Author: Ting, BlockTempo

In this bull market, the established public chain Solana has become one of the best incubators for meme coins due to its low transaction fees and smooth trading experience. The token issuance platform Pump.fun has sensed investors' fervent enthusiasm for meme coins, not only launching a "one-click token issuance" feature but also allowing users to issue meme coins for free, continuously igniting a wave of token issuance in the Solana ecosystem.

Pump.fun Daily Trading Volume Plummets 82% to Lowest Since Christmas

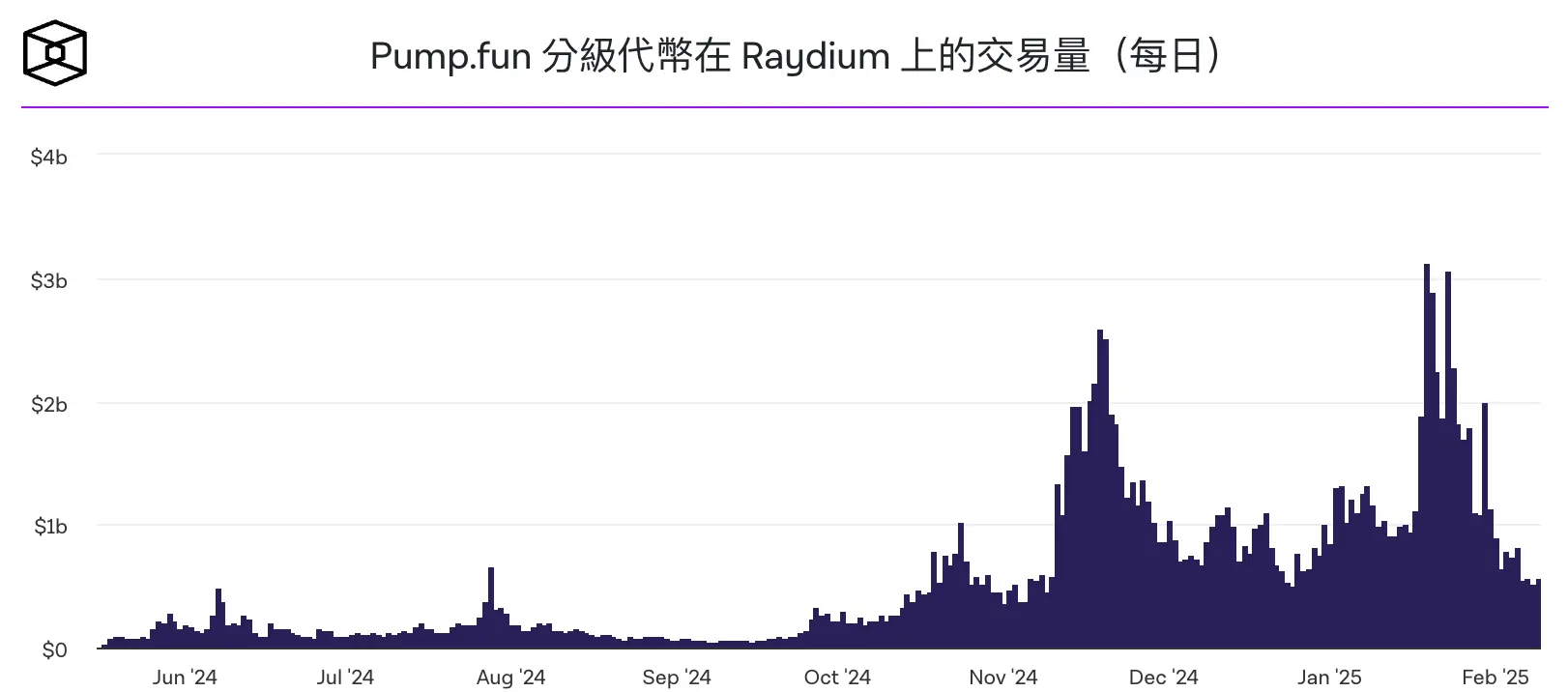

However, the recent meme coin craze on Solana has shown a clear cooling trend. According to The Block, starting from the 6th, the average daily trading volume of meme coins listed on Pump.fun and traded on the decentralized exchange Raydium has dropped to $560 million.

