Author: Alvis, MarsBit

Opening Controversy: The Magical Reality of B3 Token

Today, we are going to talk about the B3 token, which can be considered the most magical script in the crypto world of 2025—a "divine coin" operated by former Coinbase employees, claiming to be the "Tesla of the gaming industry," with a price surge of 249% within three days of its launch, now harvesting global retail investors as the "Base chain leader."

Let’s throw out some numbers to set the stage:

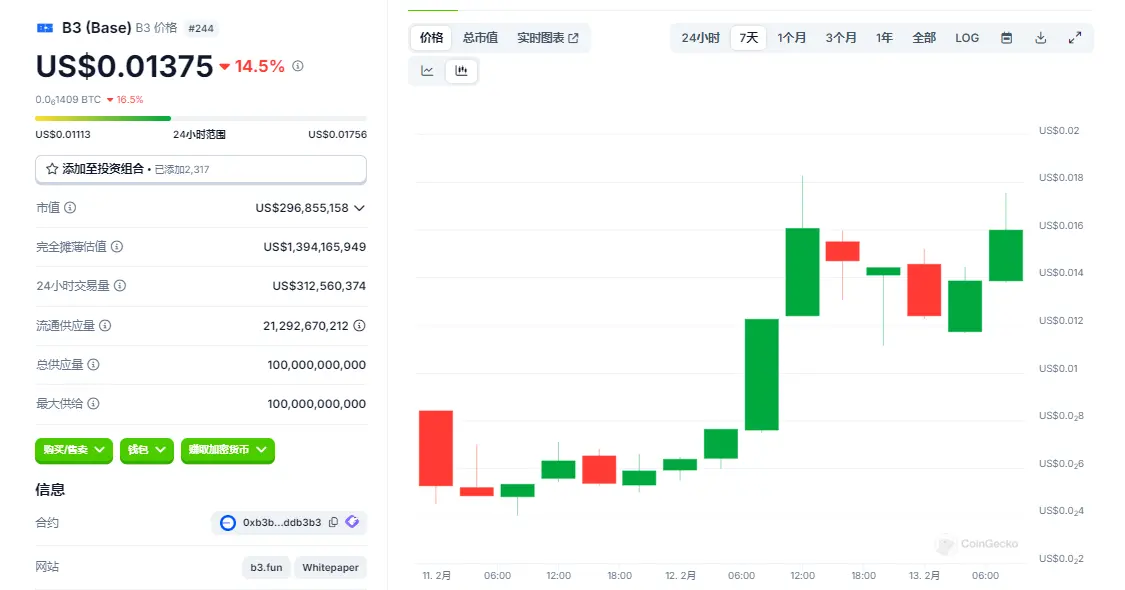

- The current price of B3 is $0.014, skyrocketing from a low of $0.04 at its launch on February 10 to a high of $0.02 on February 12, an increase of nearly 400% in three days, faster than the price increase of the pancake rolls at your local shop;

