The market remains lukewarm, and the long-ignored Hong Kong has attracted new attention.

On February 8, Hong Kong practicing accountant Clement Siu disclosed on social media that the Hong Kong Investment Promotion Agency approved an investment immigration application using Ethereum as proof of assets worth HKD 30 million. He also mentioned that last October, he successfully processed Hong Kong's first investment immigration case using Bitcoin as proof of assets.

At first glance, this seems unremarkable, but for cryptocurrency holders, especially wealthy Chinese investors, the threshold for overseas immigration has significantly lowered. After all, HKD 30 million is not a large fortune in the wealthy crypto circle, and moving to Hong Kong is a natural direction for many Chinese.

But is investment immigration really that simple? Is Hong Kong truly a crypto utopia? Different people have different answers. In fact, regardless of whether it includes cryptocurrencies, the investment immigration policy falls under the new Capital Investment Entrant Scheme (CIES) proposed by the Hong Kong government in 2023. This scheme is open to qualified investors and aims to strengthen Hong Kong's position as an international asset and wealth management center by attracting external investors and capital.

According to the scheme, qualified investors who invest HKD 30 million in Hong Kong can obtain a stay visa, and after residing for 7 years, they will have the opportunity to apply for permanent resident status in Hong Kong. The plan is not complicated, but when it comes to practical implementation, there are many details to pay attention to.

First, applicants must hire a professional accountant in Hong Kong at their own expense to provide proof of their net assets of HKD 30 million. In this step, the location of the assets is not restricted, and there are no limitations on the composition of the assets. It only needs to prove that the applicant has held net assets or net capital with a market value of no less than HKD 30 million for the entire period of 6 months prior to the date of the net asset review application. It is worth noting that this period was originally two years but was later optimized by the Hong Kong government to six months.

Having assets is certainly not enough; the ultimate goal of the Hong Kong government is to bring assets into the local market. Within the 6 months prior to submitting the application or within 6 months after approval, applicants need to invest no less than HKD 30 million in designated permitted investment asset categories. The government has made quite clear regulations regarding the investable targets: qualified investors must invest HKD 27 million in financial assets (all types are traded in HKD/RMB), which include stocks of companies listed on the Hong Kong Stock Exchange, debt securities, certificates of deposit, and subordinated bonds; qualified collective investment schemes, including funds, real estate trusts, open-end funds, and life insurance plans issued by SFC-licensed institutions; private limited partnership funds registered in Hong Kong; and non-residential real estate for commercial or industrial use (including pre-sale properties but excluding land), with an upper limit of HKD 10 million for this type of investment.

The remaining HKD 3 million is considered a mandatory target and must be invested in the "Capital Investor Entrant Scheme Investment Portfolio" established by Hong Kong Investment Management Company. This investment portfolio will invest in companies or projects related to Hong Kong to support key industries that contribute to the long-term development of Hong Kong's economy. Specifically, HKD 3 million will be deposited in a designated account of a financial intermediary, managed by four fund management companies and related service institutions, including Betatron Venture Group, Inno Angel Fund, Concept Capital, and Huike Technology Innovation Investment. To put it bluntly, this HKD 3 million is essentially a contribution to angel investment in Hong Kong; if it earns profits, everyone is happy, but if it incurs losses, there is nothing to say.

After completing the above investments, the Hong Kong Immigration Department will issue a 2-year stay visa, which needs to be renewed afterward. The renewal is generally in a 3+3 format, but each year, applicants must hire a professional accountant to provide a verification report proving that the total investment amount is still not less than HKD 30 million and that the assets have not been transferred or used for other purposes. However, the total investment amount is unrelated to previous investment losses; even if there are losses and the current investment amount does not reach HKD 30 million, it is only necessary to prove that the investment scale at the time of application reached HKD 30 million, without needing to invest additional funds. The profits or other earnings from the investment can be freely disposed of. After residing for 7 years, applicants can then switch to permanent resident status in Hong Kong, at which point the investment amount will no longer be restricted, and applicants can freely dispose of it.

The overall process is as described above, and the participation of cryptocurrencies is concentrated in the initial verification stage, where Bitcoin and Ethereum can also be used as asset recognition. Crypto assets can be stored in cold wallets or proven through leading exchanges like Binance. It is worth noting that while existing Bitcoin and Ethereum have been recognized, whether other cryptocurrencies can be used for this proof cannot be generalized. Currently, only cryptocurrencies that are relatively stable in value, have high liquidity, and are legal in Hong Kong can be applicable.

Additionally, whether the subsequent HKD 30 million investment can be used to invest in virtual currency ETFs remains to be discussed. According to Xiao Yaohe, the deputy managing partner of Hongyuan Accounting Firm, the possibility is relatively small, but it can be attempted through establishing a limited partnership fund. Whether direct investment is possible still needs further verification.

In fact, from the perspective of asset proof, places like the United States and Singapore have already set precedents for using cryptocurrencies as proof of assets. However, for cryptocurrency holders, the most challenging aspect is not about producing money but rather where the money comes from. When using cryptocurrencies as proof of assets, relevant institutions and accountants will require clients to submit proof of the source of funds.

Proof typically needs to involve the original source of funds used to purchase cryptocurrencies and the location and timing of the purchase of crypto assets. It is evident that, in the volatile and often ambiguous realm of cryptocurrencies, answering these questions is undoubtedly very difficult. This is the real challenge of immigration through crypto assets; the historical burden is heavy, and holders must ensure that everything is documented to resolve these issues.

