Original Title: How to Backfill a Narrative on Solana, Ethereum, Memecoins, and REV

Original Author: Brendan Farmer, Co-founder of Polygon

Original Translation: Ashley, BlockBeats

Editor's Note: The article critiques the value narrative of Solana, arguing that its reliance on the short-term wealth effect from meme coin trading is not sustainable and poses structural risks. Solana's success may stem more from speculation than from technological advantages, while Ethereum continues to develop robustly in the DeFi space. The author reminds readers to maintain a critical perspective on narratives in the crypto space to avoid being misled by market trends.

Below is the original content (reorganized for readability):

The task of thought leaders in the crypto space is to tell stories, explaining why the value of certain coins rises or falls. The fluctuating curves on charts are never just lines; they are part of larger technological or economic trends. These "backfilled narratives" can be eye-catching (like "digital gold" or "world computer") or less appealing (like "Play-to-Earn is the future of work"), but it is crucial to critically examine how each narrative constructs the world—and who benefits from that construction.

Blue-collar workers in the narrative factory and venture capitalists have been working overtime to explain why ETH has underperformed compared to BTC and SOL. Some of these arguments are uncontroversial: the Ethereum community should reach better consensus on shared direction, reassess its technical assumptions, or simply do better.

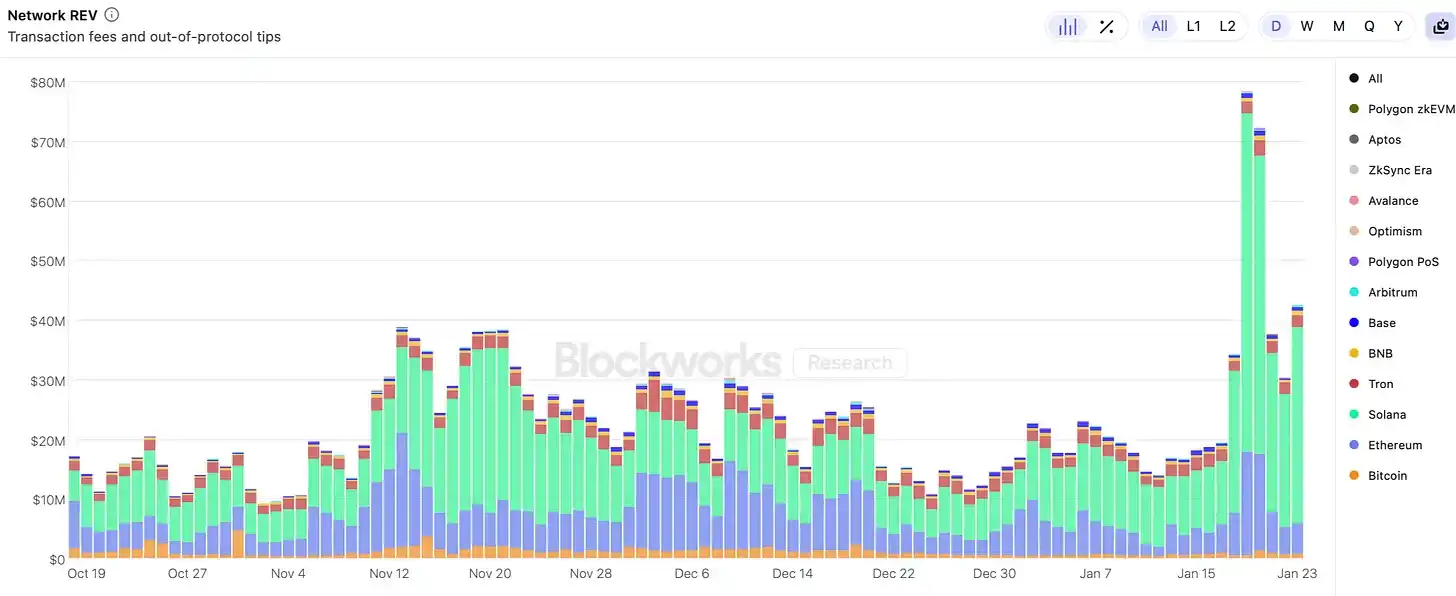

This article argues that a specific narrative about Solana and Ethereum is incorrect. The story goes something like this: Solana has dominated Ethereum on the most important economic metrics in blockchain, particularly in decentralized exchange (DEX) trading volume and REV (Real Economic Value = MEV + transaction fees, a metric for measuring protocol cash flow).

According to this narrative, Solana's lead in REV comes from technological advantages and traction across multiple application categories. The value of SOL can be assessed based on future expected REV, which is more advantageous than ETH, as ETH can only be valued based on "sentiment" or "monetary properties."