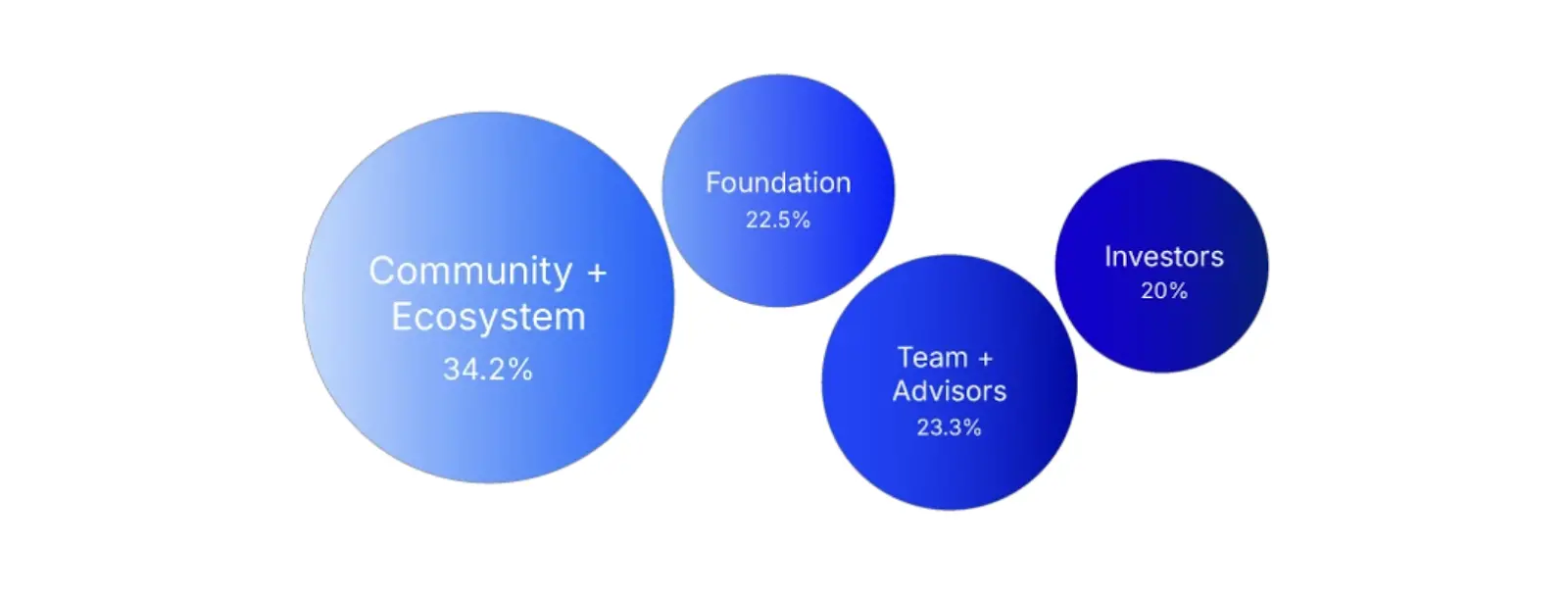

- Total supply is 10 billion tokens, with the team and investors taking 43.3% directly, meaning for every 10 tokens issued, 4 went into the pockets of the speculators;