Regardless, the use of cryptocurrencies for investment immigration in Hong Kong not only reflects Hong Kong's high degree of openness but also reaffirms the government's inclusive attitude towards cryptocurrencies, which still holds a certain appeal for the Chinese crypto community. The increase in the use cases for cryptocurrencies can further enhance Hong Kong's position in the crypto field, forming a clustering effect from the two directions of talent and capital, and promoting the vigorous development of Hong Kong's Web3 industry.

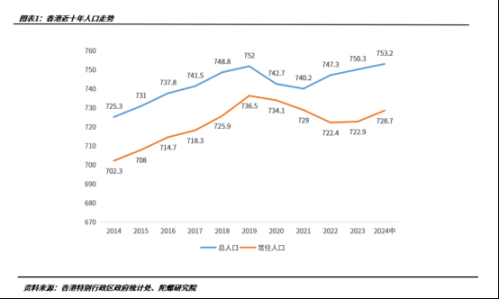

Looking at Hong Kong's planning in recent years, in addition to the new capital immigration scheme, since the end of 2022, the Hong Kong SAR government has successively released multiple measures to attract foreign talent to Hong Kong, including optimizing existing talent immigration policies such as the Quality Migrant Admission Scheme and the newly launched Top Talent Pass Scheme, diversifying talent recruitment, and enriching Hong Kong's talent pool. The reason for these initiatives is quite simple: too many people are leaving Hong Kong. Before 2022, Hong Kong's resident population had declined for five consecutive years, dropping from 7.365 million in 2019 to 7.224 million in 2022. The outflow data is even more pronounced; from July 2020 to June 2023, 6.33 million Hong Kong residents left through the airport, with only 5.8 million returning. In other words, Hong Kong had a net outflow of 530,000 people over three years, accounting for nearly 7% of the resident population.

Currently, the effectiveness of the introduction plan is significant. According to the summary from the Hong Kong Immigration Department, nearly 140,000 various talent immigration visas were successfully approved in 2024, an increase of 4,000 from 2023. As of January 2, since the launch of the "New Capital Investor Entrant Scheme," Hong Kong has successfully received over 750 applications, with a total expected investment exceeding HKD 22 billion. Unfortunately, at this stage, only two applicants have involved the use of crypto assets. Additionally, in the context of a contracting macro environment in recent years, Hong Kong's local economy has also been impacted. According to reports, Hong Kong's retail sales in December last year amounted to HKD 32.8 billion, a year-on-year decline of 9.7%, marking ten consecutive months of decline. The reports also mentioned that cryptocurrencies have become popular among the younger generation, becoming one of the external pillars of Hong Kong's consumer market.

In light of various realities, Hong Kong's focus on the Web3 field has not diminished but rather increased. Just looking back at last year, Hong Kong's window characteristics have become increasingly prominent, balancing regulation and inclusivity in the direction of virtual assets, presenting a situation of improved policies and supportive ecosystems, with significant progress in product innovation, platform licensing, and regulatory framework extension.

From the product side, in 2024, Hong Kong approved six virtual asset spot ETFs issued by Huaxia Fund (Hong Kong), Bosera International, and Harvest International, greatly enhancing the convenience of purchasing for investors and promoting the compliance and productization of virtual assets. As of now, the three Bitcoin spot ETFs hold a total of 4,330 Bitcoins, with a total net asset value of USD 425 million, while the Ethereum spot ETF holds 2,083 Ethereums, with a net asset value of USD 56 million.

From the exchange perspective, the new regulations for virtual assets have been implemented for a year and a half. As of now, there are nine approved virtual asset trading platforms in Hong Kong, with over 31 brokers upgrading to virtual asset license type 1 and more than 36 asset management firms upgrading to virtual asset license type 9. In the highly watched Payfi sector, the Hong Kong Monetary Authority has not only launched the Ensemble project to explore RWA and CBDC but is also continuously extending regulations from platforms to derivative institutions, constantly improving regulatory provisions. Recently, the relevant bill committee of the Hong Kong Legislative Council reviewed the "Stablecoin Ordinance Draft" for the first time. If there are no exceptions, this bill will take effect this year, successfully regulating stablecoin licensees under the same business, same risk, and same rules, allowing for inquiries about stablecoins. Last year, Hong Kong also launched a sandbox for stablecoin issuers, continuously promoting the integration of traditional finance and the Web3 system. The next step in regulations will focus on OTC and custody, with a second round of public consultation on the regulation of virtual asset over-the-counter (OTC) trading expected to be completed this year, along with a consultation plan for a licensing system for virtual asset custody service providers.

An environment conducive to the development of Web3 is being solidified. However, from a market perspective, under the constraints of limited market size and high costs, Hong Kong is ultimately unlikely to become a source of global Web3 development, with almost negligible influence on the global crypto market. This point can be seen from the virtual asset ETFs; compared to the over USD 111.78 billion in Bitcoin ETF net assets in the United States, the difference is more than an order of magnitude. Even regarding this immigration policy, some crypto practitioners have expressed that the costs are high and the cost-effectiveness is low, stating, "HKD 30 million to go to Hong Kong is not as good as going to Singapore or Australia; even Dubai's golden visa is only HKD 4.24 million."

However, it has been mentioned before that Hong Kong is not trying to seize market share from the crypto market but is attempting to build a new decentralized financial system based on traditional finance to fill the gap in virtual assets. This aims to solidify its position as a traditional financial center while innovating to connect with the future trading era of digital assets. This is also why Hong Kong focuses on licensing regulations for virtual asset trading platforms while emphasizing stablecoins and RWA. The old saying still holds: although Hong Kong is not the most active region in crypto, "small government, big market" also means safety and stability. From the perspective of traditional capital, safety is far more important than other factors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。