But this is just a narrative. Solana's REV is entirely generated by meme coin trading, making it difficult to assess the value of SOL based on future cash flows. Moreover, the dominance of meme coins brings structural risks to Solana.

Tracking REV

Over the past year and a half, the SOL/ETH ratio has increased by about tenfold. Whenever we see similar price fluctuations, we know it's time to backfill a new narrative.

We could tell a story like this: Solana has more advanced technology, users love it, and the best developers across various fields—including DePIN, DeFi, payments, and of course, meme coins—are flocking to Solana.

Venture capitalists would argue that this massive talent migration has led to significant growth in key metrics like REV, trading volume, and application revenue. The narrative goes that SOL does not need to become a currency or commodity like ETH, as its market cap will ultimately be validated by actual revenue at a reasonable multiple, rather than some meme culture nonsense.

If you want to see how Solana is performing, the data can prove it.

This is a great narrative.

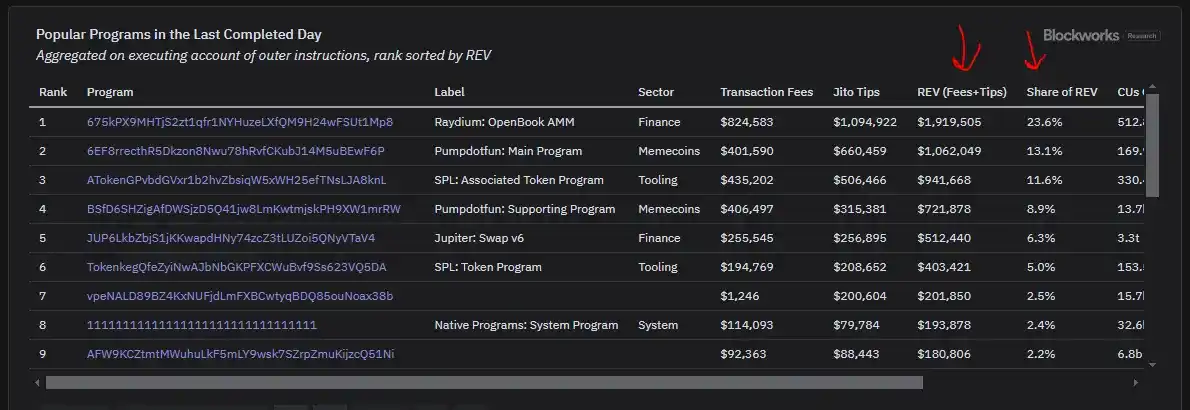

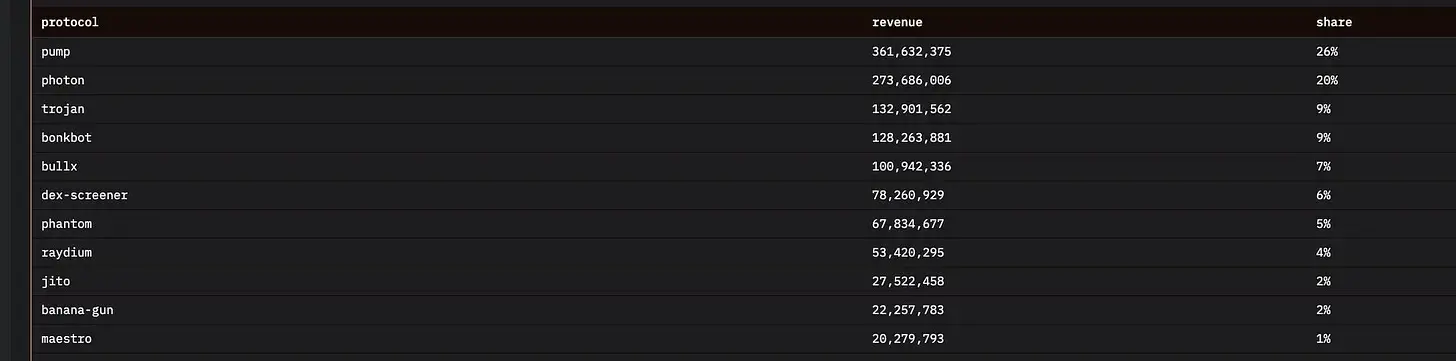

But to argue a bit, let's look at where REV actually comes from.

Perhaps it’s a brilliant combination of all the best crypto applications. Groundbreaking DePIN projects like Helium, a CLOB building a decentralized Nasdaq, stablecoin payment volumes, complex DeFi transactions, and of course, maybe a portion from meme coins, right?