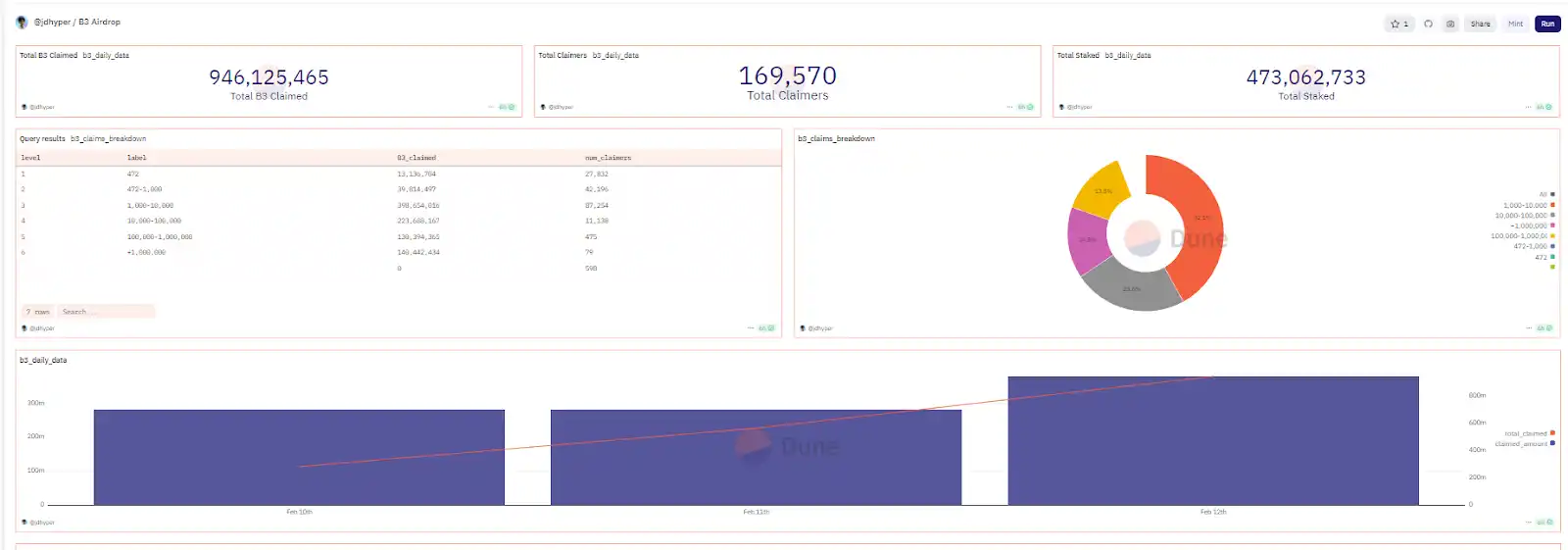

- On the first day of launch, 900 million tokens were airdropped, with the level of control by the speculators comparable to the behind-the-scenes boss in "Squid Game."

This magical plot would make even the screenwriters of "The Wolf of Wall Street" shout in admiration. Today, Marsbit will help you dissect the valuation logic of B3 using "physical hacks" to see whether this is a "new infrastructure for gaming revolution" or a "retail investor meat grinder 3.0."

B3's "Triple Persona"—Quantum Entanglement of Technology, Capital, and Retail Investors

Technical Persona: The "Gaming Highway" on Base Chain

B3 officially claims to be a "Layer 3 gaming-specific chain on Base," which in simple terms means: building another layer on Coinbase's beloved Base chain (Layer 2) specifically for game developers to provide "private room services." The technical advantages of this thing are twofold:

- Ridiculously low gas fees: each transaction costs $0.001, cheaper than buying a bottle of water at a convenience store;

- Terrifyingly high TPS: theoretical peak of 9000+, actually running faster than Solana.

But here’s the dark humor: B3's technical foundation relies entirely on the Base chain, which in turn depends on Ethereum's security.

In other words, B3 is like a "third landlord"—Ethereum is the landlord, Base chain is the second landlord, and B3 is the one converting the basement into a capsule hotel. Once Ethereum gets congested (like during an NFT craze), B3's speed advantage immediately turns into a crawl.