This figure is the lowest level since Christmas 2024, representing an 82% decrease compared to the single-day trading volume peak of $3.13 billion three weeks ago.

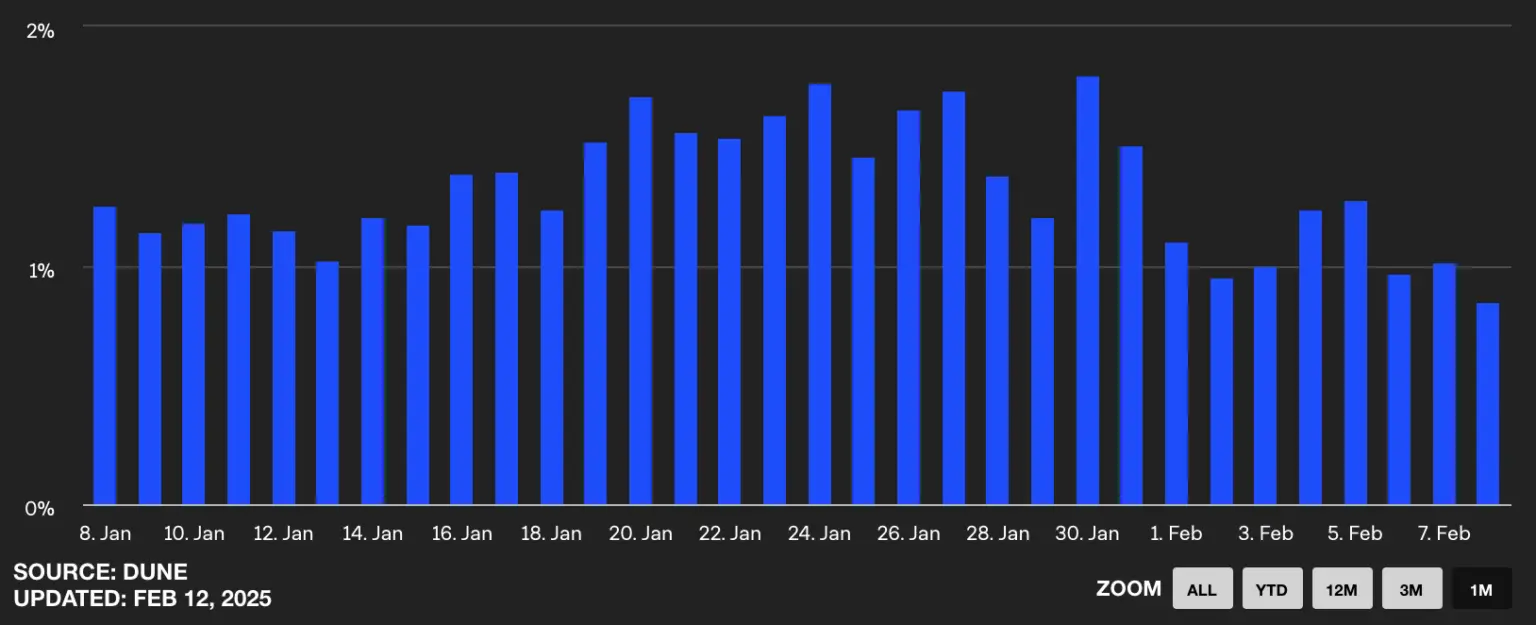

Moreover, even the "token graduation rate" (the probability of launching to Raydium) on Pump.fun has decreased. Last week, only 1.04% of Pump.fun tokens successfully launched to Raydium, while the graduation rates for the previous two weeks were 1.54% and 1.59%, respectively.

Additionally, the total daily tips paid to Jito validators in the Solana ecosystem dropped to 23,800 SOL (approximately $4.8 million) last week. In contrast, the figures for the previous two weeks were 42,000 SOL (approximately $9.9 million) and 68,500 SOL (approximately $17.5 million).

Since users typically pay tips to Jito validators to expedite transactions, this decline in data indicates that trading activity is weakening.