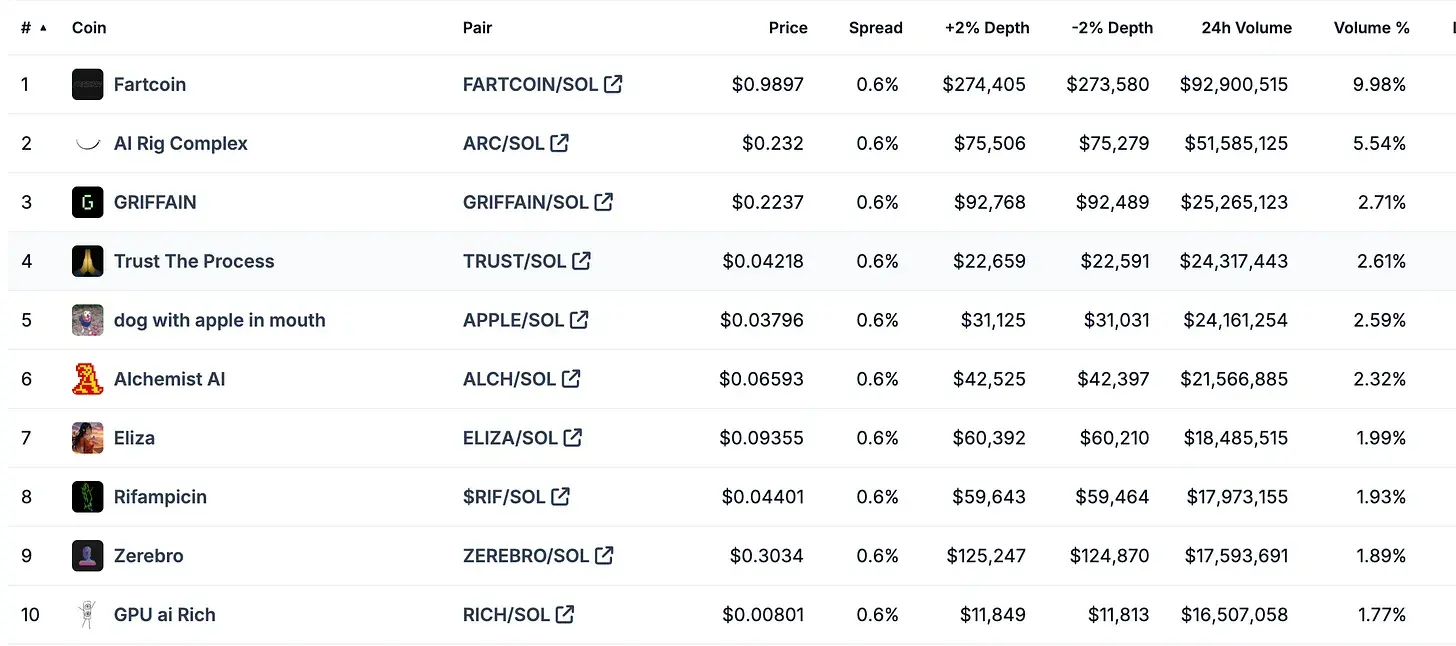

Wait—are these just pump.fun and a bunch of Telegram bots for meme coin trading?

Where are the groundbreaking applications? What about DePIN? Where is the global price discovery from events happening in Singapore or London? Where are the top, IMO award-winning developers?

Are we increasing bandwidth and reducing latency just for bot trading $BUTTHOLE?!

Building a Decentralized "Casino"

This article is not about whether meme coins are good or bad. Meme coins may be a good way to guide users to crypto protocols and transfer wealth from "uninformed market participants" to skilled liquidity providers.