Capital Persona: The "Reemployment Plan" of the Former Coinbase Dream Team

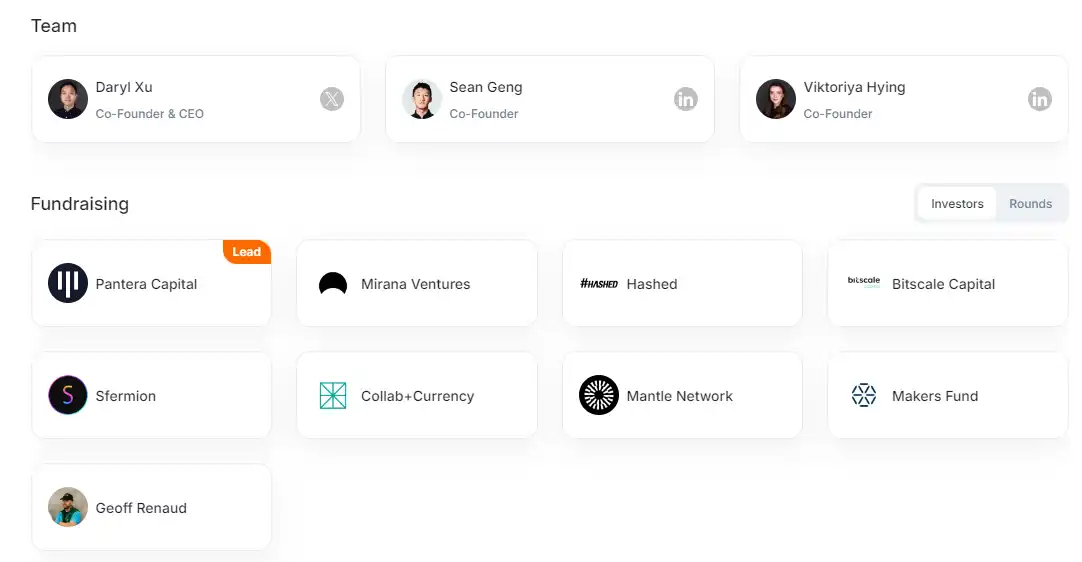

B3's core team is made up entirely of former Coinbase employees: CEO Daryl Xu worked in business development for 4 years, CTO Sean Geng is a former Coinbase engineer, and even the funding is backed by Coinbase's ecosystem fund. This background is like writing "former Alibaba P9" on a resume—investors see it and get excited, directly pouring in $21 million in seed funding.

But here’s the problem: if these people are really that impressive, why not continue to get promoted and earn more at Coinbase instead of running out to create a gaming chain? The answer may lie in the token distribution—team and advisors take 23.3%, investors take 20%, totaling 43.3%. Based on the current price, the market cap after unlocking will be at least $400 million. This isn’t entrepreneurship; it’s clearly a "guide for former big company employees to cash out."

Retail Investor Persona: The "Double Helix Harvester" of Airdrops and Games

B3's most audacious move is its "airdrop economics":

- First wave of airdrops: According to Dune data, 9.9 billion tokens have been airdropped, with players earning "points by playing games" to exchange, but the point rules are as complicated as a college entrance exam math problem;

- Second wave of airdrops: Promises of future "tournaments" and "gamified mining," but specific rules? Sorry, the speculators call the shots.

This kind of trick is essentially "using token subsidies to exchange for user data"—you think you’re shearing sheep, but you’re actually being sold as data packets to game developers. Even more outrageous, B3 has also set up "staking mining," with an annualized return of 35% looking tempting, but if you calculate carefully: if the token price drops by 35%, the principal is halved. This isn’t wealth management; it’s practically "Russian roulette."

Valuation Model Breakdown—A Fantastical Drift from Science to Metaphysics

1. Relative Valuation Method: How Much is B3 Worth Compared to Axie and Sandbox?

Let’s first look at the peers:

- Axie Infinity (AXS): At its peak, a market cap of $28 billion, with 2.7 million daily active users, valuing each user at $10,000;

- The Sandbox (SAND): Peak market cap of $20 billion, with 500,000 daily active users, valuing each user at $40,000;

- B3: Claims to have 6 million daily active users (which may be inflated), if we value each user at $10,000, the market cap should be $600 billion? But the reality is B3's circulating market cap is only $260 million, with an FDV of $1.4 billion, not even a fraction of that.

There’s a shocking loophole here: of B3's 6 million users, 90% are just here for the airdrop, with real players possibly fewer than 600,000. Based on this data, B3's reasonable valuation should be 600,000 users × $10,000 = $60 billion, which is 30 times higher than the current market cap. But the problem is—once these users claim their airdrops, they will immediately withdraw and run, leaving you with a bunch of zombie accounts.

2. DCF Model: Future Cash Flow? No, Future Pie-in-the-Sky Ability!

A proper valuation should look at cash flow, but where is B3's cash flow? The official white paper lists a bunch of scenarios:

- In-game transaction fees: charging 0.5% per transaction, but currently, 80% of games are free to play, is that just air?