Pump.fun daily token graduation rate, source: The Block

Solana Meme Coin "Golden Dog" Market Cap Gradually Declines

Furthermore, The Block pointed out that the Solana meme coin market is undergoing a "euthanasia roller coaster" process, which refers to an initial surge followed by progressively lower peaks in each subsequent market fluctuation.

The beginning of this trend can be traced back to the issuance of $TRUMP on January 18, which saw its fully diluted valuation (FDV) reach $75 billion, followed by the issuance of $MELANIA, which also reached a market cap of $13 billion.

Next, the $VINE token launched by the founder of the Vine platform peaked at nearly $500 million; a few days later, the $jellyjelly token issued by a co-founder of Venmo reached a peak market cap of $250 million; and the recently launched $JAILSTOOL, promoted by Barstool Sports founder Dave Portnoy, peaked at approximately $220 million.

The gradually decreasing peak market caps of these Solana meme coins over different periods also indirectly indicate that the enthusiasm in the Solana memecoin market is waning, and speculative sentiment is cooling down.

Pancakeswap Surpasses Uniswap in Trading Volume Over the Last 24 Hours

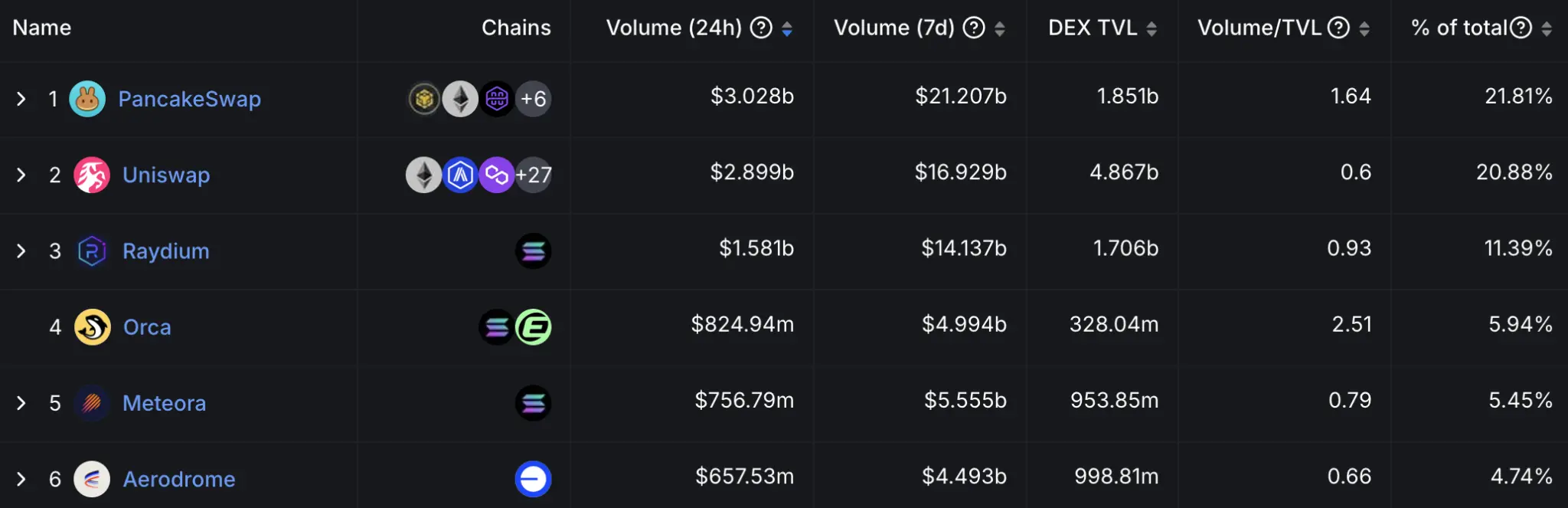

On the other hand, with Binance founder Changpeng Zhao recently interacting with the test token $TST on the social platform X, along with a series of listings and promotions by Binance and BNB Chain, there seems to be a flow of market funds into BNB Chain.

According to Defillama, the leading DEX protocol on BNB Chain, Pancakeswap, achieved a trading volume of $302 million in the last 24 hours and $2.1207 billion in the last 7 days, surpassing well-known DEXs like Uniswap, Raydium, and Orca, indicating that BNB Chain is experiencing an extraordinary level of activity recently.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。