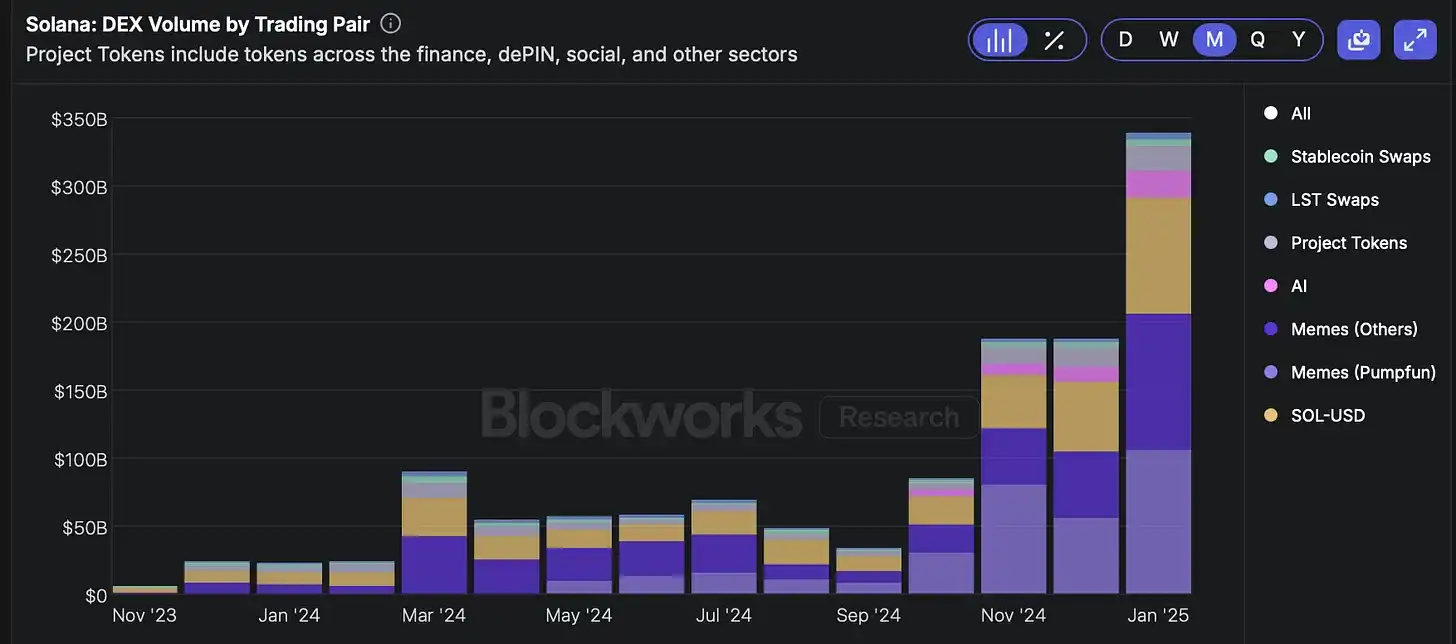

But Solana's REV comes entirely from meme coin trading, which brings structural issues to assessing the value of SOL based on future REV.

Let’s backfill our own narrative. After the FTX explosion, SOL was oversold, but Solana still managed to present a compelling story to institutional capital allocators. It has a pragmatic scaling roadmap and is culturally understandable to investors familiar with Silicon Valley tech startups.

As the pitch for SOL succeeded, the price rose. This created a wealth effect, which is a wonderful thing in the crypto space. It’s a form of financial alchemy where rising token prices (largely unrelated to technology) translate into on-chain activity (which appears to be driven by more advanced technology).

You can think of the wealth effect as a pressure cooker filled with funds, heated up, where the only way to release pressure is for capital to flow into dumber and riskier assets, like CryptoDickButts or this:

As activity increases, thought leaders can backfill an engaging narrative, driving up SOL prices and creating more activity. Applications release tokens, injecting more capital into the system (for example: Jito effectively airdropped a new car to everyone in Solana DeFi). We can call this the flywheel effect.

According to our narrative, the explosion of meme coin activity on Solana (rather than on other equally scalable L1 or L2s) is primarily due to the wealth effect of SOL. Solana's cheap transaction fees are a necessary prerequisite, but the wealth effect is needed to allow meme coin mania to reach its current scale.