- Staking rewards: 35% annualized, but this is using new retail investor money to pay old retail investors interest, a typical Ponzi structure;

- Advertising revenue: the ad price for blockchain games is less than 1/10th of Web2, and the money earned isn’t even enough to pay for server electricity.

So B3's real valuation model should be:

Market Cap = Team Background × Airdrop Heat × Retail Investor FOMO Factor ÷ Regulatory Risk

Translated into plain language: former Coinbase team + crazy airdrops + retail investor take-up – SEC surprise inspections = current price.

3. On-chain Data Metaphysics: The Love Triangle of Whales, Retail Investors, and Speculators

Let’s take a look at B3's on-chain data:

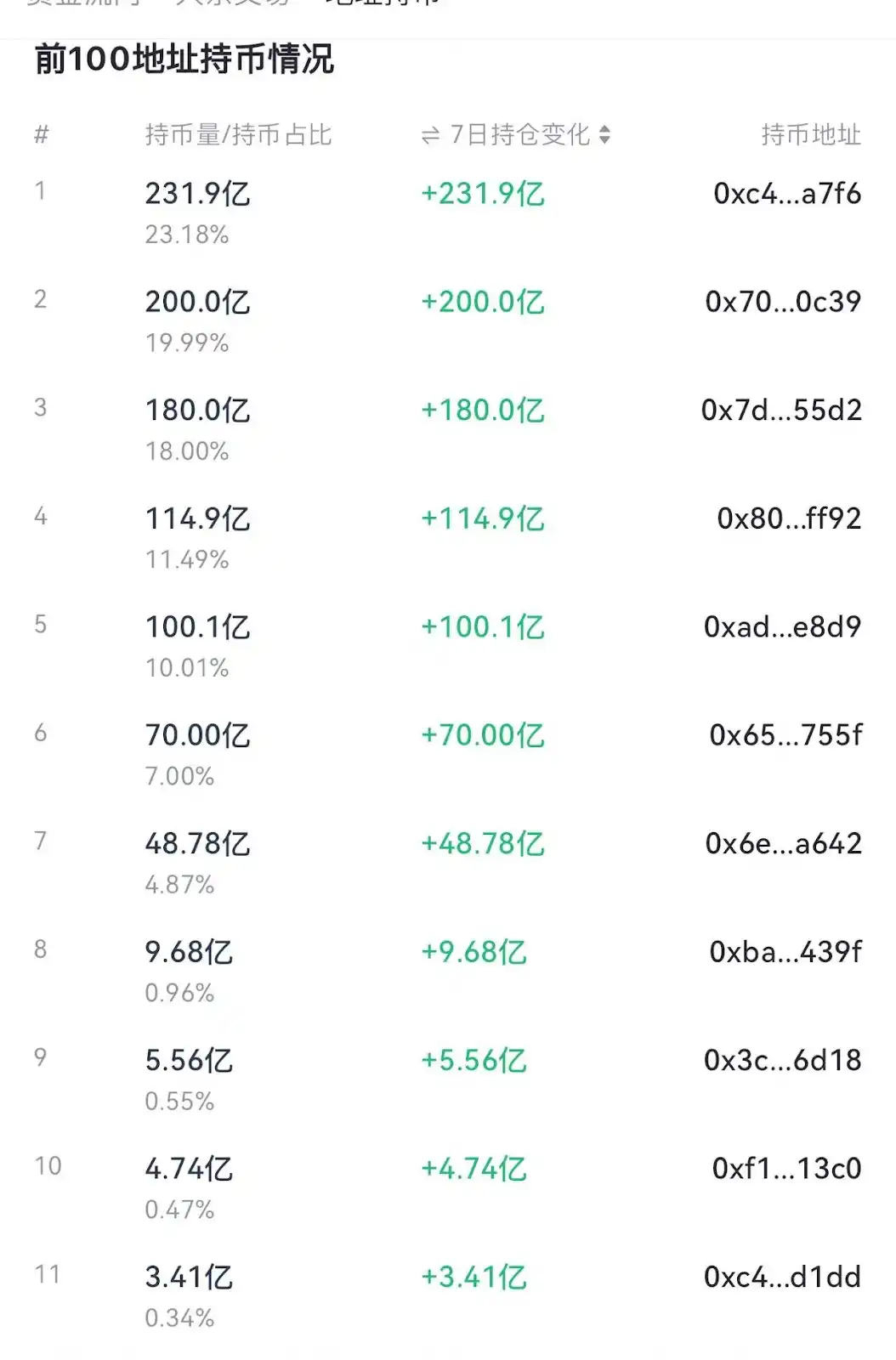

- The top 10 addresses, excluding tokens held by exchanges, account for 72%: a clear case of speculator control, with price fluctuations entirely dependent on the big players' moods;

- Net inflow to exchanges of 12,000 tokens: even with rising prices, some are still desperately depositing, either retail investors chasing highs or speculators fishing;

- Contract funding rate -0.12%: shorts are betting on a crash, but the price is being forcibly pushed up, clearly a case of speculators squeezing shorts.

In this data environment, technical analysis is less reliable than rolling dice.

Risks and Traps—Secrets the Speculators Won't Tell You

1. Token Unlocking: The Sword of Damocles Hanging Overhead

The biggest risk with B3 tokens is that "the team and investors lock up 25% for the first year, then unlock over 48 months." What does this mean? Assuming the current price is $0.1, if it drops to $0.01 when unlocked in a year, the speculators still make 10 times profit (after all, their cost might be less than $0.001). Retail investors are fighting in the secondary market while speculators are at home counting their money until their hands cramp.

2. Regulatory Nuclear Bomb: SEC's "Securities Determination" Sniper Rifle

The B3 team is entirely composed of individuals with American backgrounds, and the token is on Coinbase's beloved Base chain, making it a live target for the SEC. Once classified as a security:

