of full-chain liquidity. More importantly, how can we technically achieve efficient liquidity transfer between dApps?

1. Economic Incentives and Risk Mitigation

First, we must establish an incentive mechanism that makes the opportunity cost of not participating in enhancing full-chain liquidity exceed the cost of participation. Specifically, dApps that participate in improving full-chain liquidity will see their capital efficiency enhanced, liquidity availability increased, and potential revenue grow, thereby improving user experience, increasing transaction volume, and generating more revenue through a flywheel effect.

However, we must protect the interests of LPs and develop corresponding mechanisms to ensure timely withdrawals, avoiding events similar to bank runs. Addressing this issue involves liquidity reserve strategies and time-based withdrawal plans that allow for phased liquidity recovery. Such a system must be carefully designed to prevent market manipulation or other attack vectors, ensuring its safety and effectiveness. Once the corresponding incentive mechanisms are adjusted, the game between dApps, LPs, and users will be largely resolved, paving the way for technological development.

2. Just-in-Time (JIT) Operations

Second, to achieve full-chain liquidity availability, we need to build several core functionalities: Just-in-Time (JIT) operations, liquidity proving, solvers, and routing layers.

Just-in-Time (JIT) operations refer to immediate responses to specific on-chain state changes when certain trigger conditions are met. These operations aim to dynamically reallocate resources to optimize configuration effects.

Trigger Mechanism — JIT operations will be initiated based on predefined trigger conditions, such as surges in resource demand, changes in user activity, fluctuations in network conditions, or input parameters from the coordination layer. These trigger conditions exist as chain messages within module states and are stateful.

Integrable Asynchronous Interfaces — These interfaces support conditional interactions with the JIT system, allowing dApps to inject or withdraw liquidity based on preset conditions, thereby optimizing on-chain liquidity allocation. For example, asynchronous deployment interfaces allow dApps to contribute liquidity to the full-chain liquidity system when certain conditions are met (such as idle liquidity within the application). This enables dApps to participate in building the full-chain liquidity system without affecting business operations. Asynchronous retrieval interfaces allow dApps to request liquidity on demand based on predetermined conditions (such as a sudden surge in user demand). Through asynchronous interactions, dApps can access the full-chain liquidity available on-chain, rather than being limited to their proprietary liquidity pools, ensuring flexible use of funds.

Instruction Set — When the trigger conditions for specific operations are met, a series of instructions will be triggered. These instructions are linked in some way to specifically generate JIT operation scenarios.

Smart Contract Automation — The execution of JIT operations will be managed by smart contracts, which will automatically adjust resource allocation based on trigger conditions. Instruction triggers will be monitored by smart contracts, which will first test whether the relevant on-chain instructions can operate normally given a series of JIT operation requests.

Diverse Resource Allocation — While liquidity is our primary focus, JIT operations can extend to other areas within the public chain. For example, JIT operations can also reallocate computing power or storage resources between two parties.

3. Liquidity Proving

In addition to JIT operations, liquidity proving is crucial for ensuring that liquidity can be mobilized on demand within the network. Liquidity proving requires dApps to provide a verifiable proof scheme indicating that they can meet the necessary conditions to respond to JIT operations or provide liquidity externally. For instance, dApps need to publicly disclose how much overall liquidity can increase, how much revenue can grow, or how much capital efficiency can improve after participating in the full-chain liquidity system.

Incentivizing Participants — While liquidity proving is a necessary component of the entire full-chain liquidity system, the costs of generating and publishing proofs should not be underestimated. Therefore, it may be necessary to incentivize dApps to actively participate in generating liquidity proofs through token incentives, subsidies, or reduced fees.

Fail-Safe Mechanisms and Emergency Stop Devices — To prevent systemic risks, fail-safe mechanisms and backup plans need to be established. For example, in the event of a sudden liquidity shortage, the system can mobilize emergency liquidity reserves or temporarily restrict certain operations until liquidity is restored.

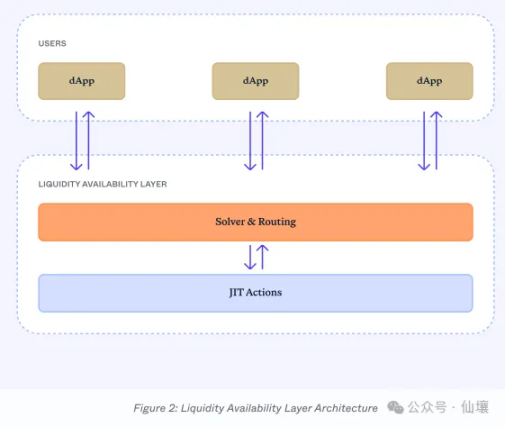

4. Solvers and Routing Layer

The concept of JIT addresses the issue of real-time liquidity supply, while liquidity proving ensures that ample liquidity is available within the system. However, a mediating entity is still needed to route and allocate liquidity between dApps or chains. This mediating entity will act as the decision engine within the liquidity availability framework, optimizing and dynamically routing liquidity based on real-time network conditions.

Optimization and Decision Engine — Solvers will continuously evaluate liquidity paths, optimizing transaction costs and capital flow speed, enhancing capital efficiency, and assessing network conditions (congestion levels, gas fees) to transfer liquidity between dApps or chains through optimal paths, ensuring real-time allocation of funds to meet specific user needs and maximizing capital efficiency.