Time is a Circle

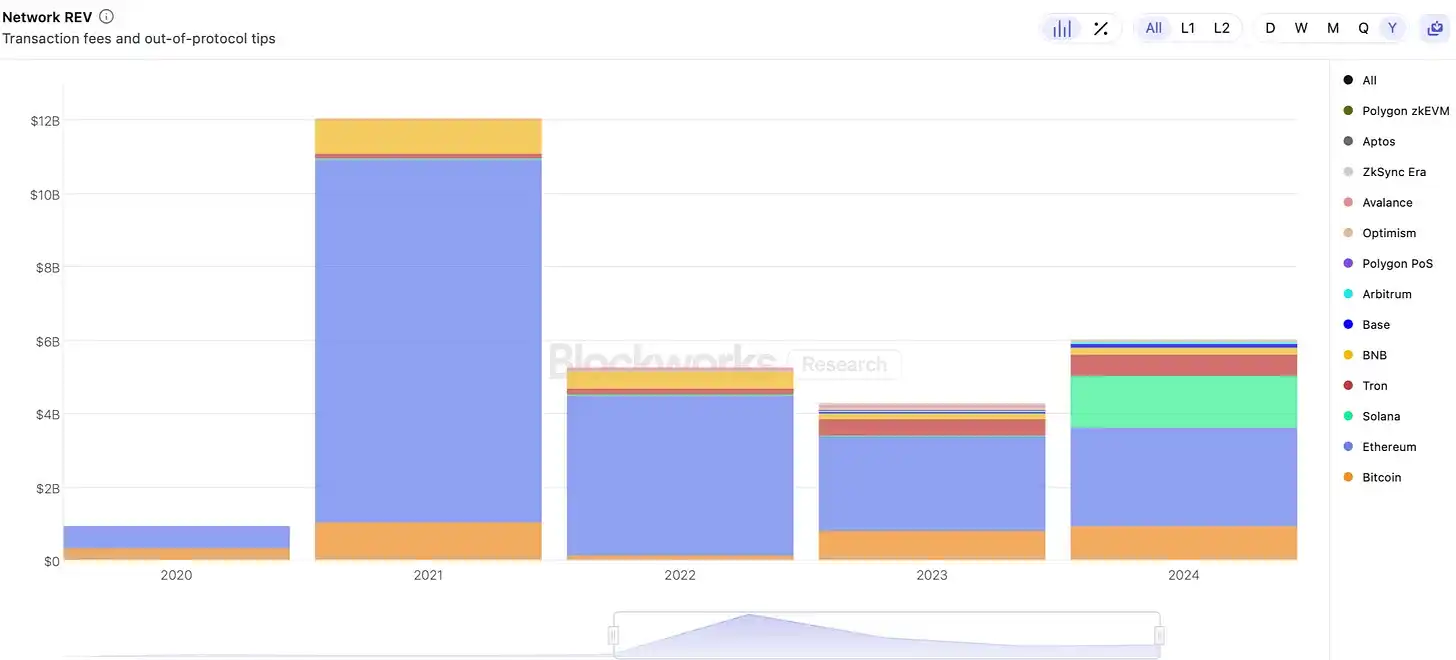

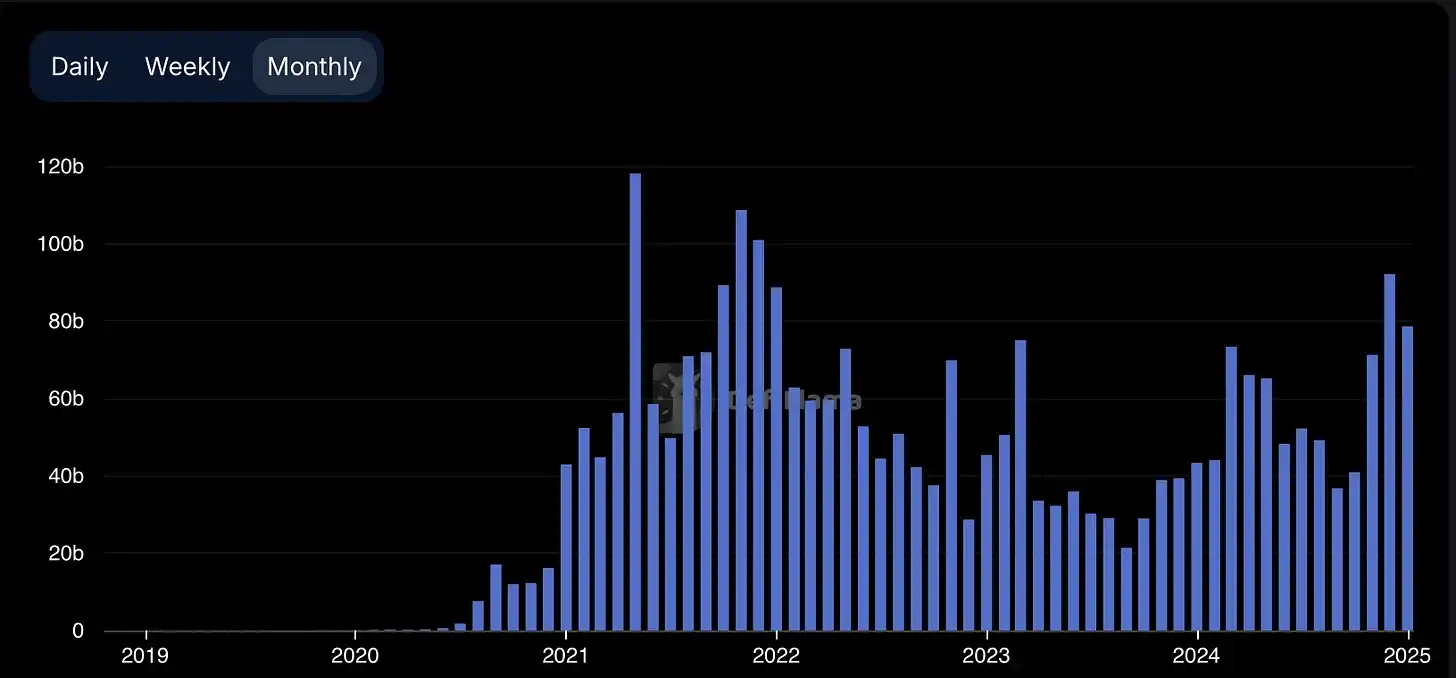

This has all happened before. If we look back at 2020-2021, we see the astonishing growth of REV on Ethereum. In the last bull market, the new wealth of ETH holders flowed into increasingly volatile on-chain assets like NFTs and meme coins.