- Exchanges will collectively delist: referencing the XRP case, the price could be halved;

- The team faces collective lawsuits: fines could reach hundreds of millions of dollars.

3. Ecological Bubble: 80 Games, 80 Landmines?

B3 claims to have 80 games launched, but a closer look reveals:

- 70% are reskinned mini-games: like "on-chain Tetris" and "blockchain Minesweeper";

- 20% are riding the AI hype: like that Zerebro AI game, with an actual experience dumber than Siri;

- The remaining 10% are still under development: the screenshots on the official website are all from PS.

This kind of ecosystem is like the "food street" at your doorstep—looks great with a variety of signs, but once you go in, it’s all Lanzhou noodles and Sha County snacks.

The Ultimate Soul-Searching Question—Is It Worth Buying Now?

1. Short-term Gamblers:

- Strategy: Take out no more than 5% of your position, set a stop-loss line (for example, cut losses if it drops below $0.08), and bet on the speculators pushing it to $0.2;

- Risk: You might become fuel for a "pig slaughtering" scheme, buried at the top of the mountain.

2. Long-term Believers:

- Strategy: Invest monthly, ignore fluctuations, and bet on B3 becoming the "Steam of blockchain games";

- Risk: There’s a high probability of waiting for the token unlock crash, with principal shrinking by 90%.

3. Rational Investors:

- Strategy: Watch from the sidelines, wait for the token unlocking period to pass before buying in;

- Risk: You might miss out on a short-term surge, but you’ll keep your principal safe.

Conclusion: Survival Rules in the Crypto World

The story of the B3 token is essentially a trio of "technological vision + capital operation + human greed." Its price surge is neither a miracle nor a scam, but a reflection of the inherent laws of the crypto market: before consensus forms, all value is a bubble; after consensus collapses, all bubbles are tears.

Finally, here’s a crypto proverb for everyone: "In a bull market, everyone is a stock god; in a bear market, everyone is a philosopher." Cherish life and trade cryptocurrencies rationally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。