Constraint Processor — In addition to optimizing liquidity routing paths, solvers will also consider constraints such as liquidity availability, gas costs, withdrawal times, and risk factors. By adhering to predefined parameters/constraint terms, solvers will ensure the safe and efficient allocation of liquidity.

Dynamic Behavior — The design goal of this solution is to dynamically adjust liquidity allocation methods based on real-time conditions. For example, if liquidity demand suddenly increases in a certain area on-chain, the system will accordingly re-route liquidity to ensure balanced liquidity distribution and respond to special changes.

Abstract Layer and JIT Interaction — The solver and routing layer will serve as an abstract layer between users (applications) and the JIT system, responsible for liquidity tracing and configuration. It will signal when and where liquidity is needed, triggering JIT actions such as borrowing, transferring liquidity, or reallocating related resources. While users may not perceive the existence of the solver and routing layer, these components will still make real-time decisions based on network conditions, ensuring that JIT actions meet liquidity demands through optimal paths.

Initially, the solver and routing layer will focus on simple, direct routing between liquidity sources. However, as the public chain network grows and matures, the solver will gradually support more complex programmatic routing, which may involve multi-hop liquidity transfers across multiple dApps or chains, dynamically responding to changes in liquidity demand and maximizing capital efficiency.

In a mature state, the end-to-end system will achieve the following architecture: JIT operation instructions as the underlying units, with the solver and routing layer positioned between users and the JIT layer, allowing the system to instantaneously allocate liquidity to dApps and chains in need.

It is important to note that the Solver and routing layer described in the liquidity availability framework are significantly different from existing solutions in the industry. Most existing solutions aim to address the issue of liquidity fragmentation from a top-down approach, with current cross-chain liquidity routing solutions primarily focusing on aggregating liquidity distributed across various dApps within multiple networks.

In contrast, the goal of the liquidity availability framework is to completely eliminate the concept of dApp-specific liquidity, aiming to decouple the liquidity layer from the dApp layer. Part of its technical stack will adopt the Solver and routing layer, optimizing and simplifying liquidity services through JIT operations across applications and chains, transforming liquidity into a flexible asset across multiple chains.

Modular Full-Chain Liquidity Framework

Implementing JIT operations, liquidity proving, and the Solver and routing layer is not only beneficial but can also provide the necessary foundational building blocks to evolve liquidity availability from an isolated, dApp-specific issue to a comprehensive multi-chain network. By establishing these fundamental components, the network can better and more dynamically meet liquidity demands, resulting in a more resilient and liquid on-chain environment.

Moreover, these foundational components lay the groundwork for further innovation. Developers will be able to adopt a modular framework to create new and diverse solutions to address many complex issues in the industry. With these capabilities, the network can not only achieve immediate, large-scale functional enhancements but also support the rapid growth that may come in the future.

Notes on Individual Participants

While this article positions the "users" of the liquidity availability framework as dApps, it is ultimately individual users or institutions acting as LPs that inject liquidity into the network. Under the liquidity availability architecture, users' assets will essentially participate in various dApps. Additionally, some users may wish to deploy liquidity directly to the liquidity availability layer, completely bypassing specific dApps. It would be wise to ensure that such functionality is available to meet these demands.

Achieving this is relatively simple, as this part of the business logic can be represented in the form of a dApp. However, this "dApp" itself will have a one-way purpose—serving the liquidity availability layer. Here, the liquidity treasury can act as a tool to receive user deposits, publish liquidity proofs to the outside world, and dynamically deploy and manage liquidity, similar to an integrable dApp. By maintaining this specificity, such a service provider may achieve higher capital efficiency, allowing LPs to earn competitive returns.

The treasury strategy is just one possible way to realize this scenario. At the current stage of on-chain finance, there are many solutions that can effectively fulfill this role. Regardless of the specific implementation, it is reasonable to assume that these applications will self-fill under market incentives, further enhancing the effectiveness and adoption of the liquidity availability framework.

Conclusion

The concept of liquidity availability provides a key perspective for addressing the inefficiencies in liquidity management within the on-chain finance sector. This article argues that shifting from dApp-specific liquidity to a liquidity availability framework across a multi-chain network can unlock significant growth potential, lower the entry barriers for new projects, and foster a more innovative and resilient ecosystem.

While the proposals for JIT actions, liquidity proving, and the Solver and routing layer are theoretical, they are fundamental components for achieving this transformation. These components can redefine liquidity management from a fragmented, decentralized form to a cohesive, integrated form. If effectively implemented, a comprehensive liquidity availability framework will transform liquidity from static, dApp-specific resources into flexible, dynamically available resources across the entire chain, enabling dApps to scale without being constrained by liquidity islands.

However, the ideas explored here are just the beginning. Further research and experimentation will validate these concepts, explore practical applications, and refine implementation strategies. Drawing inspiration from traditional financial systems and breaking through their limitations provides a unique opportunity to drive the entire on-chain economy forward.

In summary, viewing liquidity availability as a resource available across the entire chain network, rather than being specific to dApps, is of significant importance for the future of decentralized solutions. Embracing this shift can lead to more effective solutions, paving the way for sustained growth, technological advancement, and a more equitable and vibrant financial ecosystem. This approach can catalyze the next wave of innovation, propelling blockchain and on-chain finance toward a future where liquidity is no longer a constraint but a driving force.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。