Highly speculative assets often overproduce REV because users are willing to pay higher priority fees and MEV rates for the chance to be exposed to volatility. The value of meme coin trading is highly dependent on its position in the block, so block proposers controlling the sorting can capture more value. This brings higher commissions to the protocol than other forms of on-chain activity.

However, we can see that as market cycles change, the highly speculative activity on Ethereum (in NFTs and meme coins) has disappeared. Using the REV of Ethereum in 2021 as a basis for estimating future REV is fundamentally flawed.

Meme Coin REV Will Not Last (And Won't Save You)

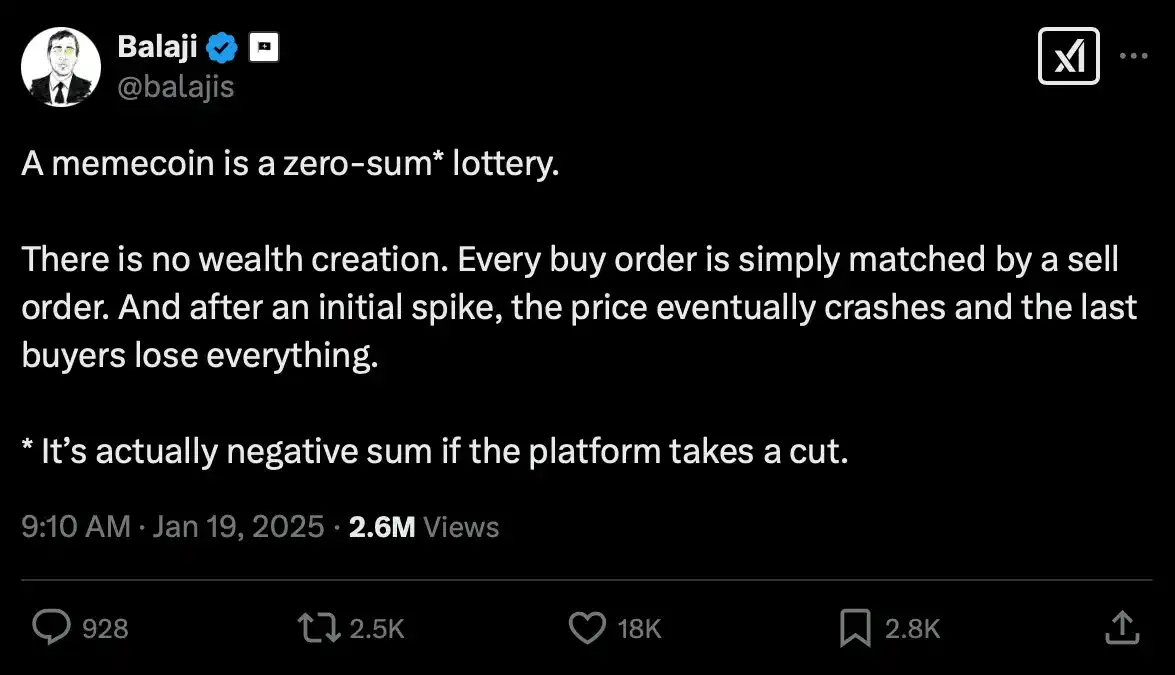

Just as the REV generated by meme coins on Ethereum is unsustainable, it will not be sustainable on Solana either. While meme coins may be entertaining, meme coin speculation is a zero-sum game.

The fees and MEV paid by meme coin gamblers are extremely high compared to other forms of gambling, and ultimately, gamblers will exhaust their funds. High fees and MEV may benefit REV, but in a zero-sum game, this does not create any economic value, and the consequence is that they extract liquidity from the ecosystem. Every dollar paid in REV means less funding for future meme coin trading, leading to a decrease in future REV.

Therefore, it is difficult to argue that the growth of REV will continue, ultimately validating SOL's market cap as reasonable.

The FDV of SOL (approximately $150 billion) compared to the 2024 REV ($1.4 billion) has a ratio of about 100:1. If we are generous and annualize based on Q4 REV ($825 million), we get a ratio of 45:1. While this is an improvement, it still assumes that meme coin trading volume will grow over time. Given that this is unlikely (see ETH in the last market cycle, where REV dropped from $10 billion to $2.6 billion), it is difficult to justify SOL's valuation based on expected future REV.

A popular counterargument is that Solana will simply scale its block space by 10x or 100x, and REV will scale proportionally.

The problem is that even if Solana could increase throughput by 100 times, it would struggle to find 100 times more innocent order flow willing to be "extracted"—buying meme coins through sandwich attacks and snipers, aside from in Ken Griffin's most twisted fantasies?

For meme coin trading volume to continue growing and compress SOL's P/E ratio, we need the price of SOL to rise to enhance the wealth effect. But this contradicts the purpose; we are trying to compress the P/E ratio, not expand or maintain it.

Other applications like DeFi, DePIN, and payment applications will not generate the same amount of REV per unit of block space. For example, a complex trader lending blue-chip assets for a 10% return or a player playing a game may consume the same amount of block space but generate REV far below that of meme coin trading.

"Mercenary" Memecoin

Meme coin trading volume also tends to shift to new chains with the wealth effect of new tokens.

You might think that the reason for the migration of meme coin issuance from Ethereum to Solana is that Solana is more scalable and better suited for trading, and that Solana's technological advantages mean it will continue to be a hotbed for degenerate gambling. This is not the so-called "decentralized Nasdaq," but as a center for crazy speculation, it at least deserves some credit.

This overlooks the direct reason for the meme coin frenzy being the wealth effect of SOL. For instance, at the end of 2023, the price and trading volume of BONK closely followed SOL. We can see that the same applies to the trading volume of decentralized exchanges (DEX), especially for meme coins, until March 2024, when meme coin trading began to explode after SOL rebounded 10 times from its low following the FTX collapse.

With the launch of new chains, especially high-performance L2s (like MegaETH and Rise), these chains may provide better trading venues for meme coin traders. These chains will launch with new tokens and new wealth.

They may not be decentralized and may not synchronize global information at light speed, but the talent trading $FARTCOIN doesn't care—they are taking on risks in meme coin gambling that far exceed any risks brought by decentralization. L2s can offer lower latency, better performance, and higher transaction success rates, making them a better trade-off.

What About Ethereum?

The narrative about REV growth on Solana is also used to advocate for changes to Ethereum. The implicit argument is that Ethereum must scale to regain lost activity (and REV). Given that Solana's activity is entirely driven by meme coins, this is not reasonable. Scaling L1 execution by 5x or 10x will not bring meme coins back to Ethereum L1; Solana still has lower fees and a stronger short-term wealth effect.

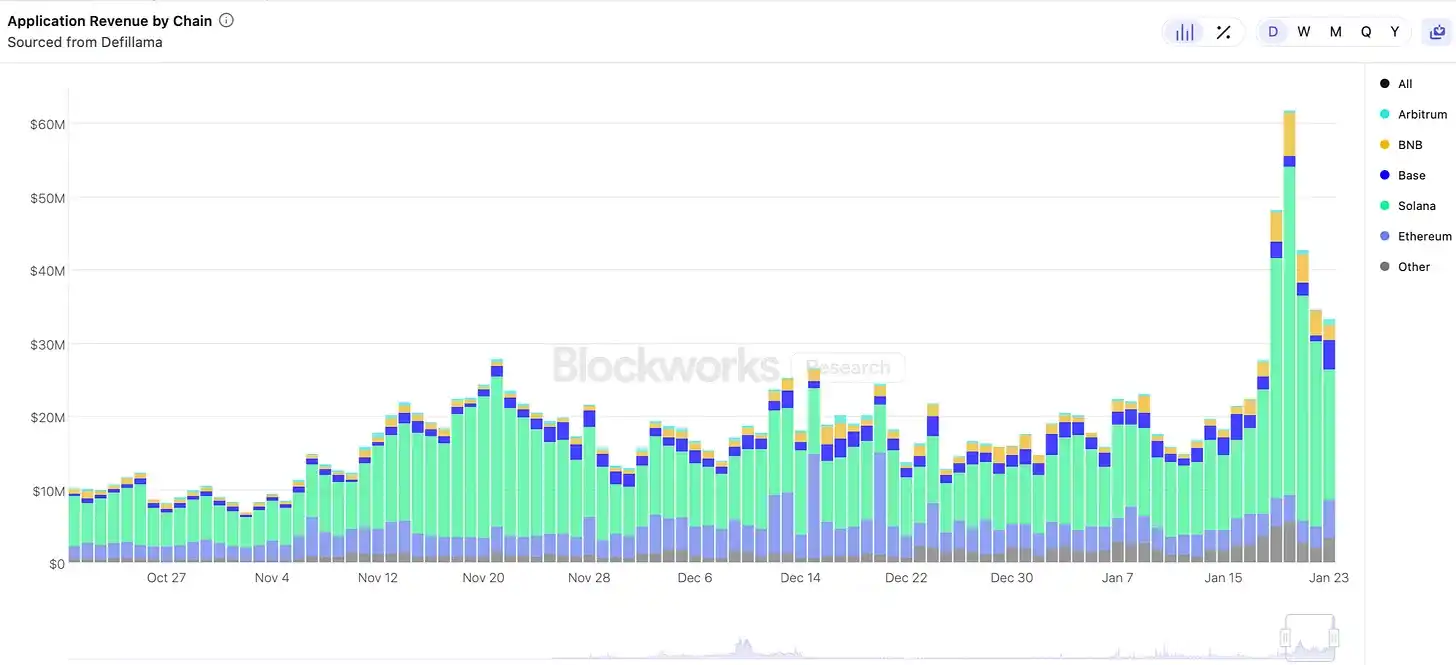

If DeFi had migrated overall to Solana, we should have seen a significant drop in Ethereum's trading volume. However, Ethereum's DEX trading volume in December 2023 remained between 10%-20% of its historical highest monthly trading volume, even during the more volatile ETH price fluctuations of the 2021/22 bull market, when NFT and meme coin trading volumes were far higher than now.

This supports the view that DeFi users belong to different categories. While meme coin traders are increasingly flocking to Solana, a significant amount of capital remains on Ethereum. Citing REV or DEX trading volume as evidence of Solana's dominance in DeFi is misleading.

If we take DeFi TVL as a measure of each network's activity type, we can see that Ethereum's TVL is 6 times that of Solana (despite ETH's weak price), indicating that the activity on Ethereum qualitatively differs from that on Solana. From a DeFi perspective, meme coins are nearly useless; by the way, what are the collateral requirements for $BUTTHOLE loans?

The counterargument is that almost all on-chain activity is purely speculative, so it is somewhat hypocritical to view Solana's activity solely as meme coin trading when Ethereum's activity is not tied to real economic activity. My first reaction is to suggest that for the sake of the industry, such statements should not be made.

More seriously, while Solana leads in REV, Ethereum clearly has a more mature and vibrant DeFi ecosystem, as it still shows strong TVL and activity even without a large number of meme coin issuances.

Countering the Rollup-Centric Roadmap

We have argued that SOL's value cannot be justified by expected future REV. Currently, SOL is still competing with BTC and ETH to become the first link in the capital flow of crypto assets.

But meme coins pose another structural challenge to Solana's long-term viability, as meme coin traders are better suited for L2 trading.

L2s can operate with extremely low latency and high throughput. They can respond more quickly to issues and downtimes, and there is no overhead for decentralized coordination. They can filter out junk transactions more easily.

You might think that Solana's high-performance client is a lasting advantage, but open-source technology always tends to be commoditized. Ironically, while venture capitalists cite Solana's technological advantages over Ethereum, teams like Eclipse and Atlas have already deployed SVM L2 on Ethereum.

Ethereum's liquidity and TVL make it a better platform for L2s. Moreover, Ethereum has explicitly made trade-offs between performance and usability, which is a better choice for L2s, as L2s do not require high throughput on L1. The worst-case scenario for L2s is being unable to complete transactions or bridge when L1 is offline.

This poses real risks for Solana, as its REV growth is entirely driven by highly cyclical activity that can be better served by other chains.

Conclusion

The optimistic scenario for Solana is that it is now in the same position as Ethereum in 2021, and eventually, activity will lead to a more mature DeFi ecosystem. But this is not guaranteed.

DeFi activity on Ethereum is dominated by whales who do not care about fees and are more focused on decentralization, usability, and security. One can envision a world where retail users trade meme coins on Unichain while whales trade UNI on Ethereum. L2s can provide a better environment for meme coins and long-tail crypto assets, while Ethereum offers a better environment for whales, as it prioritizes activity over performance.

The pessimistic scenario for Solana is that it has not truly succeeded in following its North Star of building a decentralized Nasdaq. Traders care about latency and guaranteed execution of trades. During periods of volatility, it is difficult to include trades on Solana, and latency cannot compete with (more centralized) L2s.

More accurately, Solana is successfully building a decentralized "casino," a place designed to maximize volatility and risk exposure for traders who gain substantial cash through short-term wealth effects.

When the meme coin frenzy ends, this may turn into a new form of gambling, but that is unlikely to happen, as gamblers do not care about Solana's advantages over L2s, but rather about the advantages of (centralized) L2s over Solana.

But back to the point. In the crypto space, narratives that support specific viewpoints (and heavy positions) are very easy to backfill. This is especially true when your story includes compelling technology and activity driven by speculative frenzies. But because of this, we should remain skeptical of narratives that are clearly biased toward the storyteller.

I believe that Ethereum's acceptance of critics' viewpoints has actually harmed itself. This includes the story about REV and comparisons with Solana's economic metrics, but more importantly, the debate about value accumulation and L2s as parasites of Ethereum L1. I hope to discuss this issue in future posts.

Note: This article has been in the draft box for several months, so it does not include $TRUMP, $MELANIA, or the recent market sell-off. These do not materially affect the argument and have therefore not been mentioned.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。